Qualified Variable Annuity 2024 takes center stage, offering a unique approach to retirement planning and wealth management. This guide delves into the core features, benefits, and potential drawbacks of Qualified Variable Annuities (QVAs) while providing a comprehensive overview of the market trends, investment options, and strategic considerations for incorporating QVAs into your financial plan.

QVAs are a type of annuity contract that allows investors to participate in the growth of the stock market while providing some protection against market downturns. This type of annuity is particularly attractive for individuals seeking tax-advantaged growth and a guaranteed income stream during retirement.

When choosing between an annuity and a pension, it’s essential to understand the differences. The Annuity Vs Pension 2024 page compares these retirement options.

Introduction to Qualified Variable Annuities (QVA)

Qualified Variable Annuities (QVAs) are a type of retirement savings plan that offer tax-deferred growth and the potential for higher returns compared to traditional fixed annuities. They are designed for individuals seeking to accumulate wealth for retirement while taking on a moderate level of investment risk.

Variable annuities can have tax implications. The Variable Annuity Tax Qualification 2024 article provides details on how these products are taxed.

Core Features of QVA in 2024

QVAs are characterized by several key features that distinguish them from other retirement savings options.

Understanding the structure of variable annuity contracts is crucial. You can find information on Variable Annuity Contracts 2024 to help you navigate the complexities.

- Tax-Deferred Growth:Earnings on investments within a QVA are not taxed until withdrawal in retirement, allowing for compound growth over time.

- Investment Flexibility:QVAs typically offer a range of investment options, such as mutual funds, ETFs, and other securities, allowing individuals to tailor their portfolios based on their risk tolerance and investment goals.

- Death Benefit:Many QVAs include a death benefit provision that guarantees a minimum payout to beneficiaries upon the policyholder’s death, providing an added layer of protection for loved ones.

- Guaranteed Minimum Income:Some QVAs offer a guaranteed minimum income stream during retirement, providing a sense of security and predictable cash flow.

Benefits and Drawbacks of QVA

QVAs offer several advantages, but it’s essential to consider both the pros and cons before making a decision.

Chapter 9 of the insurance code often deals with annuities. The Chapter 9 Annuities 2024 page provides a comprehensive look at the regulations.

Benefits:

- Tax Advantages:Tax-deferred growth allows for more significant wealth accumulation over time.

- Investment Flexibility:QVAs offer diverse investment options, enabling individuals to customize their portfolios to align with their financial goals and risk tolerance.

- Potential for Higher Returns:QVAs can potentially provide higher returns than traditional fixed annuities due to their investment flexibility.

- Protection against Market Volatility:Some QVAs include features like guaranteed minimum income or death benefits, providing a level of protection against market fluctuations.

Drawbacks:

- Higher Fees:QVAs typically have higher fees compared to traditional fixed annuities, which can impact overall returns.

- Investment Risk:The potential for higher returns also comes with higher investment risk, as the value of investments within a QVA can fluctuate.

- Complexity:QVAs can be more complex to understand and manage than traditional annuities, requiring careful consideration of investment options and strategies.

- Limited Liquidity:Withdrawals from a QVA before retirement may be subject to penalties or fees, limiting liquidity.

Tax Implications of QVA

The tax implications of QVAs are important to understand.

- Tax-Deferred Growth:As mentioned earlier, earnings on investments within a QVA are not taxed until withdrawal in retirement.

- Taxable Distributions:When withdrawals are made in retirement, they are generally taxed as ordinary income.

- Potential for Capital Gains Tax:If the QVA includes investments that have appreciated in value, capital gains tax may apply upon withdrawal.

