Standard deduction for students in 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Understanding the standard deduction can significantly impact a student’s tax liability and potentially increase their disposable income.

This guide delves into the intricacies of the standard deduction, exploring eligibility requirements, applicable amounts, and available deductions and credits specifically for students.

Navigating the world of taxes can be daunting, especially for students juggling education, finances, and personal responsibilities. This guide aims to simplify the process, providing clear explanations and practical advice on how to maximize tax savings and ensure compliance with tax regulations.

Eligibility for the Standard Deduction

The standard deduction is a fixed amount that taxpayers can subtract from their adjusted gross income to reduce their taxable income. This can be a valuable tool for students, as it can help to lower their tax liability. However, not all students are eligible to claim the standard deduction.

The deadline for filing your W9 form in October 2024 is approaching fast! Make sure you get yours in on time to avoid any penalties. You can find more information about the deadline and how to file your W9 form here.

To be eligible for the standard deduction, students must meet certain requirements, including filing status, age, and dependency status.

Looking to save for retirement through a SIMPLE IRA? Check out the IRA contribution limits for SIMPLE IRA in 2024 to see how much you can contribute this year.

Filing Status

Your filing status determines the amount of the standard deduction you can claim. There are five filing statuses: single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Students typically file as single, unless they are married or qualify for head of household status.

Knowing the highest tax bracket can help you make informed financial decisions. Find out what the highest tax bracket in 2024 is and how it might affect your income.

Age

Age is another factor that can affect your eligibility for the standard deduction. If you are claimed as a dependent on someone else’s tax return, you generally cannot claim the standard deduction.

Failing to comply with W9 form requirements can result in penalties. Learn about the W9 form October 2024 penalties for non-compliance to avoid any potential issues.

Dependency Status

Students who are claimed as dependents on their parents’ tax returns are generally not eligible for the standard deduction.

Impact of Student Loans

Student loans do not directly impact your eligibility for the standard deduction. However, the interest you pay on student loans may be deductible. You can claim the student loan interest deduction on Form 8995.

Maximize your retirement savings! Learn about the maximum IRA contribution for 2024 to see how much you can contribute this year.

Standard Deduction Amount for Students: Standard Deduction For Students In 2024

The standard deduction is a fixed amount that taxpayers can choose to deduct from their taxable income instead of itemizing their deductions. The amount of the standard deduction depends on your filing status and age. Students, like other taxpayers, can benefit from the standard deduction.

Standard Deduction Amounts for Students in 2024

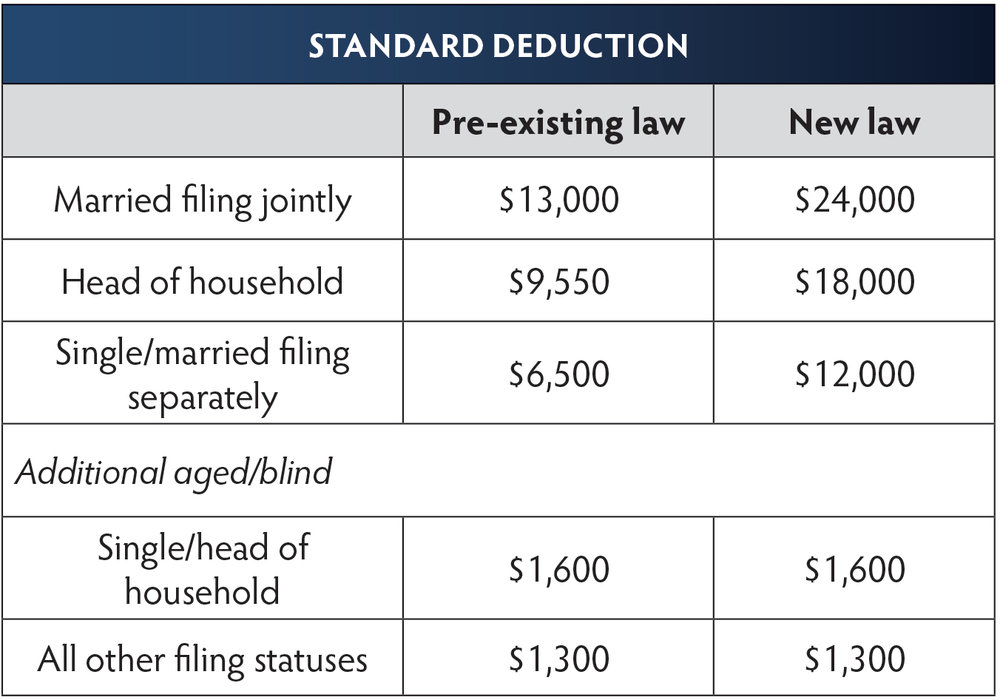

The standard deduction amount for students in 2024 will vary based on their filing status and age. Here’s a breakdown of the standard deduction amounts for different filing statuses:

| Filing Status | Standard Deduction Amount |

|---|---|

| Single | $13,850 |

| Married Filing Separately | $6,925 |

| Married Filing Jointly | $27,700 |

| Head of Household | $20,800 |

| Qualifying Widow(er) | $27,700 |

Standard Deduction Amount for Students Based on Age and Dependency Status

The standard deduction amount for students may also be affected by their age and dependency status.

With the new year comes new tax brackets. Wondering how these changes might affect your finances? Check out this article on tax bracket changes for 2024 to see what you can expect.

The standard deduction amount for students under 19 years of age or students who are full-time students under 24 years of age and claimed as dependents on another person’s tax return is limited to the greater of $1,150 or their earned income.

Planning a business trip? Keep track of your mileage for tax purposes. The IRS mileage rate for October 2024 is available here so you can stay on top of your deductions.

