Revolving Line Of Credit offers a flexible way to access funds as needed, similar to a credit card, but with distinct features and potential advantages. This type of credit line allows you to borrow money up to a set limit, repay it over time, and then borrow again as needed.

While no credit check loans guaranteed approval might sound tempting, be cautious as they often come with high interest rates. Collateral loans use an asset as security, which can affect the terms.

It’s a versatile tool that can be helpful for various situations, from covering unexpected expenses to financing major projects.

Check out Credit Karma Loans for a potential loan offer. Getting pre-approved loan can streamline the process.

Understanding how a revolving line of credit works, its benefits and risks, and how to choose the right one for your needs is crucial for maximizing its potential while avoiding financial pitfalls. This guide will delve into the key aspects of revolving lines of credit, providing insights to help you make informed decisions and manage your finances effectively.

Credit unions are known for their credit union car loans with potentially lower rates. For a new home construction, a construction to permanent loan might be the right choice.

What is a Revolving Line of Credit?

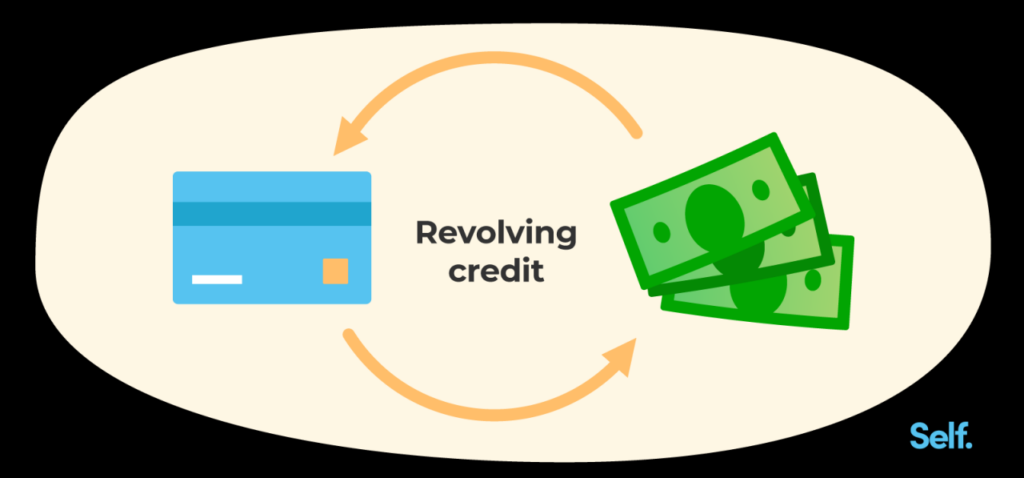

A revolving line of credit is a type of loan that allows you to borrow money repeatedly, up to a certain limit, and repay it over time. Think of it like a credit card, but instead of having a physical card, you have a line of credit that you can access through a bank or other financial institution.

Understanding Revolving Credit

Unlike a personal loan, which is a fixed amount of money borrowed at once, a revolving line of credit is like a flexible pool of funds you can dip into as needed. You can borrow as much or as little as you want, up to your credit limit, and you only pay interest on the amount you actually borrow.

You also have the flexibility to repay the borrowed amount over time, either through minimum monthly payments or by paying more to reduce your balance faster.

Revolving Line of Credit vs. Other Credit Options

Here’s a breakdown of how a revolving line of credit compares to other forms of credit:

- Credit Card:Similar to a revolving line of credit, a credit card provides access to a credit limit, allowing you to make purchases and pay them off over time. The key difference lies in how they’re used. Credit cards are typically used for everyday purchases, while revolving lines of credit are often used for larger expenses like home improvements or business needs.

- Personal Loan:Unlike revolving credit, a personal loan is a fixed amount of money borrowed at once with a set repayment period. You make regular payments until the loan is fully repaid. Personal loans are often used for specific purposes like debt consolidation or medical expenses.

