Standard Deduction for Seniors in 2024: Navigating the complexities of taxes can be challenging, especially for seniors. The standard deduction offers a valuable benefit, simplifying tax calculations and potentially reducing tax liability. This guide delves into the key aspects of the standard deduction for seniors in 2024, exploring changes, eligibility requirements, and its impact on your tax obligations.

Understanding the standard deduction for seniors is crucial for maximizing tax benefits and ensuring financial well-being. This guide provides clear and concise information, empowering you to make informed decisions about your tax planning.

Standard Deduction Overview: Standard Deduction For Seniors In 2024

The standard deduction is a fixed amount that taxpayers can deduct from their taxable income, reducing their tax liability. For seniors, the standard deduction can be particularly beneficial, offering significant tax savings. The standard deduction is designed to simplify the tax filing process and provide a baseline deduction for taxpayers.

Seniors, in particular, can benefit from the standard deduction as it helps reduce their tax burden and increases their disposable income.

High earners have a higher limit for 401k contributions, which is important to know when planning your retirement savings. Check out the latest 401k contribution limits for 2024 for high earners to see how much you can contribute.

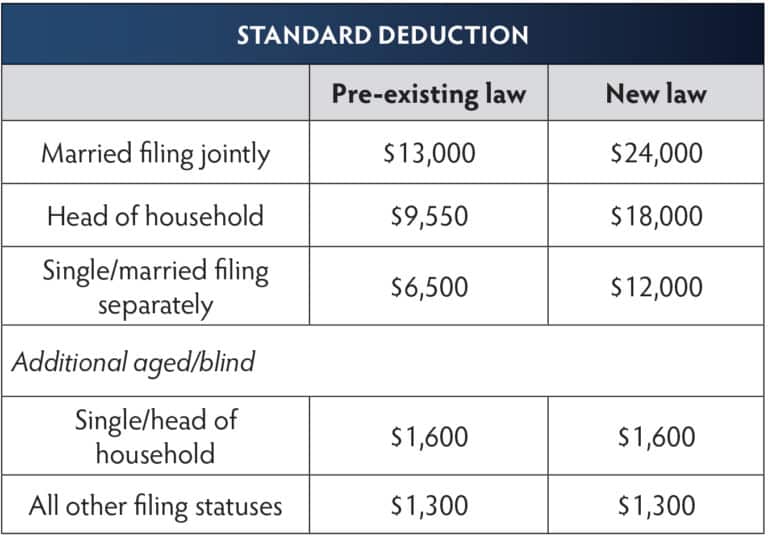

Changes in the Standard Deduction for 2024

The standard deduction amount is adjusted annually for inflation. While specific figures for 2024 are not yet available, the standard deduction is expected to increase slightly from 2023 levels.

Freelancers have a different tax deadline than those who are employed. The October 2024 tax deadline for freelancers is important to know so you can file your taxes on time.

Eligibility Requirements for Seniors

To claim the standard deduction, seniors must meet the general eligibility requirements for filing a federal income tax return. This typically includes having a Social Security number, being a U.S. citizen or resident alien, and meeting certain income thresholds. There are no specific age requirements for claiming the standard deduction.

It’s possible to contribute to both a 401k and an IRA, but there are certain limitations. Find out if you can contribute to an IRA if you have a 401k to make sure you’re maximizing your retirement savings.

