Small Business Loan Business November 2024 takes center stage as entrepreneurs navigate a dynamic landscape of funding opportunities. This guide delves into the intricacies of securing small business loans, exploring the current market conditions, loan types, and crucial factors that influence loan approval.

From understanding credit scores and crafting compelling business plans to navigating loan repayment options and exploring alternative financing sources, this comprehensive resource empowers small business owners with the knowledge and strategies needed to make informed decisions and secure the financial resources essential for growth.

This guide provides a thorough overview of the small business loan landscape in November 2024, covering essential topics such as market trends, loan types, factors affecting loan approval, the application process, loan repayment options, lender options, government-backed loan programs, loan security and collateral, loan costs and fees, financial planning, loan management, alternative financing options, and future trends.

It aims to equip small business owners with the necessary knowledge and resources to navigate the complex world of small business financing successfully.

Small Business Loan Market Overview

The small business loan market in November 2024 is navigating a complex landscape, influenced by ongoing economic uncertainty, evolving regulatory frameworks, and shifting lender appetites.

Interest Rates and Loan Terms

Interest rates remain a key consideration for small businesses seeking financing. The Federal Reserve’s recent monetary policy adjustments have resulted in a mixed impact on lending rates. While some lenders have lowered their rates to attract borrowers, others have maintained or even increased them, reflecting the ongoing risk assessment of the economic environment.

Loan terms are also evolving, with lenders becoming more selective in their lending criteria. Some lenders are offering shorter loan terms, particularly for higher-risk borrowers, while others are extending terms for businesses with strong credit histories and demonstrable financial performance.

Impact of Economic Conditions

The current economic climate is a significant factor influencing the small business loan market. Inflationary pressures and concerns about a potential recession have created a cautious lending environment. Lenders are scrutinizing borrowers’ financial statements more closely, requiring stronger financial projections and detailed business plans.

Regulatory Changes

Recent regulatory changes, including the Small Business Lending Reform Act, have impacted the small business loan market. These regulations aim to streamline the lending process and increase access to capital for small businesses. However, they have also introduced new compliance requirements for lenders, potentially impacting the availability and cost of loans.

Impact on Small Businesses

Small businesses are facing a mixed bag of challenges and opportunities in the current loan market. The availability of loans is generally healthy, with various lenders offering a range of options. However, securing financing can be more competitive, requiring businesses to demonstrate strong creditworthiness and a well-defined business strategy.

