Stimulus Check Eligibility for Those with No Income can be a complex topic, especially for individuals who may not have traditional income sources. While many think you need a steady paycheck to qualify for stimulus payments, there are several scenarios where you might be eligible even if you don’t earn a traditional wage.

Examine how Do Dependents Count Towards Stimulus Check Eligibility? can boost performance in your area.

This article explores the nuances of eligibility, providing insights into who might qualify and how to navigate the process.

From understanding what constitutes “no income” in the context of stimulus checks to exploring eligibility for those receiving government benefits or self-employed individuals with minimal income, we’ll delve into the specific criteria that determine eligibility. We’ll also discuss the importance of filing a tax return, even if you have no income, and highlight the resources available to help you navigate the process.

Stimulus Check Eligibility for Those with No Income

Stimulus checks, also known as Economic Impact Payments, were distributed by the U.S. government to help individuals and families cope with the economic fallout of the COVID-19 pandemic. While most people were eligible, some individuals with no income might have wondered if they qualified for these payments.

This article delves into the intricacies of stimulus check eligibility, particularly for those who have no earned income.

Stimulus Check Eligibility Basics

The eligibility criteria for stimulus checks were based on a combination of factors, including income, filing status, and dependents. The general rule was that individuals needed to have a Social Security number and be a U.S. citizen, resident alien, or qualifying alien to be eligible.

However, the specific income thresholds and eligibility requirements varied across the different stimulus programs.

Finish your research with information from Impact of Filing Status on Stimulus Check Qualification.

- Income:Income played a significant role in determining eligibility. There were specific income limits that individuals could not exceed to qualify for the full amount of the stimulus check.

- Filing Status:The filing status on your tax return also affected your eligibility. For example, married couples filing jointly generally had higher income limits than single filers.

- Dependents:Having dependents, such as children, could increase the amount of the stimulus check you received.

Understanding “No Income”

Defining “no income” in the context of stimulus checks can be nuanced. It generally refers to individuals who did not have any earned income, such as wages or salaries, during the relevant tax year. However, other income sources, such as government benefits or investment income, were often considered.

Browse the multiple elements of How Age Affects Stimulus Check Eligibility in New York & California to gain a more broad understanding.

- Unemployed Individuals:Individuals who were unemployed during the relevant tax year and did not receive unemployment benefits were considered to have “no income.”

- Students:Students who were not working or had minimal income were also likely to be considered to have “no income.”

- Retirees:Retirees who were solely receiving Social Security benefits might have been considered to have “no income” for stimulus check purposes.

Specific Eligibility Scenarios

The eligibility criteria for individuals with no earned income could be complex, especially if they received government benefits or were self-employed. Here are some specific scenarios to consider:

Individuals Receiving Government Benefits

Individuals who received government benefits, such as SNAP (Supplemental Nutrition Assistance Program) or TANF (Temporary Assistance for Needy Families), might have been eligible for stimulus checks. However, their eligibility would depend on the specific income limits and other criteria set by the government for each stimulus program.

You also can understand valuable knowledge by exploring Understanding the Stimulus Check Phase-Out.

Self-Employed Individuals with Minimal Income

Self-employed individuals with minimal income could also face challenges in determining their eligibility for stimulus checks. Their eligibility would depend on their adjusted gross income (AGI) and other factors, such as business expenses.

Income Thresholds and Eligibility Criteria

| Filing Status | Income Threshold | Eligibility Criteria |

|---|---|---|

| Single | $75,000 | Eligible for full stimulus check if AGI is less than $75,000. Eligibility is phased out for individuals with AGI between $75,000 and $80,000. |

| Married Filing Jointly | $150,000 | Eligible for full stimulus check if AGI is less than $150,000. Eligibility is phased out for individuals with AGI between $150,000 and $160,000. |

| Head of Household | $112,500 | Eligible for full stimulus check if AGI is less than $112,500. Eligibility is phased out for individuals with AGI between $112,500 and $120,000. |

