Roth IRA Limits 2024 sets the stage for this exploration, offering insights into how these limits affect your retirement savings strategy.

Understanding Roth IRA contribution limits is crucial for maximizing your retirement savings. In 2024, the maximum amount you can contribute to a Roth IRA is $6,500, or $7,500 if you are 50 or older. This limit is subject to change based on factors like inflation and government policies.

We’ll delve into the nuances of these limits, including eligibility requirements, tax implications, and strategies for maximizing your contributions.

Introduction to Roth IRAs

A Roth IRA is a retirement savings account that allows you to contribute after-tax dollars, which grow tax-free. This means you won’t have to pay taxes on your withdrawals in retirement. Roth IRAs offer several benefits, making them an attractive option for many individuals.The main benefit of a Roth IRA is that your withdrawals in retirement are tax-free.

This is in contrast to traditional IRAs, where withdrawals are taxed in retirement. Since your contributions are made with after-tax dollars, your earnings grow tax-deferred, meaning you won’t have to pay taxes on them until you withdraw them.

How Roth IRA Contributions Work

You can contribute to a Roth IRA if you meet certain income requirements. The contribution limit for 2024 is $6,500 for individuals and $13,000 for married couples filing jointly. You can contribute to a Roth IRA even if you have a 401(k) or other retirement savings plan.

Roth IRA Contribution Limits for 2024

The Roth IRA is a popular retirement savings option that offers tax-free withdrawals in retirement. The contribution limit for Roth IRAs is adjusted annually to account for inflation. Understanding these limits is essential for maximizing your retirement savings.

Contribution Limit for 2024

The maximum contribution limit for Roth IRAs in 2024 is $6,500. This means that individuals can contribute up to $6,500 to their Roth IRA during the year.

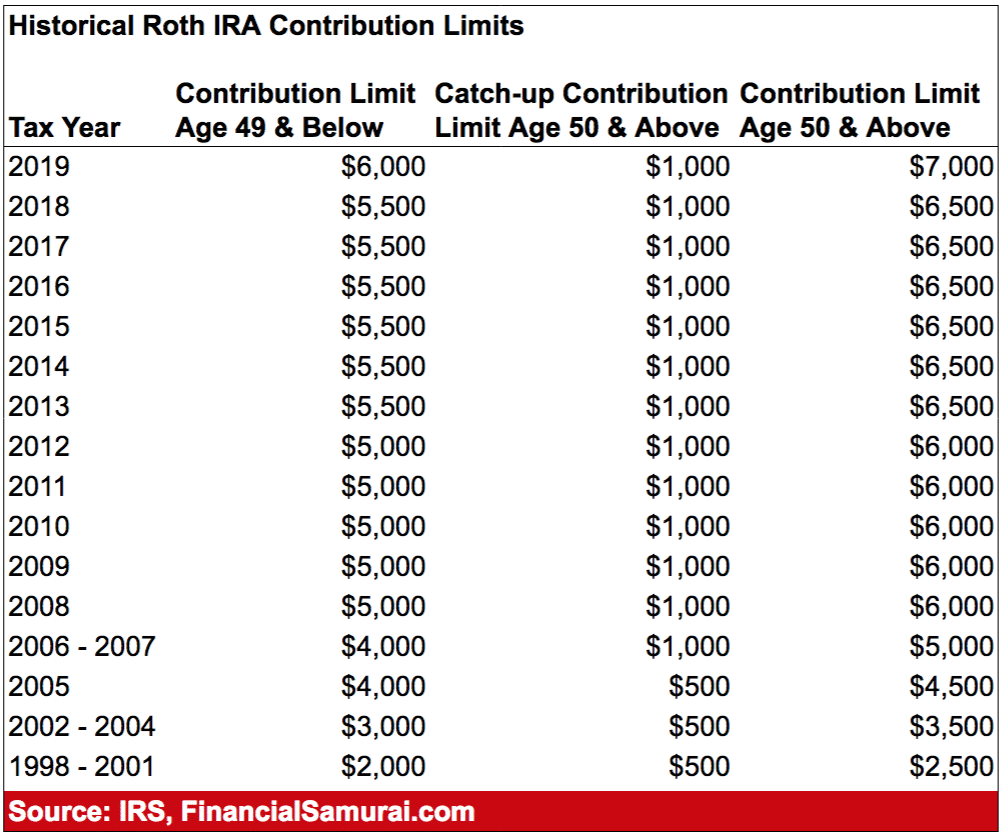

Comparison with Previous Years

The contribution limit has increased gradually over the years. Here’s a comparison of the limits for the past few years:

| Year | Contribution Limit |

|---|---|

| 2023 | $6,500 |

| 2022 | $6,000 |

| 2021 | $6,000 |

| 2020 | $6,000 |

Impact of Inflation on Future Limits

Inflation can impact the future contribution limits for Roth IRAs. As the cost of living rises, the contribution limit is typically adjusted upward to maintain the purchasing power of the contributions.

For example, if the inflation rate is 3% in 2025, the contribution limit for Roth IRAs could increase to approximately $6,695.

It’s important to note that the actual contribution limit is determined by the IRS each year, and it can vary depending on inflation and other economic factors.

Eligibility Requirements for Roth IRA Contributions

While anyone can open a Roth IRA, not everyone is eligible to contribute to one. The Internal Revenue Service (IRS) imposes income limitations on who can make Roth IRA contributions.

