Supplemental Life Insurance 2024 offers a valuable layer of financial protection for individuals and families. It goes beyond traditional life insurance, providing additional coverage to address specific needs and circumstances. This comprehensive guide explores the various aspects of supplemental life insurance, from its benefits and types to factors to consider when choosing the right policy.

Karz Insurance is a company that specializes in offering insurance products. If you’re interested in learning more about their offerings, you can visit their website at Karz Insurance 2024 to get a quote.

Supplemental life insurance serves as a crucial financial safety net, ensuring your loved ones are financially secure in the event of your untimely passing. By understanding the different types of supplemental life insurance, their advantages and disadvantages, and the factors influencing your choices, you can make an informed decision that aligns with your individual needs and financial goals.

Buying car insurance online can be a convenient way to compare quotes and find the best deal. There are many websites that allow you to compare quotes from multiple insurers, such as Buy Car Insurance Online 2024.

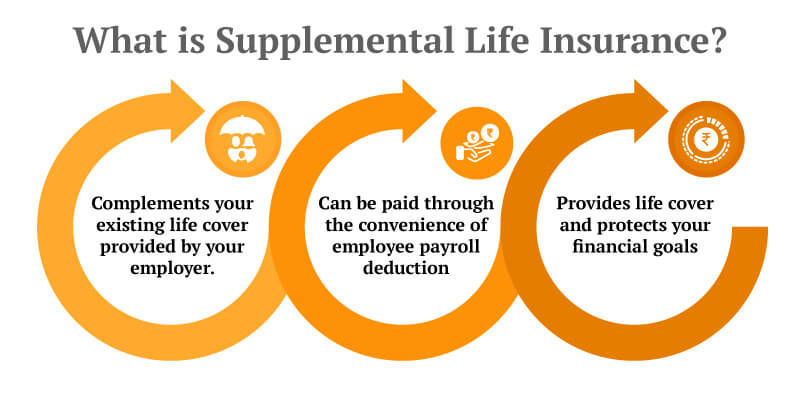

Understanding Supplemental Life Insurance

Supplemental life insurance is a type of insurance policy that provides additional coverage beyond what is offered through an employer’s group life insurance plan. It is designed to help individuals and families protect their loved ones financially in the event of their death.

Finding affordable car insurance can be a challenge, especially if you’re looking for coverage in your local area. You can use a search tool like Cheap Car Insurance Near Me 2024 to compare quotes from insurers in your area and find the best deal.

Supplemental Life Insurance vs. Traditional Life Insurance

Supplemental life insurance differs from traditional life insurance in several key ways. While traditional life insurance policies are typically purchased individually, supplemental life insurance is often offered as an optional benefit through an employer’s group plan. Supplemental life insurance policies generally have shorter terms and lower premiums than traditional life insurance policies.

They also typically have a simpler application process and may not require a medical exam.

If you’ve made modifications to your car, it’s important to make sure your insurance policy covers those changes. You can find information about modified car insurance policies at Modified Car Insurance 2024 , including details on coverage options and potential costs.

Benefits of Supplemental Life Insurance

Supplemental life insurance can offer several benefits for individuals and families, including:

- Increased Coverage:Supplemental life insurance provides additional coverage that can help meet the financial needs of beneficiaries, such as paying off debts, covering funeral expenses, or providing income replacement for dependents.

- Flexibility:Supplemental life insurance policies often offer different coverage options, allowing individuals to choose the amount of coverage that best suits their needs and budget.

- Affordability:Supplemental life insurance policies are generally more affordable than traditional life insurance policies, making them accessible to a wider range of individuals.

- Convenience:Supplemental life insurance is typically offered through an employer’s group plan, making it easy and convenient to enroll.

Key Features of Supplemental Life Insurance

Supplemental life insurance policies typically have the following features:

- Term Life Coverage:Supplemental life insurance policies typically provide term life coverage, meaning they are in effect for a specific period, such as 10, 20, or 30 years.

- Fixed Premiums:Supplemental life insurance policies generally have fixed premiums that remain the same throughout the term of the policy.

