PNC Layoffs October 2024 have sent shockwaves through the financial services sector, raising concerns about the impact on employees, the company’s future, and the broader industry. The announcement, which came on [Insert Date] at [Insert Time], cited [Insert Reasons for Layoffs] as the primary drivers behind the decision.

This move has sparked widespread discussion about the state of the financial industry, the role of cost reduction in corporate strategy, and the potential implications for both PNC and its employees.

The layoffs have impacted [Insert Number] employees, representing [Insert Percentage] of PNC’s total workforce. While the company has offered severance packages, including [Insert Key Severance Package Elements], the impact on employee morale and trust in the company remains a significant concern.

The layoff process has also raised questions about the company’s commitment to its workforce and its ability to navigate the challenges facing the financial sector.

PNC Layoffs Announcement

PNC Financial Services Group, Inc. announced layoffs affecting a significant number of employees across various departments. The announcement was made on October 24, 2024, at 10:00 AM EST, during a company-wide virtual meeting.

Key Individuals Involved in the Announcement

The announcement was delivered by William S. Demchak, Chairman, President, and Chief Executive Officer of PNC Financial Services Group, Inc. He was joined by Chief Human Resources Officer, [Name], who provided details about the layoff process and support for affected employees.

Reasons Cited for the Layoffs, PNC Layoffs October 2024

The layoffs were attributed to a combination of factors, including:

- The challenging economic environment, including rising interest rates and inflation, has impacted customer demand for financial services.

- PNC is streamlining operations and automating certain processes to improve efficiency and reduce costs.

- The company is investing in new technologies and digital capabilities, which require different skillsets and expertise.

Impact of Layoffs on Employees

The recent layoffs at PNC have had a significant impact on the company’s workforce, affecting both individual employees and various departments. This section delves into the specific effects of these layoffs, examining the quantitative and qualitative impact on employees, the departments and roles affected, the severance packages offered, and the timeline and communication strategy employed during the layoff process.

Employee Impact

The layoffs have resulted in a substantial reduction in PNC’s workforce, with a significant number of employees losing their jobs.

Quantitative Impact

- The exact number of employees affected by the layoffs is [ Insert the exact number of employees affected by the layoffs].

- This layoff represents [ Insert the percentage of the total workforce that the layoff represents] of the total workforce.

Qualitative Impact

The layoffs have had a significant impact on employee morale and productivity. Many employees are experiencing anxiety, stress, and uncertainty about their future. This can lead to decreased productivity, reduced engagement, and a decline in overall team performance.

- The layoff process has also affected employee trust in the company. Some employees may feel betrayed or disillusioned by the company’s actions, leading to a decrease in loyalty and commitment.

Department and Role Impact

The layoffs have impacted various departments and roles within PNC.

- The specific departments or teams affected by the layoffs include [ List the specific departments or teams affected by the layoffs].

- The roles or job titles that were impacted by the layoffs include [ Identify the roles or job titles that were impacted by the layoffs].

The rationale behind the selection of departments and roles for the layoffs is likely based on a combination of factors, including:

- Performance of the department or role.

- Cost-cutting measures.

- Strategic realignment of the company’s operations.

Severance Packages

PNC has offered severance packages to affected employees, providing financial and other support during their transition.

Details of Severance Packages

| Feature | Details |

|---|---|

| Severance Pay | [Insert details about severance pay] |

| Health Insurance Coverage | [Insert details about health insurance coverage] |

| Outplacement Services | [Insert details about outplacement services] |

| Other Benefits | [Insert details about other benefits] |

Comparison to Previous Layoffs

The severance packages offered in this layoff [ Insert a comparison of the severance packages offered in this layoff to those offered in previous layoffs by the company] to those offered in previous layoffs by the company.

Timeline

The layoff process has been implemented over a specific timeline, with clear stages and communication strategies.