Understanding the Qualified Variable Annuity Market

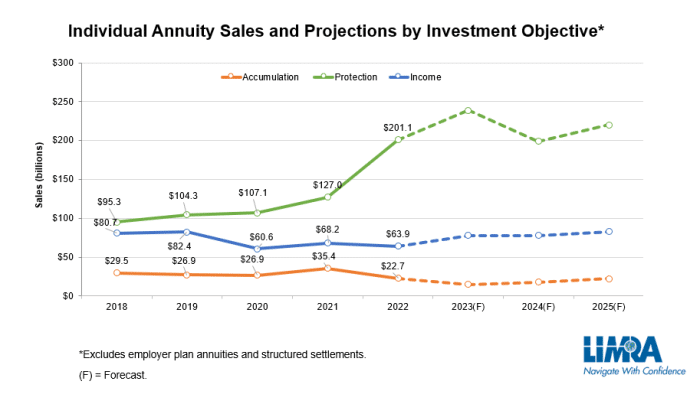

The QVA market has experienced significant growth in recent years, driven by factors such as an aging population, increasing life expectancy, and the desire for greater investment flexibility in retirement savings.

Current Market Trends for QVA in 2024

The QVA market is expected to continue its growth trajectory in 2024, fueled by several key trends.

Looking for information on specific types of annuities? The 5 Annuity 2024 page covers a range of options, from fixed to variable.

- Growing Demand for Retirement Income Solutions:As individuals approach retirement, the demand for income-generating products like QVAs is increasing.

- Low Interest Rate Environment:The current low interest rate environment makes fixed annuities less attractive, pushing investors towards QVAs for their potential for higher returns.

- Increased Focus on Longevity:With rising life expectancies, individuals need to plan for longer retirement periods, making QVAs an appealing option for long-term wealth accumulation.

Factors Influencing the Growth and Popularity of QVA

Several factors are contributing to the increasing popularity of QVAs in the retirement savings market.

Annuity and perpetuity are both financial concepts, but they have distinct features. The Annuity Vs Perpetuity 2024 page explains the key differences between these two financial instruments.

- Flexibility and Customization:QVAs offer a wide range of investment options, allowing individuals to tailor their portfolios based on their risk tolerance and investment goals.

- Tax Advantages:Tax-deferred growth and potential for tax-free withdrawals make QVAs an attractive option for tax-conscious investors.

- Guaranteed Minimum Income:Some QVAs offer guaranteed minimum income streams, providing a sense of security and predictable cash flow during retirement.

- Enhanced Retirement Planning:QVAs can be utilized effectively for retirement planning, providing a combination of growth potential and income generation.

Regulatory Landscape and Potential Changes Impacting QVA

The regulatory landscape for QVAs is evolving, with potential changes that could impact the market.

Looking for a chuckle? You can find some funny takes on annuities on the Annuity Jokes 2024 page. It’s a lighthearted look at a complex topic.

- Increased Scrutiny of Fees:Regulators are increasingly scrutinizing fees associated with QVAs, pushing insurers to offer more transparent and competitive pricing.

- Focus on Consumer Protection:Regulatory changes may focus on enhancing consumer protection by ensuring clear disclosure of risks and benefits associated with QVAs.

- Changes in Tax Laws:Potential changes in tax laws related to retirement savings could impact the attractiveness of QVAs.

Key Considerations for Choosing a QVA

Selecting the right QVA is crucial for maximizing retirement savings and ensuring that the product aligns with individual financial goals and risk tolerance.

Want to know more about annuity guarantees? The Annuity 5 Year Guarantee 2024 page explains how these guarantees work and what to consider.

Factors to Consider When Selecting a QVA in 2024

Several factors should be considered when choosing a QVA.

Annuities are available in various regions, including Hong Kong. The Annuity Hk 2024 page offers insights into the Hong Kong market.

- Investment Options:Assess the range of investment options offered, including mutual funds, ETFs, and other securities.

- Fees and Expenses:Compare the fees associated with different QVA options, including annual expenses, surrender charges, and other costs.

- Guaranteed Minimum Income:Determine if a guaranteed minimum income stream is desired and compare the terms and conditions of different options.

- Death Benefit:Consider the death benefit provisions offered by different QVA options and ensure they meet the needs of beneficiaries.

- Financial Strength of the Issuer:Research the financial strength and reputation of the insurance company issuing the QVA.

- Customer Service and Support:Evaluate the quality of customer service and support provided by the insurance company.

