Rmd Variable Annuity 2024 presents a unique investment opportunity for individuals seeking to maximize their retirement savings. Unlike traditional variable annuities, RMD Variable Annuities offer a blend of growth potential and tax advantages, making them an attractive option for those approaching retirement or already in their golden years.

The world of annuities is vast, with various options catering to different needs. Annuity Uk 2024 explores the specifics of annuities in the UK, offering valuable insights for UK residents.

This guide delves into the intricacies of RMD Variable Annuities, providing a clear understanding of their features, benefits, and potential risks.

Variable annuities, in particular, present unique features. A Variable Annuity Guarantees Which Of The Following 2024 will help you understand the key guarantees associated with this type of annuity.

We will explore the current tax regulations and guidelines surrounding RMD Variable Annuities in 2024, examining any significant changes or updates that may impact your investment strategy. We will also compare and contrast the advantages and disadvantages of RMD Variable Annuities with other retirement investment options, providing a comprehensive overview of the benefits and drawbacks of this investment vehicle.

Variable annuities can be affected by inflation. Variable Annuity Inflation 2024 explores how inflation can impact variable annuities.

RMD Variable Annuity Basics

An RMD Variable Annuity is a type of retirement savings product that allows you to defer taxes on your investment earnings until you start withdrawing them in retirement. It differs from a traditional variable annuity in that it is designed to help you meet your required minimum distributions (RMDs) in retirement.

To make informed decisions about your financial future, it’s essential to grasp the specifics of annuities. Calculating Annuity Pension 2024 , for instance, is a crucial step in understanding how much income you can expect from an annuity.

With an RMD Variable Annuity, you can choose to invest your money in a variety of sub-accounts, which are typically tied to mutual funds.

The frequency of annuity payments can vary. Annuity Formula Half Yearly 2024 provides insights into calculating annuities with half-yearly payments.

Key Features of RMD Variable Annuities, Rmd Variable Annuity 2024

RMD Variable Annuities offer a variety of features, including:

- Tax-deferred growth: You don’t have to pay taxes on your investment earnings until you start withdrawing them in retirement.

- Investment options: You can choose to invest your money in a variety of sub-accounts, which are typically tied to mutual funds.

- Guaranteed minimum death benefit: This feature ensures that your beneficiaries will receive at least a certain amount of money, even if your investment loses value.

- Living benefits: These features can provide you with income protection in the event of a long-term care need or other unexpected expenses.

However, it’s important to note that RMD Variable Annuities also come with some potential downsides, such as:

- High fees: RMD Variable Annuities can have high fees, which can eat into your investment returns.

- Investment risk: The value of your investment can go up or down, and you could lose money.

- Complexity: RMD Variable Annuities can be complex to understand and manage.

RMD Variable Annuity in 2024

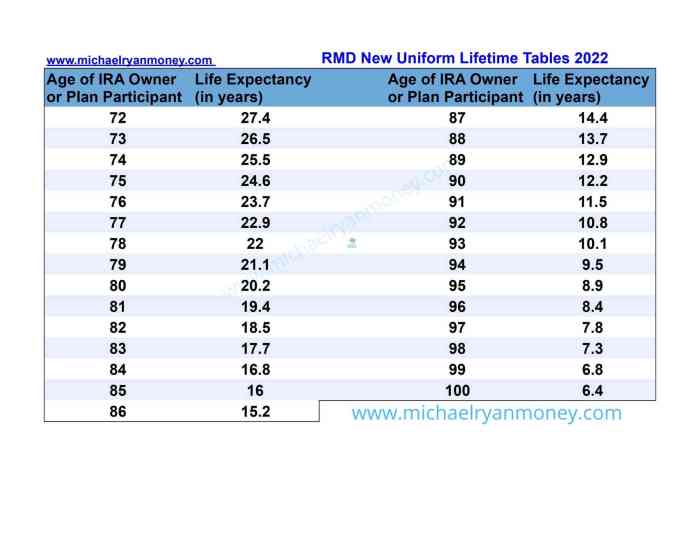

The tax regulations and guidelines for RMD Variable Annuities in 2024 are generally the same as they were in previous years. However, there are a few key changes that investors should be aware of. For example, the IRS has announced an increase in the required minimum distribution (RMD) age to 73 for those born after 1950.

Tax implications are crucial when dealing with annuities. Is Annuity Received From Lic Taxable 2024 addresses the taxability of annuities received from LIC.

This means that you will not be required to start taking RMDs from your retirement accounts until you reach age 73. This change could have a significant impact on individuals planning to invest in RMD Variable Annuities, as they may have more time to grow their retirement savings before they are required to start taking withdrawals.

Many people consider annuities as a part of their retirement planning. Annuity 200k 2024 may be a starting point for exploring how a 200k annuity can fit into your retirement strategy.