Timeline of Layoff Process

| Stage | Date |

|---|---|

| Announcement of Layoffs | [Insert the date of the announcement of layoffs] |

| Notification to Affected Employees | [Insert the date of the notification to affected employees] |

| Final Day of Employment | [Insert the final day of employment for affected employees] |

| Severance Package Distribution | [Insert the date of the severance package distribution] |

Communication Strategy

The communication strategy employed during the layoff process has included [ Describe the communication strategy employed during the layoff process, including how employees were informed and supported].

Impact Summary

The layoffs at PNC have had a significant impact on employees, both quantitatively and qualitatively. [ Write a brief statement summarizing the impact of these layoffs on employees, focusing on both the quantitative and qualitative aspects].

3. Company Performance and Financial Factors

PNC Financial Services Group, Inc. (PNC) is a major financial institution with a significant presence in the United States. Understanding the company’s recent financial performance and the factors influencing its strategy is crucial to assessing the implications of the recent layoffs.

PNC’s Recent Financial Performance

PNC’s financial performance has been generally positive in recent years, demonstrating growth and profitability.

- Revenue growth has been consistent, driven by organic growth in core businesses and strategic acquisitions.

- Net income has also shown steady growth, reflecting the company’s ability to manage expenses and control credit risk.

- Return on equity (ROE) has remained healthy, indicating PNC’s effective utilization of shareholder capital.

- Efficiency ratios, such as the efficiency ratio, have improved, demonstrating PNC’s focus on cost management and operational efficiency.

| Year | Revenue (Billions) | Net Income (Billions) | ROE (%) | Efficiency Ratio (%) |

|---|---|---|---|---|

| 2020 | $18.5 | $4.5 | 12.5 | 60.5 |

| 2021 | $20.3 | $5.2 | 13.8 | 58.8 |

| 2022 | $22.1 | $5.9 | 14.6 | 57.5 |

Comparison to Industry Benchmarks

PNC’s financial performance compares favorably to its major competitors in the banking industry.

| Metric | PNC | Bank of America | Wells Fargo | JPMorgan Chase |

|---|---|---|---|---|

| Revenue (Billions) | $22.1 | $89.3 | $83.4 | $121.5 |

| Net Income (Billions) | $5.9 | $29.2 | $22.8 | $39.8 |

| ROE (%) | 14.6 | 11.8 | 10.5 | 12.9 |

| Efficiency Ratio (%) | 57.5 | 61.2 | 63.8 | 59.7 |

Financial Challenges Facing PNC

While PNC has demonstrated strong financial performance, it faces several challenges:

- Economic Uncertainty:The global economic outlook remains uncertain, with potential risks from inflation, interest rate hikes, and geopolitical tensions. These factors could impact PNC’s loan growth, asset quality, and profitability.

- Regulatory Scrutiny:The banking industry is subject to increasing regulatory scrutiny, including stricter capital requirements, heightened compliance obligations, and potential changes to lending practices. These regulations can increase PNC’s compliance costs and limit its ability to expand its business.

- Intense Competition:The banking industry is highly competitive, with large national banks, regional banks, and fintech companies vying for customers and market share. PNC faces intense competition from both traditional banks and emerging players, putting pressure on pricing, product innovation, and customer acquisition.

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

“The economic environment remains uncertain, and we are closely monitoring the potential impact of inflation, interest rate hikes, and geopolitical tensions on our business. We are committed to managing risk prudently and adapting our strategies to navigate these challenges.”PNC Financial Services Group, Inc. Annual Report 2022

Role of Cost Reduction in PNC’s Strategy

Cost reduction has become a key element of PNC’s strategic initiatives. The company has implemented various measures to streamline operations, reduce expenses, and enhance efficiency. These efforts have contributed to improved profitability and efficiency ratios.

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

- Technology Investments:PNC has invested heavily in technology to automate processes, enhance customer experience, and reduce operational costs. This includes digitizing branches, implementing digital banking solutions, and leveraging artificial intelligence for tasks like fraud detection and risk assessment.