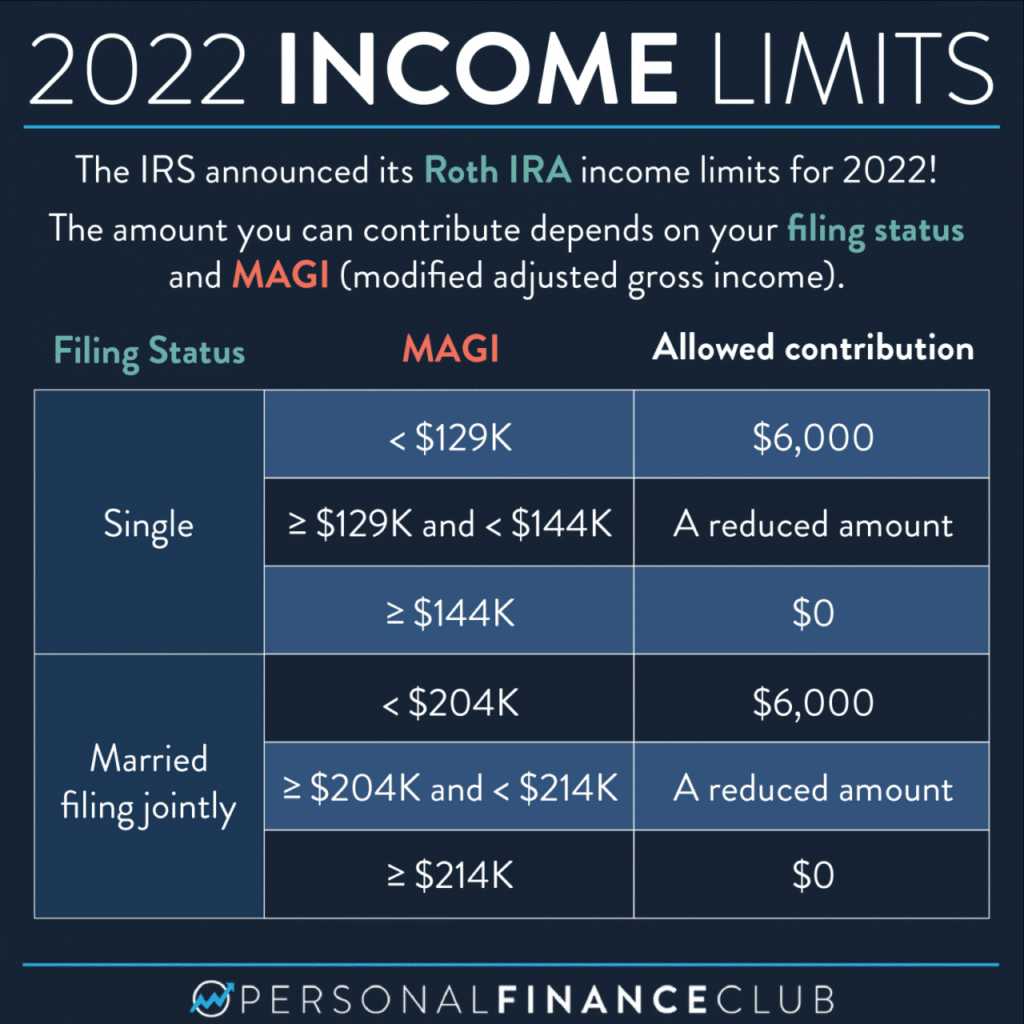

Income Limitations for Roth IRA Contributions

For 2024, there are income limits for those who can make full contributions to a Roth IRA. If your modified adjusted gross income (MAGI) is above the limit, you may not be able to contribute the full amount or any amount at all.

The IRS uses the term “modified adjusted gross income” (MAGI) to determine your eligibility for certain tax benefits, including Roth IRA contributions. MAGI is your adjusted gross income (AGI) plus certain deductions that are not allowed for tax purposes.

The following table shows the income limitations for Roth IRA contributions in 2024:

| Filing Status | Income Limit | Phase-out Range |

|---|---|---|

| Single Filers | $153,000 | $153,000

|

| Married Filing Jointly | $228,000 | $228,000

Planning for retirement? Make sure you know the Max 401k Contribution 2024 to maximize your savings. This information can help you determine how much you can contribute to your 401(k) plan this year.

|

| Head of Household | $183,000 | $183,000

|

| Qualifying Widow(er) | $228,000 | $228,000

|

| Married Filing Separately | $114,000 | $114,000

|

Phase-Out Rules

If your MAGI falls within the phase-out range, you can still contribute to a Roth IRA, but the amount you can contribute will be reduced. The amount of the reduction is calculated based on your MAGI and the phase-out range for your filing status.

For example, if you are single and your MAGI is $160,000, you can only contribute a portion of the full amount.

The phase-out rules are designed to ensure that the Roth IRA benefits are available to middle-income earners, while still limiting the benefits for high-income earners.

If your MAGI exceeds the phase-out range, you cannot contribute to a Roth IRA. You may still be able to contribute to a traditional IRA, but your contributions will be tax-deductible.

4. Tax Implications of Roth IRA Contributions

Roth IRAs offer several tax advantages that make them an attractive retirement savings option for many individuals. Understanding these tax implications is crucial when deciding whether a Roth IRA is the right choice for your financial situation.

To determine your eligibility for the California Stimulus Check, check out the California Stimulus Check October 2024 Eligibility Requirements.

Tax Advantages of Roth IRA Contributions

Roth IRA contributions are made with after-tax dollars, meaning you’ve already paid taxes on the money you contribute. This results in tax-free growth and tax-free withdrawals in retirement.

- Tax-Free Growth:Earnings on your Roth IRA contributions grow tax-deferred, meaning you don’t have to pay taxes on the interest, dividends, or capital gains until you withdraw the money in retirement.

- Tax-Free Withdrawals:Qualified withdrawals from a Roth IRA in retirement are completely tax-free. This means you can enjoy your retirement savings without having to pay any taxes on them.

