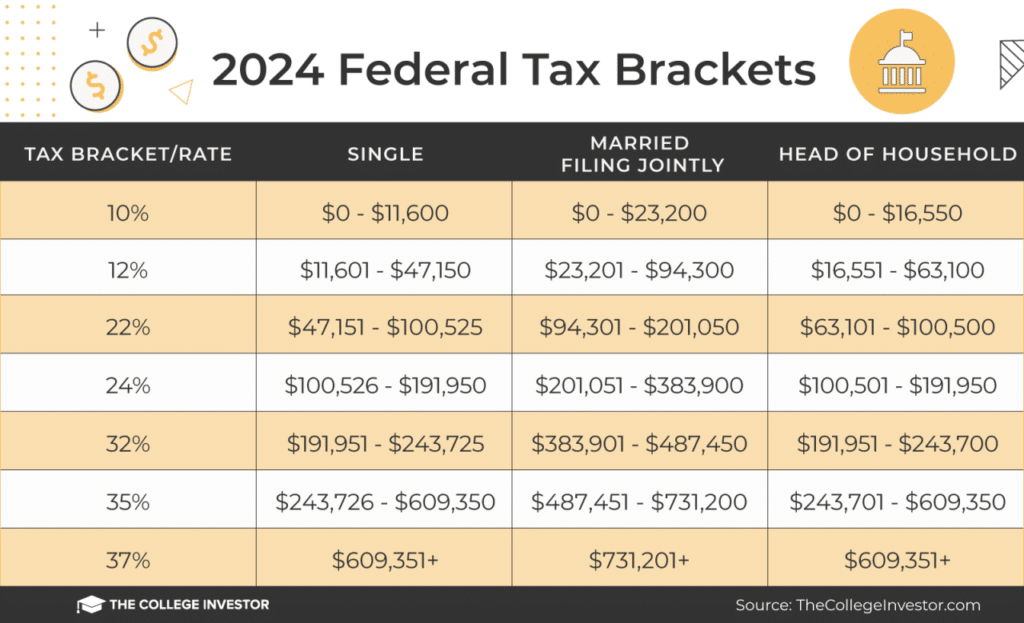

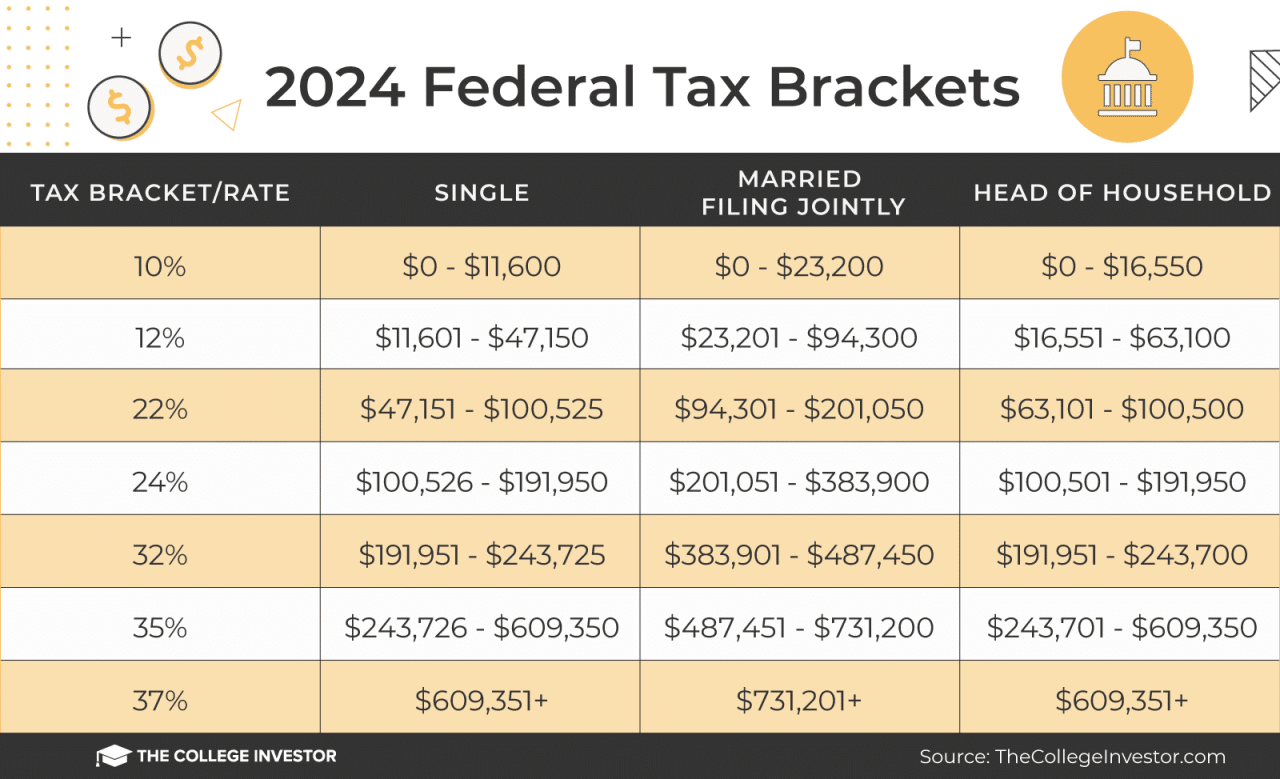

Tax bracket changes for 2024 are on the horizon, and understanding their implications is crucial for both individuals and businesses. The upcoming year will see adjustments to the tax brackets, potentially affecting the amount of taxes owed by various income groups.

This analysis delves into the specifics of these changes, examining the new thresholds and rates, and analyzing their potential impact on taxpayers and the economy.

The 2024 tax brackets are designed to adjust for inflation and potentially redistribute tax burdens. The changes might result in higher or lower tax liabilities for different income levels, leading to adjustments in financial planning and tax strategies. This overview provides a comprehensive guide to navigating these changes, offering insights into their implications and practical advice for managing tax obligations.

Impact on Taxpayers

The proposed tax bracket changes for 2024 will have a significant impact on taxpayers across different income levels. These changes could result in both increased and decreased tax liabilities for individuals and families, depending on their specific financial situation.

The Bills’ performance against the Texans raised some eyebrows, and the analysis reveals some interesting takeaways. While they ultimately emerged victorious, there were some areas where they struggled. This game offers valuable insights into their strengths and weaknesses moving forward.

Tax Burden Changes for Different Income Groups, Tax bracket changes for 2024

The tax bracket changes are likely to affect different income groups in distinct ways. For instance, individuals in the lower income brackets might experience a reduction in their tax burden due to the expansion of the standard deduction or an increase in the personal exemption.

Michigan football fans are buzzing after a thrilling win against Washington, but it’s important to keep things in perspective. While the Wolverines showed some impressive offensive firepower, they also had some defensive lapses that need to be addressed. As the article points out , it’s crucial to learn from these mistakes and ensure they don’t repeat them against tougher opponents.

Conversely, those in the higher income brackets might see an increase in their tax liability due to the introduction of higher tax rates or the elimination of certain deductions.

The Cardinals pulled off a stunning upset against the 49ers, demonstrating resilience and offensive prowess. The game highlights are full of thrilling plays and clutch moments, showcasing the Cardinals’ ability to fight back from a deficit. This victory sends a strong message to the rest of the league.

Examples of Increased and Decreased Tax Liabilities

To illustrate the potential impact of the tax bracket changes, consider the following scenarios:* Scenario 1: Increased Tax LiabilityA family with a combined income of $250,000 currently falls within the 24% tax bracket. If the proposed tax bracket changes increase the top marginal tax rate to 30%, this family’s tax liability could increase significantly.

