Stimulus Check Payment Amounts for Those with Investment Income in Florida – Navigating the complex world of stimulus check eligibility can be daunting, especially when considering investment income. This guide delves into the specific rules and regulations surrounding stimulus check payments for Floridians who have investment income, providing clarity and insight into the process.

Understanding the intricacies of investment income and its impact on eligibility is crucial for ensuring you receive the maximum benefit you qualify for.

Obtain direct knowledge about the efficiency of Stimulus Check Payment Amounts for Families with Children in Florida through case studies.

The stimulus check program was designed to provide economic relief during times of hardship. For residents of Florida, understanding how investment income affects eligibility and payment amounts is vital for maximizing potential benefits. This guide explores various aspects of the program, including eligibility criteria, payment calculations, and the tax implications of receiving a stimulus check.

Do not overlook explore the latest data about How Much Will My Florida Stimulus Check Be This November?.

Stimulus Check Eligibility in Florida

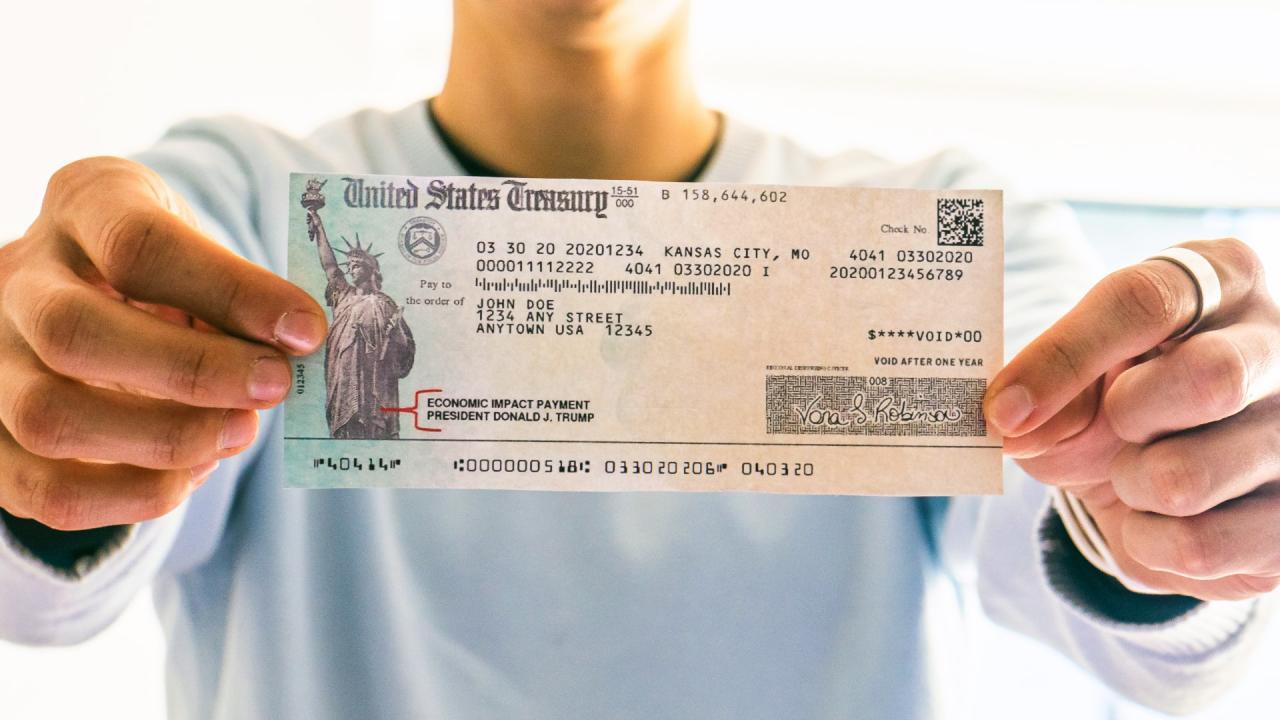

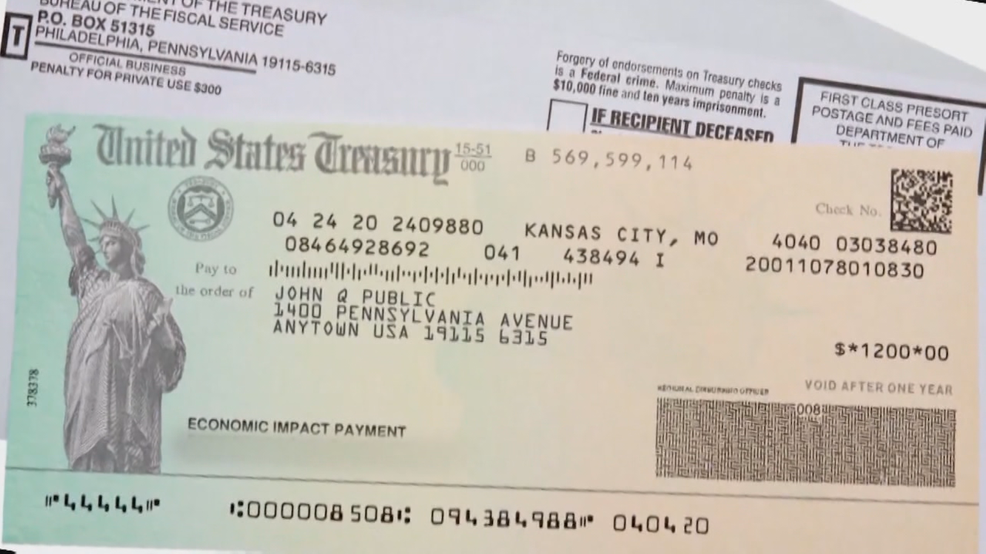

Stimulus checks, also known as Economic Impact Payments, were distributed by the federal government during the COVID-19 pandemic to help individuals and families cope with economic hardship. In Florida, as in other states, eligibility for these payments was based on specific criteria, including income levels and filing status.

Investment income, such as dividends and capital gains, played a role in determining eligibility for stimulus checks.

You also will receive the benefits of visiting How Stimulus Check Amounts Vary by Income Level in Florida today.

General Eligibility Criteria

To be eligible for a stimulus check in Florida, individuals generally needed to meet the following criteria:

- Be a U.S. citizen or lawful permanent resident.

- Have a valid Social Security number.

- Not be claimed as a dependent on someone else’s tax return.

- Have an adjusted gross income (AGI) below certain thresholds.

Investment Income and Eligibility

Investment income, such as dividends, capital gains, and interest earned on investments, was considered when determining eligibility for stimulus checks. However, the specific rules regarding how investment income affected eligibility varied depending on the stimulus package and the year in question.

For example, some stimulus packages had income thresholds that applied to all types of income, including investment income, while others had separate thresholds for investment income.