Another important change to note is the potential impact of the SECURE Act 2.0, which was passed in December 2022. This legislation makes several changes to retirement savings laws, including changes to the RMD rules for certain retirement accounts. It’s important to stay informed about any changes or updates to the rules governing RMD Variable Annuities, as these changes could impact your investment strategy.

Understanding the tax implications of annuities is essential. Annuity Under Income Tax Act 2024 delves into how annuities are treated under the Income Tax Act.

Advantages of RMD Variable Annuities

RMD Variable Annuities offer several advantages for investors looking to meet their RMD requirements while potentially growing their retirement savings. These advantages include:

- Tax-deferred growth: As mentioned earlier, RMD Variable Annuities allow you to defer taxes on your investment earnings until you start withdrawing them in retirement. This can help you accumulate more wealth over time, as you won’t have to pay taxes on your investment gains each year.

Before investing in a variable annuity, it’s crucial to thoroughly review the prospectus. Variable Annuity Prospectus 2024 will provide you with all the necessary information about the annuity.

- Flexibility: RMD Variable Annuities offer flexibility in terms of investment options, allowing you to choose how to allocate your money based on your risk tolerance and investment goals.

- Guaranteed minimum death benefit: This feature provides peace of mind, knowing that your beneficiaries will receive at least a certain amount of money, even if your investment loses value.

- Potential for higher returns: While there is always investment risk, RMD Variable Annuities have the potential to generate higher returns than other retirement investment options, such as traditional IRAs or 401(k)s.

Comparison with Other Retirement Investment Options

Here’s a table comparing the advantages and disadvantages of RMD Variable Annuities with other retirement investment options:

| Investment Option | Advantages | Disadvantages |

|---|---|---|

| RMD Variable Annuity | Tax-deferred growth, investment flexibility, guaranteed minimum death benefit, potential for higher returns | High fees, investment risk, complexity |

| Traditional IRA | Tax-deductible contributions, tax-deferred growth, potential for higher returns | Limited investment options, potential for high fees |

| 401(k) | Employer matching contributions, tax-deferred growth, potential for higher returns | Limited investment options, potential for high fees |

| Roth IRA | Tax-free withdrawals in retirement, no required minimum distributions (RMDs) | Contributions are not tax-deductible, limited contribution limits |

Risks and Considerations

Before investing in an RMD Variable Annuity, it’s important to understand the potential risks involved. These risks include:

- Investment risk: The value of your investment can go up or down, and you could lose money.

- High fees: RMD Variable Annuities can have high fees, which can eat into your investment returns.

- Complexity: RMD Variable Annuities can be complex to understand and manage.

- Potential for surrender charges: If you withdraw your money from an RMD Variable Annuity before a certain period, you may have to pay surrender charges.

- Market volatility: The value of your investment can be affected by market volatility, which can be unpredictable.

- Inflation risk: The purchasing power of your investment can be eroded by inflation.

It’s also important to consider the following factors before investing in an RMD Variable Annuity:

- Your risk tolerance: How comfortable are you with the potential for losing money on your investment?

- Your investment goals: What are you hoping to achieve with your investment?

- Your time horizon: How long do you plan to invest your money?

- Your financial situation: Do you have other sources of retirement income? How much debt do you have?

RMD Variable Annuity Investment Strategies: Rmd Variable Annuity 2024

There are a variety of investment strategies that you can use with an RMD Variable Annuity. The best strategy for you will depend on your individual circumstances and investment goals. Here are a few examples:

- Conservative strategy: This strategy involves investing in low-risk assets, such as bonds and money market accounts. This strategy is designed to preserve your capital and generate a steady stream of income.

- Moderate strategy: This strategy involves investing in a mix of stocks, bonds, and other assets. This strategy is designed to provide a balance of growth and income.

- Aggressive strategy: This strategy involves investing in high-growth assets, such as stocks. This strategy is designed to maximize your potential for growth, but it also comes with a higher risk of loss.

Examples of Investment Strategies

Here’s a table illustrating different investment strategies and their potential outcomes:

| Investment Strategy | Potential Growth | Potential Risk |

|---|---|---|

| Conservative | Low | Low |

| Moderate | Moderate | Moderate |

| Aggressive | High | High |

It’s important to diversify your investments within an RMD Variable Annuity to reduce your overall risk. This means investing in a variety of asset classes, such as stocks, bonds, and real estate. You should also consider rebalancing your portfolio periodically to ensure that your asset allocation remains consistent with your investment goals.

Managing your annuity effectively involves understanding how withdrawals work. Annuity Withdrawal Calculator 2024 can assist you in planning your withdrawals strategically.