For example, imagine you contribute $6,500 to a Roth IRA in 2024. Over the next 30 years, your contributions grow to $30,000. When you withdraw the money in retirement, you’ll receive the full $30,000 tax-free, unlike a traditional IRA where you would have to pay taxes on the $23,500 in earnings.

Roth IRA contributions can also help reduce your taxable income, potentially lowering your overall tax liability. For instance, if you are in the 22% tax bracket and contribute $6,500 to a Roth IRA, your taxable income would be reduced by $6,500, potentially saving you $1,430 in taxes.

How Roth IRA Withdrawals Are Treated for Tax Purposes

Qualified withdrawals from a Roth IRA are tax-free and penalty-free if you meet certain requirements, such as being at least 59 1/2 years old and having held the account for at least five years.

- Tax-Free Withdrawals:As long as you meet the eligibility requirements, all qualified withdrawals from your Roth IRA are tax-free.

For example, if you withdraw $20,000 from your Roth IRA at age 65 after having contributed for 20 years, you would not have to pay any taxes on that withdrawal. However, early withdrawals from a Roth IRA before age 59 1/2 can be subject to both taxes and a 10% penalty.

- Early Withdrawals:If you withdraw money from your Roth IRA before age 59 1/2, you may have to pay taxes on the earnings portion of the withdrawal, and you may also be subject to a 10% penalty.

There are exceptions to the penalty, such as for first-time home purchases, medical expenses, and qualified education expenses.

Comparing Roth IRA and Traditional IRA Tax Implications

| Feature | Roth IRA | Traditional IRA |

|---|---|---|

| Contributions | After-tax | Pre-tax |

| Growth | Tax-deferred | Tax-deferred |

| Withdrawals | Tax-free | Taxable |

The key difference between Roth IRAs and Traditional IRAs lies in the tax treatment of contributions and withdrawals. With a Roth IRA, you pay taxes upfront on your contributions, but your withdrawals in retirement are tax-free. With a Traditional IRA, you don’t pay taxes on contributions upfront, but your withdrawals in retirement are taxable.

Key Tax Considerations for Choosing Between a Roth IRA and a Traditional IRA

The best choice between a Roth IRA and a Traditional IRA depends on your individual circumstances and tax situation.

- Current Tax Bracket:If you are in a lower tax bracket now than you expect to be in retirement, a Roth IRA may be more advantageous. This is because you pay taxes on your contributions now, when your tax rate is lower, and enjoy tax-free withdrawals in retirement, when your tax rate may be higher.

- Expected Future Tax Bracket:If you anticipate being in a lower tax bracket in retirement than you are now, a Traditional IRA might be more beneficial. This is because you can deduct your contributions now, reducing your taxable income, and pay taxes on withdrawals later when your tax rate is lower.

It’s essential to consult with a financial advisor to determine the best type of IRA for your specific financial situation and tax goals.

Roth IRA Contribution Strategies: Roth IRA Limits 2024

Maximizing your Roth IRA contributions can be a powerful strategy for building wealth and securing your financial future. There are a variety of strategies you can use to make the most of your Roth IRA, depending on your individual circumstances and financial goals.

Different Roth IRA Contribution Strategies

A Roth IRA allows you to contribute after-tax dollars, which grow tax-free. This means you won’t have to pay taxes on withdrawals in retirement. Here are a few strategies you can use to maximize your Roth IRA contributions:

- Contribute the maximum amount allowed.The annual contribution limit for 2024 is $6,500 for individuals and $13,000 for couples filing jointly. Contributing the maximum amount each year will allow your savings to grow tax-free for the longest possible time.

- Make contributions early in the year.The sooner you contribute, the more time your money has to grow tax-free. Even if you can’t afford to contribute the full amount at once, consider making smaller, regular contributions throughout the year.

- Use a “catch-up” contribution if you’re 50 or older.You can contribute an extra $1,000 on top of the regular contribution limit. This can be a great way to make up for lost contributions or to boost your retirement savings.

- Consider a “backdoor Roth IRA.”If your income is too high to contribute directly to a Roth IRA, you may be able to use a backdoor Roth IRA. This involves contributing to a traditional IRA and then converting the funds to a Roth IRA.

However, there are income limitations and tax implications to consider.

Importance of Maximizing Contributions Within Income Limits

The Roth IRA contribution limit is based on your adjusted gross income (AGI). If your AGI exceeds certain thresholds, you may not be able to contribute the full amount or may not be eligible at all. It’s important to stay within the income limits to ensure you can maximize your contributions and enjoy the benefits of tax-free growth.

Don’t miss out on the 401k Limits 2024 for your retirement savings. Knowing these limits can help you plan and contribute effectively.

- Example:For 2024, if your AGI is $153,000 or higher as a single filer, you can’t contribute to a Roth IRA. If you are married filing jointly and your AGI is $228,000 or higher, you can’t contribute.

Plan for Maximizing Roth IRA Contributions Over Time

Developing a plan to maximize your Roth IRA contributions over time can help you achieve your retirement savings goals. Here’s a simple plan:

- Assess your current financial situation.Determine how much you can afford to contribute each year and whether you’re eligible for the full contribution limit.

- Set a realistic savings goal.Consider your retirement timeline and how much you’ll need to save to meet your financial needs.

- Create a budget and allocate funds.Include your Roth IRA contributions as a regular expense in your budget.

- Automate your contributions.Set up automatic transfers from your checking account to your Roth IRA to ensure regular contributions.

- Review and adjust your plan regularly.As your income and financial situation change, it’s important to review your plan and make adjustments as needed.

Roth IRA vs. Traditional IRA

Choosing between a Roth IRA and a Traditional IRA depends on your individual financial circumstances and goals. Both offer tax advantages, but they differ in how they are taxed. Understanding these differences can help you determine which type of IRA is right for you.

