Small Business Loans In California November 2024: Navigating the lending landscape can be a daunting task for small business owners, especially in a dynamic state like California. With a diverse range of lenders offering various loan options, understanding the intricacies of loan eligibility, interest rates, and repayment terms is crucial for making informed decisions that fuel business growth.

This comprehensive guide aims to equip California-based entrepreneurs with the knowledge and resources they need to find the most suitable lenders for their specific needs. We’ll delve into the different types of small business loans available, explore eligibility criteria and requirements, compare interest rates and loan terms, and provide valuable tips for choosing the right lender.

Understanding Small Business Loans in California

California is a hub for small businesses, and securing funding is crucial for their growth and success. Understanding the various loan options available can empower entrepreneurs to make informed decisions and navigate the financial landscape effectively. This section explores different types of small business loans in California, delves into the California Small Business Loan Guarantee Program, and provides information on SBA loans and their eligibility criteria for California businesses.

Types of Small Business Loans in California

California offers a diverse range of small business loans, each tailored to specific needs and circumstances.

- Traditional Bank Loans:These loans are typically offered by commercial banks and credit unions. They often require strong credit scores, a solid business plan, and collateral.

- Online Loans:Fintech companies provide alternative lending options, often with faster approval times and less stringent requirements compared to traditional banks. These loans can be particularly beneficial for startups or businesses with limited credit history.

- Microloans:These small, short-term loans are often provided by non-profit organizations or community development financial institutions (CDFIs). They are specifically designed to support entrepreneurs with limited access to traditional financing.

- Equipment Financing:This type of loan allows businesses to finance the purchase of equipment, such as machinery, vehicles, or computers.

- Invoice Financing:This option provides businesses with immediate cash flow by financing outstanding invoices.

California Small Business Loan Guarantee Program

The California Small Business Loan Guarantee Program is a valuable resource for California entrepreneurs seeking financing.

- The program provides guarantees to lenders, reducing their risk and encouraging them to extend loans to small businesses.

- This program aims to increase access to capital for small businesses, particularly those that may face challenges obtaining traditional financing.

- The California Department of Business Oversight (DBO) administers the program.

SBA Loans in California

The U.S. Small Business Administration (SBA) offers a range of loan programs designed to support small businesses.

- SBA 7(a) Loans:This is the most common SBA loan program, providing long-term financing for a variety of business purposes, including working capital, equipment purchases, and real estate acquisition.

- SBA 504 Loans:These loans are specifically designed to finance fixed assets, such as land, buildings, and machinery.

- SBA Microloans:This program offers small loans, typically under $50,000, to small businesses with limited access to traditional financing.

Loan Eligibility and Requirements

Securing a small business loan in California requires meeting specific eligibility criteria and providing necessary documentation. Understanding these requirements is crucial for maximizing your chances of approval.

General Eligibility Criteria

California small business loan providers typically evaluate applicants based on several factors. These include:

- Credit Score:A good credit score is essential for demonstrating financial responsibility and trustworthiness. Lenders often require a minimum score, typically above 650, to consider your application.

- Time in Business:Lenders prefer businesses that have been operating for a certain period, usually at least two years. This demonstrates stability and a track record of success.

- Revenue and Profitability:Demonstrating consistent revenue and profitability is crucial for lenders to assess your ability to repay the loan. They often require financial statements like profit and loss statements and balance sheets.

- Debt-to-Income Ratio:Lenders evaluate your existing debt obligations and income to determine your capacity to take on additional debt. A healthy debt-to-income ratio, generally below 40%, is preferred.

- Collateral:Depending on the loan type, lenders may require collateral, such as real estate or equipment, to secure the loan. This provides additional security for the lender in case of default.

Specific Requirements for Different Loan Types

The specific requirements for small business loans in California vary depending on the type of loan:

- SBA Loans:These loans are backed by the Small Business Administration (SBA), providing lenders with greater assurance. Eligibility requirements for SBA loans typically include meeting specific industry standards, having a good credit history, and demonstrating a strong business plan.

