Stagflation: A Challenging Economic Scenario in November 2024 (if applicable) – Stagflation: A Challenging Economic Scenario in November 2024, a term that evokes a sense of economic unease, describes a situation where inflation remains high while economic growth stagnates. This paradoxical combination poses a significant challenge for individuals, businesses, and policymakers alike.

In November 2024, the world may face the potential for stagflation, fueled by a confluence of factors including global economic trends, supply chain disruptions, and geopolitical tensions. The implications of stagflation can be far-reaching, impacting the cost of living, investment decisions, and overall economic stability.

This analysis delves into the intricacies of stagflation, examining its defining characteristics, potential causes, and its impact on various sectors of the economy. It explores strategies for managing stagflation, both from a policy perspective and through individual and business actions.

By understanding the dynamics of stagflation and the potential challenges it presents, we can better prepare for the economic landscape of November 2024 and beyond.

Stagflation: A Challenging Economic Scenario in November 2024

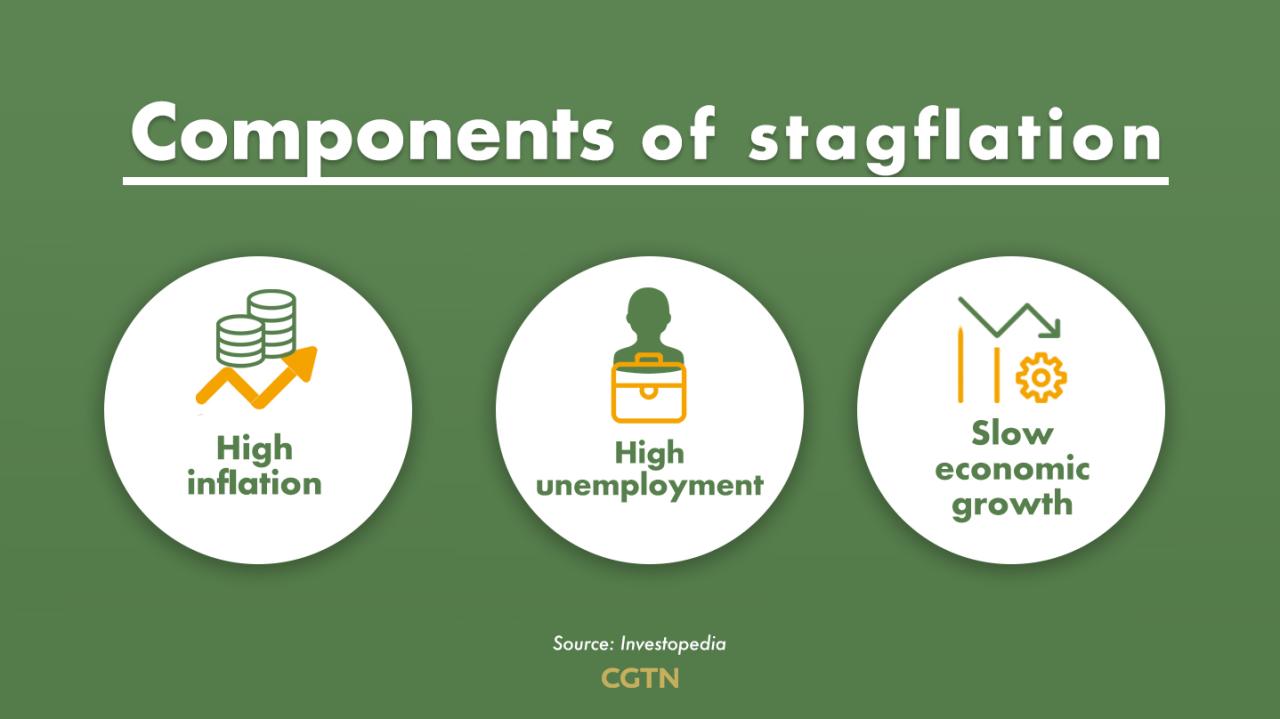

Stagflation, a seemingly paradoxical economic situation characterized by high inflation and sluggish economic growth, has emerged as a significant concern for policymakers and economists worldwide. While the term “stagflation” may seem contradictory, it accurately reflects a scenario where the economy experiences a simultaneous rise in prices and a decline in output.

In November 2024, the global economy faces a confluence of factors that could potentially push it into a stagflationary environment. This article delves into the intricacies of stagflation, its potential causes, impacts, and strategies for managing this challenging economic scenario.