Key Differences

- Contribution Limits:Both Roth IRAs and Traditional IRAs have the same annual contribution limit, which is $6,500 for 2024. Individuals aged 50 and older can contribute an additional $1,000 as a catch-up contribution, bringing their total limit to $7,500.

- Tax Treatment of Contributions:Roth IRA contributions are made with after-tax dollars, meaning you pay taxes on the money before contributing it. Traditional IRA contributions are made with pre-tax dollars, meaning you don’t pay taxes on the money until you withdraw it in retirement.

- Tax Treatment of Withdrawals:Roth IRA withdrawals in retirement are tax-free, while Traditional IRA withdrawals are taxed as ordinary income.

- Eligibility Requirements:Both Roth IRAs and Traditional IRAs have income limitations. For 2024, if your modified adjusted gross income (MAGI) exceeds $153,000 as a single filer or $228,000 as a married couple filing jointly, you cannot contribute to a Roth IRA. For Traditional IRAs, there are no income limitations for contributions, but your ability to deduct contributions may be limited based on your income.

| Feature | Roth IRA | Traditional IRA |

|---|---|---|

| Contribution Limits | $6,500 (2024) | $6,500 (2024) |

| Tax Treatment of Contributions | After-tax | Pre-tax |

| Tax Treatment of Withdrawals | Tax-free | Taxed as ordinary income |

| Eligibility Requirements | Income limitations | No income limitations for contributions, but deductibility may be limited |

Factors to Consider

- Expected Income in Retirement:If you expect to be in a lower tax bracket in retirement, a Traditional IRA may be a better choice. This is because you’ll pay taxes on your withdrawals at a lower rate. However, if you expect to be in a higher tax bracket in retirement, a Roth IRA may be a better choice, as your withdrawals will be tax-free.

- Current Tax Bracket:If you’re in a high tax bracket now, a Traditional IRA may be more appealing. You’ll get a tax deduction for your contributions, which can lower your current tax bill. However, if you’re in a low tax bracket now, a Roth IRA may be a better choice, as you’ll pay taxes on your contributions now, when your tax rate is lower.

- Anticipated Future Tax Bracket:It’s important to consider your anticipated tax bracket in the future when making this decision. If you anticipate being in a higher tax bracket in retirement, a Roth IRA may be a better choice, as your withdrawals will be tax-free.

Are you a California resident? Stay informed about the California Stimulus Check October 2024: Amount and Payment Schedule for potential financial assistance.

Conversely, if you anticipate being in a lower tax bracket in retirement, a Traditional IRA may be a better choice, as you’ll pay taxes on your withdrawals at a lower rate.

Benefits and Drawbacks

Roth IRA

Benefits:

- Tax-free withdrawals in retirement:This can be a significant advantage, especially if you expect to be in a higher tax bracket in retirement. For example, if you retire in a high-cost-of-living area, your income may be higher, putting you in a higher tax bracket.

With a Roth IRA, you won’t have to pay taxes on your withdrawals, helping you retain more of your retirement savings.

- Potential for tax-free growth:Your Roth IRA investments grow tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw them in retirement. This can result in significant tax savings over time, especially if your investments grow substantially.

- Flexibility:You can withdraw your contributions from a Roth IRA at any time without penalty, although you may have to pay taxes on any earnings. This can be helpful if you need to access your savings for an unexpected expense.

Drawbacks:

- Contributions are made with after-tax dollars:This means you’ll pay taxes on your contributions before you invest them. This can be a disadvantage if you’re in a high tax bracket now.

- Income limitations:You can’t contribute to a Roth IRA if your income exceeds certain limits. This can be a problem for high-income earners.

- Limited tax benefits in the present:Since contributions are made with after-tax dollars, you won’t receive any immediate tax benefits.

Traditional IRA

Benefits:

- Tax-deductible contributions:This can lower your current tax bill, providing immediate tax savings.

- Potential for tax-deferred growth:Your Traditional IRA investments grow tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw them in retirement. This can result in significant tax savings over time, especially if your investments grow substantially.

- No income limitations for contributions:You can contribute to a Traditional IRA regardless of your income.

Drawbacks:

- Taxable withdrawals in retirement:You’ll pay taxes on your withdrawals in retirement, which can be a disadvantage if you expect to be in a higher tax bracket.

- Potential for tax-bracket creep:If your income increases in retirement, you may end up paying taxes on your withdrawals at a higher rate than you did when you made your contributions.

- May not be as beneficial for younger individuals:Younger individuals often have lower tax rates, making the immediate tax benefits of a Traditional IRA less valuable.

Summary

Both Roth IRAs and Traditional IRAs offer tax advantages, but they differ in how they are taxed. Roth IRAs are funded with after-tax dollars and offer tax-free withdrawals in retirement, while Traditional IRAs are funded with pre-tax dollars and offer tax-deductible contributions but taxable withdrawals in retirement.

The best choice for you depends on your individual financial circumstances and goals, including your expected income in retirement, current tax bracket, and anticipated future tax bracket.

7. Roth IRA Investment Options

A Roth IRA offers a wide range of investment options, allowing you to build a diversified portfolio tailored to your financial goals and risk tolerance. By carefully selecting your investments, you can maximize your potential for growth and tax-free income in retirement.

Common Roth IRA Investment Options

- Stocks: Stocks represent ownership in a company and offer the potential for high growth. However, they also carry higher risk than other investment options.

- Bonds: Bonds are debt securities issued by corporations or governments. They generally offer lower risk than stocks and provide a steady stream of income.

- Mutual Funds: Mutual funds pool money from multiple investors to buy a diversified basket of securities, such as stocks, bonds, or a combination of both. They offer diversification and professional management.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but are traded on stock exchanges, offering greater flexibility and lower costs.