- Term Loans:These loans provide a fixed amount of money with a set repayment schedule over a specific period. Eligibility criteria for term loans generally include a minimum credit score, a proven track record, and a clear business plan.

- Lines of Credit:These loans provide a revolving credit line that businesses can access as needed. Eligibility requirements for lines of credit typically include a good credit score, consistent revenue, and a solid business plan.

- Equipment Loans:These loans are specifically designed to finance the purchase of equipment. Eligibility criteria may include a minimum credit score, a clear business plan, and a demonstrated need for the equipment.

Required Documents for Loan Applications

To complete a loan application, you’ll typically need to provide the following documents:

- Business Plan:A detailed business plan outlining your business’s mission, goals, products or services, target market, competitive analysis, and financial projections.

- Personal and Business Tax Returns:Recent tax returns demonstrate your financial history and income levels.

- Bank Statements:Recent bank statements provide insights into your cash flow and financial management practices.

- Financial Statements:Including profit and loss statements, balance sheets, and cash flow statements, these documents provide a comprehensive view of your business’s financial health.

- Credit Reports:Credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) are necessary to assess your creditworthiness.

- Personal and Business Licenses:Proof of business licenses and permits demonstrates your legal compliance and legitimacy.

- Collateral Documents:If you’re offering collateral, you’ll need to provide documents like deeds, titles, or insurance policies.

