Strategies for Minimizing NIIT: Planning and Investment Considerations are essential for businesses navigating the complexities of today’s economic landscape. NIIT, or Non-Interest Income Tax, is a significant financial burden for many companies, particularly those operating in sectors with high levels of financial activity.

This guide delves into the multifaceted aspects of minimizing NIIT, offering a comprehensive framework for strategic planning and investment decisions.

By understanding the root causes of NIIT and its potential impact, businesses can develop effective mitigation strategies. These strategies encompass a range of approaches, from optimizing operational efficiency to leveraging technological advancements. This guide explores each aspect in detail, providing practical insights and actionable steps to help organizations achieve their NIIT reduction goals.

Understanding NIIT

Navigating the complexities of the modern business landscape demands a keen understanding of the factors that can impact profitability and long-term sustainability. One such critical factor is Net Income After Income Taxes (NIIT), a key metric that reflects a company’s financial health and its ability to generate returns for shareholders.

This section delves into the definition of NIIT, its implications for businesses, and the various factors that contribute to its fluctuations.

Defining NIIT and its Implications

NIIT represents the bottom line of a company’s income statement, signifying the profit remaining after all expenses, including taxes, have been deducted from revenue. It is a crucial indicator of a company’s financial performance, as it reflects the true earnings available for distribution to shareholders or reinvestment in the business.

The DealBook Summit 2024 highlighted the critical role businesses play in combating climate change. This summit brought together leading industry figures to discuss innovative solutions, sustainable practices, and the need for collective action to address this global challenge.

A higher NIIT generally indicates a company’s strong financial position and its ability to generate consistent profits. This can attract investors, boost share prices, and enhance a company’s creditworthiness. Conversely, a declining NIIT can raise concerns among investors and lenders, potentially impacting access to capital and future growth prospects.

Factors Contributing to NIIT

Several factors can influence a company’s NIIT, both internal and external. Understanding these factors is crucial for effective planning and investment decisions.

The DealBook Summit 2024 featured compelling case studies in corporate social responsibility, showcasing companies that are effectively integrating social and environmental concerns into their operations. These examples provide valuable insights into the diverse ways businesses can contribute to a more sustainable future.

- Revenue Growth:Increased sales and top-line growth directly contribute to higher NIIT, assuming expenses remain relatively stable. Companies with robust revenue streams are typically better positioned to generate strong profits.

- Cost Management:Effective cost control is essential for maximizing NIIT. Companies that can optimize their operations, streamline processes, and negotiate favorable contracts can reduce expenses and improve profitability.

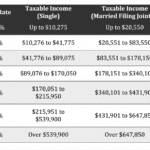

- Tax Rates:Changes in corporate tax rates can significantly impact NIIT. Lower tax rates result in higher after-tax profits, while higher tax rates reduce NIIT. Companies need to be aware of tax policies and potential changes that could affect their bottom line.

- Interest Rates:Fluctuations in interest rates can influence a company’s NIIT, particularly for businesses with significant debt obligations. Higher interest rates increase borrowing costs, reducing net income and impacting NIIT.

- Economic Conditions:Macroeconomic factors such as inflation, recession, and currency fluctuations can influence a company’s revenue and expenses, ultimately impacting NIIT. Businesses need to adapt their strategies to navigate these external challenges.

- Competition:Intense competition can pressure companies to lower prices or increase marketing spending, potentially impacting profitability and NIIT. Businesses need to develop competitive advantages to maintain their market share and protect their earnings.

Industries Where NIIT is a Significant Concern

Certain industries are particularly sensitive to fluctuations in NIIT due to their inherent business models or external factors.

- Energy:The energy sector is subject to volatile commodity prices and regulatory changes, which can significantly impact profitability. Oil and gas companies, for example, experience fluctuating NIIT based on crude oil prices and demand.

- Technology:The technology sector is characterized by rapid innovation and intense competition. Companies in this sector need to invest heavily in research and development, which can impact NIIT in the short term. However, successful innovation can lead to long-term growth and higher profits.

