Small Business Administration Loan Application November 2024 – Navigating the Small Business Administration Loan Application process in November 2024 can be a daunting task, especially considering the evolving economic landscape and potential changes to eligibility requirements. This guide provides a comprehensive overview of the SBA loan application process, outlining key eligibility criteria, required documentation, and tips for writing a successful application.

From understanding the different types of SBA loans available to crafting compelling financial projections and addressing potential credit issues, this guide equips aspiring borrowers with the knowledge and strategies necessary to navigate the SBA loan application process with confidence.

Financial Projections and Business Plans

Financial projections and a well-structured business plan are crucial components of a successful SBA loan application. They demonstrate your understanding of your business, its financial viability, and your ability to repay the loan. Lenders use these documents to assess your financial health, market potential, and overall business strategy.

You also can understand valuable knowledge by exploring Small Business Loan Near Me November 2024.

Developing Realistic Financial Projections

Developing realistic and persuasive financial projections requires careful planning and thorough research. Here are some best practices:

- Start with a solid foundation:Begin with accurate historical financial data, including income statements, balance sheets, and cash flow statements. This provides a baseline for your projections.

- Conduct market research:Analyze your target market, competition, and industry trends to estimate future demand for your products or services.

- Use realistic assumptions:Avoid overly optimistic projections. Base your assumptions on credible data and industry benchmarks. For example, if you’re projecting revenue growth, consider historical growth rates for similar businesses in your industry.

- Consider different scenarios:Prepare multiple financial projections, including best-case, worst-case, and most likely scenarios. This demonstrates your preparedness for potential challenges and provides a more comprehensive picture of your business’s financial health.

- Use financial modeling software:Tools like Excel or specialized financial modeling software can streamline the process of creating and analyzing financial projections.

Key Financial Metrics in a Business Plan

A well-structured business plan should include a comprehensive financial section that Artikels key metrics and projections. Here’s a sample table summarizing essential financial information:

| Metric | Description | Example |

|---|---|---|

| Revenue Projections | Estimated income from sales of goods or services over a specific period. | $1,000,000 in annual revenue by year 3. |

| Cost of Goods Sold (COGS) | Direct costs associated with producing or acquiring goods or services. | $500,000 in annual COGS by year 3. |

| Gross Profit | Revenue minus COGS. | $500,000 in annual gross profit by year 3. |

| Operating Expenses | Expenses incurred in running the business, excluding COGS. | $200,000 in annual operating expenses by year 3. |

| Operating Income (EBIT) | Gross profit minus operating expenses. | $300,000 in annual operating income by year 3. |

| Net Income | Operating income minus taxes and other expenses. | $250,000 in annual net income by year 3. |

| Cash Flow Statement | Shows the movement of cash into and out of the business. | Positive cash flow from operations, indicating strong financial health. |

| Balance Sheet | Provides a snapshot of the company’s assets, liabilities, and equity at a specific point in time. | Strong asset base and healthy debt-to-equity ratio. |

Remember:Financial projections should be realistic and well-supported by data. Don’t overestimate your revenue or underestimate your expenses.