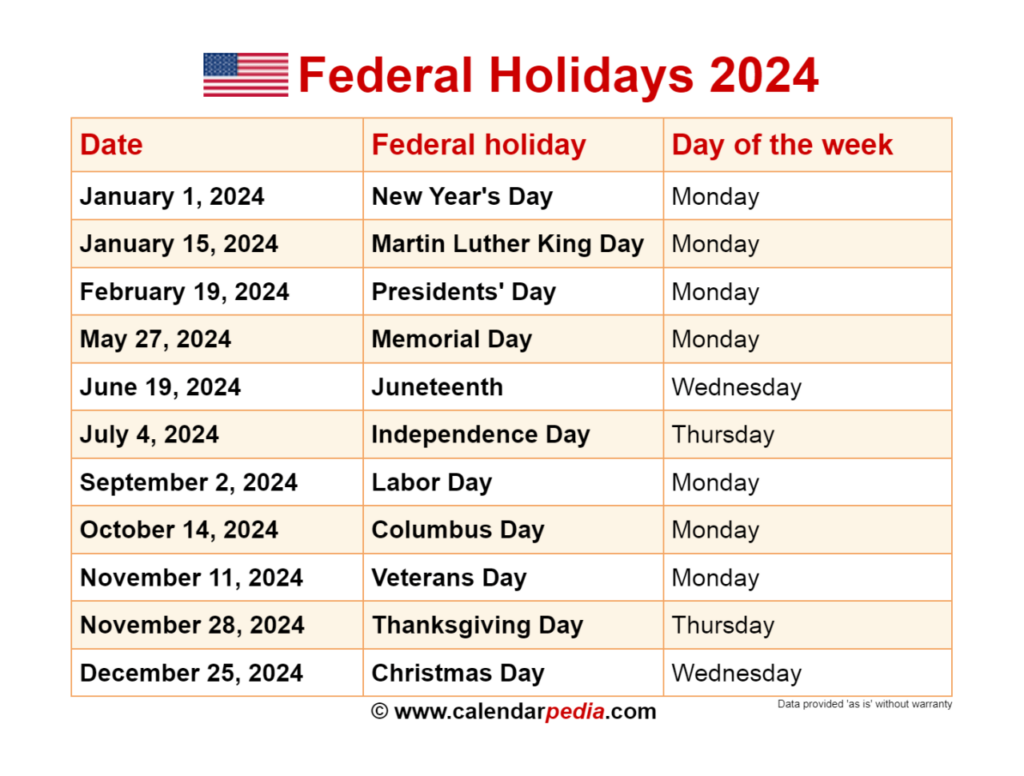

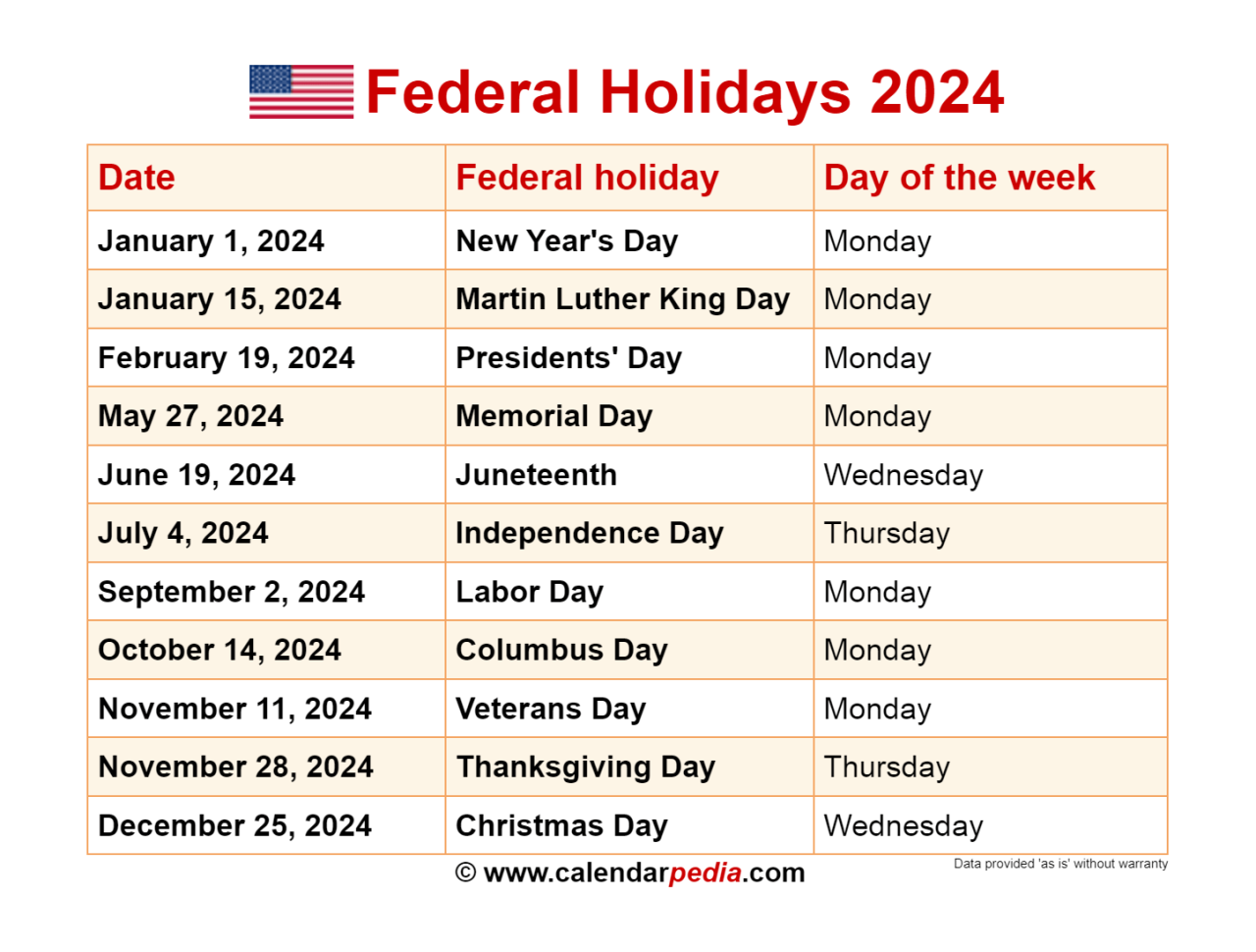

Interest Rates and Loan Terms: Small Business Loans In California November 2024

Understanding interest rates and loan terms is crucial for making informed decisions about small business loans in California. These factors directly impact the cost of borrowing and your ability to repay the loan.

Interest Rates

Interest rates are the cost of borrowing money, expressed as a percentage of the loan amount. They vary depending on factors such as your credit score, the loan amount, the loan term, and the lender’s risk assessment.