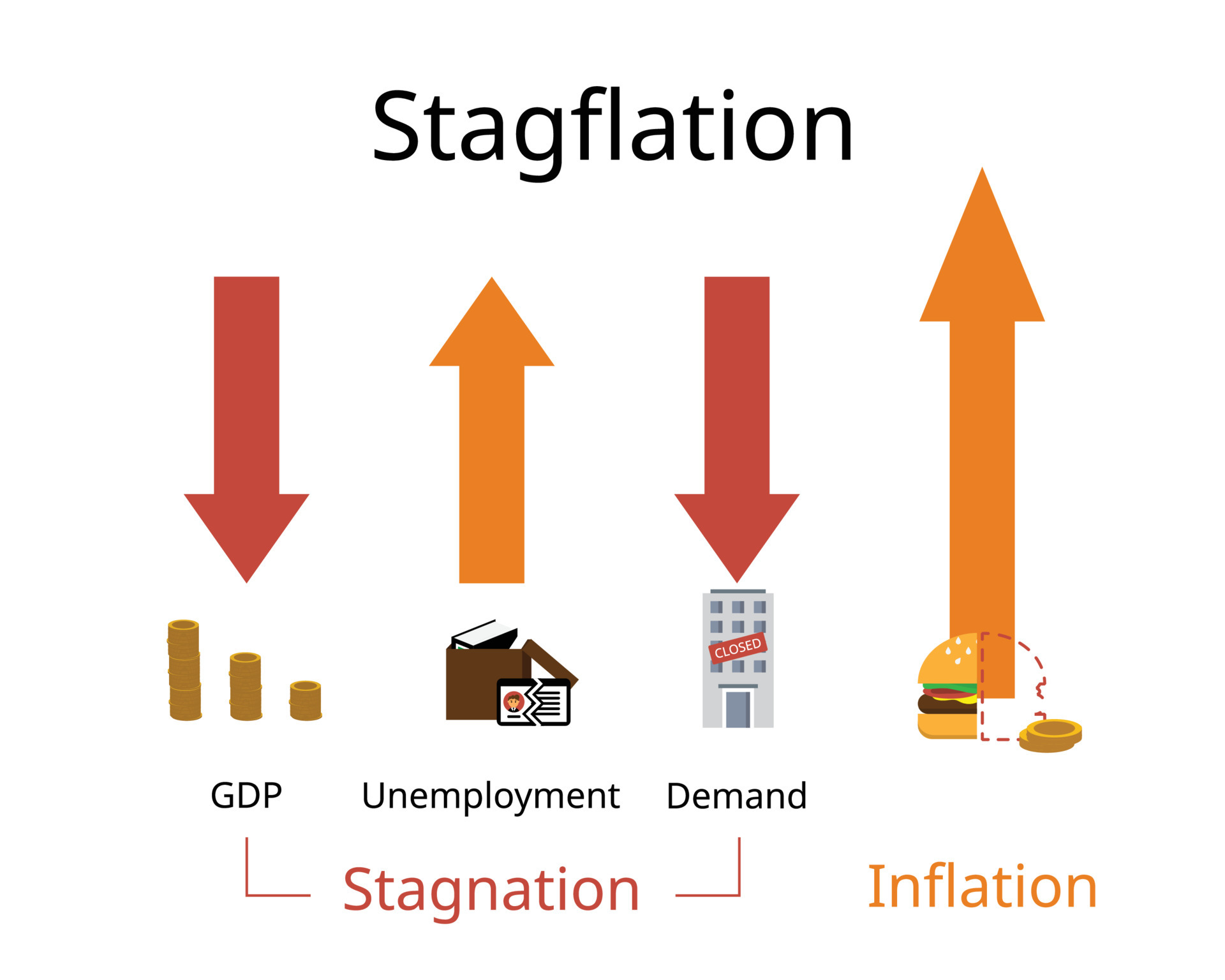

Defining Stagflation

Stagflation occurs when a country experiences a combination of high inflation and stagnant economic growth, often accompanied by high unemployment. This economic phenomenon deviates from the traditional trade-off between inflation and unemployment, where policymakers typically face a dilemma between controlling inflation and stimulating growth.

In a stagflationary environment, both inflation and unemployment rise, creating a difficult situation for policymakers and individuals alike.

Discover how Weighting and Aggregation in the November 2024 CPI Calculation has transformed methods in this topic.