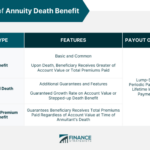

The Net Investment Income Tax is a significant tax provision that impacts individuals with substantial investment income. Understanding its implications and navigating its complexities is crucial for effective financial planning.

- Retail:Retail businesses are often impacted by consumer spending patterns, economic conditions, and competition from online retailers. Fluctuations in consumer demand and changing shopping habits can significantly influence NIIT in the retail sector.

Investment Considerations for NIIT Reduction: Strategies For Minimizing NIIT: Planning And Investment Considerations

Investing in NIIT mitigation measures is a strategic decision that requires careful consideration of the potential costs and benefits. This section explores the cost-benefit analysis of such investments, identifies potential funding sources, and examines various investment options and their impact on NIIT reduction.

Cost-Benefit Analysis of NIIT Mitigation Investments

Evaluating the cost-benefit of NIIT mitigation investments involves assessing the financial and non-financial benefits against the associated costs. The benefits of investing in NIIT mitigation measures include:

- Reduced NIIT payments, resulting in increased profitability and cash flow.

- Improved financial stability and reduced risk associated with fluctuating NIIT rates.

- Enhanced competitiveness by allowing for greater investment in growth and innovation.

- Improved corporate social responsibility by demonstrating commitment to sustainable practices.

The costs associated with NIIT mitigation investments include:

- Initial investment in technologies, equipment, and infrastructure.

- Ongoing operational costs, such as maintenance, training, and energy consumption.

- Potential disruptions during implementation and transition phases.

A thorough cost-benefit analysis should consider both tangible and intangible benefits and costs, including long-term impacts and potential synergies with other business objectives.

Funding Sources for NIIT Reduction Initiatives

Securing funding for NIIT reduction initiatives is crucial for successful implementation. Potential funding sources include:

- Internal Funding:Allocating funds from existing budgets or profits.

- External Funding:Securing loans, grants, or investments from financial institutions, government agencies, or private investors.

- Tax Incentives:Utilizing government-provided tax breaks or subsidies specifically designed to encourage NIIT reduction investments.

- Partnerships:Collaborating with technology providers, research institutions, or other organizations to share costs and expertise.

The choice of funding source depends on factors such as the project scale, financial capacity, and availability of incentives.

The DealBook Summit 2024 focused on the burgeoning field of green finance and sustainable investing. This sector is attracting growing interest as investors seek opportunities to align their portfolios with environmental and social goals.

Investment Options for NIIT Reduction

Several investment options can contribute to NIIT reduction, each with its own potential impact.

The Net Investment Income Tax is a complex tax provision that can have a significant impact on individuals with substantial investment income. Understanding its implications and navigating its complexities is crucial for effective financial planning.

Energy Efficiency Investments

Energy efficiency investments focus on reducing energy consumption and associated emissions. Examples of energy efficiency investments include:

- Implementing energy-efficient lighting systems.

- Upgrading HVAC systems to improve efficiency.

- Installing solar panels or other renewable energy sources.

- Optimizing building insulation and sealing.

Renewable Energy Investments

Renewable energy investments involve adopting renewable energy sources to replace fossil fuels. Examples of renewable energy investments include:

- Investing in wind turbines for electricity generation.

- Utilizing geothermal energy for heating and cooling.

- Deploying biomass energy systems for power production.

Carbon Capture and Storage (CCS) Investments

CCS investments focus on capturing carbon dioxide emissions and storing them underground or utilizing them for other purposes. CCS investments can significantly reduce greenhouse gas emissions, but they are often expensive and require significant technological advancements.

Green Technology Investments

Green technology investments encompass a wide range of technologies and practices that promote environmental sustainability. Examples of green technology investments include:

- Adopting electric vehicles or hybrid vehicles for transportation.

- Investing in water conservation technologies and practices.