- Death Benefit:Upon the death of the insured, the beneficiary receives a lump sum payment, known as the death benefit.

- Simplified Application Process:Supplemental life insurance policies often have a simplified application process that may not require a medical exam.

Types of Supplemental Life Insurance

There are several types of supplemental life insurance policies available, each with its own unique features and benefits. Here is a table summarizing the key characteristics of each type:

| Type | Description | Benefits | Considerations |

|---|---|---|---|

| Group Supplemental Life Insurance | Offered through an employer’s group plan, typically at a discounted rate. | Affordability, convenience, simplified application process. | Coverage may be limited, limited flexibility, coverage may end if employment ends. |

| Individual Supplemental Life Insurance | Purchased directly from an insurance company, providing more flexibility in coverage and terms. | Greater flexibility, potential for higher coverage, can be tailored to individual needs. | Higher premiums, more complex application process, may require a medical exam. |

| Term Life Insurance | Provides coverage for a specific period, typically 10, 20, or 30 years. | Affordability, simplicity, coverage for a specific period. | No cash value, coverage ends at the end of the term. |

| Whole Life Insurance | Provides lifetime coverage and accumulates cash value. | Lifetime coverage, cash value accumulation, potential for investment growth. | Higher premiums, more complex, may not be suitable for everyone. |

| Universal Life Insurance | Provides flexible premiums and death benefit options. | Flexibility, cash value accumulation, potential for investment growth. | More complex, higher premiums, may not be suitable for everyone. |

Factors to Consider When Choosing Supplemental Life Insurance

When choosing supplemental life insurance, it is important to consider several factors to ensure you select the policy that best meets your needs and budget. Here is a checklist of key considerations:

- Assess Your Needs:Determine the amount of coverage you need based on your financial obligations, such as debts, mortgage, and dependents.

- Budget:Consider your budget and the affordability of different policy options.

- Financial Goals:Align your supplemental life insurance policy with your overall financial goals, such as retirement planning or estate planning.

- Health Conditions and Lifestyle:Your health and lifestyle factors may affect your eligibility for supplemental life insurance and the premiums you will pay.

- Compare Policies:Obtain quotes from multiple insurance providers and compare features, benefits, and costs to find the best value.

Key Considerations for 2024

In 2024, several factors are shaping the supplemental life insurance landscape. The current economic conditions and market trends are influencing insurance premiums and coverage options. Regulatory changes and advancements in technology are also impacting the industry. As consumer needs and preferences evolve, the life insurance industry is adapting to provide more innovative and tailored solutions.

Impact of Economic Conditions and Market Trends

The current economic environment, characterized by inflation and interest rate fluctuations, is influencing the cost of supplemental life insurance. Insurance providers are adjusting premiums to reflect these changes, while also exploring new ways to offer competitive coverage options. The demand for supplemental life insurance is expected to remain strong as individuals seek financial protection for their loved ones in an uncertain economic climate.

Understanding your car insurance policy is crucial to ensure you’re adequately protected. You can find information about car insurance policies, including details on coverage options and terms, at Car Insurance Policy 2024.

Regulatory Changes and Policy Updates

The insurance industry is subject to ongoing regulatory scrutiny and updates. Changes in regulations and policies can impact supplemental life insurance coverage, pricing, and accessibility. It is important to stay informed about any new regulations or policy changes that may affect your supplemental life insurance coverage.

Finding cheap insurance can save you money, but it’s important to ensure the policy provides adequate coverage. You can find information about cheap insurance companies and compare quotes at Cheap Insurance Companies 2024.

Technological Advancements, Supplemental Life Insurance 2024

The life insurance industry is embracing technological advancements to streamline processes, improve customer experience, and offer more innovative products. The emergence of online platforms, digital applications, and data analytics is transforming how individuals access and purchase supplemental life insurance. These advancements are making it easier for individuals to compare policies, obtain quotes, and complete the application process online.

Geico is a popular insurance company known for its affordable rates. If you’re interested in learning more about their offerings, you can visit their website at Geico Insurance Company 2024 to get a quote.