Types of Small Business Loans

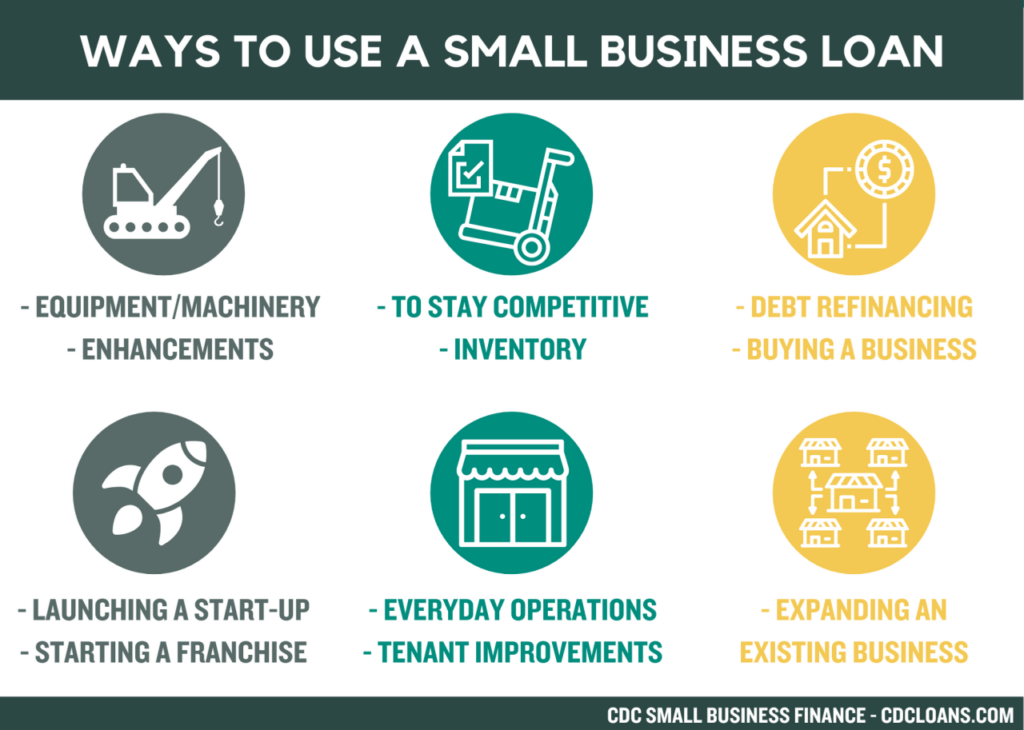

Small business loans are essential for entrepreneurs and small business owners to fund their operations, expand their reach, and achieve their goals. These loans provide the necessary capital to cover various expenses, including inventory, equipment, marketing, and more. The type of loan that best suits a business depends on several factors, including the business’s credit history, revenue, and the purpose of the loan.

Understanding the different types of small business loans available is crucial for making informed decisions and securing the right funding for your business.

Types of Small Business Loans

The small business loan market offers a wide range of options, each tailored to specific needs and circumstances. Here are some of the most common types of small business loans available in November 2024:

| Loan Type | Description | Interest Rates | Repayment Terms | Eligibility Criteria |

|---|---|---|---|---|

| Term Loan | A traditional loan with a fixed interest rate and a set repayment schedule. These loans are often used for long-term investments, such as purchasing equipment or expanding facilities. | 5%-15% | 1-10 years | Good credit history, strong revenue, and a solid business plan. |

| Line of Credit | A revolving credit line that allows businesses to borrow money as needed, up to a pre-approved limit. These loans are ideal for businesses with fluctuating cash flow needs. | 7%-18% | Variable, typically up to 10 years | Good credit history, strong revenue, and a clear business plan. |

| SBA Loan | Loans backed by the Small Business Administration (SBA), which offer lower interest rates and longer repayment terms than conventional loans. These loans are available to small businesses that meet specific eligibility criteria. | 5%-10% | 10-25 years | Good credit history, strong revenue, and a clear business plan. Must meet SBA size and eligibility requirements. |

| Equipment Financing | Loans specifically designed to finance the purchase of equipment, such as machinery, vehicles, or technology. These loans often have lower interest rates and longer repayment terms than other types of loans. | 5%-12% | 5-10 years | Good credit history, strong revenue, and a clear business plan. |

| Invoice Financing | Loans that provide businesses with immediate cash flow by using unpaid invoices as collateral. These loans are ideal for businesses with a high volume of outstanding invoices. | 8%-15% | Short-term, typically 30-90 days | Strong credit history, a high volume of outstanding invoices, and a clear business plan. |

3. Factors Affecting Loan Approval

Securing a small business loan is a crucial step for many entrepreneurs, but it’s not always easy. Lenders carefully evaluate various factors to determine the risk associated with providing a loan. Understanding these factors and taking proactive steps to address them can significantly increase your chances of approval.

Credit Score

Your credit score is a numerical representation of your creditworthiness, and it plays a significant role in the loan approval process. Lenders use this score to assess your ability to repay borrowed funds.

- Lenders generally favor borrowers with credit scores above 680, often considering scores above 700 as ideal. A higher credit score typically indicates a lower risk for lenders, leading to more favorable loan terms.

- A low credit score can negatively impact loan terms, resulting in higher interest rates and lower loan amounts. Lenders may even deny loan applications altogether if the credit score is too low.

- To improve your credit score, focus on building positive credit history. This includes paying bills on time, keeping credit utilization low, and avoiding unnecessary credit applications. Consider using a credit monitoring service to track your credit score and identify areas for improvement.

Business Plan

A well-structured business plan is essential for convincing lenders of your business’s viability and profitability. It serves as a roadmap for your business’s future, outlining your goals, strategies, and financial projections.

- Lenders scrutinize the market analysis, financial projections, and management team sections of the business plan. These sections provide insights into your target market, revenue generation potential, and the team’s expertise in executing your business strategy.

- A compelling business plan demonstrates a clear understanding of the market, a sound financial model, and a capable team, making it more likely for lenders to approve your loan application.

- Include specific elements like detailed market research, competitive analysis, realistic financial projections, and a comprehensive management team profile to strengthen your business plan’s persuasiveness.

Revenue History

Lenders use your revenue history to assess the stability and growth potential of your business. Consistent revenue streams and positive revenue trends are crucial for demonstrating your business’s financial health.

