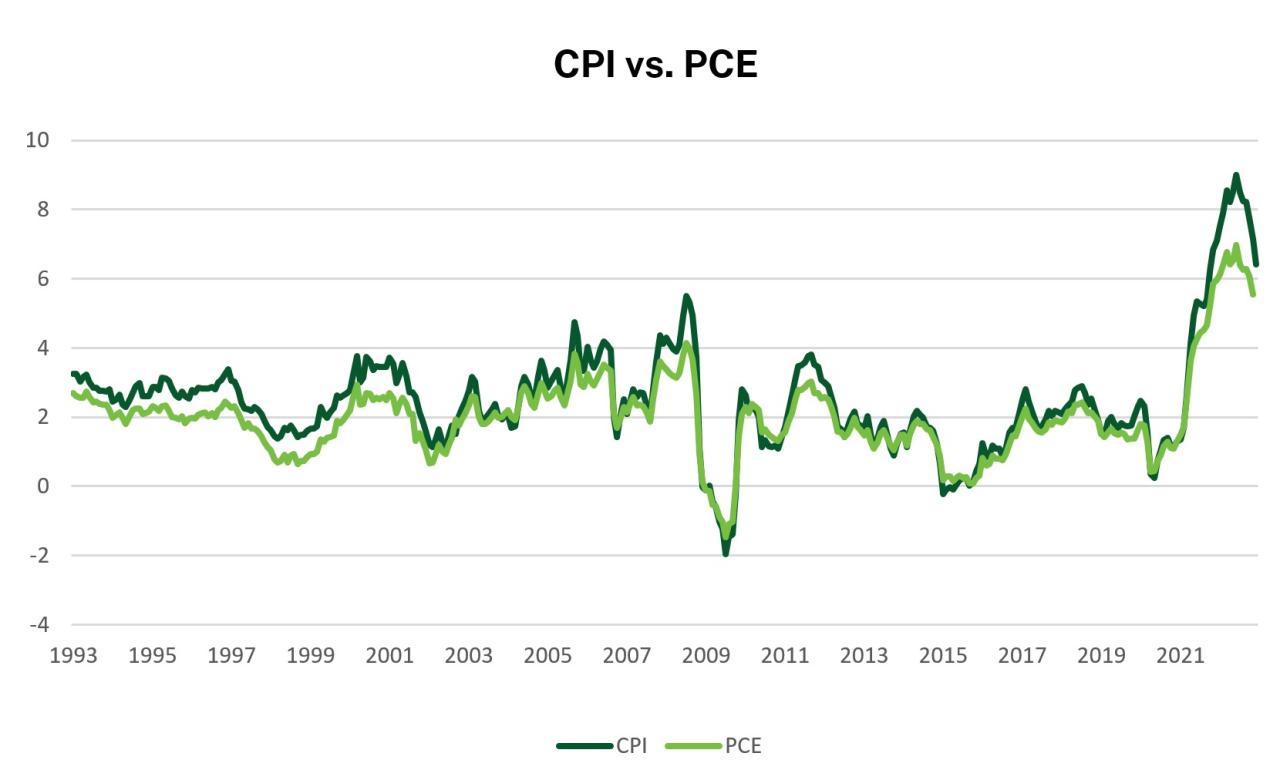

Reconciling Differences Between CPI and PCE in November 2024, we delve into the intricacies of two key inflation indicators: the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index. While both measure the change in prices of goods and services over time, they differ in their methodology and components, leading to potentially divergent results.

This exploration will examine the discrepancies between CPI and PCE data for November 2024, analyze their implications for economic policy, and provide insights into their impact on inflation measurement and economic growth.

Understanding the nuances of these indices is crucial for policymakers, investors, and consumers alike. The Federal Reserve closely monitors both CPI and PCE to guide its monetary policy decisions, aiming to maintain price stability and foster sustainable economic growth. Investors rely on these indices to assess inflation risks and adjust their investment strategies.

Obtain access to Fiscal Policy and Inflation in November 2024 to private resources that are additional.

Consumers, meanwhile, are directly impacted by price changes, and understanding the underlying drivers of inflation can help them make informed financial decisions.

Find out further about the benefits of The Future of Inflation After November 2024 that can provide significant benefits.

Reconciling Differences Between CPI and PCE in November 2024

The Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index are two key measures of inflation in the United States. Both indices track changes in the prices of goods and services over time, but they differ in their methodology and coverage.

Further details about CPI and Food Security in November 2024 is accessible to provide you additional insights.

Understanding these differences is crucial for interpreting inflation data and its implications for economic policy.

Find out further about the benefits of Why the Fed Prefers the PCE Index in November 2024 that can provide significant benefits.