- Real Estate: Real estate investments can include rental properties, REITs (Real Estate Investment Trusts), or other real estate-related investments. They can provide rental income and potential appreciation.

- Annuities: Annuities are insurance contracts that provide a stream of income for a specified period. They can be a valuable tool for retirement planning, but it’s essential to understand the terms and conditions before investing.

- Commodities: Commodities are raw materials, such as oil, gold, and agricultural products. They can be a good hedge against inflation, but they also carry significant risk.

Roth IRA Investment Strategies

Choosing the right investment strategy is crucial for achieving your financial goals. Consider your risk tolerance, time horizon, and financial goals when selecting an approach.

Passive Investing

Passive investing involves investing in a diversified portfolio of assets, such as index funds, ETFs, and target-date funds, without actively trying to beat the market. This approach aims to match the performance of a specific market index, such as the S&P 500.

If you’re driving for work, be sure to check the 2024 Mileage Rate for accurate deductions on your taxes. This rate can fluctuate, so staying informed is key.

Active Investing

Active investing involves actively managing your portfolio by selecting individual stocks, bonds, or other investments based on research and analysis. This approach aims to outperform the market by identifying undervalued assets or specific sectors with high growth potential.

Growth-Oriented Strategies

Growth-oriented strategies focus on maximizing capital appreciation over time. These strategies typically involve investments with higher risk but also higher potential returns.

- Growth Stocks: Stocks of companies expected to experience rapid growth in earnings and revenue.

- Emerging Markets: Investments in developing economies, which may offer higher growth potential but also carry higher risk.

- Venture Capital: Investing in early-stage companies with high growth potential, often with a long-term outlook.

Income-Generating Strategies

Income-generating strategies prioritize generating regular income from investments.

- Dividend-Paying Stocks: Stocks that pay regular dividends to shareholders.

- Bonds: Bonds provide a fixed stream of income through interest payments.

- Real Estate: Rental properties can provide a steady stream of rental income.

Choosing the Right Investments for Your Goals

Selecting the right investments depends on your individual circumstances and financial goals. Here are some key considerations:

- Age: Younger investors with a longer time horizon can afford to take on more risk. They may favor growth-oriented investments.

- Time Horizon: Long-term investments generally have more time to recover from market fluctuations.

- Risk Tolerance: Determine how much risk you are comfortable taking.

- Financial Goals: Investments should align with your specific goals, such as retirement, buying a home, or funding education expenses.

It’s essential to regularly review and rebalance your portfolio to ensure it remains aligned with your financial goals and risk tolerance. Consider seeking advice from a financial advisor to help you create a personalized investment plan.

Roth IRA Rollover Considerations

A Roth IRA rollover involves transferring funds from a traditional IRA to a Roth IRA. This can be a strategic move, especially if you anticipate being in a higher tax bracket in retirement. Let’s delve into the specifics of Roth IRA rollovers.

Tax Implications of a Roth IRA Rollover

A Roth IRA rollover is considered a taxable event. This means that you’ll need to pay taxes on the amount you’re rolling over from your traditional IRA. However, the taxes are calculated based on your current income tax bracket, which may be lower than your projected retirement tax bracket.

For example, if you’re currently in a 22% tax bracket and anticipate being in a 24% tax bracket in retirement, you’ll pay taxes on the rollover amount at the 22% rate. This can be advantageous if you expect your income to increase in retirement.

Potential Benefits and Drawbacks of a Roth IRA Rollover

Here are some potential benefits and drawbacks of a Roth IRA rollover:

Benefits

- Tax-free withdrawals in retirement: One of the main advantages of a Roth IRA is that withdrawals in retirement are tax-free. This can be a significant benefit, especially if you anticipate being in a higher tax bracket in retirement.

- Flexibility: Roth IRAs offer more flexibility than traditional IRAs. You can withdraw your contributions (but not earnings) at any time without penalty.

- Potential for tax savings: If you anticipate being in a higher tax bracket in retirement, a Roth IRA rollover can help you save on taxes.

Drawbacks

- Tax liability: You’ll need to pay taxes on the amount you’re rolling over from your traditional IRA.

- Income limitations: There are income limitations for Roth IRA contributions. If your income is too high, you may not be eligible to contribute to a Roth IRA.

- Time horizon: A Roth IRA rollover is generally more beneficial for individuals with a longer time horizon, as they have more time to benefit from tax-free growth.

Roth IRA Planning for Retirement

A Roth IRA is a powerful tool for retirement planning, offering tax-free withdrawals in retirement. By understanding the fundamentals of Roth IRAs and implementing effective strategies, individuals can build a solid foundation for a financially secure future. This section delves into the intricacies of Roth IRA planning, exploring strategies for maximizing contributions, optimizing investments, and maximizing tax benefits.

Roth IRA Basics

A Roth IRA is a retirement savings account that allows individuals to contribute after-tax dollars. The key advantage of a Roth IRA is that qualified withdrawals in retirement are tax-free. Unlike traditional IRAs, where contributions are tax-deductible but withdrawals are taxed in retirement, Roth IRA contributions are not tax-deductible but withdrawals are tax-free.

The EV Tax Credits Impact on the Auto Industry in 2024 could significantly affect the market. Stay informed about this developing story.

This makes Roth IRAs particularly attractive for individuals who anticipate being in a higher tax bracket in retirement than they are currently.

It’s important to understand the Standard Deduction 2024 for accurate tax filing. This deduction can significantly reduce your tax liability.

Roth IRA Contribution Strategies, Roth IRA Limits 2024

The annual contribution limit for Roth IRAs is $6,500 for individuals under age 50 and $7,500 for those age 50 and over in 2024. Individuals can contribute the full amount or a lesser amount, depending on their financial situation and retirement goals.