- Traditional Banks:Banks typically offer lower interest rates compared to alternative lenders, but they may have stricter eligibility requirements and longer approval times. Interest rates for small business loans from banks in California can range from 5% to 10%, depending on factors such as creditworthiness and the loan amount.

In this topic, you find that Small Business Loans Apply Online November 2024 is very useful.

- Credit Unions:Credit unions often offer competitive interest rates and more personalized service. Their rates for small business loans can range from 6% to 12%, depending on the borrower’s credit history and the loan amount.

- Online Lenders:Online lenders are known for their fast approval times and flexible loan terms, but they generally have higher interest rates than traditional lenders. Their rates for small business loans in California can range from 8% to 25%, depending on the borrower’s risk profile and the loan amount.

- SBA Loans:The Small Business Administration (SBA) offers government-backed loans with lower interest rates and more favorable terms than conventional loans. SBA loans in California can have interest rates ranging from 5% to 8%, depending on the loan program and the borrower’s creditworthiness.

Loan Terms

Loan terms refer to the repayment schedule and any associated fees.

Examine how Business Loans Small Businesses November 2024 can boost performance in your area.

- Repayment Periods:Repayment periods for small business loans in California can range from a few months to several years, depending on the loan amount and the lender’s policies. Longer repayment periods can result in lower monthly payments but higher overall interest costs.

Obtain a comprehensive document about the application of Website For My Business October 2024 that is effective.

For example, a loan with a 5-year repayment period will have lower monthly payments than a loan with a 3-year repayment period, but the total interest paid over the life of the loan will be higher.

- Fees:Some lenders may charge fees associated with obtaining a loan, such as origination fees, closing costs, and prepayment penalties. These fees can vary depending on the lender and the type of loan. It’s important to factor in these fees when comparing loan offers, as they can significantly impact the overall cost of borrowing.

For instance, an origination fee of 1% on a $100,000 loan would amount to $1,000.

Factors Influencing Interest Rates and Loan Terms

Several factors can influence the interest rates and loan terms you qualify for.

- Credit Score:A higher credit score generally results in lower interest rates and more favorable loan terms. Borrowers with excellent credit scores can often secure loans with lower interest rates and longer repayment periods. For instance, a borrower with a credit score of 750 or higher may qualify for a loan with a 6% interest rate, while a borrower with a credit score of 650 may face an interest rate of 8% or higher.

- Loan Amount:Larger loan amounts may come with higher interest rates, as lenders perceive larger loans as riskier. For example, a loan of $100,000 may have a lower interest rate than a loan of $500,000, as lenders may consider the larger loan to be more risky.

- Loan Term:Longer loan terms typically come with higher interest rates, as the lender is exposed to the risk of default for a longer period. For example, a 10-year loan may have a higher interest rate than a 5-year loan, as the lender is exposed to the risk of default for a longer period.

- Lender’s Risk Assessment:Lenders evaluate the borrower’s risk profile based on factors such as credit history, business plan, and industry. Borrowers with a strong business plan and a history of financial success are more likely to secure loans with lower interest rates and more favorable terms.

For example, a lender may offer a lower interest rate to a borrower with a well-established business and a track record of profitability than to a borrower with a new business and limited financial history.

Finding the Right Lender in California for Small Businesses

Securing financing is crucial for small businesses in California, especially with the state’s unique economic landscape. Finding the right lender can make a significant difference in your business’s success. This guide will help you navigate the California lending landscape and choose the lender that best suits your needs.

You also can understand valuable knowledge by exploring Set Up A Business October 2024.

Types of Loans for Small Businesses

Small businesses in California have access to various loan types, each tailored to specific needs and circumstances. Understanding the different loan types will help you determine the most suitable option for your business.

- Term Loans:These loans provide a fixed amount of money with a set repayment schedule over a specific term (typically 5-10 years). They are often used for major investments like equipment purchases or business expansion.

- Lines of Credit:Lines of credit offer a revolving credit facility that allows you to borrow funds as needed, up to a predetermined limit. This flexibility makes them suitable for working capital needs, unexpected expenses, or seasonal fluctuations.