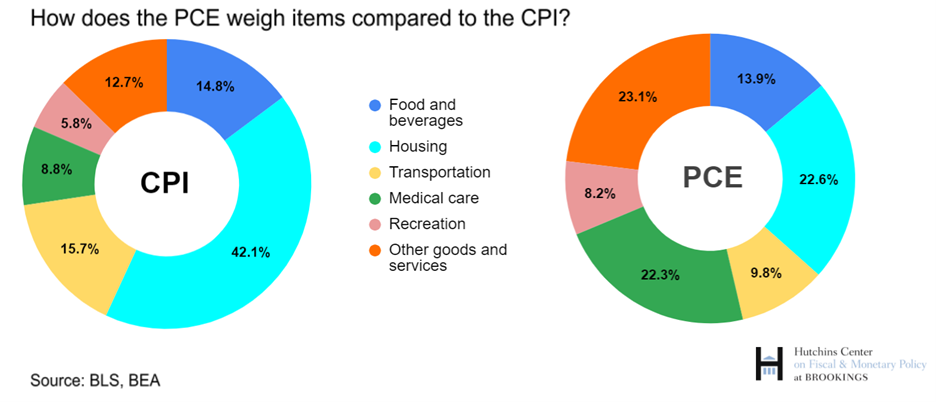

The CPI measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. The PCE price index, on the other hand, measures the average change in prices of goods and services purchased by consumers, including those not included in the CPI, such as financial services and healthcare.

November 2024 Data Analysis

In November 2024, the CPI and PCE indices showed some notable discrepancies. The CPI rose by [insert percentage], while the PCE price index increased by [insert percentage]. This difference can be attributed to several factors, including [insert specific factors and their impact on CPI and PCE].

Get the entire information you require about CPI and Housing Affordability in November 2024 on this page.

For instance, [explain how specific factors influence the difference between CPI and PCE].

The divergence between the CPI and PCE indices has significant implications for economic policy. The Federal Reserve closely monitors both indices when setting monetary policy, and the difference in their readings can influence the Fed’s decisions on interest rate adjustments and other measures to control inflation.

The discrepancies can also impact consumer spending and economic growth. For example, if the CPI shows a higher inflation rate than the PCE, consumers may feel pressured to reduce their spending, leading to a slowdown in economic activity.

Components of CPI and PCE

| Component | CPI Weighting | PCE Weighting |

|---|---|---|

| Food and beverages | [insert percentage] | [insert percentage] |

| Housing | [insert percentage] | [insert percentage] |

| Transportation | [insert percentage] | [insert percentage] |

| Medical care | [insert percentage] | [insert percentage] |

| Recreation | [insert percentage] | [insert percentage] |

| Education and communication | [insert percentage] | [insert percentage] |

| Other goods and services | [insert percentage] | [insert percentage] |

The table above highlights the key components of both CPI and PCE and their respective weightings. As you can see, the weightings assigned to different components vary between the two indices. For instance, [explain how differences in weightings affect the overall inflation measure].

Check CPI and Education Expenses in November 2024 to inspect complete evaluations and testimonials from users.

