Pv Annuity With Growth 2024 takes center stage, offering a compelling approach to financial planning and investment analysis. This concept explores the value of a series of future payments that grow over time, providing insights into their present-day worth.

The return on an annuity can vary depending on the investment strategy and market conditions. 7 Annuity Return 2024 provides insights into factors that influence annuity returns.

By understanding the dynamics of growth and its impact on present value calculations, individuals and organizations can make informed decisions about investments, retirement planning, and other financial endeavors.

This guide delves into the intricacies of PV annuities with growth, exploring its core features, real-world applications, and key factors that influence its calculation. It provides a step-by-step approach to determining the present value of these annuities, considering crucial aspects like inflation, taxes, and potential risks.

Wondering how much you could receive from an annuity? How Much Will An Annuity Pay Calculator 2024 provides tools and information to help you estimate your potential annuity payments.

Through a combination of theoretical explanations and practical examples, this guide aims to equip readers with the knowledge and tools to effectively utilize PV annuities with growth in their financial strategies.

Understanding PV Annuities with Growth

A PV annuity with growth, also known as a growing annuity, is a stream of future payments that increase at a constant rate over time. This concept is crucial in financial planning and investment analysis as it helps determine the present value of a series of future payments that are expected to grow.

Defining a PV Annuity with Growth

A PV annuity with growth is a financial tool that calculates the present value of a series of future payments that increase at a constant rate over time. It’s essentially a traditional PV annuity but with the added factor of growth.

Annuity is a series of payments made over a specific period. Annuity Is Series 2024 explains how this concept applies to financial planning and investments.

This growth factor reflects the anticipated increase in the payment amount over the annuity’s term. This growth could be due to factors such as inflation, investment returns, or salary increases.

Growth Factor’s Influence on Present Value

The growth factor significantly impacts the present value calculation. A higher growth rate leads to a higher present value because the future payments are expected to be larger. Conversely, a lower growth rate results in a lower present value. The growth factor is incorporated into the present value formula, influencing the overall calculation.

Comparing Traditional PV Annuities with PV Annuities with Growth, Pv Annuity With Growth 2024

The key difference between a traditional PV annuity and a PV annuity with growth lies in the growth factor. In a traditional PV annuity, the payments remain constant throughout the annuity’s term. In contrast, a PV annuity with growth incorporates a growth factor, meaning the payments increase over time.

When purchasing an annuity, the life expectancy of the annuitant is a crucial factor. When Annuity Is Written Whose Life Expectancy 2024 explains how this affects the annuity’s terms and payout structure.

This growth factor makes the present value of a PV annuity with growth generally higher than a traditional PV annuity.

Omni Calculator provides a user-friendly tool for calculating annuity payments. Omni Calculator Annuity 2024 allows you to explore different scenarios and understand the impact of various factors.

- Traditional PV annuity: Payments remain constant throughout the annuity’s term.

- PV annuity with growth: Payments increase at a constant rate over time.

Applications of PV Annuities with Growth

PV annuities with growth find application in various financial scenarios, providing valuable insights for planning and decision-making.

Real-World Scenarios

Here are some examples of how PV annuities with growth are used in real-world situations:

- Retirement planning:PV annuities with growth can be used to estimate the present value of future retirement income, considering potential growth in investment returns or Social Security benefits.

- Investment analysis:Investors can use PV annuities with growth to evaluate the present value of future cash flows from an investment, factoring in expected growth in dividends or rental income.

- Business valuation:Companies can use PV annuities with growth to estimate the present value of future earnings, taking into account anticipated growth in revenue or profits.

Financial Planning and Investment Analysis

PV annuities with growth are essential tools for financial planning and investment analysis. They allow individuals and businesses to:

- Estimate the present value of future cash flows:This helps make informed decisions about investments, savings, and retirement planning.

- Compare different investment options:By calculating the present value of various investments, investors can choose the option that offers the highest return.

- Plan for future expenses:PV annuities with growth can be used to estimate the present value of future expenses, such as college tuition or healthcare costs.