SBA Loan Interest Rates and Fees

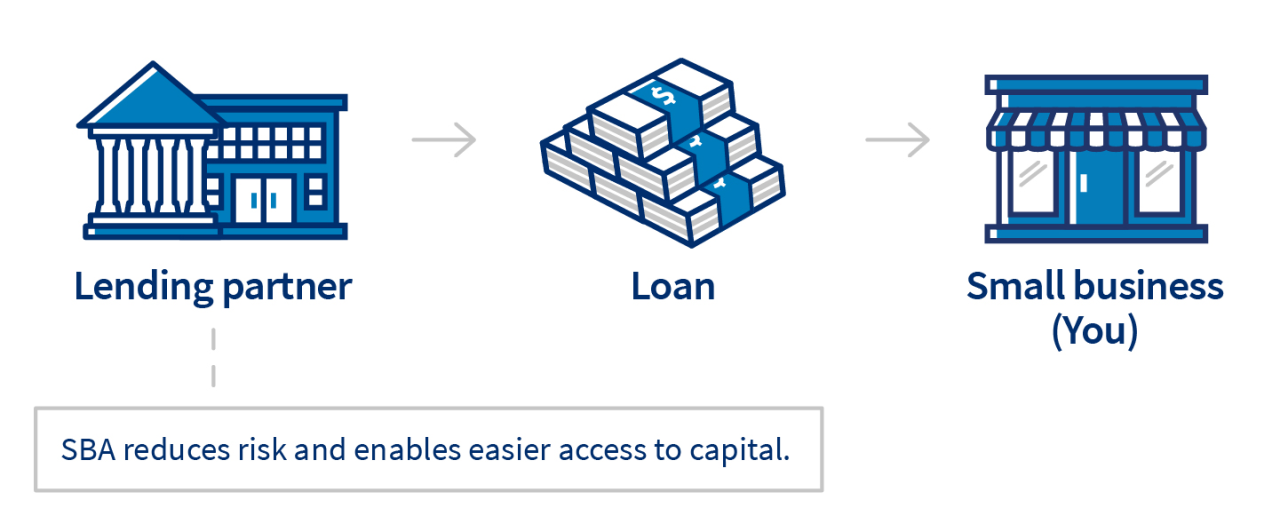

The Small Business Administration (SBA) offers a variety of loan programs to help small businesses succeed. SBA loans are typically more affordable than conventional loans, with lower interest rates and longer repayment terms. However, it’s crucial to understand the different types of SBA loans, their associated interest rates, and fees to make informed decisions about financing your business.

Do not overlook the opportunity to discover more about the subject of Loans For A Small Business November 2024.

SBA Loan Interest Rates and Fees, Small Business Administration Loan Application November 2024

SBA loan interest rates are determined by a number of factors, including the type of loan, the borrower’s credit score, the loan amount, and the current economic conditions. Generally, SBA loans have lower interest rates than conventional loans, but they also come with certain fees.

Do not overlook the opportunity to discover more about the subject of Loans For Small Business November 2024.

- SBA 7(a) Loans: The most common type of SBA loan, 7(a) loans are available for a variety of business purposes, including working capital, equipment, real estate, and refinancing. The interest rates for 7(a) loans are typically fixed and vary depending on the loan term and the borrower’s creditworthiness.

The SBA sets a maximum interest rate for 7(a) loans, which is currently 8.25%.

- SBA 504 Loans: Designed for fixed assets like land, buildings, and equipment, 504 loans require a minimum of 10% down payment from the borrower. The interest rates for 504 loans are typically fixed and are often lower than 7(a) loans. The maximum interest rate for 504 loans is currently 5.75%.

- SBA Microloans: These are small loans, typically under $50,000, designed for small businesses with limited credit history. Microloans often have higher interest rates than other SBA loans, but they are still lower than conventional loans. The interest rates for microloans are typically fixed and are often determined by the lender.

Impact of Current Economic Conditions

The current economic conditions can significantly impact SBA loan interest rates. When interest rates rise, SBA loan interest rates tend to follow suit. Conversely, when interest rates fall, SBA loan interest rates typically decrease. The Federal Reserve’s monetary policy plays a crucial role in determining interest rates.

When the Federal Reserve raises interest rates, it becomes more expensive for banks to borrow money, which can lead to higher interest rates on SBA loans.

Do not overlook explore the latest data about Register Business For Free October 2024.

Comparison of SBA Loan Options

Here’s a table comparing the interest rates and fees of various SBA loan options:

| Loan Program | Interest Rate | Fees |

|---|---|---|

| SBA 7(a) Loans | Variable, typically fixed; maximum 8.25% | Loan origination fee (1-3% of loan amount), closing costs |

| SBA 504 Loans | Variable, typically fixed; maximum 5.75% | Loan origination fee (0.5-2% of loan amount), closing costs |

| SBA Microloans | Variable, typically fixed; determined by lender | Loan origination fee (1-3% of loan amount), closing costs |

SBA Loan Repayment and Default

Understanding the repayment terms and potential consequences of defaulting on an SBA loan is crucial for small business owners. This guide will provide a comprehensive overview of SBA loan repayment, including the standard terms, available repayment options, and the potential consequences of defaulting.

It will also discuss resources available to borrowers facing repayment difficulties.

You also can understand valuable knowledge by exploring List Your Business Online November 2024.

Repayment Terms and Options

The repayment terms for SBA loans are designed to be flexible and tailored to the specific needs of borrowers. Here’s a breakdown of the standard terms and available repayment options:

Standard Repayment Terms

- Loan term length:SBA loans typically have a term length ranging from 7 to 25 years, depending on the loan type and the borrower’s circumstances.

- Interest rates:SBA loans generally offer fixed interest rates, providing borrowers with predictable monthly payments. The interest rate is determined by factors such as the borrower’s creditworthiness, the loan amount, and the prevailing market interest rates.

- Payment frequency:SBA loan payments are typically made monthly, although some loans may allow for quarterly payments.