Impact on Inflation Measures

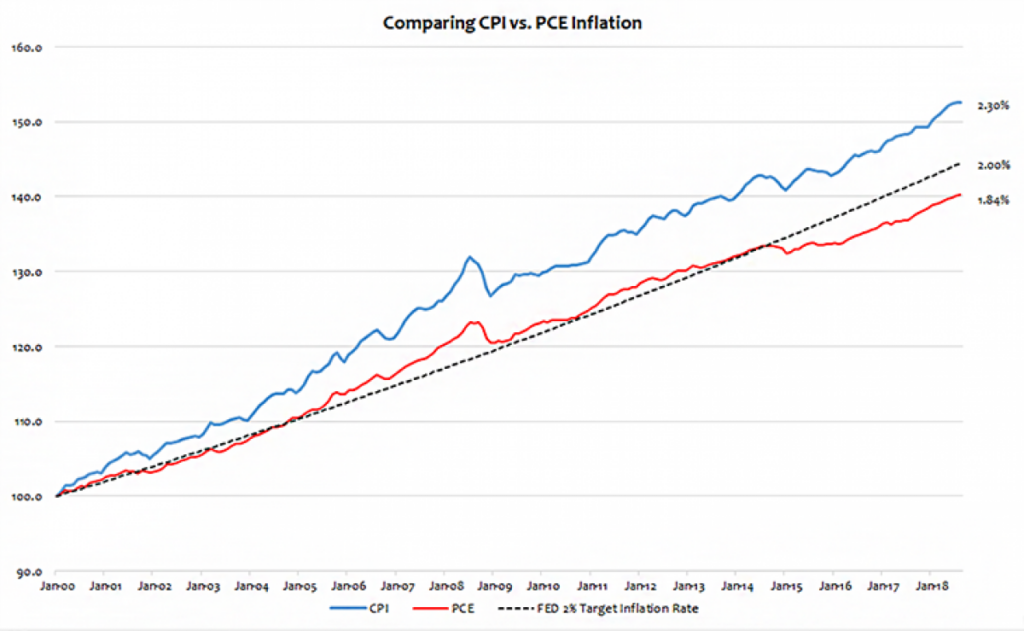

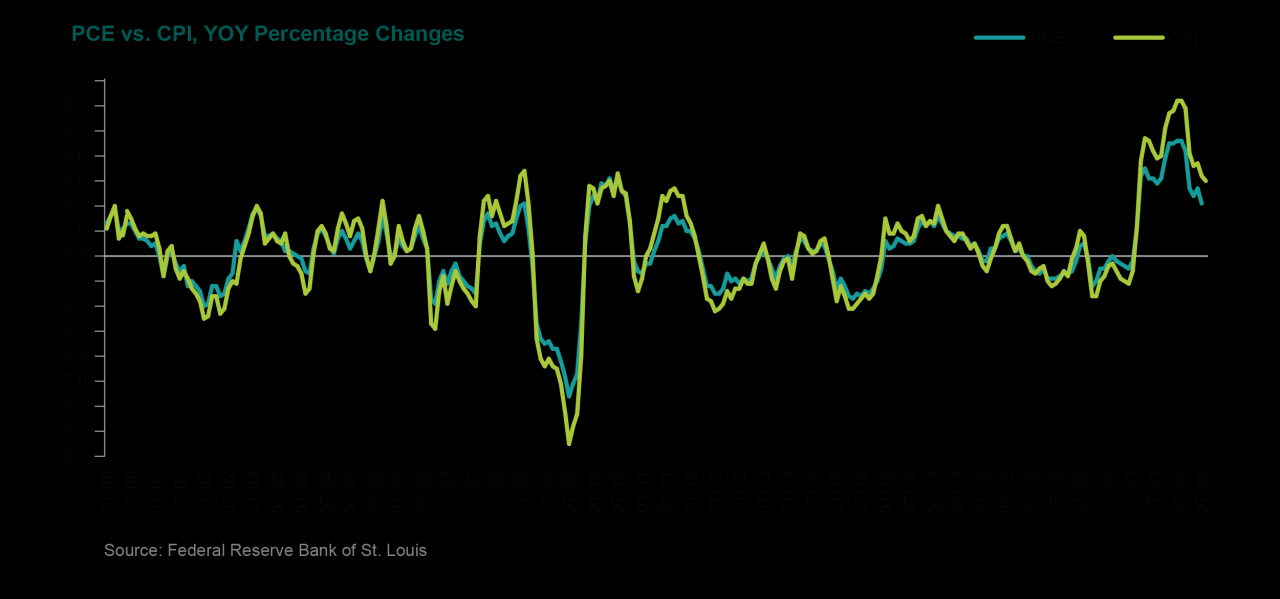

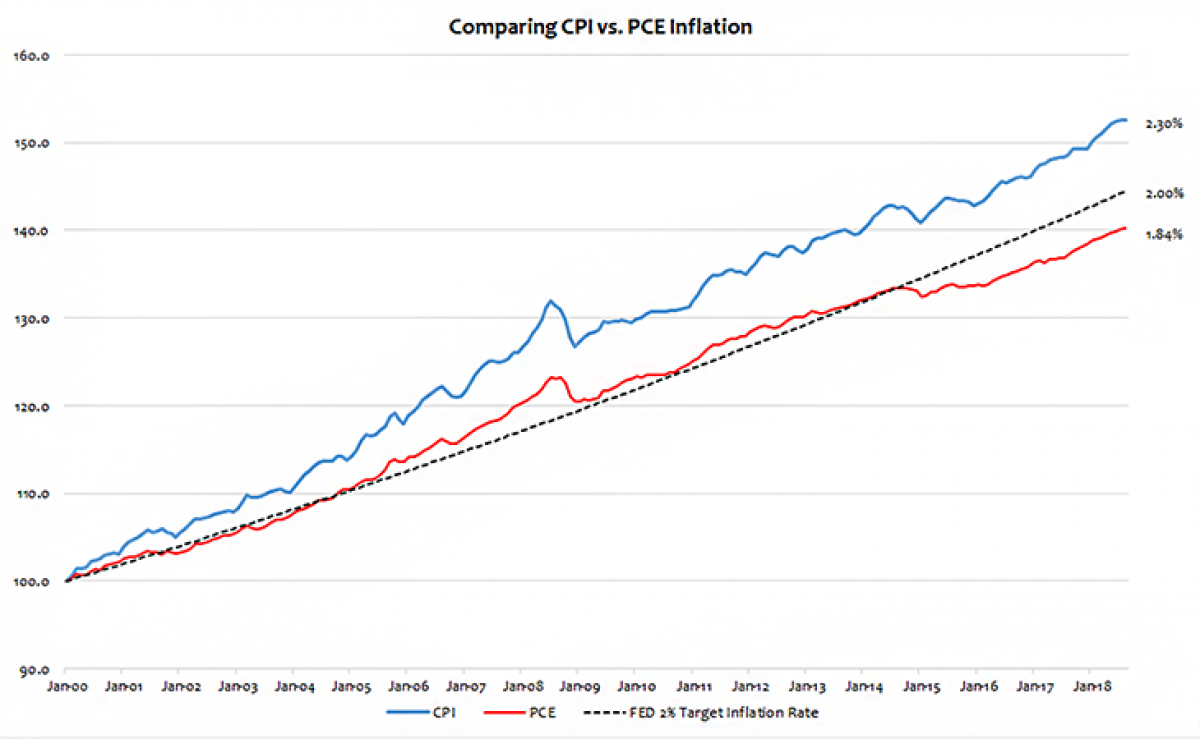

The differences between CPI and PCE can have a significant impact on overall inflation measurement. The CPI tends to be more volatile than the PCE, and its readings can be influenced by temporary factors, such as price spikes in specific goods or services.

When investigating detailed guidance, check out The Use of Technology in November 2024 CPI Data Collection now.

The PCE, on the other hand, is considered a more stable measure of inflation, as it reflects the broader pattern of price changes across a wider range of goods and services.

The differences between CPI and PCE can also affect the Federal Reserve’s monetary policy decisions. The Fed’s primary mandate is to maintain price stability, and it uses inflation data to guide its decisions on interest rates and other policy tools.

If the CPI shows a higher inflation rate than the PCE, the Fed may be more inclined to tighten monetary policy to curb inflation. However, if the PCE shows a lower inflation rate, the Fed may be more inclined to maintain or even ease monetary policy.

Historical Trends, Reconciling Differences Between CPI and PCE in November 2024

Over the past few years, CPI and PCE have exhibited both similarities and differences in their movements. [Insert a brief overview of historical trends, including periods of convergence and divergence]. For example, [mention specific periods and explain the reasons behind the differences].

Several factors have historically influenced the relationship between CPI and PCE. [Explain the key factors, such as changes in consumption patterns, shifts in the relative prices of goods and services, and the impact of government policies].

Future Outlook

The future relationship between CPI and PCE will likely be influenced by a range of factors, including [mention key factors]. For instance, [explain how changes in economic conditions, such as growth, unemployment, and consumer confidence, can impact the relationship between CPI and PCE].