- SBA Loans:Backed by the Small Business Administration (SBA), these loans offer favorable terms and conditions, including lower interest rates and longer repayment terms. The SBA offers various programs, such as the 7(a) loan program, which is a popular option for small businesses.

Discover how Business Loan In California November 2024 has transformed methods in this topic.

- Equipment Financing:This type of loan specifically finances the purchase of equipment, often with lower interest rates and longer repayment terms compared to traditional loans. It is a common choice for businesses investing in machinery, vehicles, or other essential equipment.

- Invoice Financing:This option provides funding based on your outstanding invoices. It allows you to access cash flow immediately instead of waiting for payment from your customers, making it useful for businesses with long payment cycles.

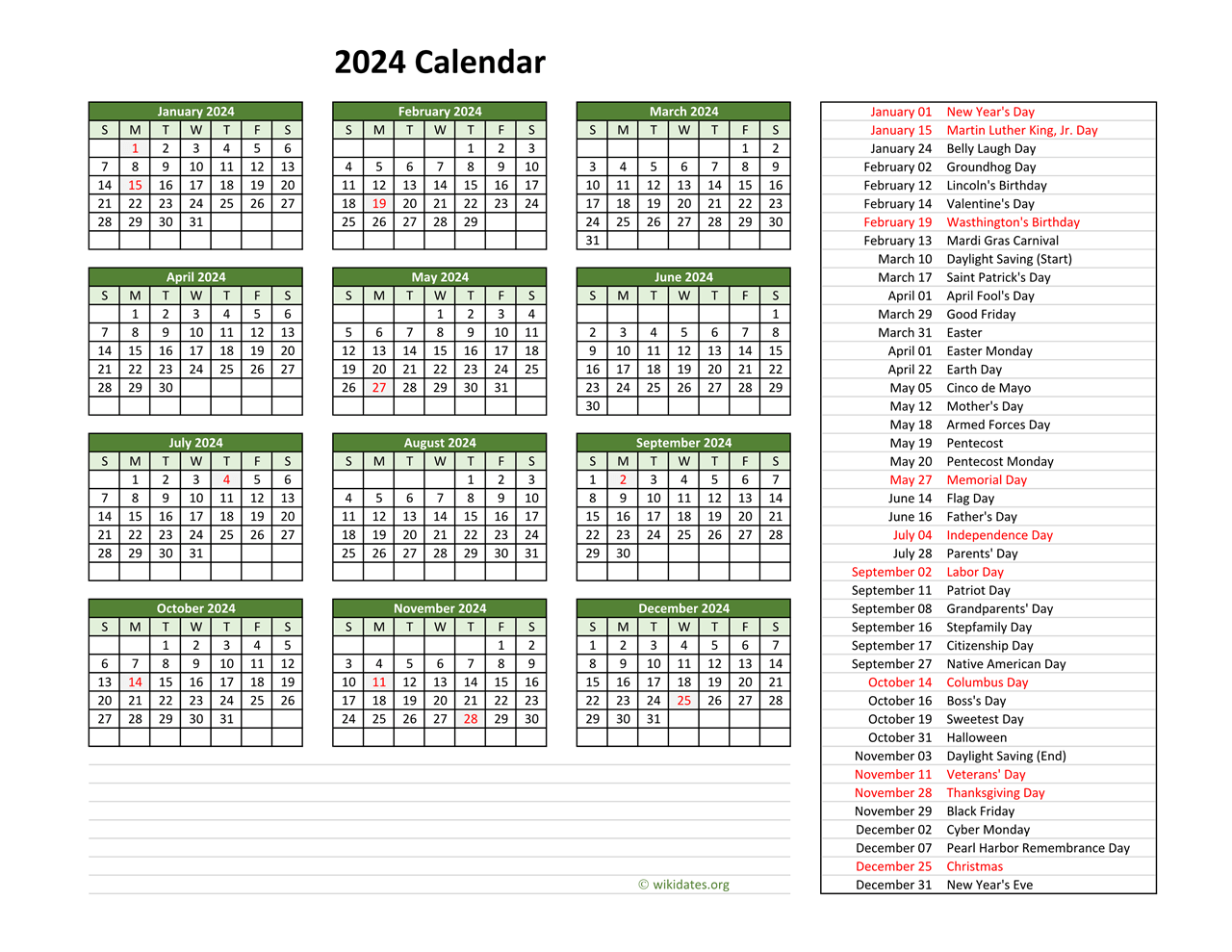

Loan Comparison Table

Comparing different lenders is crucial for finding the best loan terms and conditions. Here is a sample comparison table that highlights key features of various lenders in California:

| Lender | Loan Types Offered | Minimum Loan Amount | Interest Rates | Loan Terms | Fees | Eligibility Requirements | Application Process | Customer Reviews |

|---|---|---|---|---|---|---|---|---|

| Lender A | Term Loans, Lines of Credit, SBA Loans | $5,000 | 5.5%

|

5-10 years | 1% origination fee, closing costs | Good credit history, strong business plan | Online application, documentation required | [Link to Customer Reviews] |

| Lender B | Term Loans, Lines of Credit, Equipment Financing | $10,000 | 6%

|

3-7 years | 2% origination fee, annual fee | Good credit history, revenue requirements | Online application, business financials required | [Link to Customer Reviews] |

| Lender C | SBA Loans, Invoice Financing | $50,000 | 4.5%

|

10-25 years | 1% origination fee, closing costs | SBA eligibility requirements, good credit history | Online application, SBA documentation required | [Link to Customer Reviews] |

| Lender D | Term Loans, Lines of Credit, Equipment Financing | $25,000 | 7%

Check what professionals state about Best Small Business Banks In Maryland October 2024 and its benefits for the industry.

|

2-5 years | 3% origination fee, annual fee | Good credit history, business plan, collateral required | Online application, business financials required | [Link to Customer Reviews] |

| Lender E | SBA Loans, Invoice Financing, Equipment Financing | $10,000 | 5%

Discover how Small Business Loan Company November 2024 has transformed methods in this topic.

|

5-15 years | 1% origination fee, closing costs | SBA eligibility requirements, good credit history | Online application, SBA documentation required | [Link to Customer Reviews] |

Note:This table is for illustrative purposes only and does not represent all lenders in California. Interest rates, fees, and eligibility requirements can vary depending on the lender and your specific circumstances.

Resources for Finding Reliable Lenders

Leveraging resources can help you identify reputable lenders in California. Here are some trusted sources to consider:

- Government Agencies:

- Small Business Administration (SBA):The SBA offers various resources and loan programs for small businesses, including the SBA Lender Match program that connects businesses with SBA-approved lenders.

- California Department of Business Oversight:This agency regulates financial institutions in California and provides information about licensed lenders.

- Non-profit Organizations:

- SCORE:This non-profit organization provides free mentoring and counseling services to small businesses, including guidance on financing options.

- Small Business Development Centers (SBDCs):SBDCs offer business counseling, training, and assistance with accessing capital, including connecting businesses with lenders.

- Industry Associations:

- California Chamber of Commerce:This organization provides resources for businesses, including information on financing options and lenders.

- National Federation of Independent Business (NFIB):NFIB offers resources and advocacy for small businesses, including information on financing and lenders.

- Online Platforms:

- LendingTree:This platform allows you to compare loan offers from multiple lenders.

- Kabbage:This online platform provides small business loans and lines of credit.

- OnDeck:This platform offers online loans and lines of credit to small businesses.

- Define Clear Goals:Before applying for a loan, identify specific, measurable, achievable, relevant, and time-bound (SMART) goals. This will provide a roadmap for using the funds effectively and tracking progress.

- Create a Detailed Budget:A comprehensive budget Artikels how the loan proceeds will be allocated, ensuring funds are used efficiently and strategically to achieve your goals.

- Invest in Business Growth:Utilize the loan to expand your operations, invest in new equipment, or hire additional staff. This can increase revenue, productivity, and market share.

- Improve Efficiency:Investing in technology or process improvements can streamline operations, reduce costs, and enhance customer satisfaction.

- Expand into New Markets:The loan can provide the capital needed to explore new markets, diversify your customer base, and increase sales.