Examples of Eligibility Scenarios, Stimulus Check Payment Amounts for Those with Investment Income in Florida

Here are some examples of how investment income might have affected eligibility for stimulus checks in Florida:

- Scenario 1:An individual with a low AGI but substantial investment income might have been eligible for a full stimulus check, even though their investment income was high. This is because the income thresholds for stimulus checks were based on AGI, not just investment income.

- Scenario 2:An individual with a high AGI, even if a portion of that income came from investments, might not have been eligible for a stimulus check. This is because the income thresholds for stimulus checks were based on AGI, and their total income exceeded the threshold.

Income Thresholds

The income thresholds for stimulus checks varied depending on the stimulus package and filing status. For example, for the first stimulus check, the income threshold for single filers was $75,000, while the threshold for married couples filing jointly was $150,000.

These thresholds applied to all types of income, including investment income.

Stimulus Check Payment Amounts

The amount of the stimulus check an individual received in Florida depended on their income level and filing status. The payment amounts were generally calculated based on a sliding scale, with lower income earners receiving larger payments.

In this topic, you find that Will Florida Stimulus Check Payments Be Adjusted for Inflation? is very useful.

Payment Amount Calculation

The stimulus check payment amounts were typically calculated as follows:

- Single Filers:$1,200 for those with an AGI below $75,000, with the payment amount decreasing by $5 for every $100 in AGI above $75,000.

- Married Filing Jointly:$2,400 for those with an AGI below $150,000, with the payment amount decreasing by $5 for every $100 in AGI above $150,000.

Payment Amount Table

| Income Range | Payment Amount | Eligibility Status | Notes |

|---|---|---|---|

$0

|

$1,200 | Eligible | Full payment amount |

$75,001

|

$1,150

|

Partially eligible | Payment amount decreases by $5 for every $100 in AGI above $75,000 |

| $87,001+ (Single) | $0 | Not eligible | Income exceeds the threshold |

$0

|

$2,400 | Eligible | Full payment amount |

$150,001

|

$2,350

|

Partially eligible | Payment amount decreases by $5 for every $100 in AGI above $150,000 |

| $174,001+ (Married Filing Jointly) | $0 | Not eligible | Income exceeds the threshold |

Examples of Income Levels and Payment Amounts

Here are some examples of how different income levels might have affected stimulus check payment amounts in Florida:

- Example 1:A single filer with an AGI of $60,000 would have received a full stimulus check of $1,200.

