Tax bracket calculator for 2024: Understanding your tax bracket is crucial for making informed financial decisions. Whether you’re a seasoned investor or just starting out, knowing how your income is taxed can help you plan for the future and potentially minimize your tax liability.

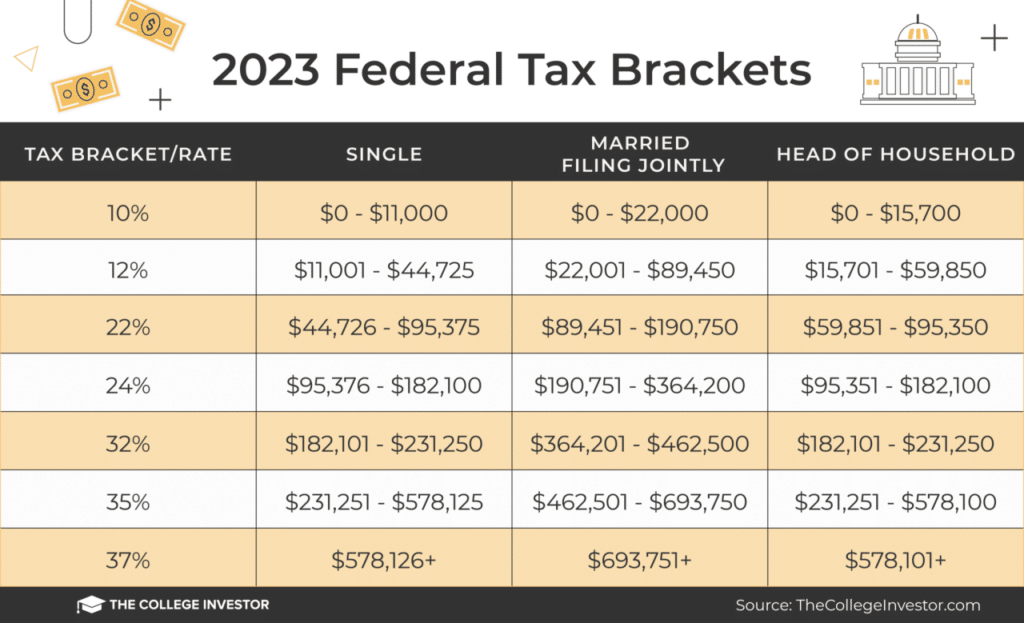

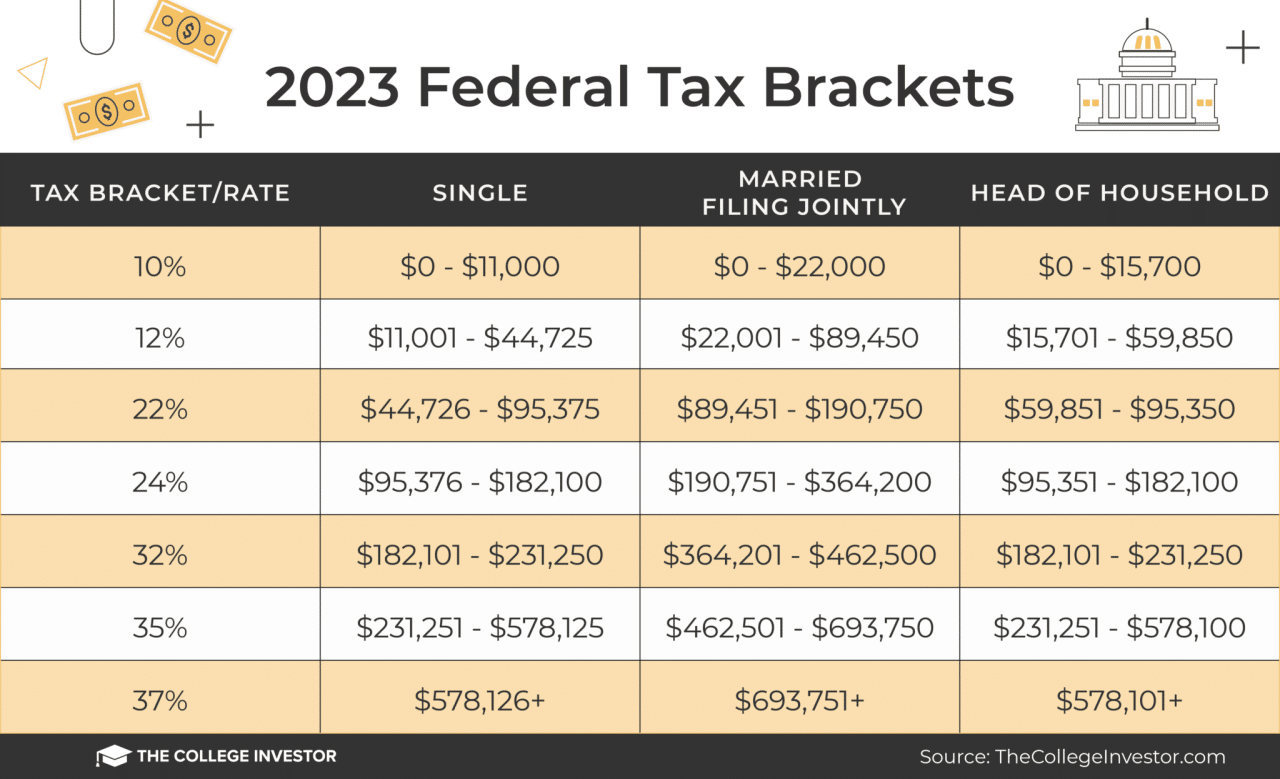

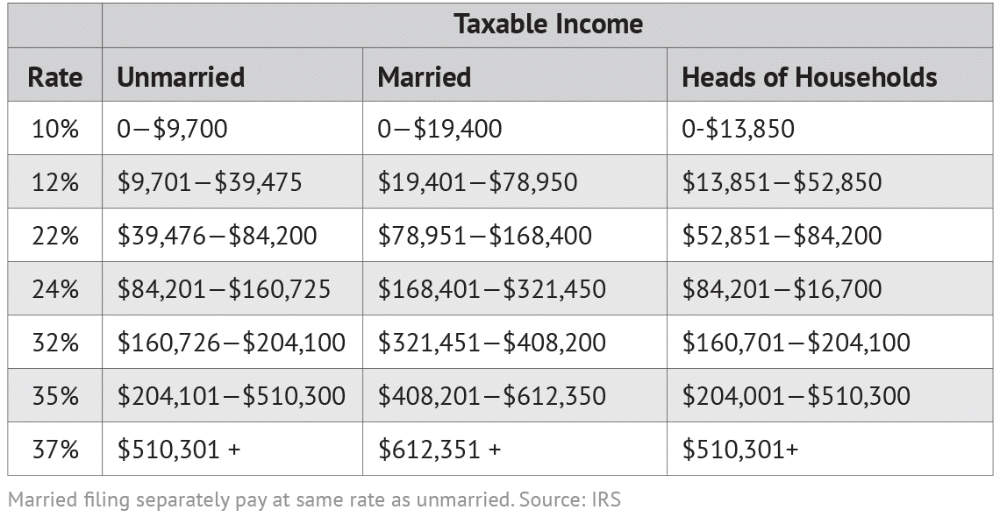

The United States tax system employs a progressive tax structure, meaning that higher earners pay a larger percentage of their income in taxes. This system is divided into tax brackets, each with its own tax rate. As your income increases, you move into higher tax brackets, subject to a greater tax rate on the portion of your income that falls within that bracket.

Using a Tax Bracket Calculator

A tax bracket calculator is a valuable tool for anyone who wants to estimate their tax liability. It can help you understand how much of your income will be taxed at different rates, and it can also help you plan for your taxes throughout the year.

Lewandowski was on fire in the first half, scoring a hat trick! You can read more about his performance and Barcelona’s victory in the First-half hat trick for Lewandowski as Barcelona top ahead of article.

Benefits of Using a Tax Bracket Calculator

Tax bracket calculators offer several benefits, including:

- Estimate your tax liability: By entering your income and deductions, a tax bracket calculator can estimate how much tax you will owe for the year. This can help you plan your finances and make informed decisions about your spending.

- Understand your tax bracket: The calculator will show you which tax bracket you fall into based on your income. This information can help you understand how much of your income will be taxed at each rate.

- Compare different tax scenarios: You can use a tax bracket calculator to see how your tax liability would change if your income increased or decreased, or if you made changes to your deductions. This can help you make informed financial decisions.