Evolving Consumer Needs and Preferences

Consumers are increasingly seeking more personalized and flexible life insurance solutions. This is driving the development of supplemental life insurance products that offer tailored coverage options, customized premiums, and digital-first experiences. Insurance providers are adapting to meet these evolving needs by offering a wider range of supplemental life insurance policies that cater to different lifestyles and financial goals.

Private medical insurance can provide additional coverage beyond what’s offered by public health insurance. If you’re interested in exploring private medical insurance options, you can find information and compare plans at Private Medical Insurance 2024.

Getting Started with Supplemental Life Insurance

If you are considering supplemental life insurance, here is a step-by-step guide to help you get started:

- Assess Your Needs:Determine the amount of coverage you need based on your financial obligations and goals.

- Obtain Quotes:Contact multiple insurance providers and obtain quotes for different supplemental life insurance policies.

- Compare Policies:Compare the features, benefits, and costs of different policies to find the best value.

- Negotiate Coverage and Premiums:If possible, negotiate with insurance providers to secure the most favorable coverage and premiums.

- Understand Policy Terms and Conditions:Carefully review the policy terms and conditions before purchasing to ensure you understand the coverage details, exclusions, and limitations.

Outcome Summary

In conclusion, supplemental life insurance plays a significant role in securing the financial well-being of your loved ones. By carefully considering your needs, budget, and the various options available, you can find a policy that provides the necessary coverage to protect your family’s future.

Commercial truck insurance is essential for businesses that operate trucks. You can find information about commercial truck insurance policies, including details on coverage options and potential costs, at Commercial Truck Insurance 2024.

Remember to explore different providers, compare policies, and seek expert advice to ensure you make the most informed decision.

FAQ Summary: Supplemental Life Insurance 2024

What is the difference between supplemental life insurance and traditional life insurance?

Supplemental life insurance provides additional coverage on top of existing life insurance policies, while traditional life insurance is a standalone policy. Supplemental life insurance is typically offered at a lower cost and with less comprehensive coverage than traditional life insurance.

Humana is a well-known health insurance company that offers a variety of plans. If you’re interested in learning more about their offerings, you can visit their website at Humana Insurance 2024 to find a plan that meets your needs.

How much supplemental life insurance do I need?

Zurich is a well-known insurance company that offers a variety of insurance products, including car insurance. If you’re interested in learning more about their car insurance offerings, you can visit their website at Zurich Car Insurance 2024 to get a quote.

The amount of supplemental life insurance you need depends on your individual circumstances, including your dependents, outstanding debts, and financial goals. It’s recommended to consult with a financial advisor to determine the appropriate coverage.

Can I get supplemental life insurance if I have health issues?

Yes, you can still qualify for supplemental life insurance even if you have health issues. However, your premiums may be higher, and you may be subject to certain limitations or exclusions.

Bright Health offers a variety of health insurance plans, including individual and family plans. If you’re interested in learning more about their offerings, you can visit their website at Bright Health Insurance 2024 to find a plan that meets your needs.

What are the common types of supplemental life insurance policies?

Amax Insurance offers a variety of insurance products, including auto, home, and business insurance. If you’re interested in learning more about their offerings, you can visit their website at Amax Insurance 2024 to explore their policies and get a quote.

Common types include group supplemental life insurance, individual supplemental life insurance, term life insurance, whole life insurance, and universal life insurance. Each type has its own features, benefits, and costs.

Where can I find supplemental life insurance quotes?

Traveling in a motorhome is a great way to see the country, but it’s important to have the right insurance coverage. You can find information about motorhome insurance policies at Motorhome Insurance 2024 , including details on coverage options and potential costs.

You can obtain quotes from various insurance providers online, through insurance brokers, or by contacting insurance agents directly. Compare quotes from different providers to find the best value for your needs.

Finding the right health insurance plan can be a challenge, especially with so many options available. If you’re looking for plans in your area, consider using a search tool like Health Insurance Near Me 2024 to compare plans and find the best fit for your needs.