Reimbursement Claim, a common practice in various industries, involves seeking compensation for expenses incurred. This guide delves into the intricacies of reimbursement claims, exploring their definition, eligibility criteria, processing procedures, and associated legal considerations. Whether you are an individual seeking reimbursement for business expenses or an organization managing reimbursement processes, understanding the nuances of this topic is crucial for ensuring smooth and efficient claim management.

If you’re a USAA member, you can file a USAA insurance claim online, by phone, or through the mobile app.

From understanding the various types of reimbursement claims to navigating the intricacies of claim processing and payment, this guide provides a comprehensive overview of the entire reimbursement claim lifecycle. We’ll also address common concerns regarding fraud and abuse, outlining best practices for prevention and mitigation.

If you’re a former professional who’s transitioned to a new career, you might want to consider tail coverage to protect yourself from any potential liability claims related to your previous work.

This comprehensive resource aims to equip individuals and organizations with the knowledge and tools necessary to navigate the world of reimbursement claims effectively.

If you have a home warranty, you can file a Select Home Warranty claim for repairs or replacements covered by your plan.

Reimbursement Claims: A Comprehensive Guide

Reimbursement claims are an integral part of many industries, encompassing healthcare, insurance, travel, and more. They essentially involve seeking financial compensation for expenses incurred, with the goal of recouping funds spent on eligible items or services. This comprehensive guide delves into the intricacies of reimbursement claims, covering key aspects from definition and scope to legal considerations and best practices.

If you need to file a claim with Wawanesa, you can find information on their website about how to file a Wawanesa claim and what documents you’ll need.

Definition and Scope, Reimbursement Claim

A reimbursement claim is a formal request for financial compensation from a designated entity, often an insurance company, employer, or government agency, for eligible expenses incurred. The process involves submitting documentation and supporting evidence to justify the claim and receive reimbursement.

To file a Kemper insurance claim , you can contact their customer service line or visit their website for more information.

The scope of reimbursement claims varies depending on the specific context, but generally encompasses expenses related to healthcare, travel, education, or other approved categories.

If you’ve been in an accident, you can file an auto claim with your insurance company to get the necessary repairs or compensation.

Several types of reimbursement claims exist, each with its unique characteristics and requirements:

- Medical Reimbursement Claims:These claims are submitted to insurance providers or government agencies for medical expenses incurred, such as doctor’s visits, hospital stays, prescription drugs, and medical procedures.

- Travel Reimbursement Claims:Employees often submit travel reimbursement claims to their employers for expenses incurred during business trips, including airfare, accommodation, and transportation.

- Education Reimbursement Claims:Some employers offer reimbursement programs for employees pursuing further education, covering expenses like tuition fees, books, and course materials.

- Insurance Reimbursement Claims:Individuals may submit insurance reimbursement claims for covered events, such as accidents, natural disasters, or theft.

Key stakeholders involved in the reimbursement process include:

- Claimants:Individuals or entities submitting the reimbursement claim.

- Payers:Entities responsible for processing and approving claims, such as insurance companies, employers, or government agencies.

- Claim Processors:Individuals or departments within the payer organization responsible for verifying, validating, and processing claims.

- Auditors:Independent professionals who may review claims to ensure accuracy and compliance with regulations.

Eligibility and Requirements

Eligibility for reimbursement claims is determined by specific criteria Artikeld by the payer. These criteria vary depending on the type of claim and the payer’s policies. Common eligibility requirements include:

- Valid Insurance Coverage:Claimants must have active insurance coverage for the event or service being claimed.

- Pre-Authorization (if applicable):Certain medical procedures or services may require pre-authorization from the payer before incurring expenses.

