Stimulus Check Payments for Mixed-Status Families in Pennsylvania sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The economic landscape for mixed-status families in Pennsylvania is complex, with a patchwork of federal and state policies affecting their access to vital resources.

This article delves into the intricacies of stimulus check eligibility, payment amounts, and the potential impact these payments have on the financial well-being of these families.

The pandemic’s economic fallout disproportionately affected mixed-status families, who often face challenges in accessing government benefits due to their immigration status. Stimulus checks were a lifeline for many, providing much-needed financial relief. However, the eligibility criteria for these payments, particularly for mixed-status families, are often confusing and difficult to navigate.

This guide aims to clarify the requirements and provide essential information for families seeking to understand their eligibility and access these payments.

Eligibility Criteria for Stimulus Check Payments: Stimulus Check Payments For Mixed-Status Families In Pennsylvania

Navigating the eligibility requirements for stimulus check payments can be confusing, especially for mixed-status families in Pennsylvania. This section will provide a clear understanding of the rules and regulations surrounding these payments, specifically tailored to families with varying immigration statuses.

Eligibility Requirements for Mixed-Status Families

To be eligible for stimulus check payments, individuals must meet specific criteria related to their immigration status. While the exact requirements may vary depending on the specific stimulus package, here’s a general overview of the most common criteria:

- U.S. Citizen:Individuals who are U.S. citizens are generally eligible for stimulus payments, regardless of their family members’ immigration status.

- Lawful Permanent Resident (Green Card Holder):Lawful permanent residents are typically eligible for stimulus payments.

- Refugee or Asylee:Individuals granted refugee or asylee status are generally eligible for stimulus payments.

- Certain Non-Citizen Spouses:In some cases, non-citizen spouses of U.S. citizens or lawful permanent residents may be eligible for stimulus payments, particularly if they meet certain residency requirements and have filed joint tax returns with their U.S. citizen or permanent resident spouse.

Social Security Number (SSN) and Individual Taxpayer Identification Number (ITIN)

The requirement for a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) can be a crucial factor in determining eligibility for stimulus check payments. Here’s a breakdown:

- SSN:Generally, individuals need a valid SSN to receive stimulus payments. However, certain exceptions may apply in specific cases, such as for children who are U.S. citizens but do not yet have an SSN.

- ITIN:While an ITIN is not typically sufficient for receiving stimulus payments, it may be used in specific circumstances, such as for non-citizen spouses who meet certain requirements. It’s essential to consult with a tax professional to understand the specific rules related to ITINs and stimulus payments.