- Lenders analyze your revenue history to identify patterns, trends, and any potential red flags. They look for consistent revenue growth, indicating a sustainable business model and strong customer demand.

- A steady and increasing revenue history suggests a business with a strong track record and a lower risk profile, making it more attractive to lenders. Conversely, inconsistent or declining revenue can raise concerns about your business’s long-term viability.

- Present your revenue history effectively by providing clear and concise financial statements, including income statements, balance sheets, and cash flow statements. Highlight positive trends and address any inconsistencies or dips in revenue with explanations and corrective actions.

Collateral

Collateral refers to assets that you pledge as security for a loan. In case of default, lenders can seize and sell the collateral to recover their losses.

- Common types of collateral include real estate, equipment, inventory, and accounts receivable. The type of collateral accepted varies depending on the lender and the loan type.

- Collateral can reduce the risk for lenders, as they have a tangible asset to recover if the borrower defaults. This can lead to more favorable loan terms, including lower interest rates and larger loan amounts.

- Collateral is particularly important for securing loans with higher loan amounts or for businesses with limited credit history or lower credit scores. For example, a business seeking a loan to purchase a new piece of equipment may be required to provide the equipment itself as collateral.

Lender Options

Securing a small business loan requires understanding the various lender options available. Each lender type offers unique advantages and disadvantages, so it’s crucial to carefully consider your needs and financial situation before making a decision.

Types of Lenders

This section explores the primary lender categories for small business loans: banks, credit unions, online lenders, and alternative lenders. Each type is characterized by its loan offerings, interest rates, and eligibility requirements, influencing the overall borrowing experience.

- Banks: Traditional banks are often the first choice for small business loans due to their established reputation and extensive resources. They typically offer a wide range of loan products, including term loans, lines of credit, and equipment financing, catering to diverse business needs.

- Credit Unions: Credit unions are member-owned financial institutions, typically offering more favorable interest rates and loan terms compared to banks. They prioritize community involvement and often focus on supporting local businesses, making them a viable option for small businesses seeking competitive rates.

- Online Lenders: Online lenders have gained popularity in recent years, offering a convenient and streamlined application process. They often cater to businesses with limited credit history or those seeking quick funding, though their interest rates may be higher than traditional lenders.

- Alternative Lenders: Alternative lenders provide financing options for businesses that may not qualify for traditional loans. They often focus on specific industries or offer specialized loan products, such as merchant cash advances or invoice factoring. While they can be a valuable resource for businesses with limited credit, their interest rates and fees can be significantly higher.

Lender Comparison Table

The following table provides a comparison of loan offerings, interest rates, and eligibility requirements for different lender types:

| Lender Type | Loan Offerings | Interest Rates | Eligibility Requirements |

|---|---|---|---|

| Banks | Term loans, lines of credit, equipment financing | Variable, depending on credit score, loan amount, and industry | Strong credit history, established business, and financial statements |

| Credit Unions | Term loans, lines of credit, equipment financing | Generally lower than banks | Membership in the credit union, good credit history, and financial statements |

| Online Lenders | Term loans, lines of credit, merchant cash advances | Variable, often higher than traditional lenders | Good credit history, revenue history, and financial statements |

| Alternative Lenders | Merchant cash advances, invoice factoring, business loans | Very high interest rates and fees | Limited credit history, revenue history, and industry-specific requirements |

Note:Interest rates and eligibility requirements can vary significantly depending on the lender, the loan amount, and the borrower’s financial situation. It’s crucial to shop around and compare offers from multiple lenders before making a decision.

Small Business Loan Programs

Government-backed small business loan programs can be a valuable resource for entrepreneurs seeking funding. These programs offer a variety of benefits, such as lower interest rates, longer repayment terms, and loan forgiveness options. Understanding the different programs available and their eligibility requirements can help you determine which one is right for your business.

