The Stimulus Check Program and the Housing Market have become inextricably linked in recent years, with the influx of government funds injecting a powerful force into the real estate landscape. This article explores the multifaceted impact of stimulus checks on housing demand, prices, affordability, and policy, providing a comprehensive analysis of this complex economic phenomenon.

From the initial surge in home buying activity fueled by stimulus payments to the subsequent adjustments in market dynamics, this investigation delves into the intricate interplay between government intervention and housing market trends. It examines the varying effects across different housing segments, analyzes the influence on affordability challenges, and explores the potential long-term consequences of stimulus programs on housing policy.

Do not overlook explore the latest data about Where to Find Official Information on Stimulus Check Eligibility.

Stimulus Check Program Overview

The Stimulus Check Program, formally known as the Economic Impact Payments, was a series of direct payments issued by the U.S. government to individuals and families during the COVID-19 pandemic. These payments aimed to provide economic relief and stimulate the economy during a period of widespread economic hardship.

History and Purpose of the Stimulus Check Program

The Stimulus Check Program was a response to the economic fallout caused by the COVID-19 pandemic. The program was designed to provide financial assistance to individuals and families facing unemployment, reduced income, and economic uncertainty. The program was also intended to stimulate consumer spending and support businesses affected by the pandemic.

Timeline of Stimulus Checks

- March 2020:The CARES Act authorized the first round of stimulus checks, with most adults receiving $1,200. Eligibility was based on income and filing status.

- December 2020:The Consolidated Appropriations Act, 2021, authorized a second round of stimulus checks, with most adults receiving $600. Eligibility criteria were similar to the first round.

- March 2021:The American Rescue Plan Act authorized a third round of stimulus checks, with most adults receiving $1,400. Eligibility was based on income, filing status, and dependents.

Economic Context and Rationale

The Stimulus Check Program was implemented within a broader economic context marked by significant job losses, business closures, and widespread economic uncertainty. The rationale behind the program was to provide immediate financial relief to individuals and families, stimulate consumer spending, and support businesses struggling to stay afloat.

Housing Market Dynamics: Stimulus Check Program And The Housing Market

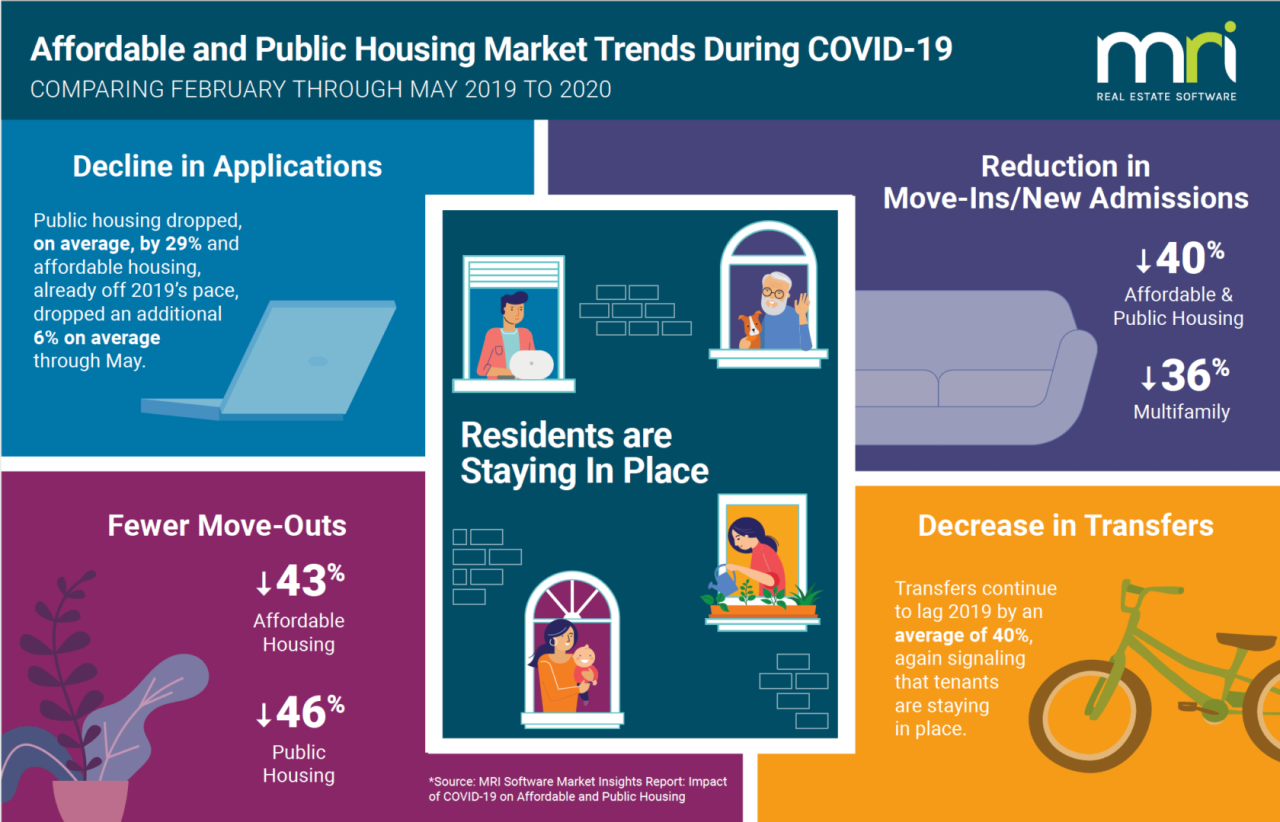

The housing market experienced a period of volatility during the COVID-19 pandemic, influenced by factors such as low interest rates, shifting consumer preferences, and the economic impact of the pandemic. The Stimulus Check Program played a role in shaping these dynamics, particularly in terms of housing demand.