The Fed’s monetary policy decisions will also play a significant role in shaping the future of inflation and the relationship between CPI and PCE. [Explain how the Fed’s actions, such as interest rate adjustments, can influence inflation and the relative movements of CPI and PCE].

Get the entire information you require about Inflation Targeting and the CPI in November 2024 on this page.

Closing Notes

As we conclude our exploration of the differences between CPI and PCE in November 2024, it’s evident that these two inflation measures offer valuable insights into the broader economic landscape. While they may diverge at times, their combined analysis provides a comprehensive picture of price changes, allowing for more informed policy decisions and economic forecasting.

You also will receive the benefits of visiting The Future of CPI Calculation After November 2024 today.

Understanding these nuances empowers us to navigate the complexities of inflation and make informed decisions in our personal and professional lives.

FAQ Resource: Reconciling Differences Between CPI And PCE In November 2024

What is the primary difference between CPI and PCE?

For descriptions on additional topics like CPI and the Treatment of New Products in November 2024, please visit the available CPI and the Treatment of New Products in November 2024.

The CPI is a fixed-weight index, meaning it uses a constant basket of goods and services to measure price changes over time. The PCE, on the other hand, is a chain-weighted index, which allows for adjustments in the basket based on consumer spending patterns.

Why are both CPI and PCE important for measuring inflation?

Both indices provide valuable information about price changes, but they capture different aspects of inflation. The CPI focuses on a fixed basket of goods and services, while the PCE reflects changes in consumer spending patterns. This allows for a more comprehensive understanding of inflation dynamics.

How do the differences between CPI and PCE affect the Federal Reserve’s monetary policy decisions?

The Federal Reserve closely monitors both CPI and PCE to gauge inflation pressures. While both indices are considered, the PCE is often given more weight in monetary policy decisions, as it is seen as a better reflection of actual consumer spending.