Stimulus Check Program and its Impact on Inflation in Florida is a topic that has garnered significant attention in recent years. The COVID-19 pandemic led to unprecedented economic hardship, prompting the government to implement stimulus programs aimed at mitigating the crisis.

These programs, including direct payments to individuals, were intended to boost consumer spending and support the economy. However, they also raised concerns about potential inflationary pressures, particularly in a state like Florida, with its diverse and sensitive economy.

This analysis delves into the intricate relationship between stimulus checks and inflation in Florida. It examines the various stimulus programs implemented during the pandemic, their intended goals, and their potential impact on the state’s economy. The study also explores the dynamics of inflation in Florida, including its key drivers and the impact on different sectors.

By comparing and contrasting the Florida experience with other regions, we aim to gain a deeper understanding of the complex interplay between stimulus measures and inflation.

Introduction to Stimulus Check Programs in Florida

The COVID-19 pandemic significantly impacted the Florida economy, leading to widespread job losses and business closures. In response, the federal government implemented several stimulus check programs to provide financial assistance to individuals and families. Florida, like other states, played a role in distributing these funds and administering additional state-level support programs.

Check Stimulus Check Application Process for Deceased Individuals in California to inspect complete evaluations and testimonials from users.

Stimulus Check Programs in Florida, Stimulus Check Program and its Impact on Inflation in Florida

The primary federal stimulus programs that impacted Florida residents were:

- The CARES Act (Coronavirus Aid, Relief, and Economic Security Act): This act, passed in March 2020, provided a one-time stimulus payment of $1,200 to eligible individuals and $2,400 to married couples. The program also included enhanced unemployment benefits, loans for small businesses, and funding for healthcare providers.

- The Coronavirus Response and Relief Supplemental Appropriations Act (CRRSA): Enacted in December 2020, this act provided a second round of stimulus payments, this time $600 per individual and $1,200 for married couples. The CRRSA also extended unemployment benefits and provided additional funding for various programs.

- The American Rescue Plan Act (ARPA): Passed in March 2021, ARPA provided a third round of stimulus payments, with $1,400 per individual and $2,800 for married couples. The act also included expanded child tax credits, funding for vaccine distribution, and support for state and local governments.

Florida also implemented its own stimulus programs, such as the Florida Unemployment Assistance Program, which provided additional benefits to unemployed individuals, and the Florida Small Business Emergency Bridge Loan Program, which offered low-interest loans to struggling businesses.

Obtain recommendations related to Public Opinion on the Florida Stimulus Check Program that can assist you today.

The primary goal of these stimulus programs was to mitigate the economic impact of the pandemic by providing financial relief to individuals and businesses, supporting consumer spending, and stimulating economic activity. The programs were designed to help individuals cover essential expenses, prevent widespread job losses, and support businesses during a period of significant economic uncertainty.

Understanding Inflation in Florida

Inflation is a general increase in the prices of goods and services over time, resulting in a decrease in the purchasing power of money. In the context of Florida’s economy, inflation is influenced by various factors, including:

- Increased demand: As the economy recovers from a recession, increased consumer spending can lead to higher demand for goods and services, putting upward pressure on prices.

- Supply chain disruptions: The pandemic caused disruptions in global supply chains, leading to shortages of certain goods and higher prices.

- Rising energy costs: Florida, like many other states, experienced rising energy costs due to factors like increased demand and geopolitical events.

- Housing costs: Florida has experienced a significant increase in housing costs, particularly in major metropolitan areas, contributing to overall inflation.

Data on inflation rates in Florida during the periods when stimulus checks were distributed show a general upward trend. For example, the Consumer Price Index (CPI) for the Miami-Fort Lauderdale-West Palm Beach Metropolitan Statistical Area (MSA) rose by 2.8% in 2020, 4.2% in 2021, and 7.1% in 2022.

Understand how the union of Future of the Stimulus Check Program in New York & California can improve efficiency and productivity.

This suggests that inflation was a significant concern in Florida during the pandemic and the period of stimulus check distribution.

Inflation has a significant impact on different sectors of the Florida economy. For example, rising energy costs affect transportation, manufacturing, and tourism industries. Higher housing costs impact affordability for residents and contribute to the cost of living. Increased prices for consumer goods and services reduce the purchasing power of residents, impacting their ability to afford essential items and discretionary spending.

Analyzing the Potential Impact of Stimulus Checks on Inflation

The potential economic effects of stimulus checks on consumer spending and demand in Florida are complex and multifaceted. While stimulus checks can provide temporary relief to individuals and families, they can also contribute to inflation.

- Increased consumer spending: Stimulus checks can lead to increased consumer spending, as individuals have more disposable income. This increased demand can put upward pressure on prices, especially if supply chains are unable to keep pace.