RMD Variable Annuity and Retirement Planning

RMD Variable Annuities can play an important role in retirement planning. They can be used to supplement retirement income, provide tax-deferred growth, and protect your beneficiaries in the event of your death. When integrated into a comprehensive retirement plan, RMD Variable Annuities can help you achieve your financial goals and enjoy a comfortable retirement.

Variable annuities offer the potential for growth, but it’s essential to understand their dynamics. Variable Annuity Calculator 2024 can help you visualize the potential growth of a variable annuity.

Using RMD Variable Annuities to Supplement Retirement Income

RMD Variable Annuities can be used to supplement retirement income by providing a stream of income during retirement. You can choose to withdraw a fixed amount of money each year, or you can take withdrawals as needed. This flexibility can help you manage your retirement income and ensure that you have enough money to cover your expenses.

Variable annuities often involve fees and charges. A Variable Annuity Charges 2024 will guide you through the typical charges associated with these annuities.

Examples of Integrating RMD Variable Annuities into a Comprehensive Retirement Plan

Here are some examples of how RMD Variable Annuities can be integrated into a comprehensive retirement plan:

- Use an RMD Variable Annuity to supplement your Social Security income: This can help you maintain your standard of living in retirement.

- Use an RMD Variable Annuity to cover unexpected expenses: This can provide you with a safety net in case of a medical emergency or other unexpected event.

- Use an RMD Variable Annuity to leave a legacy to your beneficiaries: This can help you ensure that your loved ones are financially secure after you are gone.

Choosing the Right RMD Variable Annuity

When choosing an RMD Variable Annuity, it’s important to consider a number of factors, including:

- Fees: RMD Variable Annuities can have high fees, so it’s important to compare the fees of different products.

- Investment options: Make sure that the annuity offers a variety of investment options that align with your investment goals.

- Guaranteed minimum death benefit: This feature can provide peace of mind, knowing that your beneficiaries will receive at least a certain amount of money, even if your investment loses value.

- Living benefits: These features can provide you with income protection in the event of a long-term care need or other unexpected expenses.

- Financial strength of the insurer: It’s important to choose an annuity from a financially sound insurer.

- Customer service: Choose an insurer that provides excellent customer service.

Research and Compare RMD Variable Annuity Options

To research and compare different RMD Variable Annuity options, you can:

- Talk to a financial advisor: A financial advisor can help you understand your options and choose the right product for your needs.

- Read reviews and ratings: Online resources such as NerdWallet and Investopedia provide reviews and ratings of different RMD Variable Annuity products.

- Compare quotes: Get quotes from several insurers to compare fees and features.

Questions to Ask Potential RMD Variable Annuity Providers

Here are some questions to ask potential RMD Variable Annuity providers:

- What are the fees associated with the annuity?

- What investment options are available?

- What is the guaranteed minimum death benefit?

- What living benefits are available?

- What is the financial strength of the insurer?

- What is the customer service like?

Last Point

Investing in an RMD Variable Annuity in 2024 requires careful consideration and planning. Understanding the potential risks and benefits, as well as the current tax landscape, is crucial to making an informed decision. This guide has provided you with a comprehensive overview of RMD Variable Annuities, equipping you with the knowledge needed to assess whether this investment aligns with your retirement goals and financial strategy.

The question of who provides annuities is also essential. Annuity Is Given By 2024 will help you understand the sources of these financial products.

By carefully evaluating your individual circumstances and consulting with a qualified financial advisor, you can make a well-informed decision about whether an RMD Variable Annuity is the right choice for you.

FAQ Corner

What are the tax implications of withdrawing funds from an RMD Variable Annuity?

Withdrawals from an RMD Variable Annuity are generally taxed as ordinary income. However, the specific tax treatment may vary depending on the type of withdrawal and the individual’s tax situation. It’s essential to consult with a tax advisor to understand the tax implications of your specific circumstances.

Annuities offer a sense of security, and some even come with guarantees. Annuity 5 Year Guarantee 2024 is a common type of guarantee that ensures a specific return for a set period.

Are there any penalties for withdrawing funds from an RMD Variable Annuity before age 59 1/2?

Yes, there may be penalties for withdrawing funds from an RMD Variable Annuity before age 59 1/2. The specific penalties will depend on the terms of the annuity contract and the individual’s tax situation. It’s important to consult with a financial advisor to understand the potential penalties associated with early withdrawals.

Understanding the intricacies of annuities can be overwhelming, especially when trying to navigate the various types available. For example, Annuity 7 Letters 2024 may seem like a complex concept, but it’s simply a way of referring to the standard annuity contract.

How can I choose the right RMD Variable Annuity for my needs?

Choosing the right RMD Variable Annuity involves considering several factors, including your risk tolerance, investment goals, and financial situation. It’s important to compare different annuity options from reputable providers and carefully evaluate the terms and conditions of each contract. Consulting with a financial advisor can help you navigate the complexities of choosing the right annuity for your needs.