Want to improve your audio recordings? Discover the benefits of Acoustic Foam Youtube 2024: Elevate Your Audio for clearer sound.

It is generally recommended to contribute the maximum amount allowed, as this will maximize the tax-free growth potential of your savings. However, income limits may apply to Roth IRA contributions. For 2024, individuals with modified adjusted gross income (MAGI) above $153,000 ($228,000 for married couples filing jointly) are ineligible to contribute to a Roth IRA.

If your income exceeds these limits, you may still be able to contribute to a traditional IRA and convert it to a Roth IRA later.

Roth IRA Investment Options

Roth IRAs offer a wide range of investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate investment trusts (REITs). The specific investment options available will depend on the custodian or financial institution that manages your Roth IRA.

It is crucial to choose investments that align with your risk tolerance, time horizon, and retirement goals.

Roth IRA Withdrawal Strategies

Qualified withdrawals from a Roth IRA are tax-free and penalty-free after five years, provided you are age 59 1/2 or older, disabled, or using the funds for a first-time home purchase. You can withdraw your contributions at any time without penalty or taxes.

However, withdrawals of earnings before age 59 1/2 are subject to taxes and a 10% penalty. When withdrawing funds from your Roth IRA, prioritize withdrawing contributions first to ensure you are maximizing your tax-free benefits.

Roth IRA for Financial Independence

A Roth IRA can be a valuable tool for achieving financial independence in retirement. By consistently contributing to your Roth IRA and investing wisely, you can build a substantial nest egg that can provide you with a steady stream of tax-free income in retirement.

Roth IRAs can help you achieve financial independence by:

- Providing a tax-free source of income in retirement

- Allowing you to withdraw your contributions at any time without penalty or taxes

- Protecting your savings from potential future tax increases

- Providing flexibility in retirement, allowing you to pursue your passions and goals without financial constraints

Resources for Roth IRA Information

Navigating the world of Roth IRAs can be a bit overwhelming, but there are many resources available to help you make informed decisions about your retirement savings. This section provides a comprehensive guide to reliable sources of information on Roth IRAs, including government websites, financial institutions, and professional advice.

Government Websites

Government websites are a valuable starting point for understanding Roth IRA regulations and guidelines.

- IRS.gov:The IRS website offers a wealth of information on Roth IRAs, including publications, FAQs, and tax forms. You can find detailed explanations of contribution limits, eligibility requirements, and withdrawal rules. Here are some key links to explore:

- Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs):Provides comprehensive guidance on Roth IRAs, including eligibility requirements, contribution limits, and tax implications.

[https://www.irs.gov/pub/irs-pdf/p590a.pdf](https://www.irs.gov/pub/irs-pdf/p590a.pdf)

- Frequently Asked Questions (FAQs) about Roth IRAs:Answers common questions about Roth IRA contributions, withdrawals, and tax implications. [https://www.irs.gov/retirement-plans/retirement-plans-faqs](https://www.irs.gov/retirement-plans/retirement-plans-faqs)

- Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs):Provides comprehensive guidance on Roth IRAs, including eligibility requirements, contribution limits, and tax implications.

- Social Security Administration:The Social Security Administration website provides information on retirement planning, including resources on Roth IRAs. You can find information on how Roth IRAs can supplement your Social Security benefits. [https://www.ssa.gov/](https://www.ssa.gov/)

Financial Institutions

Many financial institutions offer Roth IRA accounts and provide educational resources on the topic.

- Vanguard:Vanguard offers a variety of Roth IRA investment options and provides detailed information on contributions, withdrawals, and investment strategies. [https://investor.vanguard.com/retirement/roth-ira](https://investor.vanguard.com/retirement/roth-ira)

- Fidelity:Fidelity offers educational materials on Roth IRA benefits, tax implications, and investment strategies. They also provide tools to help you track your retirement savings. [https://www.fidelity.com/retirement-planning/roth-ira](https://www.fidelity.com/retirement-planning/roth-ira)

- Schwab:Schwab provides information on Roth IRA account management, fees, and investment options. They also offer tools to help you plan for retirement. [https://www.schwab.com/retirement/roth-ira](https://www.schwab.com/retirement/roth-ira)

Financial Advisor Contact Information

Seeking professional advice from a financial advisor can be invaluable in navigating the complexities of Roth IRAs.

- Certified Financial Planner (CFP) Directory:The CFP Board maintains a directory where you can search for CFPs specializing in retirement planning. [https://www.cfp.net/find-a-planner](https://www.cfp.net/find-a-planner)

- National Association of Personal Financial Advisors (NAPFA):NAPFA offers a directory of NAPFA-registered advisors who specialize in retirement planning. [https://www.napfa.org/](https://www.napfa.org/)

Additional Information

Here’s a summary of key information about Roth IRAs:

Pros of Roth IRAs:

- Tax-free withdrawals in retirement

- Potential for tax-free growth

- Can be a good option for those expecting to be in a higher tax bracket in retirement

Cons of Roth IRAs:

- You pay taxes on contributions upfront

- Income limitations may prevent you from contributing

- Early withdrawals before age 59 1/2 are generally subject to taxes and penalties

Eligibility Requirements:

Looking to maximize your retirement savings? Check out the Ira Limits 2024 to see how much you can contribute to your IRA.

- You must have earned income to contribute to a Roth IRA.

- There are income limitations for contributing to a Roth IRA. For 2024, if your modified adjusted gross income (MAGI) is $153,000 or greater as a single filer, married filing separately, or head of household, you cannot contribute to a Roth IRA.

For married filing jointly or qualifying widow(er), the limit is $228,000.

Contribution Limits:The annual contribution limit for Roth IRAs in 2024 is $7,000. If you are 50 or older, you can make an additional “catch-up” contribution of $1,000.