- Demand-pull inflation: When demand for goods and services exceeds supply, prices rise. Stimulus checks can contribute to demand-pull inflation by increasing aggregate demand in the economy.

- Supply chain bottlenecks: Stimulus checks can exacerbate existing supply chain bottlenecks, as increased demand puts further strain on already stretched resources.

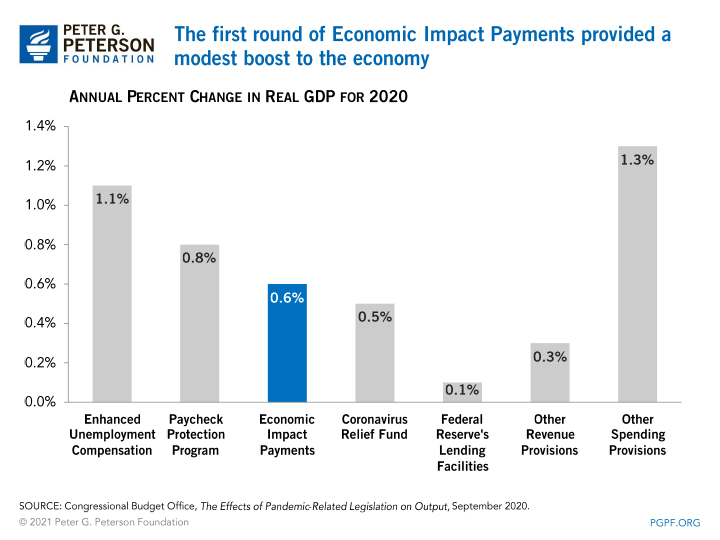

While stimulus checks are often seen as a contributing factor to inflation, it’s important to note that other factors, such as supply chain disruptions, rising energy costs, and labor shortages, also played a role in the inflationary environment in Florida during the pandemic.

The extent to which stimulus checks contributed to inflation is a subject of ongoing debate among economists.

Comparing the impact of stimulus checks on inflation in Florida with other states or regions can provide insights into the relative influence of these programs. For example, states with higher levels of unemployment and greater reliance on tourism may have experienced a more pronounced impact from stimulus checks on inflation compared to states with more diversified economies.

Examining the Effectiveness of Stimulus Programs in Florida

The effectiveness of stimulus check programs in achieving their intended goals in Florida is a complex issue. While the programs provided short-term relief to individuals and businesses, their long-term impact on the state’s economy is still being assessed.

For descriptions on additional topics like Addressing Concerns and Rumors About Florida Stimulus Checks, please visit the available Addressing Concerns and Rumors About Florida Stimulus Checks.

- Economic recovery: Stimulus checks helped to mitigate the immediate economic impact of the pandemic by providing financial assistance to individuals and businesses, supporting consumer spending, and preventing widespread job losses. However, the long-term economic implications of these programs remain uncertain.

- Government debt: Stimulus programs have contributed to an increase in government debt, which could have long-term implications for the state’s fiscal health.

- Unintended consequences: Stimulus programs can have unintended consequences, such as inflation and increased government debt. The balance between providing economic relief and mitigating potential negative consequences is a key challenge for policymakers.

Evaluating the effectiveness of stimulus programs requires a comprehensive analysis that considers both their intended and unintended consequences. It is crucial to assess the long-term impact of these programs on the Florida economy, including their effects on inflation, government debt, and economic growth.

Closure

The impact of stimulus check programs on inflation in Florida remains a subject of ongoing debate. While these programs undoubtedly provided crucial support during the pandemic, they also contributed to increased consumer spending and demand. This, in turn, fueled inflationary pressures, affecting various sectors of the state’s economy.

Ultimately, the effectiveness of these programs and their long-term consequences require careful evaluation, considering both their intended benefits and potential unintended consequences.

Question Bank: Stimulus Check Program And Its Impact On Inflation In Florida

What were the specific stimulus programs implemented in Florida?

Florida implemented various stimulus programs during the pandemic, including direct payments to individuals, unemployment benefits, and support for businesses. The specific programs, eligibility criteria, and amounts distributed varied over time.

How did inflation impact different sectors of the Florida economy?

Further details about Stimulus Check Legislation Updates in Florida is accessible to provide you additional insights.

Inflation affected different sectors of the Florida economy in varying degrees. For example, the tourism and hospitality industries experienced price increases due to supply chain disruptions and increased demand. The housing market also saw significant price appreciation, driven by low interest rates and a shortage of available properties.

What are some alternative economic strategies that could have been implemented in Florida?

Alternative economic strategies could have included targeted tax breaks for businesses, infrastructure investments, or programs to support specific industries. The potential impact of these strategies on inflation and economic growth would depend on their specific design and implementation.