Government-Backed Loan Programs

Government-backed small business loan programs are designed to make it easier for small businesses to access capital. These programs are typically offered by the Small Business Administration (SBA) or other government agencies. Here are some of the most common government-backed small business loan programs:

| Program | Description | Eligibility | Benefits |

|---|---|---|---|

| SBA 7(a) Loan | Provides loans to small businesses for a variety of purposes, including working capital, equipment purchases, and real estate. | Must be a for-profit business located in the United States, have good credit history, and demonstrate ability to repay the loan. | Lower interest rates, longer repayment terms, and loan guarantees. |

| SBA 504 Loan | Provides loans for fixed assets, such as land, buildings, and machinery. | Must be a for-profit business located in the United States, have good credit history, and demonstrate ability to repay the loan. | Lower interest rates, longer repayment terms, and loan guarantees. |

| SBA Microloans | Provides loans up to $50,000 to small businesses for working capital, equipment, or inventory. | Must be a for-profit business located in the United States, have good credit history, and demonstrate ability to repay the loan. | Lower interest rates, longer repayment terms, and loan guarantees. |

| USDA Business & Industry Loan Guarantee Program | Provides loan guarantees to small businesses in rural areas. | Must be a for-profit business located in a rural area, have good credit history, and demonstrate ability to repay the loan. | Lower interest rates, longer repayment terms, and loan guarantees. |

| State Small Business Credit Initiative (SSBCI) | Provides grants and loans to small businesses through state programs. | Eligibility varies by state. | Lower interest rates, longer repayment terms, and loan guarantees. |

SBA Loans

The Small Business Administration (SBA) offers a variety of loan programs to help small businesses succeed. SBA loans are backed by the federal government, which means they have lower interest rates and longer repayment terms than conventional loans.

Obtain access to Applying For Business Loans November 2024 to private resources that are additional.

Types of SBA Loans

There are several types of SBA loans available, each with its own specific purpose and eligibility requirements. Some of the most common types include:* SBA 7(a) Loan:The most common type of SBA loan, used for a variety of purposes, including working capital, equipment purchases, and real estate.

SBA 504 Loan

Used for financing fixed assets, such as land, buildings, and machinery.

Discover more by delving into Florida Small Business Loans October 2024 further.

SBA Microloans

Small loans up to $50,000 for working capital, equipment, or inventory.

SBA Loan Application Process

The application process for an SBA loan can be complex, but it’s important to gather all the necessary documentation and follow the steps carefully.* Gather Required Documentation:This includes your business plan, financial statements, tax returns, and personal credit history.

Complete the Application

Find out further about the benefits of Register A Business For Free October 2024 that can provide significant benefits.

The SBA loan application requires detailed information about your business, including your business plan, financial projections, and your personal financial information.

Submit the Application

Once you’ve completed the application, you’ll need to submit it to an SBA-approved lender.

Review and Approval

You also will receive the benefits of visiting Small Business Administration Loan Application October 2024 today.

The lender will review your application and make a decision on whether to approve the loan.

Insights

Tips for Securing a Government-Backed Loan

Develop a Strong Business Plan

Do not overlook explore the latest data about New York Times Business Articles October 2024.

A well-written business plan is essential for securing any type of loan, including government-backed loans.

Enhance your insight with the methods and methods of Loan For Small Business Owners October 2024.

Build a Strong Credit History

Your credit score is a major factor in loan approval, so it’s important to maintain a good credit history.

Gather Required Documentation

Make sure you have all the necessary documentation before you apply for a loan.

Work with an SBA-Approved Lender

SBA loans are processed through SBA-approved lenders, so it’s important to find a lender that has experience working with SBA loans.

Resources for Small Business Owners

SBA Website

The SBA website is a great resource for information about SBA loan programs, eligibility requirements, and the application process.

SCORE

SCORE is a non-profit organization that provides free mentoring and counseling to small business owners.

Small Business Development Centers (SBDCs)

SBDCs are local organizations that offer free business counseling and training to small business owners.

Loan Security and Collateral

Collateral plays a crucial role in securing small business loans. Lenders often require collateral as a safety net to mitigate their risk in case the borrower defaults on their loan. This collateral acts as a guarantee, providing the lender with an asset to seize and sell to recover their losses if the borrower is unable to repay the loan.

Types of Collateral

Collateral can significantly influence loan terms and interest rates. Lenders may offer more favorable terms, including lower interest rates and longer repayment periods, to borrowers who provide strong collateral.

| Collateral Type | Description | Examples |

|---|---|---|

| Real Estate | Real estate, such as property or land, is a common form of collateral. It represents a tangible asset with inherent value. | Buildings, land, commercial property |

| Inventory | Inventory refers to the goods or products a business holds for sale. This type of collateral is relevant for businesses involved in manufacturing, retail, or distribution. | Raw materials, finished goods, merchandise |

| Equipment | Equipment used in business operations can serve as collateral. This includes machinery, vehicles, computers, and other tools. | Manufacturing equipment, delivery trucks, office equipment |

Implications of Using Collateral

Using collateral can significantly impact loan approval and terms. * Increased Likelihood of Loan Approval:Collateral provides lenders with a tangible asset to recover their investment if the borrower defaults. This reduces the lender’s risk and increases the likelihood of loan approval.