Retirement Planning

PV annuities with growth play a crucial role in retirement planning. They help individuals:

- Estimate the amount of savings needed:By calculating the present value of future retirement income needs, individuals can determine how much they need to save.

- Choose appropriate investment strategies:Understanding the growth potential of different investment options can help individuals create a diversified portfolio.

- Plan for longevity:As life expectancies increase, PV annuities with growth can help individuals plan for a longer retirement period, ensuring they have sufficient income to meet their needs.

Factors Affecting PV Annuities with Growth

Several factors influence the present value of an annuity with growth, impacting the overall calculation.

Key Factors

The following factors significantly impact the present value of a PV annuity with growth:

- Interest rate:A higher interest rate leads to a lower present value because the time value of money is greater. The present value of future payments is discounted at a higher rate.

- Growth rate of annuity payments:As mentioned earlier, a higher growth rate leads to a higher present value because the future payments are expected to be larger.

- Number of periods:A longer annuity term (more periods) generally results in a higher present value because there are more future payments to be discounted.

- Initial payment amount:The initial payment amount is the starting point for the annuity. A higher initial payment amount leads to a higher present value.

Impact of Interest Rates

The interest rate used to discount future payments is crucial in determining the present value. A higher interest rate implies a higher opportunity cost of money, leading to a lower present value. For example, if the interest rate is 5%, the present value of $100 received in one year is $95.24.

If you’re studying finance or economics, Quizlet can be a valuable resource for learning about annuities. An Annuity Is Quizlet 2024 provides definitions, examples, and practice questions to solidify your understanding.

However, if the interest rate is 10%, the present value of the same $100 is only $90.91.

Excel can also be used to calculate annuities due, which are payments made at the beginning of each period. Calculating Annuity Due In Excel 2024 offers guidance on this specific type of annuity calculation.

Growth Rate’s Influence

The growth rate of the annuity payments also plays a significant role in the present value calculation. A higher growth rate implies that the future payments will be larger, leading to a higher present value. For instance, if the growth rate is 3%, the present value of a $100 annuity payment received in one year is $97.09.

Annuity is a financial product that offers a stream of regular payments, often used for retirement income. Annuity Is The Value Of 2024 explores how annuities can provide a steady income flow and financial security.

However, if the growth rate is 5%, the present value of the same $100 payment is $95.24.

Calculating PV Annuities with Growth: Pv Annuity With Growth 2024

Calculating the present value of an annuity with growth involves a specific formula and a step-by-step process.

For those seeking financial products that align with Islamic principles, the question of whether annuities are halal arises. Is Annuity Halal 2024 discusses the relevant considerations.

Formula for PV

The formula for calculating the present value of an annuity with growth is as follows:

PV = P

Annuity options vary depending on your needs and goals. Annuity Options 2024 provides an overview of different annuity types and their features.

- [(1

- (1 + g) ^

- n) / (r

- g)]

Where:

- PV = Present value

- P = Initial payment amount

- g = Growth rate of annuity payments

- r = Discount rate (interest rate)

- n = Number of periods

Step-by-Step Guide

Here’s a step-by-step guide to calculating the present value of an annuity with growth:

- Determine the initial payment amount (P):This is the first payment in the annuity stream.

- Identify the growth rate (g):This is the constant rate at which the annuity payments increase over time.

- Determine the discount rate (r):This is the interest rate used to discount future payments.

- Specify the number of periods (n):This is the total number of payments in the annuity stream.

- Plug the values into the formula:Substitute the values for P, g, r, and n into the formula above.

- Calculate the present value (PV):Solve the equation to determine the present value of the annuity with growth.