Tax Filing and Eligibility

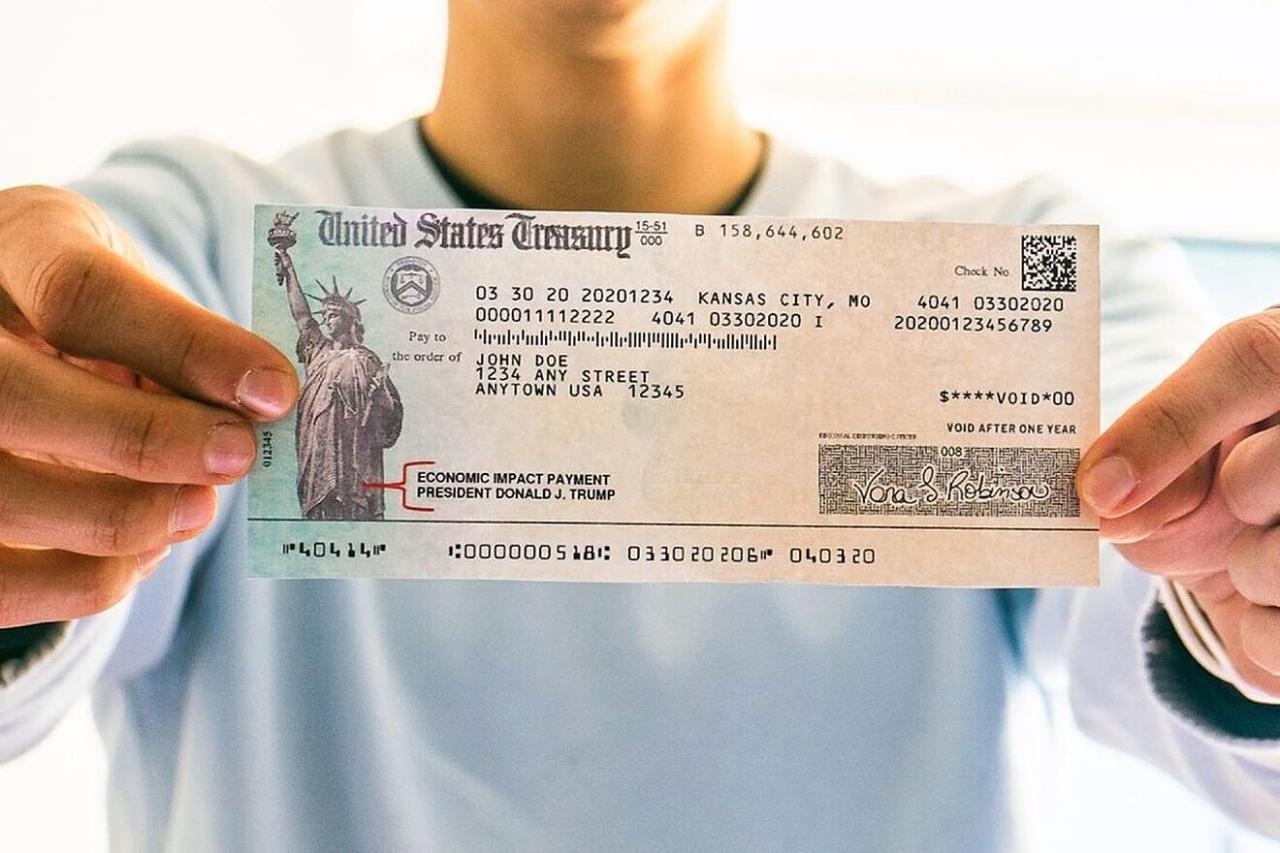

Filing a tax return was crucial for individuals with no income to determine their eligibility for stimulus checks. The IRS used tax return information to verify income and filing status.

- Claiming Dependents:Individuals with no income who had dependents, such as children, should have claimed them on their tax return. This could increase the amount of the stimulus check they received.

- Filing a Tax Return:Even if you had no income, it was important to file a tax return to ensure you received any stimulus payments you were eligible for. The IRS used tax return information to verify income and filing status.

Resources and Support, Stimulus Check Eligibility for Those with No Income

If you have questions about stimulus check eligibility or need assistance with filing your taxes, several resources can help.

- IRS Website:The IRS website provides comprehensive information about stimulus checks, including eligibility criteria, payment amounts, and FAQs.

- IRS Taxpayer Advocate Service:The Taxpayer Advocate Service (TAS) can assist taxpayers who are experiencing problems with the IRS, including issues related to stimulus checks.

Individuals with no income who are facing financial hardship can also seek assistance from organizations that offer financial aid and support. Here are some organizations that can provide assistance:

| Organization | Contact Information | Services Offered |

|---|---|---|

| United Way | 1-800-227-4673 | Financial assistance, housing assistance, food assistance, and other services. |

| Salvation Army | 1-800-728-2769 | Financial assistance, food assistance, clothing assistance, and other services. |

| Catholic Charities | 1-800-434-4550 | Financial assistance, housing assistance, food assistance, and other services. |

Summary: Stimulus Check Eligibility For Those With No Income

Navigating the world of stimulus checks can be daunting, especially if you’re not sure where to start. Understanding the eligibility criteria for those with no income is crucial to ensuring you receive the support you’re entitled to. Remember, filing a tax return is often the first step towards accessing these benefits.

Don’t hesitate to utilize the resources and support available to you – your financial well-being matters.

Popular Questions

What if I only have income from Social Security?

Individuals receiving Social Security benefits are generally eligible for stimulus checks. You may need to file a tax return to receive the payment, even if you’re not required to file annually.

Do I need to file a tax return if I have no income?

In most cases, yes. Filing a tax return is essential to claim any stimulus payments you may be eligible for. This allows the government to determine your eligibility and send you the payment.

When investigating detailed guidance, check out Who Qualifies for a Stimulus Check in New York? now.

What if I’m a student with no income?

If you’re a student with no income, you may still be eligible for a stimulus check if you meet the general eligibility criteria, such as being a U.S. citizen or resident and having a valid Social Security number. However, your eligibility may depend on your filing status and whether you’re claimed as a dependent on another person’s tax return.