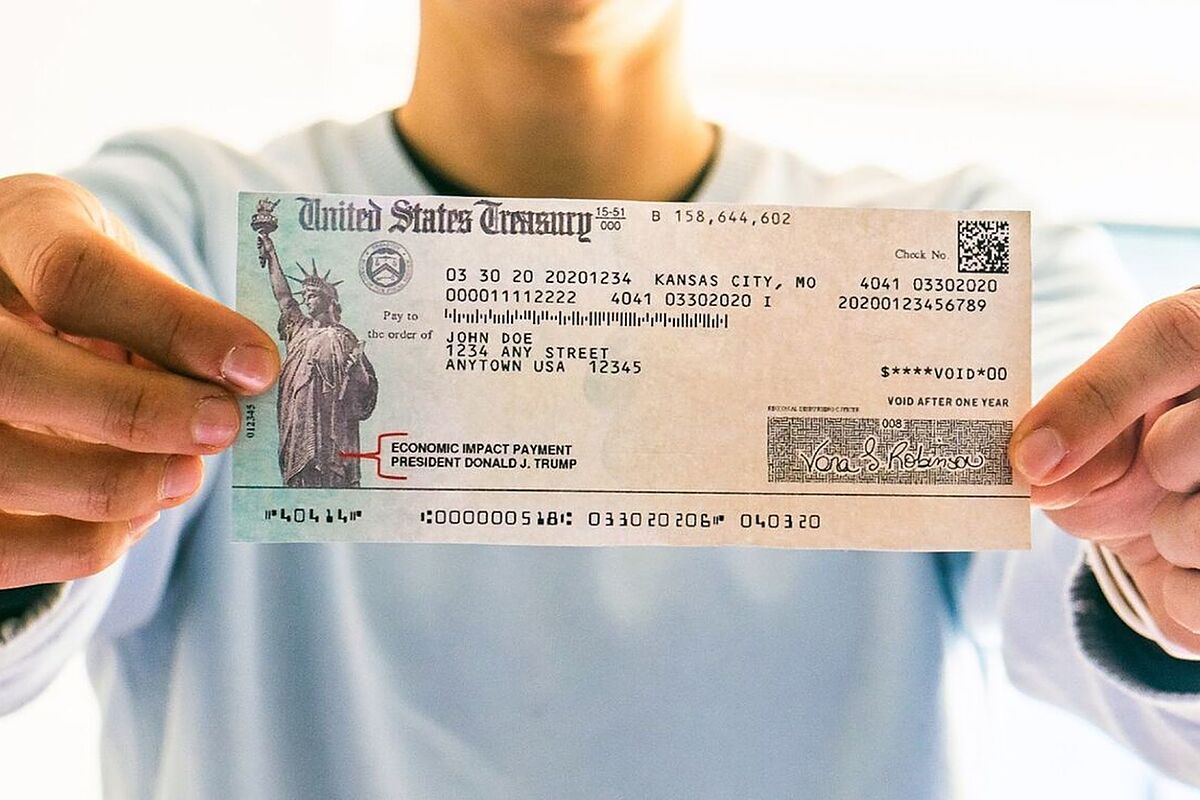

Payment Amounts and Distribution

The amount of the stimulus check payment depends on the family size and income level. This section will Artikel the different payment amounts and the methods used to distribute these payments.

Payment Amounts

The amount of the stimulus check payment is typically determined based on the following factors:

- Family Size:The payment amount may increase with the number of dependents in the household.

- Income Level:The amount of the stimulus check payment may be reduced or eliminated for individuals with higher incomes.

Distribution Methods

Stimulus check payments can be distributed through various methods, including:

- Direct Deposit:The most common method of distribution is through direct deposit into a bank account. If the IRS has your banking information on file, the payment will be deposited directly into your account.

- Mailed Check:If the IRS does not have your banking information, the payment may be mailed to you in the form of a check.

Timeline for Receiving Payments

The timeline for receiving stimulus check payments can vary depending on the specific stimulus package and the distribution method. In general, payments are typically issued within a few weeks of the legislation being passed. However, delays may occur due to various factors, such as the processing of applications or the mailing of checks.

Obtain direct knowledge about the efficiency of How Stimulus Check Amounts Vary by Income Level in Pennsylvania through case studies.

Tax Implications for Mixed-Status Families

Receiving stimulus check payments may have tax implications for mixed-status families. This section will explain the potential tax liability and reporting requirements associated with these payments.

Tax Liability

Stimulus check payments are generally considered taxable income. However, there may be certain exceptions or deductions that can reduce the tax liability. For example, if the payment is used for certain expenses, such as medical costs or education, it may be deductible.

Reporting Requirements

It’s important to report the receipt of stimulus check payments on your tax return. The IRS may require you to provide specific information about the payments, such as the amount received and the date of receipt.

Filing Taxes Accurately

To avoid any penalties, it’s essential to file your taxes accurately and report all relevant information about stimulus check payments. Consulting with a tax professional can help ensure that you comply with all tax regulations and minimize your tax liability.

Check Stimulus Check Program and Consumer Spending Trends in Ohio to inspect complete evaluations and testimonials from users.

Resources and Support for Mixed-Status Families

Navigating the complexities of stimulus check payments can be challenging for mixed-status families. This section will provide a list of resources and support organizations that can assist these families in obtaining information and accessing benefits.