Key Features of a Revolving Line of Credit

Here are some key features of a revolving line of credit:

- Credit Limit:The maximum amount of money you can borrow at any given time.

- Interest Rate:The cost of borrowing money, usually expressed as an annual percentage rate (APR).

- Minimum Payment:The smallest amount you need to pay each month to keep your account in good standing.

- Variable Interest Rate:Most revolving lines of credit have variable interest rates, which means the rate can fluctuate over time based on market conditions.

How Does a Revolving Line of Credit Work?

Applying for a Revolving Line of Credit

To apply for a revolving line of credit, you’ll typically need to provide information about your financial situation, including your income, credit history, and debt-to-income ratio. The lender will review your application and determine if you qualify for a line of credit and what your credit limit will be.

Finding car loans near me can be easier than you think. Use online tools to compare rates and find the best deal.

Credit Limit and Interest Rates

The credit limit you’re approved for depends on your creditworthiness, which is assessed based on your credit score, income, and debt levels. The interest rate on your revolving line of credit will also be determined based on your creditworthiness.

If you’re in a rural area, you might be eligible for a rural development loan. When it comes to loans, seeking best loan rates is crucial, so shop around.

Borrowers with good credit scores typically qualify for lower interest rates.

USAA members might be interested in exploring USAA mortgage rates , while others may prefer the convenience of Rocket Mortgage Com.

Making Payments and Managing Your Line of Credit

Once you’ve been approved for a revolving line of credit, you can start borrowing money as needed, up to your credit limit. You’ll need to make regular payments on your outstanding balance. The minimum payment is usually a small percentage of your outstanding balance, but you can always pay more to reduce your balance faster.

Managing your revolving line of credit effectively is crucial to avoid accumulating debt and high interest charges. It’s essential to track your spending, make payments on time, and keep your credit utilization ratio (the percentage of your available credit that you’re using) low.

Benefits of a Revolving Line of Credit

Financial Flexibility

One of the main benefits of a revolving line of credit is its flexibility. You can borrow money as needed, up to your credit limit, and only pay interest on the amount you borrow. This can be particularly helpful for unexpected expenses or for covering short-term cash flow needs.

Potential for Building Credit

Using a revolving line of credit responsibly can help you build your credit score. By making timely payments and keeping your credit utilization low, you can demonstrate your ability to manage credit responsibly. This can improve your chances of qualifying for other loans and credit products in the future.

Finding the right car loan can be a challenge, especially with fluctuating car finance rates. It’s wise to stay updated on interest rates today to make informed decisions.

Access to Funds for Various Purposes

Revolving lines of credit can be used for a variety of purposes, including:

- Business Expenses:Covering operating costs, inventory, or marketing campaigns.

- Home Improvements:Funding renovations or repairs.

- Unexpected Emergencies:Covering medical bills, car repairs, or other unexpected expenses.

- Debt Consolidation:Combining multiple debts into one loan with a lower interest rate.

Examples of When a Revolving Line of Credit Can Be Advantageous

- Seasonal Business Needs:A business owner who experiences seasonal fluctuations in sales can use a revolving line of credit to cover expenses during slow periods.

- Unexpected Home Repairs:If your home needs unexpected repairs, a revolving line of credit can provide quick access to funds to cover the costs.

- Medical Expenses:In the event of a medical emergency, a revolving line of credit can help cover unexpected medical bills.

Risks of a Revolving Line of Credit

High Interest Rates

One of the main risks associated with revolving lines of credit is the potential for high interest rates. If you don’t pay off your balance in full each month, you’ll accrue interest charges, which can quickly add up.

Late Payment Fees

If you miss a payment on your revolving line of credit, you may be charged a late payment fee. These fees can be substantial, and they can add to your overall debt burden.

Debt Accumulation

It’s easy to overspend on a revolving line of credit if you’re not careful. If you’re constantly borrowing money and not paying it off quickly enough, you can easily accumulate debt and find yourself in a difficult financial situation.

