Navigating the complexities of tax filing can be daunting, especially for single filers. Understanding the standard deduction and its potential impact on your tax liability is crucial. This guide delves into the standard deduction for single filers in 2024, providing insights into eligibility, benefits, and key factors that influence its value.

We’ll explore the advantages of choosing the standard deduction over itemized deductions and offer a step-by-step guide to claiming it on your tax return.

The standard deduction offers a straightforward way to reduce your taxable income. It’s a fixed amount that can be claimed by taxpayers who choose not to itemize their deductions. The amount of the standard deduction varies based on your filing status, with single filers having a specific amount allocated to them.

This deduction can significantly impact your tax burden, potentially leading to a lower tax liability.

Standard Deduction Overview

The standard deduction is a fixed amount that taxpayers can subtract from their adjusted gross income (AGI) to reduce their taxable income. This deduction is available to individuals who choose not to itemize their deductions. It’s important to understand how the standard deduction works, as it can significantly impact your tax liability.The standard deduction for single filers in 2024 is a significant part of the tax system.

The tax brackets for 2024 are changing, so it’s a good idea to familiarize yourself with the new rates. You can find out more about what are the new tax brackets for 2024? on this helpful resource.

It allows individuals to reduce their taxable income by a specific amount, thereby lowering their tax burden.

Self-employed individuals often have different tax deadlines. You can find out more about the October 2024 tax deadline for self-employed individuals and stay on top of your tax obligations.

Standard Deduction Amount for Single Filers in 2024, Standard deduction for single filers in 2024

The standard deduction for single filers in 2024 is $14,000. This amount is subject to change based on potential adjustments or updates to the tax code. It’s crucial to stay informed about any modifications that might affect your tax liability.

SEP IRA contributions are a great option for self-employed individuals. You can find out more about Ira contribution limits for SEP IRA in 2024 and make the most of your retirement savings.

Potential Changes or Updates to the Standard Deduction

The standard deduction amount can be adjusted annually due to inflation and other economic factors. It’s important to consult official IRS resources or reliable tax websites for the most up-to-date information regarding any changes to the standard deduction for single filers.

Qualifying widow(er)s have different tax brackets than other filers. Learn more about tax brackets for qualifying widow(er)s in 2024 and how they can affect your tax liability.

For example, if inflation is high in 2024, the standard deduction amount could be adjusted upward to reflect the increased cost of living. This would mean a higher deduction for single filers, potentially resulting in lower taxes.

The tax deadline for October 2024 is approaching, so make sure you’re prepared. You can learn more about what is the tax deadline for October 2024 and avoid any penalties.

Eligibility and Requirements: Standard Deduction For Single Filers In 2024

Most taxpayers are eligible to claim the standard deduction. This deduction is a set amount that you can subtract from your adjusted gross income (AGI) to reduce your taxable income. The standard deduction is based on your filing status.

The tax bracket thresholds are updated annually. You can learn more about tax bracket thresholds for 2024 and how they might affect your tax liability.

Here are the eligibility criteria for claiming the standard deduction as a single filer in 2024:

Filing Status

You must be filing as “single” on your tax return to claim the standard deduction for single filers. This means you are not married, are not filing as head of household, and are not a qualifying widow(er).

If you’re contributing to a 401k, it’s important to know the contribution limits. You can find out more about how much can I contribute to my 401k in 2024 and maximize your retirement savings.

Age

There are no age restrictions for claiming the standard deduction. Anyone can claim the standard deduction, regardless of their age.

IRA contributions are capped each year. Check out this resource to find out more about what is the maximum IRA contribution for 2024 and plan your retirement savings accordingly.

Citizenship

You must be a U.S. citizen or resident alien to claim the standard deduction. This means you must have a valid Social Security number or ITIN (Individual Taxpayer Identification Number).

The mileage rate is used for business expenses and is updated periodically. Find out more about how is the mileage rate calculated for October 2024? and how it can impact your tax deductions.

Other Requirements

There are no other specific requirements for claiming the standard deduction as a single filer. However, there are some factors that may affect the amount of your standard deduction, such as:

- Whether you are claimed as a dependent on someone else’s return.

- Whether you are blind or over 65.

Benefits and Advantages

Choosing the standard deduction can be advantageous for single filers in 2024, especially if they don’t have significant deductible expenses. The standard deduction simplifies the tax filing process and often results in a lower tax liability compared to itemizing deductions.This section delves into the advantages of opting for the standard deduction over itemized deductions, comparing their key differences and highlighting potential benefits for single filers in 2024.

If you’re a foreign entity operating in the US, you’ll need to fill out a W9 form to provide your tax identification number. Check out this guide on W9 Form October 2024 for foreign entities for detailed instructions and requirements.

Comparison of Standard Deduction and Itemized Deductions

The standard deduction is a fixed amount that taxpayers can claim instead of itemizing their deductions. Itemized deductions allow taxpayers to deduct specific expenses, such as medical expenses, state and local taxes, charitable contributions, and mortgage interest.The standard deduction is generally simpler to calculate and claim than itemized deductions.

Students often have different tax deadlines. Check out this resource to find out more about the October 2024 tax deadline for students and stay on top of your tax obligations.