Government Agencies

- Internal Revenue Service (IRS):The IRS website provides information about stimulus check payments, including eligibility criteria, payment amounts, and distribution methods. The IRS also offers various resources for taxpayers, including tax forms and publications.

- Social Security Administration (SSA):The SSA website provides information about Social Security benefits and other government programs. The SSA also offers various resources for individuals with disabilities and their families.

Non-Profit Organizations

- National Immigration Forum:The National Immigration Forum provides information and advocacy on immigration issues, including access to government benefits for immigrants. The organization also offers legal assistance and resources for immigrant families.

- Catholic Legal Immigration Network (CLINIC):CLINIC provides legal assistance and advocacy for immigrants, including access to government benefits. The organization also offers resources for immigrant families, including information about immigration laws and procedures.

Legal Aid Providers

- Legal Aid Society of Philadelphia:The Legal Aid Society of Philadelphia provides legal assistance to low-income individuals and families in Pennsylvania, including immigrants. The organization offers various services, including legal representation, advocacy, and education.

- Community Legal Services of Philadelphia:Community Legal Services of Philadelphia provides legal assistance to low-income individuals and families in Pennsylvania, including immigrants. The organization offers various services, including legal representation, advocacy, and education.

Impact of Stimulus Checks on Mixed-Status Families

Stimulus check payments can have a significant impact on the economic well-being of mixed-status families in Pennsylvania. This section will discuss the potential economic impact of these payments, considering the challenges and opportunities they present.

Economic Impact

Stimulus check payments can provide much-needed financial relief to mixed-status families, helping them to cover essential expenses such as housing, food, and healthcare. These payments can also help to stimulate the local economy by increasing consumer spending.

Challenges and Opportunities

While stimulus check payments can provide economic benefits, mixed-status families may face unique challenges in accessing and utilizing these funds. For example, families with undocumented members may be hesitant to claim benefits due to fear of deportation or other immigration consequences.

Additionally, these families may face difficulties accessing financial services, such as bank accounts and loans.

Discover more by delving into Stimulus Check Payment Amounts for Families with Children in Pennsylvania further.

Real-World Impact, Stimulus Check Payments for Mixed-Status Families in Pennsylvania

Stimulus check payments have helped many mixed-status families in Pennsylvania to meet their basic needs and improve their overall financial stability. For example, some families have been able to use the payments to pay off debt, purchase essential goods, or invest in their children’s education.

However, the impact of these payments can vary depending on individual circumstances and the specific challenges faced by each family.

Last Recap

Navigating the complexities of stimulus check eligibility for mixed-status families in Pennsylvania requires a deep understanding of the specific requirements and available resources. While this article provides a comprehensive overview, it’s crucial to seek personalized advice from qualified legal professionals and community organizations to ensure access to all available benefits.

By understanding the intricacies of these programs, mixed-status families can secure their financial well-being and navigate the challenges of a complex legal landscape.

FAQ Overview

What if a family member doesn’t have a Social Security Number (SSN)?

Check what professionals state about Impact of Dependents on Stimulus Check Payment Amounts in Pennsylvania and its benefits for the industry.

Families with members who do not have an SSN may still be eligible for stimulus check payments. Individuals without an SSN may qualify if they have an Individual Taxpayer Identification Number (ITIN) and meet other eligibility criteria.

How can I verify my eligibility for stimulus check payments?

You can verify your eligibility by visiting the IRS website or contacting the IRS directly. They can provide guidance on the specific requirements for your situation.

Are there any deadlines for claiming stimulus check payments?

There may be deadlines for claiming past stimulus check payments. It’s crucial to research the specific deadlines for each payment round and contact the IRS for any questions.

Browse the multiple elements of Stimulus Check Program and the Upcoming Election in Ohio to gain a more broad understanding.

What if I received a stimulus check but believe I’m not eligible?

If you believe you received a stimulus check in error, you may need to return it to the IRS. Contact the IRS for guidance on how to proceed.