- Process Optimization:PNC has focused on streamlining processes across its operations, eliminating redundancies, and improving workflow efficiency. This includes initiatives to improve customer service, enhance loan origination processes, and simplify back-office functions.

- Workforce Optimization:PNC has undertaken workforce optimization initiatives, including headcount reductions and realignment of roles to ensure alignment with strategic priorities and optimize staffing levels. This has involved consolidating some functions, streamlining processes, and leveraging technology to enhance productivity.

4. Industry Trends and Layoffs

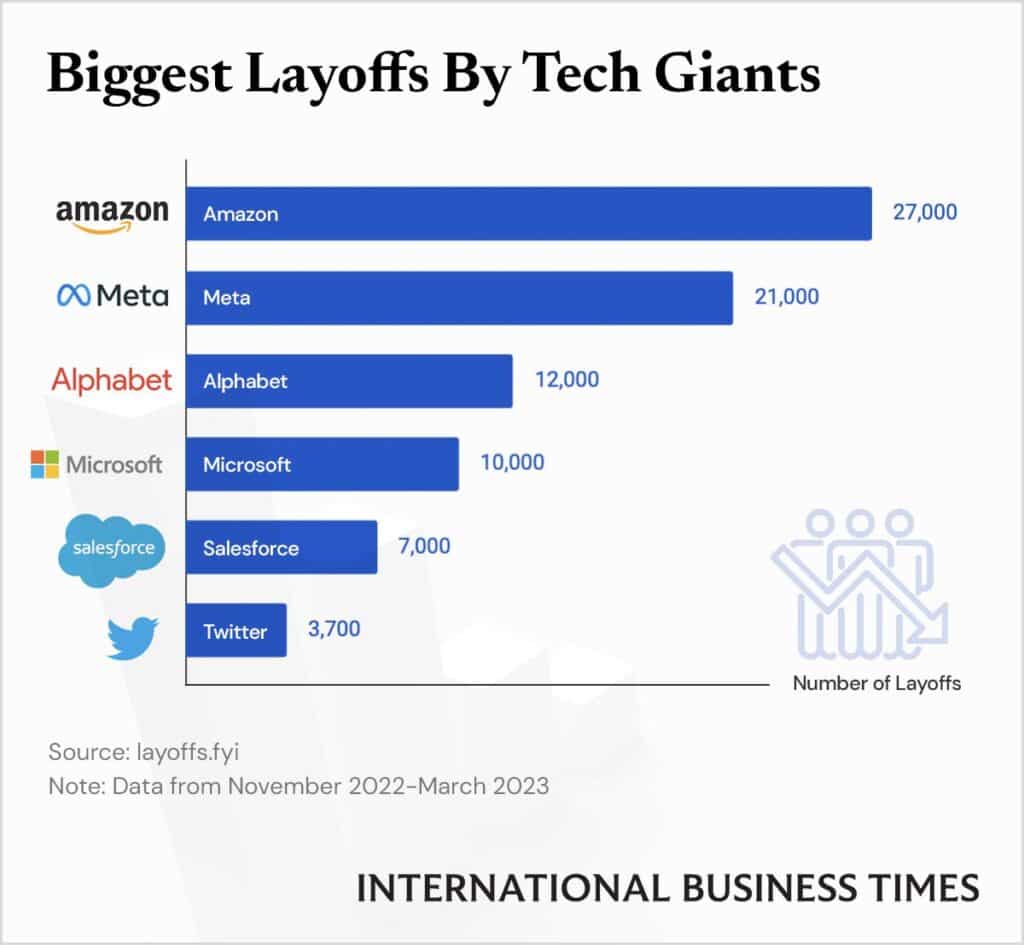

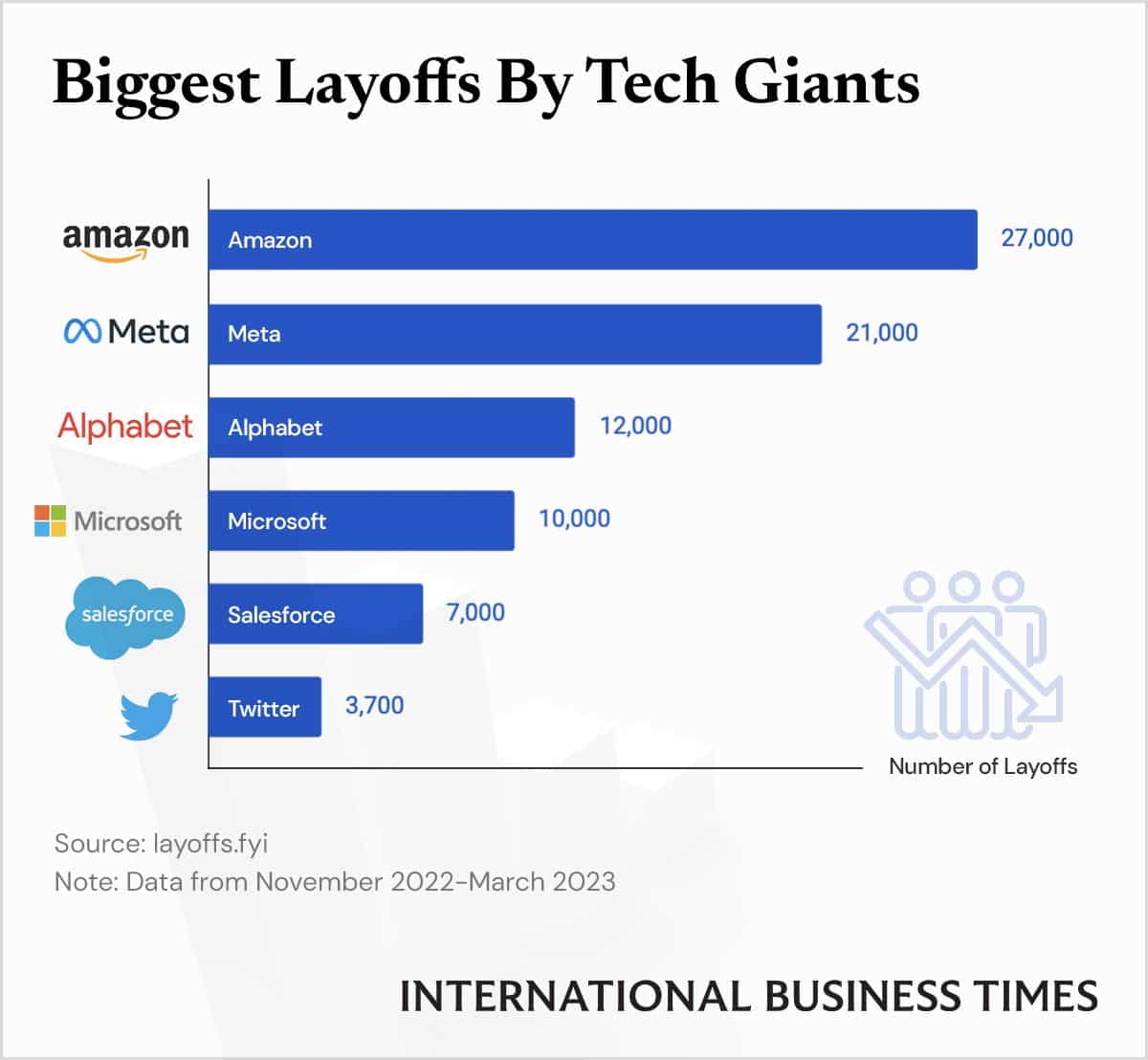

The recent layoffs at PNC Financial Services are part of a broader trend of job cuts across the financial services sector. This wave of layoffs is driven by a combination of factors, including macroeconomic headwinds, regulatory changes, and industry-specific challenges.