- Grace periods:Certain SBA loans, such as those for equipment purchases, may offer a grace period during which only interest payments are required. This grace period can help borrowers manage their cash flow during the initial stages of their business.

Repayment Options

- Interest-only payments:This option allows borrowers to pay only the interest on their loan for a specific period, typically during the initial years of the loan. Interest-only payments can help reduce monthly expenses and free up cash flow for business growth.

This option is often available for SBA loans with longer terms, such as those for real estate purchases.

- Deferred payments:SBA loans may offer a deferment option, allowing borrowers to postpone payments for a certain period. This option is typically available for borrowers facing temporary financial hardship, such as a natural disaster or a personal emergency. To be eligible for deferment, borrowers must demonstrate a legitimate reason for the delay and meet specific eligibility criteria.

- Loan forgiveness programs:The SBA offers loan forgiveness programs for certain types of loans, such as the Paycheck Protection Program (PPP). The PPP was a government-backed program designed to provide forgivable loans to small businesses during the COVID-19 pandemic. While the PPP program is no longer accepting new applications, there may be other loan forgiveness programs available in the future.

To qualify for loan forgiveness, borrowers must meet specific eligibility criteria, such as using the loan proceeds for eligible expenses and maintaining employment levels.

Consequences of Defaulting on an SBA Loan

Defaulting on an SBA loan can have severe financial and legal consequences for borrowers. Understanding these consequences is essential for making responsible repayment decisions.

Do not overlook the opportunity to discover more about the subject of Small Business Loans Usa November 2024.

Potential Consequences of Default

- Legal action:If a borrower defaults on an SBA loan, the SBA can take legal action to recover the outstanding debt. This may involve filing a lawsuit, obtaining a judgment against the borrower, and pursuing the borrower’s assets.

- Credit score impact:Defaulting on an SBA loan can significantly damage a borrower’s credit score, making it difficult to obtain financing in the future. A lower credit score can lead to higher interest rates on future loans, limiting access to credit for both personal and business purposes.

- Loss of collateral:If a borrower has pledged assets as collateral for an SBA loan, defaulting on the loan can lead to the loss of those assets. The SBA may seize and sell the collateral to recover the outstanding debt.

- Financial penalties:In addition to the principal and interest owed, borrowers who default on an SBA loan may be subject to additional financial penalties, such as late fees, collection costs, and legal fees.

Resources for Borrowers Facing Repayment Difficulties

Borrowers facing difficulties in repaying their SBA loans have access to a range of resources and support options. The SBA is committed to helping borrowers navigate repayment challenges and avoid default.

Obtain a comprehensive document about the application of Small Business Loans Application November 2024 that is effective.

Resources Available to Borrowers

- SBA counseling services:The SBA offers free counseling services to small business owners through its network of Small Business Development Centers (SBDCs) and SCORE chapters. These organizations provide expert advice on business planning, financial management, and loan repayment strategies.

- Debt management programs:Debt management programs can help borrowers consolidate their debt, negotiate lower interest rates, and develop a repayment plan that fits their budget. These programs can be particularly helpful for borrowers with multiple loans or high-interest debt.

- Loan modification options:The SBA may be willing to modify the terms of an SBA loan to make repayment easier for borrowers facing financial hardship. Loan modification options may include extending the loan term, reducing the interest rate, or adjusting the payment schedule.

- Bankruptcy:In some cases, bankruptcy may be a last resort for borrowers who are unable to repay their debts. Bankruptcy can discharge certain debts, but it can also have significant consequences for borrowers’ credit score and financial future.

SBA Loan Resources and Support

The Small Business Administration (SBA) provides various resources and support programs to help borrowers navigate the loan application process and succeed in their business ventures. These resources offer guidance, training, and assistance to ensure that small businesses have the necessary tools and information to thrive.

Understand how the union of Application For Small Business November 2024 can improve efficiency and productivity.

SBA Counselors and Loan Officers

SBA counselors and loan officers play crucial roles in guiding borrowers through the loan application process. They provide personalized advice, answer questions, and offer support throughout the journey.

Enhance your insight with the methods and methods of Set Up A Business October 2024.

- SBA Counselors:SBA counselors are experts in small business development and financing. They offer free, confidential advice on various business aspects, including developing business plans, understanding financial statements, and exploring funding options.

- SBA Loan Officers:SBA loan officers are responsible for evaluating loan applications and determining eligibility. They work closely with borrowers to gather necessary documentation, assess financial needs, and negotiate loan terms.