- Example 2:A married couple filing jointly with an AGI of $160,000 would have received a partial stimulus check of $1,400.

Investment Income and Stimulus Checks

The specific rules regarding how investment income was treated for stimulus check eligibility varied depending on the stimulus package and the year in question. However, in general, investment income was considered part of an individual’s AGI, which was used to determine eligibility and payment amounts.

Types of Investment Income

Different types of investment income were treated the same for stimulus check eligibility purposes. This included:

- Dividends

- Capital gains

- Interest earned on investments

Examples of Investment Income and Eligibility

Here are some examples of how different investment income sources might have affected eligibility for stimulus checks in Florida:

- Example 1:An individual who received $10,000 in dividends from a stock investment would have had this income included in their AGI when determining eligibility for a stimulus check.

- Example 2:An individual who sold a stock for a profit of $5,000 would have had this capital gain included in their AGI when determining eligibility for a stimulus check.

Comparison with Other Income Sources

Investment income was treated the same as other income sources, such as wages, salaries, and self-employment income, for stimulus check eligibility purposes. This means that all types of income were considered when determining an individual’s AGI, which was used to determine eligibility and payment amounts.

Tax Implications of Stimulus Checks

Stimulus checks were generally not considered taxable income in Florida. However, it’s important to understand the potential tax implications of receiving a stimulus check.

Tax Treatment of Stimulus Checks

Stimulus checks were treated as “recovery rebates” for tax purposes. This means that they were not considered taxable income. However, if an individual received a stimulus check but was not eligible for it based on their income, they might have had to report the payment as income on their tax return.

When investigating detailed guidance, check out How Stimulus Check Payments Are Affected by Bankruptcy in California now.

Potential Tax Liabilities or Deductions

While stimulus checks were not generally taxable, there were some potential tax liabilities or deductions related to them:

- Tax Liability:If an individual received a stimulus check but was not eligible for it based on their income, they might have had to report the payment as income on their tax return.

- Deduction:If an individual received a stimulus check but was not eligible for it based on their income, they might have been able to claim a deduction for the payment on their tax return.

Flowchart for Determining Tax Treatment

Here is a flowchart outlining the steps for determining the tax treatment of a stimulus check:

- Did you receive a stimulus check?

- Yes:Did you meet the eligibility requirements for a stimulus check based on your income?

- Yes:The stimulus check is not taxable income.

- No:The stimulus check is considered taxable income and must be reported on your tax return.

- No:The stimulus check is not applicable.

Resources for Stimulus Check Information

Here are some reliable resources for obtaining information about stimulus checks in Florida:

List of Resources

| Resource Name | Website URL | Contact Information | Key Information |

|---|---|---|---|

| Internal Revenue Service (IRS) | https://www.irs.gov/ | 1-800-829-1040 | Information on stimulus check eligibility, payment amounts, and tax implications |

| Florida Department of Revenue | https://floridarevenue.com/ | (850) 488-6800 | Information on Florida state taxes and tax credits |

| United States Treasury Department | https://www.treasury.gov/ | (202) 622-1000 | Information on federal government programs and initiatives |

Concluding Remarks: Stimulus Check Payment Amounts For Those With Investment Income In Florida

By understanding the specific rules and regulations regarding investment income, Floridians can confidently navigate the stimulus check program and ensure they receive the financial support they are entitled to. Remember to consult reliable resources and seek professional advice if you have any questions or need further clarification.

Q&A

What types of investment income are considered for stimulus check eligibility?

Investment income includes dividends, interest, capital gains, and rental income. The specific types of investment income that affect eligibility may vary depending on the specific stimulus check program.

How do I know if I qualify for a stimulus check?

The eligibility criteria for stimulus checks can vary depending on factors such as income level, filing status, and dependents. The IRS provides a free online tool to help determine eligibility.

Where can I find more information about stimulus check eligibility and payment amounts?

The IRS website is a valuable resource for information about stimulus checks. You can also contact the IRS directly or consult with a tax professional for personalized advice.