Historical Examples of Stagflation

Historically, stagflation has manifested in various forms, each with unique characteristics. The most prominent example is the stagflation experienced in the 1970s, primarily in the United States and other developed economies. This period was marked by soaring oil prices triggered by the OPEC oil embargo, leading to a sharp increase in inflation and a decline in economic activity.

Comparing Stagflation with Other Economic Scenarios

Stagflation can be distinguished from other economic scenarios, such as recession and hyperinflation. A recession is characterized by a decline in economic activity, typically measured by a decrease in GDP for two consecutive quarters. While stagflation also involves a slowdown in economic growth, it is accompanied by high inflation, unlike a recession where prices may remain relatively stable.

Hyperinflation, on the other hand, refers to an extremely rapid and uncontrolled increase in prices, typically exceeding 50% per month. While stagflation involves high inflation, it is not as extreme or uncontrollable as hyperinflation.

Potential Causes of Stagflation in November 2024, Stagflation: A Challenging Economic Scenario in November 2024 (if applicable)

Several factors could contribute to stagflation in November 2024, stemming from a complex interplay of global economic trends, supply chain disruptions, and geopolitical tensions.

Do not overlook explore the latest data about CPI and Housing Affordability in November 2024.

Global Economic Trends

The global economy has been experiencing a period of heightened uncertainty, marked by rising inflation, supply chain bottlenecks, and geopolitical risks. The COVID-19 pandemic disrupted global supply chains, leading to shortages and price increases. The war in Ukraine has further exacerbated these issues, particularly in energy markets.

Obtain recommendations related to Step-by-Step Guide to CPI Calculation for November 2024 that can assist you today.

Supply Chain Disruptions

Supply chain disruptions have played a significant role in fueling inflation. The pandemic’s impact on manufacturing and logistics has led to shortages of key goods, driving up prices. Moreover, geopolitical tensions have disrupted trade flows, adding to supply chain challenges.

Investigate the pros of accepting Accuracy and Reliability of the November 2024 CPI Data in your business strategies.

Geopolitical Tensions

Geopolitical tensions, particularly the war in Ukraine, have created uncertainty and volatility in global markets. The conflict has disrupted energy supplies, leading to higher oil prices and energy costs.

Government Policies

Government policies, including monetary and fiscal policies, can influence the trajectory of inflation and economic growth. Expansionary fiscal policies, such as increased government spending, can stimulate demand and contribute to inflation. Similarly, loose monetary policies, such as low interest rates, can encourage borrowing and spending, potentially fueling inflation.

Remember to click CPI and Healthcare Costs in November 2024 to understand more comprehensive aspects of the CPI and Healthcare Costs in November 2024 topic.

Potential Triggers for Stagflation

Several potential triggers could push the economy into stagflation in November 2024.

- Energy Price Shocks: A sudden surge in energy prices, such as those triggered by geopolitical events or disruptions in energy production, can significantly impact inflation and economic growth.

- Unexpected Economic Downturns: An unexpected economic downturn, such as a recession in a major economy, can lead to a decline in demand and economic activity, potentially triggering stagflation.

Impacts of Stagflation on Individuals and Businesses

Stagflation has a significant impact on individuals and businesses, affecting their purchasing power, investment decisions, and overall well-being.

Examine how Seasonal Adjustment of November 2024 CPI Data can boost performance in your area.

Impact on Individuals

- Rising Costs of Living: Stagflation leads to higher prices for essential goods and services, such as food, energy, and housing, eroding the purchasing power of individuals.

- Reduced Purchasing Power: With rising inflation, individuals’ incomes may not keep pace with the rising cost of living, leading to a decline in their purchasing power.

- Job Insecurity: Stagflation can lead to job losses and unemployment as businesses struggle to cope with rising costs and declining demand.

Impact on Businesses

- Decreased Investment: Businesses may become hesitant to invest in new projects or expansions due to uncertainty and rising costs.

- Profit Margins: Businesses may experience a decline in profit margins as rising costs are passed on to consumers, potentially reducing demand.

- Consumer Demand: Stagflation can lead to a decline in consumer demand as individuals cut back on spending due to reduced purchasing power.