Navigating the SBA Website

The SBA website is a valuable resource for accessing information on loan programs, eligibility criteria, application procedures, and other relevant topics.

- SBA Website Navigation:The SBA website is organized with a user-friendly interface, making it easy to find specific information. The website includes a search bar, a comprehensive menu, and frequently asked questions (FAQs) sections.

- SBA Resource Center:The SBA Resource Center provides access to a wealth of information, including guides, templates, and webinars on various business topics. It also offers tools and calculators to help small businesses analyze their financial performance and make informed decisions.

Tips for a Successful SBA Loan Application

Securing an SBA loan can be a significant step for your business, providing the financial resources needed for growth and expansion. However, the application process can be intricate, and a well-prepared application is crucial for increasing your chances of approval.

This section will guide you through essential tips to maximize your success in obtaining an SBA loan.

Preparing a Strong Business Case

A compelling business case is the foundation of a successful SBA loan application. It demonstrates your understanding of your market, your business model, and your ability to repay the loan. Here are some key strategies:

- Develop a Comprehensive Business Plan:A well-structured business plan is a vital component of your application. It should Artikel your business objectives, target market, competitive analysis, marketing strategy, financial projections, and management team.

- Highlight Your Business’s Strengths:Emphasize your business’s unique selling proposition, proven track record (if applicable), strong management team, and potential for growth. Showcase any competitive advantages or innovative aspects that distinguish your business.

- Demonstrate Market Demand:Provide evidence of the market demand for your products or services. This could include market research data, customer testimonials, or industry trends that support your business’s viability.

Building Creditworthiness

Your credit history plays a crucial role in the SBA’s assessment of your loan application. A strong credit score demonstrates your financial responsibility and ability to manage debt.

- Review Your Credit Report:Obtain a copy of your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) and review it for any errors or inaccuracies. Dispute any discrepancies promptly.

- Improve Your Credit Score:If your credit score needs improvement, focus on paying bills on time, reducing credit card balances, and avoiding new credit applications. A consistent history of responsible financial management is essential.

- Establish Business Credit:Build your business credit by obtaining a business credit card, paying your business bills on time, and establishing trade lines with suppliers. Strong business credit demonstrates your financial stability and responsible business practices.

SBA Loan Application Checklist

A structured approach to the application process can help you avoid overlooking critical details.

You also can understand valuable knowledge by exploring Small Business Management Services November 2024.

Before Applying

- Determine Loan Eligibility:Research SBA loan programs and eligibility requirements to ensure your business qualifies. Consider factors like business type, industry, loan purpose, and loan amount.

- Gather Required Documents:Prepare all necessary documentation, including business plan, financial statements, tax returns, personal financial information, and legal documents.

- Consult with a Lender:Connect with an SBA-approved lender to discuss your loan needs and explore available options. They can provide guidance on the application process and loan terms.

During the Application Process

- Complete the Application Thoroughly:Provide accurate and complete information on the application form. Double-check all details before submitting.

- Respond Promptly to Requests:The SBA may require additional information or clarification during the review process. Respond to requests promptly and comprehensively to avoid delays.

- Maintain Open Communication:Stay in contact with your lender and the SBA throughout the process. Ask questions and seek clarification when needed.

After Application Submission

- Follow Up:Check in with your lender and the SBA to inquire about the status of your application.

- Prepare for Loan Closing:If your loan is approved, be prepared for the loan closing process, which includes reviewing loan documents and signing necessary paperwork.

- Utilize Loan Funds Wisely:Once you receive the loan funds, use them strategically for the intended purpose, adhering to the loan terms and conditions.

Last Word: Small Business Administration Loan Application November 2024

Securing an SBA loan requires meticulous planning, thorough preparation, and a deep understanding of the application process. By following the insights and recommendations Artikeld in this guide, small business owners can enhance their chances of securing the funding they need to achieve their business goals.

Remember, the SBA loan application process is a journey, and with the right preparation and guidance, success is within reach.

FAQ Summary

What is the current interest rate for SBA loans?

Interest rates for SBA loans fluctuate based on market conditions. It’s best to consult with an SBA lender or visit the SBA website for the most up-to-date information.

How long does it typically take to receive SBA loan funds after approval?

The disbursement timeline for SBA loans can vary depending on factors such as the lender, loan amount, and documentation completeness. However, it generally takes several weeks to a few months for funds to be disbursed after loan approval.

Are there any specific SBA loan programs for startups?

Yes, the SBA offers several programs specifically designed for startups, including the 7(a) loan program and the microloan program. These programs provide tailored funding and support to help new businesses get off the ground.