Comparing and Contrasting Features and Benefits of Different QVA Options

Different QVA options may offer varying features and benefits.

| Feature | Option A | Option B | Option C |

|---|---|---|---|

| Investment Options | Broad range of mutual funds and ETFs | Limited selection of mutual funds | Access to a proprietary investment platform |

| Fees | Higher annual expenses | Lower annual expenses, but higher surrender charges | Moderate fees, with a focus on transparency |

| Guaranteed Minimum Income | Offers a guaranteed minimum income stream | No guaranteed minimum income | Provides a guaranteed minimum income with a rider |

| Death Benefit | Includes a death benefit provision | No death benefit provision | Offers a flexible death benefit option |

Aligning QVA with Individual Financial Goals and Risk Tolerance

It’s essential to select a QVA that aligns with individual financial goals and risk tolerance.

Annuities can be used for various purposes, and the fund is often unrestricted. The Annuity Fund Is Unrestricted Fund 2024 page explains how this works.

- Investment Goals:Consider your investment goals, such as retirement income, wealth accumulation, or legacy planning.

- Time Horizon:Determine your time horizon for investing in a QVA, as this will impact your risk tolerance.

- Risk Tolerance:Assess your ability to handle potential fluctuations in investment value.

- Financial Situation:Evaluate your current financial situation, including income, expenses, and assets.

QVA Investment Options and Strategies

QVAs typically offer a range of investment options, allowing individuals to customize their portfolios based on their risk tolerance and investment goals.

Need to calculate the net present value of an annuity? Check out the Annuity Npv Calculator 2024 page for a handy tool to help you with your financial planning.

Investment Options Available Within QVA

The specific investment options available within a QVA will vary depending on the insurer, but they typically include:

- Mutual Funds:Offer diversification across various asset classes, such as stocks, bonds, and real estate.

- Exchange-Traded Funds (ETFs):Track specific indexes or baskets of securities, offering low-cost diversification.

- Annuities:Some QVAs offer the option to allocate a portion of their assets to traditional fixed annuities, providing a guaranteed income stream.

- Target-Date Funds:Automatically adjust asset allocation based on the investor’s retirement date, offering a convenient and diversified approach.

- Managed Accounts:Provide personalized investment management services, offering tailored strategies based on individual needs and goals.

Investment Strategies That Can Be Implemented with QVA, Qualified Variable Annuity 2024

Several investment strategies can be implemented with QVAs, depending on individual goals and risk tolerance.

- Growth-Oriented Strategy:Allocate a larger portion of assets to stocks and other growth-oriented investments to seek higher returns over the long term.

- Income-Focused Strategy:Allocate a larger portion of assets to bonds and other income-producing investments to generate a steady stream of income.

- Balanced Strategy:Diversify assets across various asset classes, such as stocks, bonds, and real estate, to achieve a balance between growth and income.

- Conservative Strategy:Allocate a larger portion of assets to low-risk investments, such as fixed annuities or money market accounts, to preserve capital and minimize risk.

Importance of Diversification and Asset Allocation Within QVA

Diversification and asset allocation are crucial for managing risk and maximizing returns within a QVA.

Kenya’s annuity market is growing, with a range of options available to individuals and families. Learn more about the current trends and options in the Annuity Kenya 2024 article.

- Diversification:Spreading investments across various asset classes helps reduce risk by minimizing the impact of any single investment’s performance.

- Asset Allocation:Determining the appropriate mix of asset classes, such as stocks, bonds, and real estate, based on individual goals and risk tolerance.

QVA and Retirement Planning

QVAs can play a significant role in retirement planning, offering a combination of growth potential and income generation.

The benefit base of a variable annuity is an important factor to consider. The Variable Annuity Benefit Base 2024 page explains how this base is calculated and what it means for your income.

Utilizing QVA Effectively for Retirement Planning

QVAs can be utilized effectively for retirement planning by:

- Accumulating Wealth:Tax-deferred growth allows for more significant wealth accumulation over time.

- Generating Income:QVAs can provide a source of income during retirement through withdrawals or guaranteed minimum income streams.