Withdrawal Rules:

- You can withdraw your contributions from a Roth IRA at any time, tax-free and penalty-free.

- Withdrawals of earnings are tax-free and penalty-free after age 59 1/2, provided the account has been open for at least five years.

- Early withdrawals of earnings before age 59 1/2 may be subject to taxes and a 10% penalty.

Tax Implications:

- Roth IRA contributions are made with after-tax dollars, meaning you pay taxes on the money before contributing it.

- Withdrawals of contributions and earnings in retirement are tax-free.

12. Future Outlook for Roth IRA Limits

Predicting future Roth IRA contribution limits is an important exercise for anyone planning their retirement savings. While no one can guarantee the future, analyzing historical trends and current economic factors can provide insights into potential scenarios.

Potential Factors Influencing Future Limits

Several factors could influence the future growth of Roth IRA contribution limits. These include:

- Inflation: Inflation erodes the purchasing power of money over time. To maintain the real value of Roth IRA contributions, limits are often adjusted annually to reflect inflation. The Consumer Price Index (CPI) is a key measure used for this adjustment.

For example, if inflation averages 3% annually, Roth IRA contribution limits might increase by approximately 3% each year to keep pace with rising prices.

- Economic Growth: Economic growth can impact Roth IRA limits in various ways. Strong economic growth often translates to higher tax revenues, potentially allowing for increased government spending on social programs, including retirement savings incentives. However, economic downturns could lead to reduced government revenue, potentially resulting in slower growth or even decreases in Roth IRA contribution limits.

Thinking about annuities for retirement? Learn about the Annuity King Sarasota 2024: Your Guide to Secure Retirement to explore this option.

- Government Budget: The federal budget plays a significant role in determining Roth IRA contribution limits. Budget deficits could limit the government’s ability to increase retirement savings incentives, while budget surpluses might provide more flexibility for raising contribution limits. Additionally, political priorities and legislative decisions can influence how much funding is allocated to retirement programs.

- Demographic Shifts: An aging population could put pressure on social security and Medicare, potentially influencing the government’s approach to retirement savings. As the number of retirees increases, there might be a greater emphasis on promoting individual retirement savings through programs like Roth IRAs.

Impact of Economic Conditions and Government Policies

Economic conditions and government policies can significantly influence Roth IRA contribution limits.

- Recessions: Recessions can have a mixed impact on Roth IRA limits. On one hand, economic downturns often lead to lower tax revenues, potentially restricting the government’s ability to increase contribution limits. On the other hand, policymakers might consider raising limits during recessions to encourage retirement savings and stimulate economic growth.

- Tax Reform: Tax reforms can significantly impact Roth IRA limits. Changes to tax brackets, deductions, and credits could affect the attractiveness of Roth IRA contributions and potentially influence future contribution limits. For example, if tax rates are reduced, the tax advantages of a Roth IRA might be less compelling, potentially leading to slower growth in contribution limits.

With the new year, it’s wise to be aware of the Tax Brackets 2024 to plan your finances and potentially reduce your tax burden.

- Social Security and Medicare: Changes to Social Security and Medicare could have implications for Roth IRA limits. If these programs face financial challenges, the government might consider increasing incentives for individual retirement savings to reduce reliance on these programs.

Conversely, significant improvements to Social Security and Medicare could potentially lead to slower growth in Roth IRA limits.

Predictions for Future Roth IRA Limits

Predicting future Roth IRA limits involves considering various economic and political factors.

- Short-Term (Next 5 Years): Based on current economic trends and projected inflation rates, it’s reasonable to expect gradual increases in Roth IRA contribution limits over the next five years. However, unexpected economic shocks or significant policy changes could alter this trajectory.

- Long-Term (Next 10-20 Years): Over the next 10-20 years, demographic shifts, technological advancements, and potential changes in government priorities will likely influence Roth IRA limits. While predicting the future is challenging, it’s possible that contribution limits will continue to increase, but perhaps at a slower pace than in the past.

Roth IRA FAQs

This section addresses some of the most frequently asked questions about Roth IRAs. It covers key aspects like eligibility, contributions, withdrawals, taxes, and investment options. The information provided is intended for general knowledge and does not constitute financial advice.

Eligibility Requirements

- Who is eligible to contribute to a Roth IRA?

– Anyone with earned income can contribute to a Roth IRA, regardless of age. This includes individuals, spouses, and even minors with earned income.

- What happens if my income exceeds the Roth IRA contribution limit?

– If your modified adjusted gross income (MAGI) exceeds certain limits, you may be ineligible to contribute to a Roth IRA. For 2024, the income limits are:

– Single filers:$153,000 or higher

– Married filing jointly:$228,000 or higher

– Head of household:$204,000 or higher

– If you exceed these limits, you may consider alternative strategies like a backdoor Roth IRA.

- What if I am already contributing to a 401(k)?

– You can contribute to both a Roth IRA and a 401(k) as long as you meet the eligibility requirements for both.

Contributions

- How much can I contribute to a Roth IRA in 2024?

– The annual contribution limit for 2024 is $7,500. Individuals aged 50 and older can contribute an additional $1,500, for a total of $9,000.

- Can I contribute to a Roth IRA after the tax year ends?

– You can contribute to a Roth IRA until the tax filing deadline for the year, including extensions.

- What happens if I contribute more than the annual limit?

– You may be subject to a 6% penalty on the excess contribution.

- Can I contribute to a Roth IRA if I am already receiving Social Security benefits?

– Yes, you can contribute to a Roth IRA even if you are receiving Social Security benefits.

Withdrawals

- When can I withdraw money from my Roth IRA without penalties?

– You can withdraw contributions from a Roth IRA at any time, tax-free and penalty-free. Withdrawals of earnings are generally tax-free and penalty-free after age 59 1/2, as long as the account has been open for at least five years.