- Identify potential tax savings: By exploring different tax scenarios, you may discover potential tax savings opportunities, such as deductions or credits that you are eligible for.

How to Use a Tax Bracket Calculator Effectively

To use a tax bracket calculator effectively, follow these steps:

- Gather your income information: You will need to know your total income for the year, including wages, salaries, self-employment income, and any other sources of income.

- Gather your deduction information: Collect information about any deductions you are eligible for, such as standard deduction, itemized deductions, and other relevant deductions.

- Select the appropriate tax year: Most tax bracket calculators allow you to choose the tax year for which you want to calculate your taxes. Ensure you select the correct year for your situation.

- Enter your information accurately: Carefully enter your income and deduction information into the calculator. Any errors in the data will lead to inaccurate results.

- Review the results: Once the calculator has processed your information, review the results carefully. Pay attention to your estimated tax liability, your tax bracket, and any potential tax savings opportunities.

Types of Tax Bracket Calculators

Tax bracket calculators are available in various forms, each with its own features:

- Online tax bracket calculators: Many websites offer free online tax bracket calculators. These calculators are generally easy to use and provide quick estimates. They may offer additional features, such as tax planning tools and comparisons of different tax scenarios.

- Tax software: Tax preparation software, such as TurboTax or H&R Block, typically includes a built-in tax bracket calculator. These calculators are more comprehensive than online calculators and may offer more advanced features, such as the ability to import your tax information from other sources.

The Jaguars pulled off a thrilling win against the Colts in Week 5, and you can catch all the details in the Game Report, 2024 Week 5: Jaguars 37, Colts 34 article.

- Financial calculators: Some financial calculators, such as those offered by financial institutions or personal finance websites, may also include a tax bracket calculator. These calculators may be integrated with other financial tools, such as budgeting tools or investment calculators.

Factors Affecting Tax Bracket Calculations

Several factors can affect your tax bracket calculation, including:

- Filing status: Your filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er)) affects your tax bracket and deductions.

- Deductions: Taking advantage of available deductions, such as standard deduction, itemized deductions, and other relevant deductions, can reduce your taxable income and potentially lower your tax liability.

- Credits: Tax credits, such as the earned income tax credit or child tax credit, directly reduce your tax liability. These credits can significantly impact your overall tax burden.

- State income taxes: State income taxes vary significantly from state to state. Some states have higher tax rates than others, which can impact your overall tax liability.

It is important to note that tax bracket calculators provide estimates only. Your actual tax liability may differ based on specific circumstances and changes in tax laws. Consult with a qualified tax professional for personalized advice and accurate tax calculations.

Want to know what the Miami Dolphins had to say after their recent game? Check out the Miami Dolphins Postgame Quotes 10/6 for insights from the players and coaches.

Tax Bracket Calculator Resources: Tax Bracket Calculator For 2024

Finding the right tax bracket calculator can help you understand your tax obligations and plan your finances effectively. There are various online tools available, each with its unique features and functionalities.

Want to know what’s going on in the world of Arkansas football recruiting? Check out the WATCH: Arkansas Football Recruiting Report with Otis Kirk (10-6-24) for the latest updates.

Tax Bracket Calculator Resources, Tax bracket calculator for 2024

Several reputable online tax bracket calculators can provide accurate estimates of your tax liability for

The Ravens and Bengals battled it out on the field, and you can find out who came out on top and what the players had to say in the Postgame Notes and Quotes: Ravens at Bengals article.

2024. Here are some of the most popular options

The Seahawks had a close call in Week 5, but ultimately fell short in their comeback attempt. Get all the details in the Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss article.

- TurboTax: TurboTax offers a free tax bracket calculator that allows you to estimate your federal income tax liability based on your income, filing status, and deductions. It also provides personalized tax tips and guidance.

- H&R Block: H&R Block offers a free tax calculator that estimates your federal and state income tax liability. It includes features like tax planning tools and a personalized tax report.

- TaxAct: TaxAct provides a free tax bracket calculator that estimates your federal and state income tax liability. It also offers features like tax preparation software and a refund tracker.

- Bankrate: Bankrate offers a free tax bracket calculator that estimates your federal income tax liability based on your income, filing status, and deductions. It also provides articles and guides on tax-related topics.

- NerdWallet: NerdWallet offers a free tax bracket calculator that estimates your federal income tax liability based on your income, filing status, and deductions. It also provides personalized tax tips and guidance.