Standard Deduction Amounts for Seniors

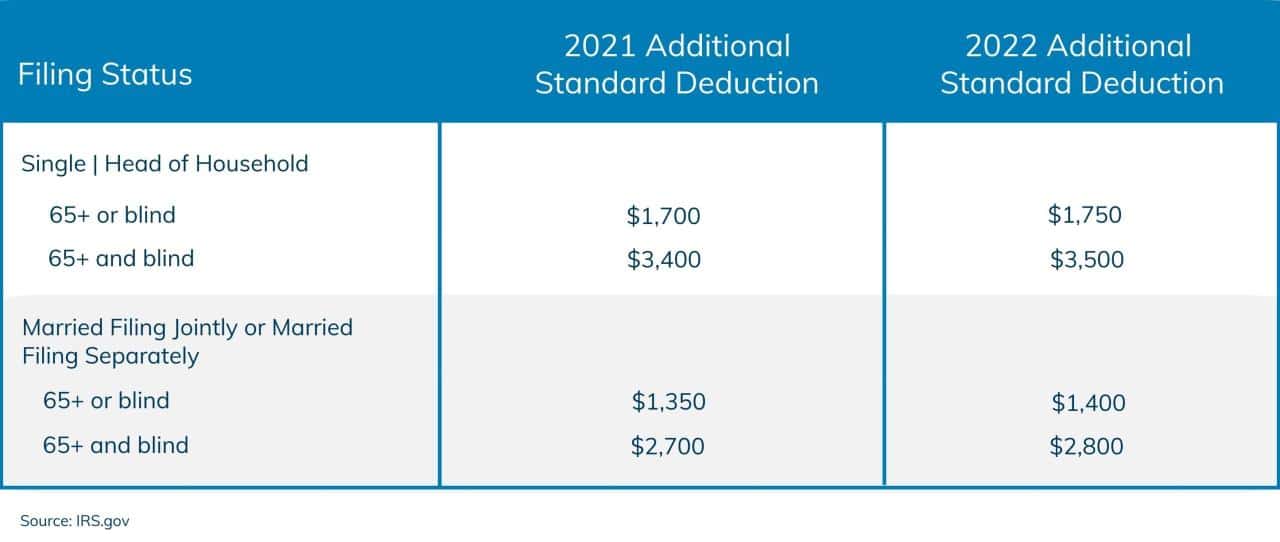

The standard deduction is a fixed amount that taxpayers can subtract from their taxable income. Seniors, who are aged 65 and older, may be eligible for a higher standard deduction than younger taxpayers.

The IRS mileage rate is updated periodically, so it’s important to know the current rate. Find out the mileage rate for October 2024 to ensure you’re using the correct rate for your deductions.

Standard Deduction Amounts for Seniors in 2024

The standard deduction amounts for seniors in 2024 are as follows:

| Filing Status | Standard Deduction | Standard Deduction (Seniors) |

|---|---|---|

| Single | $13,850 | $15,850 |

| Married Filing Jointly | $27,700 | $29,700 |

| Qualifying Widow(er) | $27,700 | $29,700 |

| Head of Household | $20,800 | $22,800 |

| Married Filing Separately | $13,850 | $15,850 |

Factors that Influence the Standard Deduction Amount for Seniors

The standard deduction amount for seniors is determined by their filing status and age. If a taxpayer is 65 or older, they are eligible for an additional standard deduction amount. This additional amount is added to the regular standard deduction amount based on their filing status.

If you’re filing as head of household, you’ll have a different standard deduction than other filing statuses. Check out the standard deduction for head of household in 2024 to see how much you can deduct.

For example, a single taxpayer who is 65 or older would be eligible for a standard deduction of $15,850 in 2024, which is $2,000 more than the regular standard deduction amount for single filers.

There are penalties for non-compliance with the W9 form, so it’s important to make sure you’re following the rules. Learn about the W9 form penalties for non-compliance in October 2024 to avoid any potential issues.

The standard deduction amount for seniors is based on their filing status and age.

The W9 form is constantly being updated, so it’s important to stay informed. Make sure you’re up-to-date on the latest W9 form changes and updates for October 2024.

The standard deduction amount for seniors is not affected by their income. However, the amount of their taxable income may be affected by other factors, such as their deductions and credits.

If you’re contributing to a traditional 401k, there are specific contribution limits to keep in mind. Find out the 401k contribution limits for 2024 for traditional 401ks to maximize your retirement savings.

Standard Deduction vs. Itemized Deductions

The standard deduction is a set amount that you can subtract from your adjusted gross income (AGI) to reduce your taxable income. Itemized deductions are specific expenses that you can deduct from your AGI, such as medical expenses, state and local taxes, and charitable contributions.

There is a deadline for filing your W9 form, so make sure you don’t miss it. Check out the W9 form deadline for filing in October 2024 to ensure you’re compliant.

Seniors may choose to take the standard deduction or itemize their deductions, depending on which option results in a lower tax liability.Seniors may benefit from itemizing their deductions if their itemized deductions exceed the standard deduction amount.

Itemized Deductions for Seniors

Itemized deductions can provide significant tax savings for seniors. Here are some common itemized deductions that seniors may be eligible for:

- Medical Expenses:Seniors often incur significant medical expenses. You can deduct medical expenses that exceed 7.5% of your adjusted gross income (AGI). For example, if your AGI is $50,000, you can deduct medical expenses exceeding $3,750.

- State and Local Taxes (SALT):The Tax Cuts and Jobs Act of 2017 limited the deduction for state and local taxes to $10,000 per household. This deduction can be beneficial for seniors who live in states with high property taxes or income taxes.

- Charitable Contributions:Seniors who make charitable donations can deduct a portion of their contributions. The amount you can deduct depends on the type of charity and the amount of your contribution.

- Home Mortgage Interest:Seniors who own a home can deduct the interest paid on their mortgage. This deduction can be substantial, especially for those with large mortgages.

- Property Taxes:Similar to home mortgage interest, seniors can deduct the property taxes paid on their primary residence.