Influence on Interest Rate and Loan Terms

Collateral can influence loan terms, such as interest rates and repayment periods. Lenders may offer lower interest rates and more flexible repayment terms to borrowers who provide strong collateral, as it reduces their risk.

Consequences of Default

Failing to repay a loan secured by collateral can have serious consequences for the business. * Loss of Collateral:If a borrower defaults on a loan secured by collateral, the lender has the right to seize and sell the collateral to recover their losses.

This can result in the loss of valuable assets for the business, potentially impacting its operations.

Investigate the pros of accepting Best Online Payment For Small Business November 2024 in your business strategies.

Impact on Business

The loss of collateral can have a significant impact on the business. It can lead to operational disruptions, financial strain, and even business closure.

Benefits and Drawbacks of Using Collateral

Using collateral can provide benefits for small business owners, but it also comes with drawbacks. Benefits:

Increased Loan Approval Chances

Collateral can significantly increase the likelihood of loan approval.

Potentially Lower Interest Rates

Strong collateral can lead to lower interest rates and more favorable loan terms. Drawbacks:

Further details about California Small Business Loans October 2024 is accessible to provide you additional insights.

Risk of Loss

If the business defaults on the loan, the collateral can be seized and sold, resulting in a significant loss for the business.

Limited Access to Funds

Browse the multiple elements of Business Business Business Numbers October 2024 to gain a more broad understanding.

Using collateral can limit the amount of funding available, as the lender may require a specific loan-to-value ratio based on the collateral’s worth. Factors to Consider:

Examine how Business Loans For Small Business November 2024 can boost performance in your area.

Value of Collateral

Assess the current market value of the collateral and its potential future value.

Importance to Business Operations

Consider the impact of losing the collateral on the business’s operations.

Alternative Funding Options

Explore other funding options that may not require collateral, such as SBA loans or crowdfunding.

Loan Costs and Fees: Small Business Loan Business November 2024

Securing a small business loan involves more than just the principal amount you borrow. You’ll also need to consider various costs and fees that come with it. Understanding these charges is crucial for making informed decisions about your financing options.

Origination Fees

Origination fees are a one-time charge levied by lenders to cover the administrative costs associated with processing your loan application. This fee is typically a percentage of the total loan amount, ranging from 1% to 3%. For example, a $100,000 loan with a 2% origination fee would incur a $2,000 charge.

Closing Costs

Closing costs are expenses incurred during the final stages of securing your loan. These costs can include various fees, such as appraisal fees, title search fees, and recording fees. They are typically paid at the loan closing and can vary depending on the type of loan and the lender’s policies.

Interest Charges

Interest charges are the primary cost associated with any loan. Lenders charge interest as a percentage of the outstanding loan balance, reflecting the cost of borrowing money. Interest rates vary depending on factors like your credit score, loan amount, and loan term.

The higher the interest rate, the more expensive the loan becomes.

Comparing Loan Costs

When comparing loan costs from different lenders, it’s essential to consider the Annual Percentage Rate (APR). The APR reflects the total cost of borrowing, including interest charges, origination fees, and other costs. Comparing APRs from different lenders allows you to evaluate the true cost of each loan option.

Financial Planning and Budgeting

Securing a small business loan is a significant step, but equally crucial is the ability to manage your finances effectively to ensure loan repayment. This involves meticulous financial planning and budgeting to ensure your business can comfortably meet its financial obligations.

Cash Flow Management and Financial Forecasting, Small Business Loan Business November 2024

Effective cash flow management is essential for any business, but it becomes even more critical when you have a loan to repay. You need to understand your business’s cash flow patterns, including income generation and expense outflow, to accurately predict future cash flows.

“Cash flow forecasting is the process of predicting the amount of cash that will flow into and out of a business over a specific period.”

This forecasting helps you identify potential cash flow shortages and take proactive steps to mitigate them. By analyzing historical data, you can identify trends and patterns in your business’s cash flow, enabling you to make informed decisions about loan repayment.

