Speedy Cash Near Me: We’ve all been there – unexpected expenses pop up, and you need money fast. Whether it’s a car repair, a medical bill, or just a temporary cash flow issue, finding quick financial help can feel like a race against time.

Car loan rates can vary depending on factors like your credit score, the vehicle’s age and mileage, and the loan term. Car Loan Rates can be influenced by the current economic climate and interest rate trends.

But navigating the world of payday loans, cash advances, and other “speedy cash” options can be tricky. This guide will help you understand the different types of services available, their potential benefits and drawbacks, and most importantly, how to find reputable providers in your area.

Peer-to-peer lending, also known as P2P lending, is a way to borrow or lend money directly from individuals, bypassing traditional financial institutions. Peer To Peer Lending platforms connect borrowers and lenders, allowing for more personalized loan terms and potentially lower interest rates.

Understanding the need for quick cash is crucial. From unforeseen medical emergencies to unexpected car repairs, situations arise where immediate financial assistance is essential. While traditional loans can take weeks to process, “speedy cash” services offer a solution for those seeking funds quickly.

Sometimes you need money quickly, and there are options for borrowing money instantly. Borrow Money Instantly through online lenders or payday loan services can provide a solution in a pinch, but it’s important to understand the associated fees and interest rates.

This guide will help you navigate the landscape of these services, equipping you with the knowledge to make informed decisions.

Unsecured loans are loans that don’t require collateral, meaning the lender relies on your creditworthiness for repayment. Unsecured Loans can be convenient, but they often come with higher interest rates compared to secured loans.

Last Point

In conclusion, “speedy cash” services can be a valuable resource in times of financial need, but it’s essential to approach them with caution. Before seeking quick cash, assess your financial situation, compare interest rates and fees, and explore alternative options.

Creditninja is a financial technology company that offers various financial services, including loans and credit building tools. Creditninja aims to provide accessible and transparent financial solutions to help individuals improve their financial well-being.

By making informed decisions and understanding the potential risks, you can leverage these services responsibly and navigate unexpected financial challenges with greater confidence.

Rise Loans is a fintech company that provides online personal loans to individuals with less-than-perfect credit. Rise Loans focuses on helping people access credit even with limited credit history, offering flexible repayment options.

FAQ Summary: Speedy Cash Near Me

What is the difference between a payday loan and a cash advance?

Credit unions are member-owned financial institutions that often offer competitive rates on personal loans. Credit Union Personal Loan options can be a good alternative to traditional banks, especially for those seeking lower interest rates and personalized service.

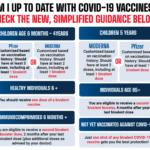

A payday loan is a short-term loan typically based on your income, while a cash advance is a loan against your credit card limit. Payday loans often have higher interest rates and fees than cash advances.

When buying a new car, understanding the current auto loan rates is crucial. Current Auto Loan Rates can vary depending on factors like your credit score and the type of vehicle. Comparing rates from different lenders can help you secure the best deal.

What are the risks associated with using “speedy cash” services?

The biggest risk is the potential for high interest rates and fees, which can quickly lead to debt if you can’t repay the loan on time. These services can also negatively impact your credit score if they are not handled responsibly.

How can I find a reputable “speedy cash” provider?

Look for providers licensed in your state, check their online reviews, and compare interest rates and fees before applying. You can also consult with a financial advisor for guidance.

Planning your dream wedding can be exciting, but the costs can add up quickly. Wedding Loans can help you cover expenses like venue rental, catering, and photography, allowing you to focus on celebrating your special day.

For urgent financial needs, same-day loans online can provide a quick solution. Same Day Loans Online are typically processed and funded within a single business day, offering fast access to cash when you need it most.

Quick cash loans are designed to provide fast access to funds for unexpected expenses. Quick Cash Loans can be helpful in emergencies, but it’s important to consider the interest rates and repayment terms before taking one out.

A mortgage company is a financial institution that specializes in providing loans for the purchase of real estate. Mortgage Company professionals can help you navigate the homebuying process, from pre-approval to closing.

USAA is a financial institution that offers a variety of services to military members and their families, including personal loans. Usaa Personal Loan options can provide competitive rates and tailored financial solutions for those who qualify.

Pool financing can help you turn your dream of a backyard oasis into reality. Pool Financing options can include loans specifically designed for pool construction and installation, making it easier to budget for this significant investment.

If you have fair credit, finding the best personal loan options can be challenging. Best Personal Loans For Fair Credit platforms can help you compare rates and terms from lenders who specialize in lending to borrowers with less-than-perfect credit scores.