- Implementing waste management systems to reduce landfill waste.

- Adopting sustainable agricultural practices to reduce carbon footprint.

The specific investment options chosen should align with the organization’s industry, size, and specific NIIT reduction goals.

Operational Efficiency and NIIT Reduction

Operational efficiency plays a crucial role in minimizing NIIT (Net Income to Total Assets) by maximizing resource utilization and minimizing operational costs. By streamlining processes, optimizing resource allocation, and reducing waste, companies can significantly enhance their profitability and improve their NIIT.

Areas for Operational Improvement

Operational efficiency can be achieved through targeted improvements in various areas.

- Process Optimization:Identifying and eliminating redundant or inefficient processes can lead to significant cost savings and improved productivity. For example, automating manual tasks, streamlining workflows, and implementing lean management principles can help reduce operational costs and improve efficiency.

- Resource Optimization:Optimizing resource allocation, such as personnel, equipment, and materials, is essential for efficient operations. This can involve rightsizing workforce, implementing resource scheduling tools, and optimizing inventory management to reduce waste and unnecessary expenditures.

- Technology Adoption:Leveraging technology to automate processes, improve data analysis, and enhance communication can significantly enhance operational efficiency. Implementing enterprise resource planning (ERP) systems, customer relationship management (CRM) tools, and data analytics platforms can streamline operations and reduce costs.

- Cost Control:Implementing rigorous cost control measures is essential for maximizing profitability and improving NIIT. This can involve negotiating better prices with suppliers, reducing energy consumption, and minimizing overhead expenses.

Examples of Operational Efficiency in NIIT Reduction

Several companies have successfully implemented operational efficiency strategies to reduce NIIT and enhance profitability.

- Walmart:Walmart’s success in minimizing NIIT is largely attributed to its efficient supply chain management and inventory optimization. By leveraging its vast network of stores and distribution centers, Walmart can minimize transportation costs and optimize inventory levels, resulting in lower operating expenses and higher profitability.

- Amazon:Amazon’s efficient logistics and fulfillment operations, coupled with its data-driven approach to pricing and customer service, have contributed to its high profitability and low NIIT. The company’s focus on automation and technology has enabled it to optimize its operations and reduce costs.

- Toyota:Toyota’s lean manufacturing principles, known as the Toyota Production System (TPS), have been instrumental in its operational efficiency and low NIIT. TPS emphasizes waste reduction, continuous improvement, and customer-centricity, resulting in optimized production processes and lower costs.

Future Trends and Emerging Technologies

The rapidly evolving landscape of technology is poised to significantly impact NIIT reduction strategies, presenting both opportunities and challenges for businesses. Emerging technologies, particularly those focused on automation, data analytics, and artificial intelligence, hold the potential to revolutionize how companies manage their non-interest income tax (NIIT) obligations.

This section explores key future trends and technologies that could influence NIIT management and Artikels strategies for businesses to adapt and thrive in this dynamic environment.

The DealBook Summit 2024 underscored the importance of stakeholder engagement in addressing complex challenges, particularly those related to climate change. Engaging with diverse stakeholders, including employees, customers, investors, and communities, is crucial for fostering transparency, building trust, and driving sustainable solutions.

Impact of Emerging Technologies on NIIT Reduction Strategies

Emerging technologies have the potential to streamline processes, enhance efficiency, and optimize resource allocation, all of which can contribute to NIIT reduction.

- Artificial Intelligence (AI) and Machine Learning (ML):AI and ML algorithms can analyze vast amounts of data to identify patterns and trends that might not be apparent to human analysts. This capability can be leveraged to improve forecasting accuracy, optimize tax planning, and identify potential areas for NIIT reduction.

For instance, AI-powered tools can automate the process of identifying and classifying transactions, minimizing manual errors and ensuring accurate reporting for tax purposes.