Comparison of Tax Bracket Calculator Features

The following table compares the key features and functionalities of some popular tax bracket calculators:

| Calculator | Features | Functionality |

|---|---|---|

| TurboTax | Federal income tax liability estimation, personalized tax tips, and guidance. | Estimates your federal income tax liability based on your income, filing status, and deductions. Provides personalized tax tips and guidance. |

| H&R Block | Federal and state income tax liability estimation, tax planning tools, and personalized tax report. | Estimates your federal and state income tax liability. Includes features like tax planning tools and a personalized tax report. |

| TaxAct | Federal and state income tax liability estimation, tax preparation software, and refund tracker. | Estimates your federal and state income tax liability. Offers features like tax preparation software and a refund tracker. |

| Bankrate | Federal income tax liability estimation, tax-related articles, and guides. | Estimates your federal income tax liability based on your income, filing status, and deductions. Provides articles and guides on tax-related topics. |

| NerdWallet | Federal income tax liability estimation, personalized tax tips, and guidance. | Estimates your federal income tax liability based on your income, filing status, and deductions. Provides personalized tax tips and guidance. |

Official Government Resources

For accurate and up-to-date tax information and guidance, consult official government resources:

- Internal Revenue Service (IRS): The IRS website provides comprehensive information on tax laws, regulations, and forms. You can find guidance on tax brackets, deductions, credits, and other tax-related topics. https://www.irs.gov/

- State Tax Agencies: Each state has its own tax agency that provides information on state income tax laws and regulations. You can find contact information for your state’s tax agency on the IRS website.

“It is essential to consult official government resources for accurate and up-to-date tax information. Tax laws and regulations can change frequently, so it’s crucial to stay informed.”

Closing Notes

By utilizing a tax bracket calculator and understanding the key factors that influence your tax liability, you can make informed financial decisions, potentially optimize your tax situation, and ensure that you are paying the correct amount of taxes. While the tax system can seem complex, taking the time to understand it can lead to significant benefits in the long run.

FAQ Guide

What is the difference between a marginal tax rate and an effective tax rate?

The marginal tax rate is the tax rate applied to the last dollar of income earned. The effective tax rate is the overall percentage of income paid in taxes. For example, if you have a marginal tax rate of 22% but your effective tax rate is 15%, it means you are paying 15% of your total income in taxes, even though your highest income bracket is taxed at 22%.

How often do tax brackets change?

Tax brackets are typically adjusted annually for inflation. However, major tax legislation can also lead to significant changes in tax brackets.

What are some common deductions and credits that can help lower my taxable income?

Common deductions include mortgage interest, charitable contributions, and state and local taxes. Common credits include the earned income tax credit, the child tax credit, and the American opportunity tax credit.

The world is mourning the loss of TikTok star Taylor Rousseau Grigg, who tragically passed away at the age of 25. You can read more about her life and legacy in the TikTok star Taylor Rousseau Grigg dead at 25 article.

The Texans pulled off an upset victory over the Bills in Week 5! You can find the final score, key stats, and highlights in the Texans 23, Bills 20 | Final score, stats to know + game highlights article.

Michigan football faced a tough challenge against Washington, and you can find out what lessons were learned from the game in the Michigan football: What we learned vs. Washington: ‘Don’t let this article.

The Cowboys and Steelers are facing off, and you can catch all the live updates and find out how to watch the game in the Cowboys vs. Steelers score today: Live updates, how to watch article.

The Bills’ loss to the Texans in Week 5 was a big surprise. You can find out the top three takeaways from the game in the Top 3 things we learned from Bills at Texans | Week 5 article.

The Jets fell short in their London matchup against the Vikings. Get all the details about the game in the Jets-Vikings Game Recap | Green & White Fall Short in London article.

Southern California experienced an early morning earthquake originating in Ontario. You can find out more about the earthquake and its impact in the Early morning Ontario earthquake shakes parts of Southern California article.

The Packers pulled off a victory over the Rams thanks to some key turnovers. You can read the full recap of the game in the Recap: Turnovers help Packers defeat Rams, 24-19 article.

The college football rankings are changing! Alabama fell, while Big Ten teams are dominating the top spots. You can find the latest rankings in the College Football Rankings: Alabama falls, Big Ten teams stack top article.