Impact of Stimulus Checks on Housing Demand

The Stimulus Check Program had a notable impact on housing demand, as individuals and families used the payments to cover housing costs, make down payments on homes, or invest in real estate. The program contributed to increased demand for both home purchases and rentals, particularly in the early stages of the pandemic when economic uncertainty was high.

Effects on Different Housing Market Segments, Stimulus Check Program and the Housing Market

The impact of stimulus checks varied across different housing market segments. In the luxury housing market, the program may have contributed to increased demand from higher-income individuals and families with greater financial flexibility. In the affordable housing market, the program may have provided some relief for lower-income households struggling to make ends meet.

Impact on Home Prices

The relationship between stimulus checks and home prices is complex and multifaceted. While the program may have contributed to increased demand, other factors, such as low interest rates and supply chain disruptions, also played a significant role in price fluctuations.

Stimulus Checks and Home Price Changes

- In some regions, stimulus checks may have contributed to modest price increases, particularly in areas with high demand and limited inventory.

- However, the impact of stimulus checks on home prices was not uniform across all markets. In areas with lower demand or a more stable housing market, the impact may have been less pronounced.

Data and Insights

- Data from the National Association of Realtors (NAR) suggests that home prices rose significantly during the pandemic, with the median home price reaching record highs in 2021.

- While stimulus checks may have played a role in this trend, it’s important to consider other factors, such as low interest rates, supply chain disruptions, and shifting consumer preferences.

Impact on Housing Affordability

The impact of stimulus checks on housing affordability is a matter of debate. While the program may have provided temporary relief for some households, it’s unclear whether it had a long-term impact on housing affordability overall.

Stimulus Checks and Affordability Challenges

The stimulus checks may have exacerbated affordability challenges in some regions, particularly in areas with high demand and limited inventory. In these areas, the increased demand fueled by stimulus checks may have driven up prices, making it more difficult for some households to afford housing.

Potential for Alleviation

In other regions, the stimulus checks may have provided temporary relief for households struggling to make ends meet. For example, the payments may have helped some families cover rent or mortgage payments, preventing them from falling behind or facing eviction.

Obtain direct knowledge about the efficiency of Special Circumstances and Stimulus Check Eligibility (e.g., Disabilities, Recently Unemployed) through case studies.

Impact on Income Brackets

| Income Bracket | Stimulus Check Amount | Impact on Housing Affordability |

|---|---|---|

$0

|

$1,400 | May have provided temporary relief, but long-term impact is unclear. |

$35,000

|

$1,400 | May have provided some relief, but affordability challenges persist in high-cost areas. |

| $75,000

You also can investigate more thoroughly about How Age Affects Stimulus Check Eligibility in New York & California to enhance your awareness in the field of How Age Affects Stimulus Check Eligibility in New York & California.

|

$1,400 | May have had a limited impact on affordability, as this bracket is generally less affected by housing costs. |

| $150,000+ | $0 | No direct impact on housing affordability. |

Stimulus Check Program and Housing Market Policy

The Stimulus Check Program had potential policy implications for the housing market, influencing government policies related to housing affordability, homeownership, and rental assistance.

Do not overlook explore the latest data about Understanding the Stimulus Check Phase-Out.

Policy Implications

The program highlighted the need for government intervention to address housing affordability challenges, particularly for low- and moderate-income households. The program also underscored the importance of providing rental assistance to prevent evictions and maintain housing stability.

Government Policies

- The program may have influenced policies such as the Emergency Rental Assistance Program (ERAP), which provided financial assistance to renters facing eviction.

- It may have also influenced policies related to homeownership, such as the expansion of down payment assistance programs.

Long-Term Effects

The long-term effects of the Stimulus Check Program on housing market regulations and interventions are still unfolding. However, the program may have contributed to a greater awareness of the need for affordable housing solutions and the importance of government intervention in the housing market.

Explore the different advantages of How the Stimulus Check Program is Funded that can change the way you view this issue.

Ultimate Conclusion

The relationship between stimulus checks and the housing market is a dynamic one, with both short-term and long-term implications. While stimulus programs can provide much-needed economic relief, they also have the potential to create unforeseen consequences in the housing sector.

Understanding these nuances is crucial for policymakers, investors, and homebuyers alike, as they navigate the evolving landscape of the housing market in the wake of government interventions.

Question Bank

Did stimulus checks cause a housing bubble?

While stimulus checks contributed to increased demand, attributing a housing bubble solely to them is overly simplistic. Other factors, such as low interest rates and limited inventory, also played significant roles.

How long did the impact of stimulus checks last on the housing market?

The effects of stimulus checks on the housing market varied in duration depending on the specific program and region. However, the overall impact was felt for several years, influencing both demand and pricing trends.

What are the long-term implications of stimulus checks on housing affordability?

Long-term implications are complex and still unfolding. Some argue that stimulus checks exacerbated existing affordability challenges, while others believe they provided temporary relief. Continued monitoring and research are crucial to understanding the full impact.