- Managing Risk:QVAs can help manage retirement income risk through features like guaranteed minimum income or death benefits.

Contribution of QVA to Income Generation During Retirement

QVAs can contribute to income generation during retirement through:

- Withdrawals:Individuals can withdraw funds from their QVA during retirement, subject to tax implications.

- Guaranteed Minimum Income:Some QVAs offer guaranteed minimum income streams, providing a predictable source of income.

- Annuitization:Upon reaching retirement, individuals can annuitize their QVA, converting their accumulated wealth into a guaranteed stream of income for life.

QVA Strategies for Different Retirement Scenarios

Different retirement scenarios may require different QVA strategies.

- Early Retirement:A growth-oriented strategy may be suitable for individuals planning to retire early, allowing for more time to accumulate wealth.

- Traditional Retirement:A balanced strategy may be appropriate for individuals retiring at the traditional age, balancing growth potential with income generation.

- Late Retirement:An income-focused strategy may be preferred for individuals retiring later in life, prioritizing income generation over growth potential.

QVA and Estate Planning

QVAs can play a role in estate planning, offering tax advantages and providing a mechanism for wealth transfer.

Role of QVA in Estate Planning and Wealth Transfer

QVAs can be used in estate planning by:

- Minimizing Estate Taxes:QVAs can help minimize estate taxes by passing wealth to beneficiaries tax-deferred.

- Providing for Beneficiaries:Death benefit provisions in QVAs can provide financial security for beneficiaries upon the policyholder’s death.

- Controlling Wealth Transfer:QVAs can be structured to control the timing and method of wealth transfer to beneficiaries.

Tax Implications of QVA in Estate Planning

The tax implications of QVAs in estate planning are complex and depend on several factors.

Variable annuities offer a combination of guaranteed income and potential growth. If you’re considering this type of insurance, the Variable Annuity Insurance 2024 article provides a good overview.

- Death Benefit:Death benefits from QVAs are generally subject to income tax but may be exempt from estate taxes.

- Inherited QVAs:Beneficiaries who inherit QVAs may be subject to different tax rules than the original policyholder.

- Estate Tax Planning:Consult with a tax advisor to understand the specific tax implications of QVAs in your estate plan.

QVA Strategies for Estate Planning Purposes

Various QVA strategies can be used for estate planning purposes.

If you’re studying for the JAIIB exam, you’ll need to understand annuity formulas. You can find resources on the Annuity Formula Jaiib 2024 page, which covers the basics of annuity calculations.

- Naming Beneficiaries:Designate specific beneficiaries for the QVA to ensure the desired distribution of assets.

- Trust Ownership:Transfer ownership of the QVA to a trust to control distribution and potentially minimize estate taxes.

- Irrevocable Life Insurance Trusts (ILITs):Use an ILIT to hold the QVA and potentially reduce estate taxes.

Final Thoughts

In conclusion, Qualified Variable Annuities offer a compelling combination of potential growth, income security, and tax advantages. Understanding the nuances of QVAs, including their investment options, tax implications, and potential drawbacks, is essential for making informed financial decisions. By carefully considering your individual financial goals and risk tolerance, you can determine if a QVA is the right fit for your retirement planning strategy.

Questions Often Asked: Qualified Variable Annuity 2024

What is the difference between a Qualified Variable Annuity (QVA) and a traditional annuity?

A traditional annuity provides a fixed stream of income, while a QVA allows you to invest your funds in a variety of investment options, such as stocks, bonds, and mutual funds. QVAs offer the potential for higher returns, but they also carry a higher level of risk.

Are there any tax implications associated with QVAs?

Yes, QVAs have certain tax implications. The growth of your QVA is typically tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them in retirement. However, withdrawals from a QVA may be subject to ordinary income tax.

How can I find a qualified financial advisor to help me with my QVA decisions?

You can seek guidance from a certified financial planner (CFP) or a registered investment advisor (RIA) who specializes in retirement planning and annuities. They can provide personalized advice and help you select the QVA that best meets your needs.