Creating a Realistic Repayment Plan

A well-structured repayment plan is vital to avoid falling behind on your loan payments. This plan should be realistic and achievable, considering your business’s cash flow, loan terms, and financial goals. Here are some tips for creating a realistic repayment plan:

- Analyze your cash flow:Track your income and expenses to understand your current cash flow situation. This will help you determine how much you can comfortably allocate to loan repayments.

- Consider your loan terms:Carefully review your loan agreement, paying close attention to the interest rate, repayment period, and any prepayment penalties. This will help you understand the total cost of the loan and plan your repayments accordingly.

- Set realistic goals:Don’t overextend yourself. Set achievable repayment goals based on your business’s financial capacity. Consider using a loan amortization schedule to track your progress and adjust your plan as needed.

- Allocate funds for loan repayments:Make loan repayments a priority in your budget. Dedicate a specific amount of money each month to cover your loan payments.

- Review your plan regularly:As your business grows and evolves, it’s important to review your repayment plan periodically. This ensures that your plan remains realistic and aligned with your financial goals.

Alternatives to Traditional Loans

Small businesses often face challenges in securing traditional loans, especially during economic downturns. Fortunately, alternative financing options have emerged to provide much-needed support. This section delves into three prominent alternatives: crowdfunding, invoice factoring, and merchant cash advances. We will explore their mechanisms, advantages, disadvantages, and suitability for different business needs.

Crowdfunding

Crowdfunding represents a collective effort to raise funds from a large number of individuals, often through online platforms. It allows businesses to tap into a diverse pool of potential investors, bypassing traditional financial institutions.

- Types of Crowdfunding Platforms

- Equity Crowdfunding: Involves selling ownership shares in the business to investors. This provides a long-term investment opportunity with potential for capital appreciation and dividends.

- Reward-Based Crowdfunding: Offers rewards or perks to contributors in exchange for their financial support. Rewards can range from early access to products or services to exclusive merchandise or experiences.

- Donation-Based Crowdfunding: Relies on charitable donations from individuals who believe in the business’s mission or social impact. Donors typically receive no tangible rewards in return.

- Leveraging Crowdfunding for Funding

- Product Development: Launching a new product or service often requires substantial upfront investment. Crowdfunding can help businesses raise funds to cover development costs, production, and marketing.

- Expansion: Businesses seeking to expand their operations, open new locations, or enter new markets can leverage crowdfunding to finance growth initiatives.

- Emergency Funding: In unforeseen circumstances, such as natural disasters or economic downturns, crowdfunding can provide a lifeline to businesses facing financial hardship.

Crowdfunding platforms are categorized based on the nature of the investment and the returns offered to contributors.

Businesses can utilize crowdfunding to secure funding for various purposes, such as:

Invoice Factoring

Invoice factoring is a financing solution that allows businesses to access cash flow by selling their unpaid invoices to a factoring company. It essentially converts accounts receivables into immediate cash, improving liquidity and freeing up working capital.

- How Invoice Factoring Works

- Invoice Submission: The business submits its invoices to the factoring company for review and approval.

- Advance Payment: The factoring company provides an advance payment, typically a percentage of the invoice value, to the business.

- Invoice Collection: The factoring company assumes responsibility for collecting payments from the business’s customers.

- Remaining Balance: Once the customer pays the invoice, the factoring company deducts its fees and remits the remaining balance to the business.

- Benefits and Drawbacks of Invoice Factoring

- Improved Cash Flow: Accessing funds immediately upon invoice submission improves cash flow, enabling businesses to meet short-term obligations.

- Reduced Credit Risk: Factoring companies assume the risk of non-payment, relieving businesses from potential bad debt losses.

- Working Capital Management: Factoring frees up working capital, allowing businesses to invest in growth opportunities or manage expenses more effectively.

- Fees and Interest: Factoring companies charge fees and interest rates for their services, which can be significant depending on the terms of the agreement.

- Loss of Control: Businesses lose control over the collection process as the factoring company handles customer interactions.

- Potential Damage to Customer Relationships: Customers may perceive factoring as a sign of financial distress, potentially impacting future business relationships.

The process of invoice factoring involves the following steps:

Invoice factoring offers several advantages:

However, it also comes with drawbacks:

Merchant Cash Advances

Merchant cash advances (MCAs) provide businesses with upfront funding based on their future credit card sales. They are often considered a quick and convenient financing option, particularly for businesses with consistent card transactions.

