Stimulus Check Payment Amounts for Families with Children in Pennsylvania sheds light on the financial assistance provided to families during a challenging period. This guide delves into the eligibility criteria, payment amounts, distribution timelines, and the potential impact of these payments on families in the state.

Do not overlook the opportunity to discover more about the subject of Stimulus Checks Payment Amounts in Pennsylvania.

It provides a comprehensive overview of the program, addressing key aspects and offering valuable insights for families seeking support.

The stimulus checks, designed to alleviate economic hardship, were targeted towards families with children, recognizing the unique challenges they faced. The program aimed to provide financial relief, allowing families to cover essential expenses such as food, housing, and healthcare. This guide explores the specifics of the program, including the amount of stimulus checks received by families with different numbers of dependents, the methods of payment distribution, and the resources available to families in need.

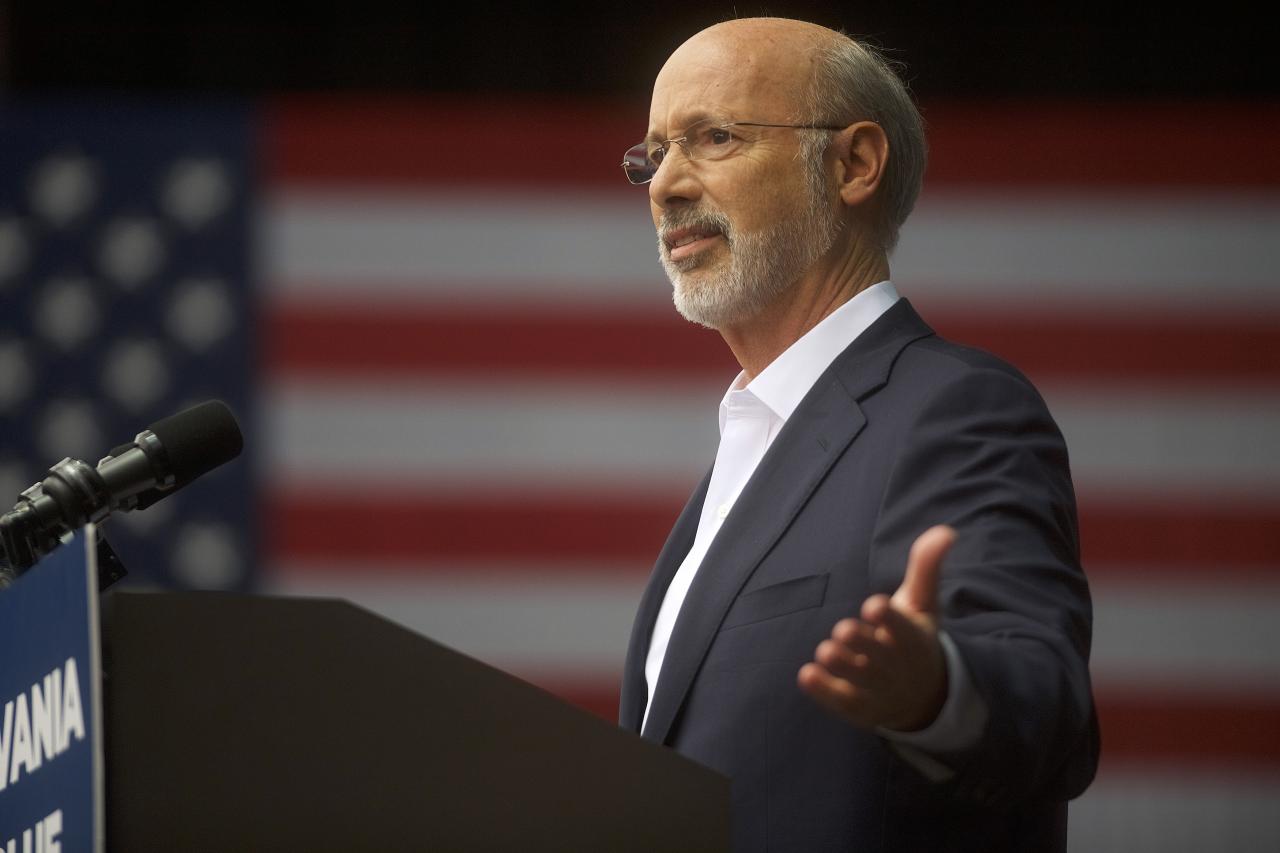

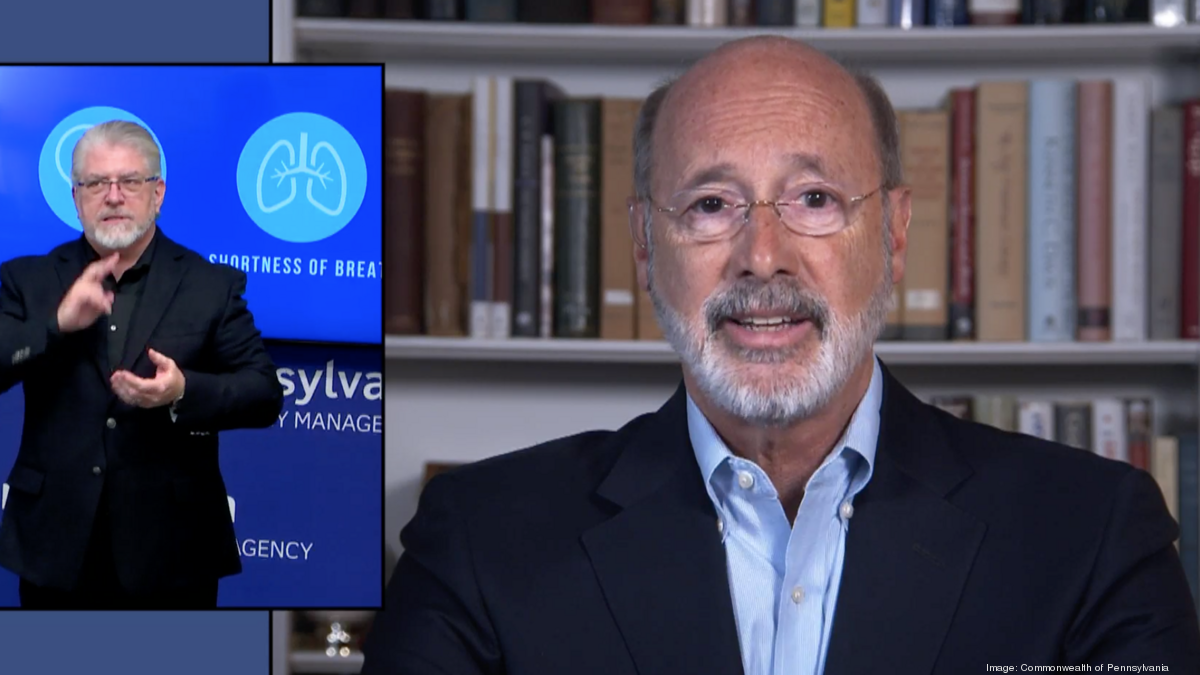

Stimulus Check Eligibility in Pennsylvania

The stimulus checks, formally known as Economic Impact Payments, were part of the federal government’s response to the COVID-19 pandemic. These payments were designed to provide financial relief to individuals and families who were experiencing economic hardship during the pandemic.

Remember to click Stimulus Check Legislation Updates in Ohio to understand more comprehensive aspects of the Stimulus Check Legislation Updates in Ohio topic.

In Pennsylvania, as in other states, eligibility for these payments was determined based on a number of factors, including income levels, filing status, and dependents.

Eligibility Criteria for Families with Children