Impact on Credit Score, Revolving Line Of Credit

Overusing a revolving line of credit and making late payments can negatively impact your credit score. This can make it harder to qualify for other loans and credit products in the future, and it can also lead to higher interest rates on future borrowing.

Types of Revolving Lines of Credit

There are several different types of revolving lines of credit, each with its own purpose, eligibility requirements, and interest rates. Here’s a breakdown of some common types:

| Type | Purpose | Eligibility Requirements | Typical Interest Rates |

|---|---|---|---|

| Business Line of Credit | Funding business expenses, inventory, or marketing campaigns. | Good credit history, strong financial statements, and a viable business plan. | Variable, typically higher than personal lines of credit. |

| Home Equity Line of Credit (HELOC) | Borrowing against the equity in your home. | Homeownership, good credit history, and sufficient equity in your home. | Variable, typically lower than personal lines of credit. |

| Personal Line of Credit | Covering unexpected expenses, home improvements, or debt consolidation. | Good credit history, steady income, and a low debt-to-income ratio. | Variable, typically based on your credit score and financial situation. |

Choosing the Right Revolving Line of Credit

Factors to Consider

When choosing a revolving line of credit, it’s important to consider the following factors:

- Interest Rates:Compare interest rates from different lenders to find the lowest rate possible.

- Fees:Look for lenders who charge low or no fees for things like annual fees, late payment fees, and overdraft fees.

- Credit Limit:Choose a credit limit that’s appropriate for your needs and that you’re confident you can manage responsibly.

- Credit Score:Your credit score will play a major role in determining your eligibility and the interest rate you’ll be offered.

- Financial History:Lenders will review your financial history, including your income, debt levels, and payment history.

Comparing Options

It’s important to shop around and compare offers from multiple lenders before choosing a revolving line of credit. This will help you find the best terms and conditions for your specific needs.

Responsible Use of a Revolving Line of Credit

Budgeting and Tracking Expenses

One of the most important aspects of responsible revolving line of credit use is budgeting. Create a budget that Artikels your income and expenses, and stick to it as closely as possible. Track your spending to ensure you’re not overspending on your line of credit.

Making Timely Payments

Make all your payments on time to avoid late fees and damage to your credit score. Set up automatic payments or reminders to help you stay on track.

Avoiding Overspending

Be mindful of your credit limit and avoid borrowing more than you can comfortably repay. It’s also important to avoid using your revolving line of credit for everyday purchases. Use it only for emergencies or larger expenses.

Managing Debt Effectively

If you find yourself accumulating debt on your revolving line of credit, make a plan to pay it off as quickly as possible. Consider making more than the minimum payment each month to reduce your balance faster and minimize interest charges.

Concluding Remarks

Revolving lines of credit can be valuable financial tools, offering flexibility and convenience when you need access to funds. However, it’s crucial to approach them with caution, understanding the potential risks involved, and using them responsibly. By carefully considering your financial situation, comparing different options, and managing your debt effectively, you can harness the power of a revolving line of credit to achieve your financial goals.

User Queries

What is the difference between a revolving line of credit and a personal loan?

A revolving line of credit allows you to borrow money up to a set limit and repay it over time, with the ability to borrow again as needed. A personal loan is a fixed amount of money borrowed with a set repayment schedule.

How do I know if I qualify for a revolving line of credit?

Looking for a personal loan? Credit union personal loans can be a great option, often offering competitive rates. You can find various loan places online, but remember to compare options carefully.

Lenders typically assess your credit score, income, debt-to-income ratio, and other financial factors to determine your eligibility.

What are some common fees associated with revolving lines of credit?

Common fees include annual fees, interest charges, late payment fees, and overdraft fees.

How can I improve my chances of getting approved for a revolving line of credit?

Maintaining a good credit score, managing your existing debt, and demonstrating a stable income can improve your chances of approval.