For example, if a student is 18 years old and earned $5,000 in income, their standard deduction would be $5,000, not the standard deduction amount for their filing status.

Need a little extra time to file your taxes? There are options for tax filing extensions. You can find out more about tax filing extensions for October 2024 here to see if you qualify.

Standard Deduction Amount Adjustment for Inflation

The standard deduction amount is adjusted for inflation annually to reflect changes in the cost of living. This adjustment ensures that the standard deduction amount remains relevant and keeps pace with inflation.

The standard deduction amount is adjusted for inflation using the Consumer Price Index (CPI).

For example, if the CPI increases by 2% from 2023 to 2024, the standard deduction amount for each filing status would be adjusted accordingly.

Filling out a W9 form can seem daunting, but it doesn’t have to be. This guide on how to fill out a W9 form for October 2024 can help you navigate the process smoothly.

Deductions and Credits for Students

Beyond the standard deduction, students can benefit from additional deductions and credits that can lower their tax liability. These benefits are designed to help offset the costs of education and encourage students to pursue higher education.

IRA contribution limits can vary depending on your age. Learn more about the IRA contribution limits for 2024 by age to see how much you can contribute based on your age.

Student Loan Interest Deduction

This deduction allows you to deduct up to $2,500 of interest paid on qualified student loans. The amount of the deduction is phased out for taxpayers with modified adjusted gross incomes (MAGI) above certain thresholds. For 2024, the phase-out begins at $85,000 for single filers and $170,000 for married couples filing jointly.

To claim this deduction, you must have paid interest on a qualified student loan and the loan must have been taken out by you to pay for qualified educational expenses.

If you’re over 50, you might be eligible for a higher 401k contribution limit. Find out the maximum 401k contribution for 2024 for over 50 to maximize your retirement savings.

American Opportunity Tax Credit

The American Opportunity Tax Credit (AOTC) is a tax credit for qualified education expenses paid for the first four years of post-secondary education. The credit is worth up to $2,500 per eligible student, and it is phased out for taxpayers with MAGI above certain thresholds.

Foreign nationals living in the United States have their own tax deadlines. You can find out more about the October 2024 tax deadline for foreign nationals to make sure you’re in compliance.

For 2024, the phase-out begins at $80,000 for single filers and $160,000 for married couples filing jointly.

Retirement planning is a team effort. Find out about the IRA contribution limits for 2024 for married couples to maximize your combined savings.

The AOTC is a refundable credit, meaning you can receive a portion of the credit even if your tax liability is zero.

Want to make the most of your 401k contributions? Check out the 401k contribution limits for 2024 for traditional 401k to see how much you can contribute this year.

Impact of the Standard Deduction on Students

The standard deduction can be a significant benefit for students, especially those who are just starting out in their careers and may have limited income. It can help reduce their tax liability and increase their disposable income, which can be used for essential expenses like tuition, housing, and food.

Understanding tax brackets is crucial for planning your finances. Check out the tax brackets for 2024 in the United States to get a clear picture of how your income will be taxed.

Benefits of the Standard Deduction for Students, Standard deduction for students in 2024

The standard deduction can benefit students in several ways:

- Reduced Tax Liability:By claiming the standard deduction, students can lower their taxable income, resulting in a lower tax bill. This can be especially beneficial for students who have part-time jobs or internships, as their income may be modest.

- Increased Disposable Income:With a lower tax liability, students have more money available for other expenses, such as tuition, books, rent, and groceries. This can help alleviate financial stress and allow students to focus on their studies.

Example of the Standard Deduction’s Impact

Consider a student who earns $10,000 from a part-time job. If they are single and claim the standard deduction, their taxable income would be reduced by $13,850, the standard deduction amount for single filers in 2024. This means they would only owe taxes on $3,850 of their income, potentially saving them hundreds of dollars in taxes.

Maximizing Tax Savings

Students can maximize their tax savings by understanding and taking advantage of various deductions and credits:

- Student Loan Interest Deduction:Students who are paying off student loans may be able to deduct up to $2,500 in interest paid on their loans. This can significantly reduce their tax liability and help them manage their student loan debt.

- American Opportunity Tax Credit:Students who meet certain eligibility requirements may be eligible for the American Opportunity Tax Credit, which can provide up to $2,500 in tax credits per eligible student. This credit is phased out for taxpayers with adjusted gross incomes above certain thresholds.

- Tuition and Fees Deduction:Students can deduct up to $4,000 in qualified education expenses, including tuition, fees, and course materials. This deduction is phased out for taxpayers with adjusted gross incomes above certain thresholds.

It is important for students to understand the specific requirements and limitations of these deductions and credits. The IRS provides detailed information on its website and through various publications.

Last Word

As students navigate the complexities of education and finances, understanding the standard deduction is crucial. By utilizing this guide, students can confidently determine their eligibility, calculate the appropriate amount, and explore additional deductions and credits that can minimize their tax burden.

Remember, taking advantage of available tax benefits can free up valuable resources, allowing students to focus on their academic pursuits and future goals.

Frequently Asked Questions

Can I claim the standard deduction if I am a part-time student?

Yes, you can claim the standard deduction regardless of your student status, whether you are a full-time or part-time student.

What if I am a dependent on my parents’ tax return?

If you are claimed as a dependent on your parents’ tax return, you may not be able to claim the standard deduction on your own tax return. However, there are exceptions, so it’s best to consult with a tax professional.

Are there any specific forms I need to file for the standard deduction?

You will need to file Form 1040, the U.S. Individual Income Tax Return, to claim the standard deduction. You may also need to complete other forms depending on your individual circumstances.

How does the standard deduction affect my financial aid eligibility?

The standard deduction itself does not directly affect your financial aid eligibility. However, your overall income and tax liability, which are impacted by the standard deduction, can influence your financial aid package.