- What happens if I withdraw money before age 59 1/2?

– Withdrawals of earnings before age 59 1/2 are generally subject to taxes and a 10% penalty. There are some exceptions to the penalty, such as for first-time home purchases, medical expenses, or disability.

- Can I withdraw money from my Roth IRA to pay for college?

– You can withdraw contributions to a Roth IRA tax-free and penalty-free for qualified education expenses. Withdrawals of earnings may be subject to taxes and penalties, depending on the circumstances.

Taxes

- Are Roth IRA withdrawals taxable?

– Qualified withdrawals of earnings from a Roth IRA are tax-free in retirement.

- How does the “kiddie tax” rule affect Roth IRA withdrawals?

– The “kiddie tax” rule applies to children under age 19 (or 24 if a full-time student) who have unearned income exceeding certain thresholds. This rule can affect Roth IRA withdrawals, potentially making some withdrawals taxable.

- How does inflation impact Roth IRA investments?

– Inflation can erode the purchasing power of your Roth IRA investments over time. Consider diversifying your portfolio and investing in assets that may outpace inflation, such as stocks and real estate.

Investment Options

- What types of investments can I hold in a Roth IRA?

– Roth IRAs offer a wide range of investment options, including stocks, bonds, mutual funds, ETFs, and real estate.

- Can I invest in cryptocurrency through a Roth IRA?

– While some custodians may offer cryptocurrency investment options, it’s important to note that the IRS has not provided specific guidance on the tax treatment of cryptocurrency investments in Roth IRAs.

- What are the risks associated with Roth IRA investments?

– Like any investment, Roth IRA investments carry risks, including market volatility, inflation, and potential losses.

Backdoor Roth IRA

- What is a backdoor Roth IRA?

– This strategy allows individuals with high incomes who are ineligible to contribute directly to a Roth IRA to contribute to a traditional IRA and then convert it to a Roth IRA. This way, you can potentially benefit from tax-free withdrawals in retirement.

- What are the tax implications of a backdoor Roth IRA?

– The conversion of traditional IRA funds to a Roth IRA is taxable in the year of conversion. However, you will avoid taxes on qualified withdrawals in retirement.

Case Studies and Examples

Real-life examples illustrate how individuals have successfully leveraged Roth IRAs to achieve their financial goals. These case studies highlight the potential benefits of contributing to a Roth IRA, providing practical advice based on real-world scenarios.

Early Retirement with a Roth IRA

This case study explores how an individual utilized a Roth IRA to retire early.

“I started contributing to a Roth IRA at 25, saving $5,000 annually. By age 50, I had accumulated over $250,000 in tax-free growth. I was able to retire early and enjoy my retirement without worrying about taxes on my withdrawals,” said John, a retired software engineer.

John’s example demonstrates the power of compounding returns over time, especially when combined with the tax-free nature of Roth IRA withdrawals. Early contributions, even small ones, can significantly impact long-term savings.

Funding a Child’s Education with a Roth IRA

This case study illustrates how a parent used a Roth IRA to fund their child’s college education.

“I started contributing to a Roth IRA for my daughter when she was born. By the time she was 18, the account had grown to over $100,000, which covered a significant portion of her college expenses,” said Sarah, a mother of two.

Sarah’s case highlights the flexibility of Roth IRAs, allowing for withdrawals of contributions tax-free and penalty-free for qualified education expenses. This strategy provides a tax-advantaged way to save for a child’s future education.

Protecting Retirement Savings from Taxes

This case study demonstrates how a retiree used a Roth IRA to shield their retirement income from taxes.

“I contributed to a Roth IRA throughout my working years. Now in retirement, I can withdraw my contributions and earnings tax-free, ensuring my retirement income isn’t subject to taxes,” said David, a retired accountant.

David’s case demonstrates the benefit of Roth IRAs in retirement, providing tax-free income that can supplement other retirement income sources. This strategy allows retirees to maintain their standard of living without worrying about tax implications.

Conclusion

In conclusion, Roth IRA limits are an important factor to consider when planning for retirement. By understanding the rules and regulations, you can make informed decisions about your savings strategy. Whether you are a seasoned investor or just starting out, it’s essential to stay informed about these limits and how they can impact your financial future.

Answers to Common Questions

What is the difference between a Roth IRA and a Traditional IRA?

A Roth IRA allows you to contribute after-tax dollars, meaning you won’t pay taxes on your withdrawals in retirement. A Traditional IRA allows you to contribute pre-tax dollars, meaning you’ll pay taxes on your withdrawals in retirement.

What is the “backdoor Roth IRA” strategy?

The “backdoor Roth IRA” strategy is a way to contribute to a Roth IRA even if you exceed the income limits. This involves contributing to a traditional IRA and then converting it to a Roth IRA. However, there are tax implications associated with this strategy.

How do inflation and economic growth affect Roth IRA limits?

Inflation and economic growth can impact Roth IRA limits over time. Generally, limits tend to increase with inflation to maintain the purchasing power of your contributions.

What are the potential benefits and drawbacks of a Roth IRA?

Benefits of a Roth IRA include tax-free withdrawals in retirement and the potential for tax-free growth of your investments. Drawbacks include income limitations and the fact that your contributions aren’t tax-deductible.

Can I withdraw my Roth IRA contributions before age 59 1/2?

You can withdraw your Roth IRA contributions at any time without penalty. However, if you withdraw earnings before age 59 1/2, you may have to pay taxes and penalties.

What are some common investment options for Roth IRAs?

Common investment options for Roth IRAs include stocks, bonds, mutual funds, ETFs, and real estate. The best options for you will depend on your risk tolerance, time horizon, and financial goals.