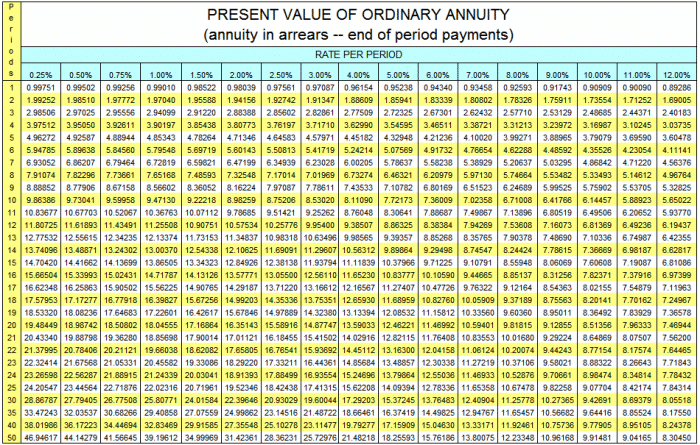

Using Financial Calculators or Spreadsheets

Financial calculators and spreadsheet software, such as Microsoft Excel, can simplify the calculation of PV annuities with growth. These tools have built-in functions that automate the calculation, making it more efficient and accurate. Most financial calculators and spreadsheets offer a function for calculating the present value of an annuity with growth, allowing users to input the necessary variables and obtain the result quickly.

Annuity can be a valuable tool for retirement planning, but it’s essential to understand the pros and cons. Annuity Is Good Or Bad 2024 offers insights to help you decide if an annuity is the right choice for you.

Practical Considerations

When calculating the present value of an annuity with growth, it’s essential to consider practical factors such as inflation and taxes.

Inflation and Taxes

Inflation can erode the purchasing power of future payments, making the present value lower. Therefore, it’s crucial to adjust the growth rate for inflation when calculating the present value. Similarly, taxes can reduce the actual amount of payments received, impacting the present value.

If you’re comfortable with Excel, you can calculate your annuity payments yourself. Calculating Annuity With Excel 2024 provides a guide and formulas to help you get started.

It’s important to consider the tax implications of the annuity when making calculations.

From mortgages to retirement plans, annuities play a role in many aspects of life. Annuity Examples In Real Life 2024 illustrates how annuities are used in everyday financial situations.

Potential Risks

Investing in annuities with growth carries certain risks:

- Interest rate risk:If interest rates rise, the present value of the annuity may decline. This is because the future payments are discounted at a higher rate.

- Growth rate risk:The actual growth rate of the annuity payments may be lower than expected, resulting in a lower present value.

- Inflation risk:Inflation can erode the purchasing power of future payments, making the present value lower.

- Credit risk:If the issuer of the annuity defaults, investors may lose their investment.

Best Practices for Management

To manage and monitor PV annuities with growth effectively, consider the following best practices:

- Diversify your investments:Don’t put all your eggs in one basket. Diversifying your investment portfolio can help mitigate risk.

- Monitor the performance of your investments:Regularly review the performance of your annuities and adjust your investment strategy as needed.

- Consult with a financial advisor:A financial advisor can help you create a personalized investment plan and manage your PV annuities with growth effectively.

Wrap-Up

Understanding PV annuities with growth empowers individuals and organizations to make sound financial decisions, particularly when planning for the future. By grasping the principles behind this concept, one can effectively assess the present value of future income streams that are expected to increase over time.

This knowledge is invaluable in making informed choices regarding investments, retirement planning, and other financial strategies, ultimately leading to greater financial security and stability.

Annuity’s value is tied to its present value, meaning the current worth of future payments. Annuity Is Present Value 2024 explains how this concept influences annuity calculations.

Q&A

What are the benefits of using a PV annuity with growth in retirement planning?

Annuity and pension might sound similar, but they’re not the same thing. Is Annuity The Same As Pension 2024 explains the differences, helping you understand which option best suits your retirement goals.

A PV annuity with growth allows for a more accurate assessment of the present value of future retirement income, considering the potential for growth in income streams. This can help individuals plan for a more comfortable and secure retirement.

How does inflation impact the present value of an annuity with growth?

Inflation erodes the purchasing power of money over time. When calculating the present value of an annuity with growth, it’s essential to factor in inflation to ensure that the present value accurately reflects the real value of future payments.

What are some common risks associated with investing in annuities with growth?

Risks include interest rate fluctuations, market volatility, and the potential for the growth rate to be lower than anticipated. It’s crucial to carefully consider these risks and diversify investments to mitigate potential losses.