- Blockchain Technology:Blockchain’s inherent transparency and immutability can be harnessed to enhance the accuracy and efficiency of financial transactions. This can significantly reduce the risk of errors and fraud, leading to a more streamlined and compliant tax environment. By leveraging blockchain technology, companies can automate the recording and verification of transactions, simplifying the process of calculating and reporting NIIT.

- Cloud Computing:Cloud-based solutions offer scalability, flexibility, and cost-effectiveness, making them ideal for managing complex financial operations. By migrating to the cloud, businesses can access powerful data analytics tools and leverage AI and ML capabilities without the need for significant upfront investments in hardware and infrastructure.

The concept of investing for impact is gaining traction, merging the pursuit of financial returns with positive social and environmental outcomes. This approach emphasizes the potential to generate both financial profit and societal good through strategic investments.

This can streamline processes, enhance data security, and ultimately contribute to more efficient NIIT management.

Potential Future Trends Influencing NIIT Management, Strategies for Minimizing NIIT: Planning and Investment Considerations

As technology continues to advance, several trends will shape the future of NIIT management.

Companies are increasingly integrating sustainability into their core strategies, recognizing its significance in long-term success. Integrating sustainability entails incorporating environmental, social, and governance (ESG) considerations into business decisions, from supply chain management to product development.

- Increased Automation:Automation will continue to play a critical role in streamlining financial processes and reducing the risk of human error. This trend will extend beyond basic tasks to include more complex functions like tax planning and compliance. Businesses will need to invest in technologies that can automate repetitive tasks and free up human resources for more strategic initiatives.

- Data-Driven Decision-Making:Data analytics will become increasingly crucial for making informed decisions regarding NIIT management. Companies will need to develop robust data collection and analysis capabilities to identify patterns, predict future trends, and optimize their tax strategies.

- Real-Time Reporting and Transparency:Real-time reporting and increased transparency will be essential for effective NIIT management. Businesses will need to implement systems that provide up-to-date information on their financial performance and tax obligations. This will allow for more proactive tax planning and minimize the risk of unexpected liabilities.

- Growing Complexity of Tax Regulations:As tax regulations become more complex, businesses will need to invest in sophisticated software and tools to ensure compliance. This will require staying abreast of regulatory changes and implementing systems that can adapt to evolving requirements.

Adapting Strategies to Address Emerging Trends

To effectively manage NIIT in the face of emerging trends, companies should consider the following strategies:

- Invest in Technology:Embrace emerging technologies such as AI, ML, blockchain, and cloud computing to streamline processes, enhance data analysis, and improve compliance.

- Develop Data Analytics Capabilities:Invest in building robust data analytics capabilities to gain insights from financial data, identify trends, and optimize tax planning strategies.

- Foster a Culture of Continuous Improvement:Continuously assess and adapt NIIT management processes to incorporate new technologies and stay ahead of evolving regulations.

- Partner with Experts:Engage with tax specialists and technology consultants to leverage their expertise and navigate the complexities of NIIT management in the digital age.

Ultimate Conclusion

In conclusion, minimizing NIIT requires a multifaceted approach that combines strategic planning, targeted investments, and operational improvements. By embracing the principles Artikeld in this guide, businesses can effectively manage their NIIT exposure and achieve long-term financial stability. The journey towards NIIT reduction is a continuous process, demanding ongoing vigilance and adaptability to emerging trends and technologies.

By proactively addressing these challenges, businesses can navigate the complex world of NIIT with confidence and secure a more favorable financial future.

Commonly Asked Questions

What are some common examples of industries where NIIT is a significant concern?

Industries with high levels of financial activity, such as banking, insurance, and investment management, often face significant NIIT challenges.

How can I determine if my business is at risk for high NIIT?

Consult with a tax professional or financial advisor to assess your business’s specific NIIT risk. They can analyze your financial statements and identify potential areas of concern.

What are some examples of technological solutions for NIIT minimization?

Examples include automated tax compliance software, data analytics platforms for financial reporting, and cloud-based solutions for managing financial transactions.