- Manage Cash Flow:A small business loan can provide a short-term cash injection to cover unexpected expenses or seasonal fluctuations, ensuring smooth operations.

- Initial Application:Complete the loan application form, providing detailed information about your business and financial history.

- Credit Check:The lender will review your credit score and history to assess your creditworthiness.

- Financial Review:The lender will analyze your financial statements, including income, expenses, and debt levels, to determine your ability to repay the loan.

- Loan Approval:If your application is approved, the lender will provide you with the loan terms and conditions.

- Loan Disbursement:Once you sign the loan agreement, the funds will be deposited into your business account.

- Create a Budget:Develop a detailed budget that includes loan payments as a priority expense, ensuring you have sufficient funds to make timely payments.

- Track Expenses:Monitor your business expenses closely to identify areas where you can reduce costs and free up cash flow for loan repayments.

- Develop a Repayment Plan:Create a repayment schedule that Artikels the amount and frequency of payments, ensuring you stay on track.

- Consider Refinancing:If interest rates decline or your financial situation improves, consider refinancing your loan to secure a lower interest rate and reduce your overall debt burden.

- How does a loan affect the debt-to-equity ratio?A loan increases your liabilities, which can raise your debt-to-equity ratio, indicating a higher level of financial risk.

- How does interest expense impact profitability?Interest expense reduces your net income, lowering your profitability. However, the impact is often offset by increased revenue generated through business growth financed by the loan.

- What are the potential tax implications of a small business loan?Interest payments on business loans are generally tax-deductible, reducing your tax liability.

- Prepare Thoroughly:Before applying for a loan, ensure you have all the necessary documentation readily available. This includes your business plan, financial statements, tax returns, and personal credit reports.

- Understand Loan Requirements:Different lenders have varying loan requirements. Carefully research the specific criteria for each lender you’re considering to ensure your business meets their eligibility standards.

- Seek Professional Guidance:If you’re unsure about the application process or need assistance in preparing your documentation, consider seeking guidance from a business advisor or loan consultant. They can offer valuable insights and support.

- Build Credit:If your business has a limited credit history, focus on building credit by making timely payments on all your business obligations, such as rent, utilities, and supplier invoices.

- Consider Alternative Lending Options:Explore alternative lending sources like online lenders or microlenders who may be more flexible with credit score requirements. However, these options often come with higher interest rates.

- Seek Guarantors:If your personal credit score is strong, consider using it as collateral by having a personal guarantor co-sign the loan.

- Prepare a Comprehensive Business Plan:A well-written business plan outlining your business goals, revenue projections, and financial forecasts can demonstrate your business’s potential for success.

- Highlight Key Financial Metrics:Emphasize strong financial metrics such as profitability, cash flow, and debt-to-equity ratio to showcase your business’s financial health.

- Consider a Line of Credit:A line of credit can provide short-term financing options to cover immediate expenses while you build your business’s financial history.

- Explore Alternative Collateral Options:If you lack traditional collateral, consider alternative options such as accounts receivable, inventory, or equipment.

- Negotiate with the Lender:Discuss the possibility of reducing the amount of collateral required or explore alternative financing options that don’t require collateral.

- Consider a Microloan:Microloans are smaller loans often offered by non-profit organizations or government agencies that may have less stringent collateral requirements.

- Compare Loan Options:Shop around and compare loan offers from multiple lenders to find the most competitive interest rates and terms.

- Negotiate Loan Terms:Don’t be afraid to negotiate with lenders on interest rates, loan terms, and fees.

- Consider Loan Repayment Options:Evaluate different repayment options, such as fixed payments or variable payments, to determine the most suitable option for your business.

Using a Small Business Loan Effectively

Securing a small business loan is a significant step towards achieving your business goals. However, simply having the funds isn’t enough. Strategic utilization is crucial to maximize the loan’s impact and ensure a positive return on investment. This guide explores key strategies for using a small business loan effectively to unlock growth and financial success.

Find out about how Apply Small Business Loans November 2024 can deliver the best answers for your issues.