Potential Effects of Stagflation on Different Sectors of the Economy

| Sector | Potential Effects of Stagflation |

|---|---|

| Manufacturing | Increased input costs, reduced production, potential job losses |

| Retail | Declining consumer demand, price increases, inventory build-up |

| Services | Reduced consumer spending, potential job losses, price increases for services |

Strategies for Managing Stagflation

Addressing stagflation requires a multifaceted approach involving both monetary and fiscal policies, as well as supply-side interventions.

Policy Responses to Address Stagflation

- Monetary Policy Adjustments: Central banks can raise interest rates to curb inflation, but this can also slow down economic growth. Balancing these objectives is crucial in managing stagflation.

- Fiscal Stimulus: Government spending can help stimulate demand and create jobs, but it can also contribute to inflation. Targeted fiscal policies aimed at addressing specific sectors or vulnerable groups can be more effective.

- Supply-Side Interventions: Governments can take measures to address supply chain disruptions, such as investing in infrastructure, promoting domestic production, and reducing trade barriers.

Historical Responses to Stagflation

Historical responses to stagflation have varied, with mixed results. The stagflation of the 1970s was addressed through a combination of monetary tightening and supply-side policies, such as deregulation and tax cuts. While these policies helped to curb inflation, they also slowed down economic growth.

Actions Individuals and Businesses Can Take to Mitigate the Impact of Stagflation

Individuals and businesses can take steps to mitigate the impact of stagflation.

- Budgeting: Individuals should create a budget and prioritize essential expenses, while businesses should focus on cost-cutting measures.

- Investment Diversification: Individuals and businesses can diversify their investments to reduce risk and protect against inflation.

- Seeking New Opportunities: Individuals should consider acquiring new skills or exploring new career paths, while businesses should seek new markets or product lines.

Outlook for the Economy in November 2024

Predicting the duration and severity of stagflation in November 2024 is challenging, as it depends on a complex interplay of factors. However, economic forecasts and expert opinions suggest that stagflation could persist for several months or even longer.

You also can investigate more thoroughly about The Impact of Big Data on November 2024 CPI Calculation to enhance your awareness in the field of The Impact of Big Data on November 2024 CPI Calculation.

Potential Economic Recovery Paths Following a Period of Stagflation

Economic recovery following a period of stagflation can be slow and gradual. It typically involves a combination of policies aimed at stimulating demand, controlling inflation, and addressing supply chain disruptions.

When investigating detailed guidance, check out The CPI Basket of Goods and Services in November 2024: What’s Included? now.

Potential Economic Scenarios in the Months Following November 2024

- Scenario 1: Mild Stagflation: Inflation remains elevated but gradually subsides, while economic growth slows down but does not fall into a recession. This scenario could lead to a gradual recovery with modest inflation and stable growth.

- Scenario 2: Persistent Stagflation: Inflation remains high and persistent, while economic growth stagnates or even declines. This scenario could lead to a prolonged period of economic uncertainty and instability.

- Scenario 3: Stagflation Followed by Recession: Stagflation transitions into a recession, with a significant decline in economic activity and rising unemployment. This scenario would require aggressive policy responses to address the economic downturn.

Conclusion: Stagflation: A Challenging Economic Scenario In November 2024 (if Applicable)

The potential for stagflation in November 2024 serves as a stark reminder of the complex and interconnected nature of the global economy. While the economic outlook remains uncertain, understanding the challenges and opportunities associated with stagflation is crucial for informed decision-making.

Understand how the union of Causes of Inflation in November 2024: A Deep Dive can improve efficiency and productivity.

By proactively addressing potential risks and exploring strategies for managing stagflation, we can mitigate its negative impacts and foster a more resilient economic future.

Find out about how How to Use November 2024 CPI Data for Personal Finance Decisions can deliver the best answers for your issues.

FAQ

What are the potential consequences of stagflation on the stock market?

Stagflation can negatively impact the stock market, as investors become wary of investing in companies with uncertain future earnings due to high inflation and low economic growth. This can lead to decreased investment, reduced stock valuations, and increased market volatility.

How can individuals prepare for a potential stagflationary environment?

Individuals can prepare by focusing on financial discipline, including budgeting, saving, and diversifying investments. They can also explore opportunities to increase their skills and knowledge to adapt to changing economic conditions.

What are the potential policy responses to address stagflation?

Policy responses can include a combination of monetary and fiscal measures. Monetary policy adjustments, such as raising interest rates, can help control inflation. Fiscal stimulus, such as government spending or tax cuts, can boost economic growth. Supply-side interventions, such as deregulation or investment in infrastructure, can address underlying supply constraints.