- Obtaining a Merchant Cash Advance

- Potential Risks and Disadvantages

- High Fees and Interest Rates: MCAs are known for their high fees and interest rates, often exceeding those of traditional loans. The costs are typically expressed as a percentage of the advance amount, leading to significant repayment obligations.

- Repayment Burden: MCAs are repaid through daily or weekly deductions from credit card sales. This can strain cash flow, particularly during slow periods.

- Lack of Transparency: The terms and conditions of MCAs can be complex and difficult to understand, making it challenging for businesses to fully grasp the true cost of borrowing.

Businesses can apply for an MCA through specialized providers. The application process typically involves providing financial information, including credit card sales history and bank statements. Once approved, funds are typically deposited into the business’s account within a few days.

MCAs come with potential risks and disadvantages:

Case Studies and Success Stories

Seeing is believing, and in the world of small business loans, nothing speaks louder than real-world examples of success. These case studies showcase how diverse businesses have navigated the loan process, overcome challenges, and achieved significant growth through strategic use of small business financing.

Case Studies

To illustrate the power of small business loans, let’s explore three compelling case studies, each representing a unique industry and loan type. These businesses demonstrate how the right loan can be a catalyst for growth and success.

-

The Coffee Bean

Industry: Coffee Shop

Loan Type: SBA 7(a) Loan

Loan Amount: $100,000

Challenges Faced: Limited credit history, lack of collateral

Strategies Employed: Strong business plan, personal guarantee, mentorship program participation

Outcomes Achieved: Expanded operations, increased revenue, new store opening

“We were a young company with limited credit history, making it difficult to secure traditional loans. The SBA 7(a) program was a lifesaver. We were able to leverage the mentorship program and present a compelling business plan, which helped us secure the funding we needed.

The loan enabled us to open a second location and significantly increase our revenue,” said Sarah, owner of The Coffee Bean.

-

Green Thumb Gardening

Industry: Landscaping and Gardening Services

Loan Type: Equipment Loan

Loan Amount: $25,000

Challenges Faced: Seasonal business, fluctuating cash flow

Strategies Employed: Demonstrated strong revenue history, secured loan with low interest rate

Outcomes Achieved: Purchased new equipment, expanded service offerings, increased efficiency

“We needed to upgrade our equipment to handle larger projects and offer new services. The equipment loan allowed us to invest in new machinery, which boosted our productivity and helped us win more contracts,” said David, owner of Green Thumb Gardening.

-

Tech Solutions Inc.

Industry: Software Development

Loan Type: Line of Credit

Loan Amount: $50,000

Challenges Faced: Rapid growth, need for working capital

Strategies Employed: Strong financial projections, established relationships with lenders

Outcomes Achieved: Hired new developers, expanded product offerings, accelerated growth

“As a fast-growing tech company, we needed flexible financing to manage our working capital. The line of credit gave us the financial flexibility to hire new talent and invest in product development, allowing us to scale our operations rapidly,” said Emily, CEO of Tech Solutions Inc.

Ultimate Conclusion

The small business loan market in November 2024 presents a unique set of challenges and opportunities for entrepreneurs. Understanding the current market trends, loan types, and factors influencing loan approval is crucial for navigating this complex landscape. By leveraging the insights and strategies Artikeld in this guide, small business owners can increase their chances of securing the necessary funding to fuel their growth and achieve their goals.

Remember, careful planning, a strong business plan, and a proactive approach to loan management are essential for success.

Common Queries

What are the most common types of small business loans available in November 2024?

The most common types of small business loans available include SBA loans, term loans, lines of credit, equipment financing, and merchant cash advances. Each loan type has unique characteristics, interest rates, repayment terms, and eligibility requirements. It’s essential to research and compare different loan types to determine the best fit for your specific business needs.

What are the key factors that lenders consider when evaluating loan applications?

Lenders typically evaluate loan applications based on factors such as credit score, business plan, revenue history, collateral, debt-to-income ratio, and time in business. A strong credit score, a well-structured business plan, consistent revenue streams, and adequate collateral can significantly improve your chances of loan approval.

What are some tips for managing loan debt effectively?

Effective loan debt management involves creating a comprehensive debt management plan, prioritizing high-interest loans, setting realistic repayment goals, exploring debt consolidation options, and negotiating lower interest rates or extended repayment terms with lenders. It’s also essential to track loan payments diligently and stay on top of loan obligations.