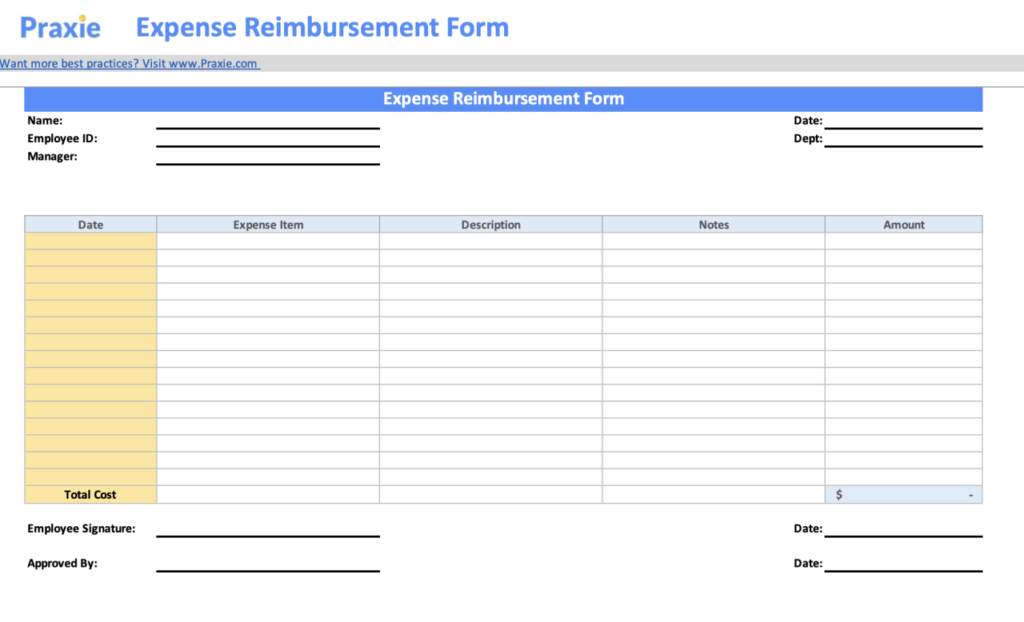

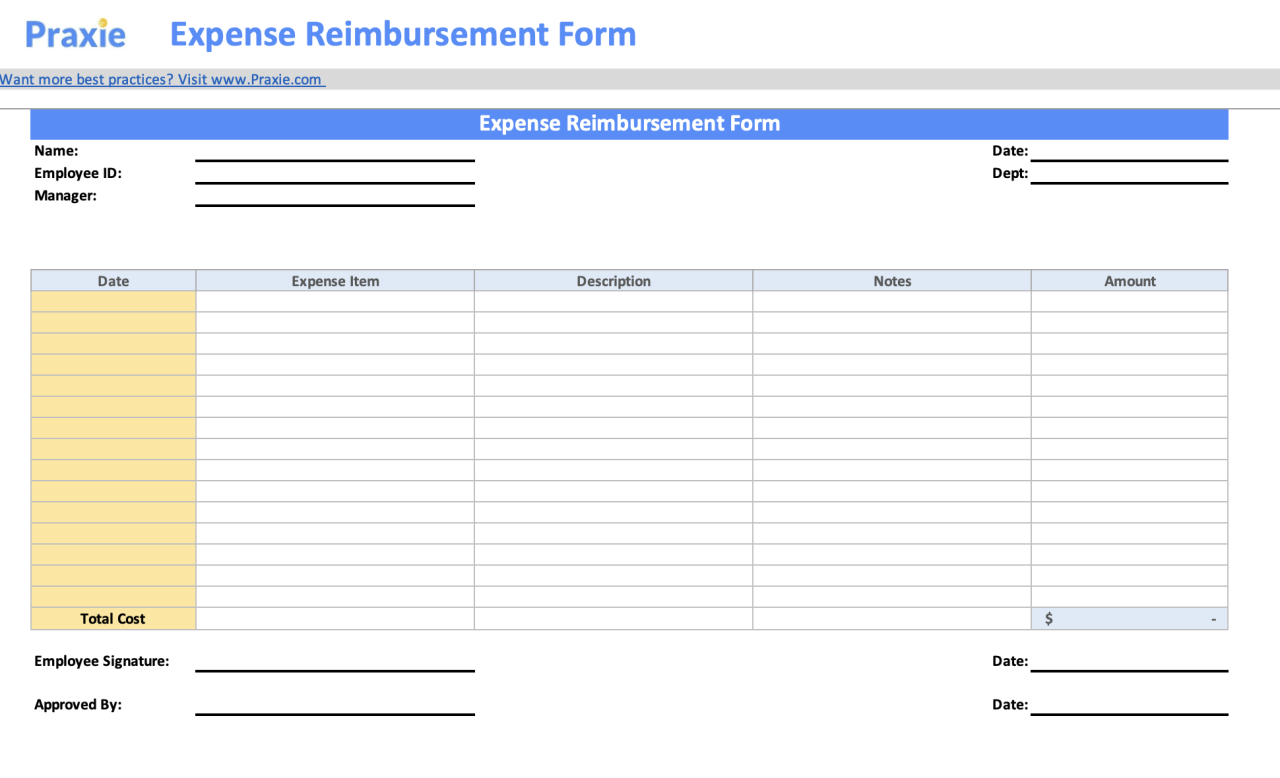

- Documentation:Claimants must provide comprehensive documentation to support their claim, such as invoices, receipts, medical records, and travel itineraries.

- Time Limits:Claimants must submit their claims within specific timeframes, often referred to as “filing deadlines.”

Required documentation varies based on the type of claim:

- Medical Reimbursement Claims:Medical bills, insurance cards, doctor’s notes, prescription details, and other relevant medical records.

- Travel Reimbursement Claims:Flight itineraries, hotel receipts, taxi receipts, and expense reports.

- Education Reimbursement Claims:Tuition invoices, course enrollment confirmations, and receipts for books and materials.

Claims may be denied for various reasons, including:

- Lack of Coverage:The expense may not be covered by the claimant’s insurance policy or reimbursement program.

- Insufficient Documentation:Incomplete or inaccurate documentation may result in claim denial.

- Violation of Policy Terms:Claimants may have violated the terms and conditions of their insurance policy or reimbursement program.

- Fraudulent Activity:Claims involving fraudulent activities, such as inflated expenses or falsified documentation, will be denied.

The Claim Process

The reimbursement claim process involves a series of steps designed to ensure accuracy, completeness, and compliance with regulations. Here’s a step-by-step guide:

| Stage | Steps |

|---|---|

| 1. Preparation |

|

| 2. Submission |

|

| 3. Processing and Review |

|

| 4. Approval or Denial |

|

Claims can be submitted through various channels, including:

- Online Portals:Many payers offer secure online portals for submitting claims electronically.

- Mail:Claimants can submit claims by mail using the payer’s designated address.

- Fax:Some payers accept claims submitted via fax.

Last Point: Reimbursement Claim

By understanding the complexities of reimbursement claims, individuals and organizations can streamline their processes, minimize errors, and ensure timely and accurate reimbursement. This guide provides a roadmap for navigating the entire reimbursement claim journey, from initial eligibility assessment to final payment disbursement.