This is because the standard deduction amount is pre-determined by the IRS based on filing status and age. In contrast, itemizing deductions requires taxpayers to gather receipts and documentation for each deductible expense.Here’s a comparison of the standard deduction and itemized deductions for single filers in 2024:

| Feature | Standard Deduction | Itemized Deductions |

|---|---|---|

| Calculation | Fixed amount determined by the IRS | Calculated based on individual expenses |

| Documentation | No specific documentation required | Requires receipts and documentation for each deductible expense |

| Complexity | Simpler to claim | More complex to claim |

| Potential Benefits | Lower tax liability if deductible expenses are low | Higher tax savings if deductible expenses are significant |

Benefits of the Standard Deduction

Choosing the standard deduction can provide several benefits for single filers in 2024:

- Simplified Tax Filing:The standard deduction simplifies the tax filing process by eliminating the need to itemize deductions and gather supporting documentation.

- Faster Tax Refund:The standard deduction often leads to a faster tax refund as it requires less paperwork and calculations, allowing for quicker processing by the IRS.

- Potential for Lower Tax Liability:The standard deduction can result in a lower tax liability for single filers who don’t have significant deductible expenses. This is because the standard deduction amount is often higher than the total amount of itemized deductions that they would be eligible to claim.

If you’re a small business owner, it’s important to know the contribution limits for 401k plans. You can find information about 401k contribution limits for 2024 for small businesses here, to help you plan for your retirement savings.

Example of Standard Deduction Benefits

Consider a single filer with an adjusted gross income of $50,000 in 2024. Their standard deduction amount is $13,850. If they choose to itemize their deductions, they may only be able to claim $10,000 in total deductions. In this case, the standard deduction would result in a lower tax liability because it provides a higher deduction amount.

IRA contributions can be a great way to save for retirement. Check out this resource to learn more about how much can I contribute to my IRA in 2024 and maximize your savings.

Factors Affecting the Standard Deduction

The standard deduction amount for single filers in 2024 is subject to various factors. Understanding these factors is crucial for determining the exact standard deduction amount you can claim.

Factors Affecting the Standard Deduction

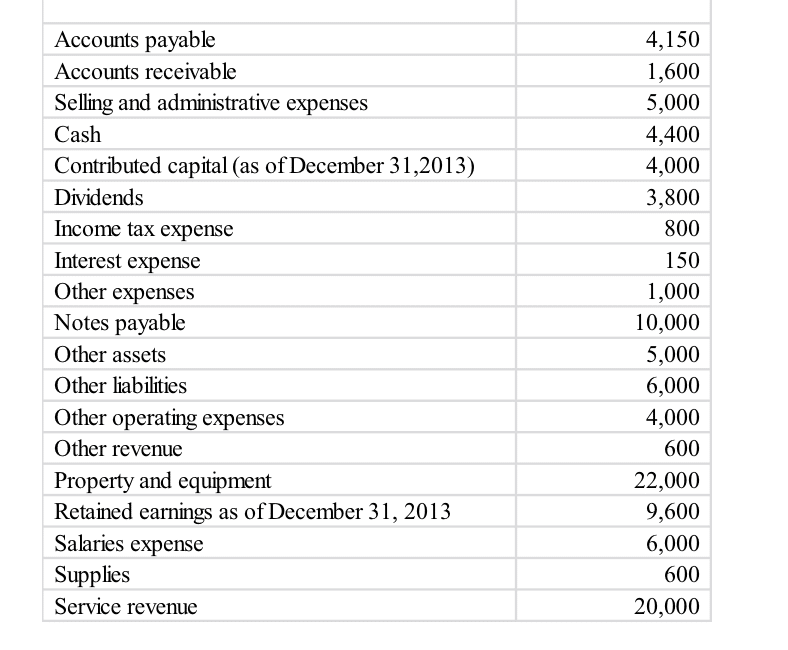

The standard deduction amount for single filers can be affected by several factors, including age, dependents, and specific situations. Here’s a table summarizing these factors:

| Factor | Description | Impact on Standard Deduction |

|---|---|---|

| Age | Individuals aged 65 and older are eligible for an additional standard deduction. | Increased standard deduction amount. |

| Dependents | Having dependents, such as children or other qualifying relatives, can increase the standard deduction. | Increased standard deduction amount. |

| Blindness | Individuals who are legally blind are eligible for an additional standard deduction. | Increased standard deduction amount. |

Ultimate Conclusion

Understanding the standard deduction for single filers in 2024 is a crucial step in maximizing your tax benefits. By carefully considering your eligibility, exploring the advantages it offers, and navigating the filing process, you can ensure you’re taking full advantage of this valuable deduction.

Remember to consult with a tax professional for personalized advice and guidance tailored to your specific circumstances.

Commonly Asked Questions

What happens if my income exceeds the standard deduction amount?

Even if your income exceeds the standard deduction amount, you can still claim it. The standard deduction is a fixed amount, and it doesn’t depend on your income level. It’s a valuable deduction regardless of your income.

Can I claim the standard deduction if I’m a student?

Yes, students can claim the standard deduction if they meet the eligibility requirements. The standard deduction is available to all eligible taxpayers, regardless of their employment status or educational background.

Is there a penalty for claiming the standard deduction when I could have itemized?

No, there’s no penalty for claiming the standard deduction even if you could have itemized. You’re free to choose the deduction method that benefits you most.

Can I claim the standard deduction if I’m self-employed?

Yes, self-employed individuals can also claim the standard deduction. It’s available to all eligible taxpayers, including those who are self-employed.

Can I claim the standard deduction if I’m married filing separately?

Yes, married individuals filing separately can also claim the standard deduction. However, the amount of the standard deduction for married filing separately is different from the amount for single filers.

Tax brackets are subject to change each year. Learn more about tax bracket changes for 2024 and how they might affect your tax liability.

IRA contribution limits are set annually. Check out this resource to learn more about Ira contribution limits for 2024 and 2025 and plan your retirement savings accordingly.