Impact of Standard Deduction on Senior Taxes

The standard deduction significantly influences the overall tax liability for seniors. By claiming the standard deduction, seniors can reduce their taxable income, leading to lower tax bills. The amount of the standard deduction depends on the senior’s filing status, and the impact on their tax liability can vary based on their income level and other deductions they may be eligible for.

If you’re looking to contribute to an IRA, you’ll want to know the limits for the year. The IRA limits for October 2024 will help you understand how much you can contribute before reaching the limit.

Tax Savings from the Standard Deduction

The standard deduction can provide substantial tax savings for seniors, especially those in lower tax brackets. The deduction directly reduces the amount of income subject to taxation, leading to lower tax bills. For example, a senior with an adjusted gross income of $30,000 and the standard deduction of $13,850 (for 2024) will only have $16,150 of their income taxed.

For those who drive for business, it’s important to know the current mileage rate. The mileage rate for October 2024 can help you calculate the right amount of deductions.

This reduction in taxable income can result in significant tax savings, especially for seniors with modest incomes.

The IRS mileage rate is an important consideration for those who drive for business purposes. You can find the latest information on the IRS mileage rate for October 2024 to make sure you’re claiming the right amount of deductions.

Standard Deduction Impact on Different Tax Brackets

The impact of the standard deduction on senior taxes varies depending on the tax bracket they fall into. For instance, a senior in the 12% tax bracket who claims the standard deduction will see a lower tax liability compared to a senior in the 22% tax bracket, even if both have the same adjusted gross income.

The W9 form is essential for businesses and government agencies. If you’re working with a government agency, make sure you understand the requirements for the W9 form for government agencies in October 2024.

This is because the standard deduction reduces the amount of income subject to the higher tax rate in the 22% bracket.

Married couples have a higher contribution limit for their IRAs, which can be helpful for maximizing retirement savings. Make sure to check out the IRA contribution limits for 2024 for married couples to see what you’re eligible for.

Resources for Seniors

Navigating the complexities of taxes can be challenging, especially for seniors who may have unique financial situations. Fortunately, various resources are available to provide guidance and support.

The IRS mileage rate is updated periodically, so you’ll want to know when the next update is coming. Check out when the mileage rate will be updated for October 2024 to make sure you’re using the most current rate.

Government Agencies and Organizations, Standard deduction for seniors in 2024

These organizations offer valuable information and assistance to seniors regarding taxes and other financial matters.

- Internal Revenue Service (IRS):The IRS is the primary source for tax information. Their website, IRS.gov, provides comprehensive resources, including publications, forms, and instructions. You can also contact the IRS directly by phone or mail.

- Phone:1-800-829-1040

- Website:IRS.gov

- AARP Foundation:The AARP Foundation offers free tax preparation assistance to low- and moderate-income taxpayers, including seniors. Their website, aarpfoundation.org, provides information on their services and how to find a volunteer tax preparer near you.

- Website:aarpfoundation.org

- National Council on Aging (NCOA):The NCOA is a non-profit organization that advocates for older adults. Their website, ncoa.org, provides information on a wide range of topics, including tax benefits for seniors.

- Website:ncoa.org

- State Tax Agencies:Each state has its own tax agency that can provide information on state-specific tax deductions and credits for seniors. You can find your state’s tax agency website by searching online.

Helpful Websites and Documents

This table provides links to helpful websites and documents related to senior tax deductions.

| Resource | Description | Link |

|---|---|---|

| IRS Publication 554, “Tax Guide for Seniors” | Provides comprehensive information on tax issues specific to seniors, including deductions and credits. | IRS Publication 554 |

| AARP Tax-Aide Program | Offers free tax preparation assistance to low- and moderate-income taxpayers, including seniors. | AARP Tax-Aide Program |

| National Council on Aging (NCOA) | Provides information on a wide range of topics, including tax benefits for seniors. | NCOA Website |

Ultimate Conclusion

The standard deduction for seniors offers a significant opportunity to simplify your taxes and potentially save money. By understanding the intricacies of this deduction, you can make informed decisions that optimize your tax liability. Remember, seeking guidance from a qualified tax professional can provide personalized advice tailored to your specific circumstances.

FAQ

What if I’m over 65 but not retired?

You’re still eligible for the standard deduction for seniors even if you’re working.

How do I claim the standard deduction?

When filing your taxes, you’ll choose to take the standard deduction or itemize your deductions. You don’t need to file any special forms for the standard deduction for seniors.

Can I claim the standard deduction if I’m married filing separately?

Yes, you can still claim the standard deduction if you’re married filing separately.

What if I have other deductions, like medical expenses?

You can still claim the standard deduction even if you have other itemized deductions. Compare the total amount of your itemized deductions to the standard deduction and choose the option that results in the lowest tax liability.