You can use Insuranceclaimcheck to quickly and easily check the status of your insurance claim.

By adhering to best practices, utilizing appropriate systems, and remaining compliant with legal regulations, stakeholders can optimize their reimbursement experiences and foster trust and transparency within their respective ecosystems.

To determine your eligibility for Universal Credit , you’ll need to consider your income, savings, and other factors.

Frequently Asked Questions

What are the most common reasons for reimbursement claim denial?

Common reasons for denial include missing documentation, exceeding authorized limits, ineligible expenses, and failure to meet deadlines.

If you’ve lost your job, you can file an unemployment claim to receive financial assistance while you search for a new position.

How long does it typically take to process a reimbursement claim?

Filing a Safeco insurance claim can be a straightforward process, but it’s important to gather all the necessary documentation and follow the steps outlined by the insurance company.

Processing times vary depending on the complexity of the claim and the specific organization’s policies, but it can range from a few days to several weeks.

What are some tips for preventing fraud and abuse in reimbursement claims?

Implement strong internal controls, conduct regular audits, enforce clear policies, and educate employees about ethical practices.

With Allstate My Claim , you can easily track the progress of your claim and communicate with your insurance company.

If you need to reach out to State Farm Claims Customer Service , you can find their contact information online or through your policy documents.

Property damage insurance can help cover the cost of repairs or replacement for your property if it’s damaged by a covered event, such as a fire or storm. You can find more information about property damage insurance online.

Filing a death claim can be a difficult process, but it’s important to understand the requirements and documentation needed.

If you have a Choice Home Warranty, you can file a Choice Home Warranty claim for covered repairs or replacements.