They would need to pay a higher percentage of their income in taxes, potentially reducing their disposable income.* Scenario 2: Decreased Tax LiabilityA single individual earning $40,000 currently pays taxes at a rate of 12%. If the tax bracket changes include an expansion of the standard deduction, this individual’s taxable income could decrease, leading to a lower tax liability.

This could result in increased disposable income for the individual.

Concluding Remarks: Tax Bracket Changes For 2024

Understanding the intricacies of tax bracket changes is essential for making informed financial decisions. By carefully analyzing the new thresholds, rates, and their potential impact, individuals and businesses can effectively plan for the upcoming year. The information presented here provides a foundation for navigating these changes, offering insights into their implications and practical advice for managing tax obligations.

With a clear understanding of the 2024 tax bracket changes, taxpayers can position themselves for success and optimize their financial outcomes.

Detailed FAQs

What is the standard deduction for 2024?

The standard deduction amount for 2024 will be announced by the IRS, and it is expected to be higher than in previous years due to inflation adjustments. It’s essential to check the official IRS website for the most up-to-date information.

Will the tax bracket changes affect my retirement contributions?

The tax bracket changes may indirectly affect your retirement contributions. If your tax bracket changes, the tax benefits associated with traditional IRA or 401(k) contributions may be altered. It’s crucial to consult with a financial advisor to determine the optimal strategy for your situation.

Lewandowski is on fire! He delivered a hat trick in the first half, leading Barcelona to a dominant victory. His performance is a testament to his incredible talent and goal-scoring ability. The match report is a must-read for any football fan, showcasing Lewandowski’s brilliance.

An early morning earthquake shook parts of Southern California, reminding us of the unpredictable nature of our planet. The article provides details about the magnitude and location of the quake, along with information about potential damage and safety precautions.

The Texans pulled off a surprising upset against the Bills, showcasing their resilience and offensive power. The final score may not reflect the entire story, but it certainly highlights the Texans’ ability to overcome adversity and fight for every point.

The Jaguars came out on top in a thrilling matchup against the Colts, showcasing their offensive firepower and resilience. The game report provides a detailed analysis of the game, highlighting key moments and individual performances that contributed to the Jaguars’ victory.

The news of TikTok star Taylor Rousseau Grigg’s passing at the age of 25 is deeply saddening. Her vibrant personality and engaging content touched countless lives. The article shares details about her life and legacy, highlighting her impact on the social media community.

The college football landscape is shifting as the Big Ten teams continue to dominate the rankings. Alabama’s fall from grace is a testament to the competitive nature of the sport. The latest rankings offer a glimpse into the current state of the game and provide insights into potential contenders for the championship.

The Packers secured a hard-fought victory against the Rams, with turnovers playing a crucial role in their success. The recap highlights key moments and individual performances that contributed to the Packers’ win, showcasing their ability to capitalize on opportunities.

The Giants showcased their offensive firepower in a dominant victory against the Seahawks. The instant analysis breaks down key plays and highlights the Giants’ offensive strategy that propelled them to victory.

The Ravens and Bengals faced off in a heated matchup, with both teams showcasing their strengths and weaknesses. The postgame notes and quotes offer valuable insights into the game, highlighting key moments and player perspectives.

The Bears dominated the Panthers in a convincing victory, improving their record to 3-2. The rapid recap highlights key moments and individual performances that contributed to the Bears’ victory, showcasing their offensive firepower and defensive resilience.

The Jets faced a tough challenge against the Vikings in London, falling short in a closely contested match. The game recap highlights key moments and individual performances, providing insights into the Jets’ struggles and areas for improvement.

The Seahawks mounted a valiant comeback attempt against their opponent, but ultimately fell short in a heartbreaking loss. The rapid reactions provide an immediate analysis of the game, highlighting key moments and player performances that contributed to the outcome.