Unlocking Growth: How to Use a Small Business Loan Strategically

A small business loan can be a powerful tool for driving growth and achieving your business objectives. To ensure you maximize the loan’s potential, consider these strategic steps:

Loan Repayment Strategies

Choosing the right repayment strategy is essential for managing your loan effectively and minimizing interest costs. Consider these options:

| Strategy | Pros | Cons |

|---|---|---|

| Fixed Payments | Predictable monthly payments, easier budgeting | May lead to higher overall interest payments, especially if interest rates rise |

| Variable Payments | Lower initial payments, potential for lower overall interest if rates decline | Less predictable payments, risk of higher payments if interest rates increase |

| Interest-Only Payments | Lower initial payments, more cash flow available for business growth | Higher overall interest payments, principal remains unchanged until the end of the loan term |

| Balloon Payments | Lower monthly payments, potentially shorter loan term | Large lump sum payment due at the end of the loan term, may create financial strain |

Applying for and Receiving a Small Business Loan, Small Business Loans In California November 2024

The application process for a small business loan involves several key steps:

Impact of a Small Business Loan on Financial Statements

A small business loan can significantly impact your financial statements. Consider this example:

A fictional bakery, “Sweet Treats,” secures a $50,000 loan to purchase new equipment and expand its production capacity. The loan proceeds increase the bakery’s assets (equipment) and liabilities (loan). As the bakery expands production, its revenue increases, leading to higher profits. The loan also generates interest expense, which is reflected on the income statement.

Obtain direct knowledge about the efficiency of Small Business Loans Program October 2024 through case studies.

Managing Loan Repayments

Effective loan management is crucial for minimizing debt and ensuring financial stability. Follow these steps:

Impact of a Small Business Loan on Financial Statements

A small business loan can impact your financial statements in various ways. Here are some common questions and answers:

Common Challenges and Solutions

Securing a small business loan in California can be a challenging process. Understanding the common hurdles and implementing practical solutions can significantly improve your chances of success. This section will explore some of the most frequent obstacles faced by small business owners in California and provide strategies for overcoming them.

Navigating the Application Process

The loan application process itself can be a significant challenge for many small business owners. It often involves extensive paperwork, detailed financial documentation, and a rigorous review process. To navigate this process effectively, consider the following:

Meeting Credit Requirements

Lenders often require a certain credit score to qualify for a loan. Small businesses with limited credit history or lower credit scores may face difficulties in securing financing.

Demonstrating Financial Viability

Lenders need to be confident that your business is financially viable and can repay the loan. If your business lacks a strong track record or has experienced recent financial difficulties, it may be challenging to secure financing.

Examine how Website For Small Business Owners October 2024 can boost performance in your area.

Securing Collateral

Many lenders require collateral, which is an asset that can be seized if you default on the loan. Small businesses may struggle to provide sufficient collateral, especially those operating in industries with limited tangible assets.

Understanding Interest Rates and Loan Terms

Navigating the complexities of interest rates and loan terms can be daunting.

Summary

Securing a small business loan in California requires careful planning, thorough research, and a strategic approach. By understanding the different loan options, eligibility requirements, and lending landscape, small business owners can make informed decisions that align with their financial goals and drive sustainable growth.

Remember to leverage available resources, compare lenders carefully, and seek professional advice when needed to navigate the complexities of the lending process.

Clarifying Questions

What are the typical interest rates for small business loans in California?

Interest rates for small business loans in California vary depending on factors such as loan type, lender, borrower creditworthiness, and the current economic climate. It’s essential to compare rates from multiple lenders to find the most competitive offer.

What are the most common challenges faced by small businesses seeking loans in California?

Common challenges include meeting stringent eligibility requirements, securing sufficient collateral, navigating complex application processes, and facing high interest rates. Small businesses may also encounter difficulties in demonstrating a strong track record or securing adequate financial projections.

How can I improve my chances of getting a small business loan approved in California?

To increase your chances of approval, maintain a strong credit score, build a solid business plan, demonstrate a track record of profitability, secure adequate collateral, and prepare comprehensive financial statements. It’s also beneficial to research lenders thoroughly and choose those that specialize in your industry or business type.