Families with children in Pennsylvania were eligible for stimulus checks if they met certain income thresholds and other requirements. These requirements were designed to ensure that the payments reached those who were most in need of financial assistance. The following factors determined eligibility:

- Adjusted Gross Income (AGI):The AGI is a measure of your income after certain deductions are taken. The income thresholds for eligibility varied based on filing status and the number of dependents. For example, a single filer with no dependents needed to have an AGI of less than $75,000 to qualify for the full stimulus payment.

The threshold was higher for married couples filing jointly and families with children.

- Dependents:Families with children were eligible for an additional payment for each qualifying dependent. This meant that families with more children received a larger stimulus check.

- Filing Status:Eligibility for stimulus checks also depended on your filing status. Single filers, married couples filing jointly, and head of household filers all had different income thresholds.

- Citizenship or Residency Status:You must have been a U.S. citizen, national, or resident alien to be eligible for a stimulus check.

Here are some examples of family situations that would have qualified or disqualified them for stimulus payments:

- Qualifying Situation:A married couple filing jointly with two children, whose AGI was less than $150,000, would have been eligible for the full stimulus payment.

- Disqualifying Situation:A single filer with no dependents, whose AGI was over $75,000, would not have been eligible for the stimulus payment.

Payment Amounts for Families with Children

The amount of the stimulus check received by families with children varied based on the number of dependents they claimed. The payment amounts were designed to provide greater financial assistance to families with more children, as they typically have higher expenses.

Obtain recommendations related to Ohio Stimulus Check Program Latest Announcements that can assist you today.

Payment Amounts by Family Size

| Family Size | Payment Amount |

|---|---|

| 1 Person | $1,200 |

| 2 People | $2,400 |

| 3 People | $3,600 |

| 4 People | $4,800 |

For example, a family of four would have received a $4,800 stimulus check, while a single individual would have received a $1,200 payment.

Timeline and Distribution of Payments

The stimulus checks were distributed in phases, with the first round of payments being sent out in April 2020. The payments were distributed through a variety of methods, including direct deposit, mailed checks, and debit cards.

Distribution Timeline and Methods

- April 2020:The first round of stimulus checks began to be distributed, with most payments being sent through direct deposit.

- May-June 2020:Paper checks and debit cards were mailed to those who did not have direct deposit information on file with the IRS.

- Later Rounds:Additional stimulus checks were distributed in subsequent months, following similar timelines and distribution methods.

There were some challenges and delays in the distribution of stimulus checks, particularly in the early stages. Some individuals experienced delays in receiving their payments due to incorrect bank account information or other issues.

Browse the implementation of Stimulus Check Program and the Upcoming Election in Ohio in real-world situations to understand its applications.

Impact of Stimulus Checks on Families

The stimulus checks had a significant impact on families with children in Pennsylvania. The funds provided much-needed financial relief to families who were struggling during the pandemic. These funds could be used to cover essential needs such as food, housing, healthcare, and childcare.

Economic Impact of Stimulus Checks, Stimulus Check Payment Amounts for Families with Children in Pennsylvania

- Financial Relief:The stimulus checks provided a significant source of income for many families, particularly those who had lost jobs or experienced a reduction in income due to the pandemic.

- Essential Needs:Families used the stimulus funds to cover essential needs such as food, housing, and healthcare. This helped to prevent families from falling into financial hardship and ensured their basic needs were met.

- Economic Stimulus:By providing financial relief to families, the stimulus checks helped to stimulate the economy. Families were able to spend the funds on goods and services, which boosted businesses and created jobs.

The impact of the stimulus checks varied based on family income levels. Families with lower incomes were more likely to use the funds to cover essential needs, while families with higher incomes may have been able to use the funds for savings or investments.

Resources and Support for Families

In addition to the stimulus checks, there are a number of other resources and support programs available to families in Pennsylvania. These programs can provide financial assistance, food assistance, housing assistance, and other forms of support.

Resources for Families

- Pennsylvania Department of Human Services (DHS):DHS offers a variety of programs and services to help families, including SNAP benefits, TANF, and medical assistance.

- Pennsylvania Department of Labor & Industry:This department provides unemployment benefits and job training services.

- United Way of Pennsylvania:The United Way provides a variety of resources and support services to families in need, including financial assistance, food pantries, and housing assistance.

Families can access information about these resources and other benefits through the websites and phone numbers listed below:

- Pennsylvania Department of Human Services: https://www.dhs.pa.gov/ , 1-800-692-7462

- Pennsylvania Department of Labor & Industry: https://www.dli.pa.gov/ , 1-888-313-7284

- United Way of Pennsylvania: https://www.unitedwaypa.org/ , 1-800-228-2910

Last Point

Understanding the intricacies of the stimulus check program for families with children in Pennsylvania empowers families to navigate the process effectively and access the support they deserve. This guide provides a comprehensive resource, offering insights into eligibility, payment amounts, distribution timelines, and the impact of these checks on family finances.

It serves as a valuable tool for families seeking information and support during challenging times.

FAQ Insights: Stimulus Check Payment Amounts For Families With Children In Pennsylvania

What if my family’s income changed after the stimulus checks were distributed?

The eligibility and payment amounts for stimulus checks were based on income reported in a specific tax year. Changes in income after the distribution period would not affect the received payments.

You also can understand valuable knowledge by exploring Ohio Stimulus Check Program Compared to Other States.

Are there any penalties for receiving stimulus checks if I was not eligible?

Check How the Ohio Stimulus Check Program is Funded to inspect complete evaluations and testimonials from users.

The IRS typically reviews tax returns and may require repayment of stimulus checks if they were received in error. However, there may be exceptions or waivers depending on individual circumstances.

Where can I find more information about stimulus checks and other financial assistance programs?

You can visit the official website of the IRS, the Pennsylvania Department of Human Services, or contact a local community action agency for additional resources and information.