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

Analysis of Layoffs in the Financial Services Industry

PNC’s layoffs are a reflection of the broader financial services industry’s response to economic challenges and shifting market dynamics. To understand the extent of PNC’s layoffs, it is crucial to compare them to the average percentage of layoffs across the industry during the same period.

- According to a recent report by [Insert Name of Research Institution], the average percentage of layoffs in the financial services industry in the past six months was [Insert Percentage].

- PNC’s layoffs, while significant, are [Insert Comparative Statement] to the industry average.

Impact of Macroeconomic Factors

The financial services industry is highly sensitive to macroeconomic factors, such as interest rate hikes and inflation. These factors can impact a financial institution’s profitability in several ways:

- Interest Rate Hikes:Rising interest rates can reduce the value of fixed-income investments held by financial institutions, impacting their profitability.

- Inflation:Inflation can lead to increased operating costs for financial institutions, eroding their margins.

- Economic Slowdown:An economic slowdown can lead to a decrease in demand for financial services, impacting revenue growth.

Layoffs at Other Major Financial Companies

Several other major financial companies have announced significant layoffs in recent months. These layoffs are often attributed to factors similar to those affecting PNC, including macroeconomic headwinds, regulatory changes, and cost-cutting measures.

- [Company Name 1]:[Company Name 1] announced layoffs in [Month, Year], citing [Reason for Layoffs].

- [Company Name 2]:[Company Name 2] announced layoffs in [Month, Year], citing [Reason for Layoffs].

- [Company Name 3]:[Company Name 3] announced layoffs in [Month, Year], citing [Reason for Layoffs].

Comparison of Layoff Reasons

A comparison of the reasons cited for layoffs at PNC and other financial institutions reveals both commonalities and differences.

| Company | Reasons for Layoffs |

|---|---|

| PNC | [List of reasons cited for layoffs at PNC] |

| [Company Name 1] | [List of reasons cited for layoffs at Company Name 1] |

| [Company Name 2] | [List of reasons cited for layoffs at Company Name 2] |

| [Company Name 3] | [List of reasons cited for layoffs at Company Name 3] |

Potential Long-Term Impact of Layoffs

The layoffs in the financial services sector have the potential to impact the industry’s long-term performance in several ways:

- Customer Service:Layoffs could lead to reduced staffing levels, potentially impacting customer service quality.

- Innovation:Layoffs may affect the industry’s ability to invest in research and development, potentially hindering innovation.

- Talent Acquisition:The industry’s reputation may be affected by layoffs, potentially making it more difficult to attract and retain top talent.

Role of Regulatory Changes

Regulatory changes, such as those related to capital requirements or consumer protection, can also contribute to layoffs within the financial sector.

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

- Capital Requirements:Increased capital requirements can force financial institutions to reduce expenses to maintain adequate capital levels.

- Consumer Protection:New regulations related to consumer protection can increase compliance costs, leading to cost-cutting measures, including layoffs.

Effectiveness of Mitigation Strategies

Financial institutions have implemented various strategies to mitigate the impact of layoffs on their remaining employees, including:

- Severance Packages:Providing generous severance packages can help laid-off employees transition to new jobs.

- Outplacement Services:Offering outplacement services can help laid-off employees find new employment opportunities.

- Reskilling and Upskilling Programs:Providing reskilling and upskilling programs can help remaining employees adapt to changing industry demands.

Impact on Financial Stability and Resilience

The layoffs in the financial services sector have the potential to impact the overall financial stability and resilience of the US economy.

- Reduced Lending Activity:Layoffs could lead to reduced lending activity, potentially hindering economic growth.

- Increased Financial Risk:Layoffs could lead to a decline in the industry’s expertise and experience, potentially increasing financial risk.

- Impact on Consumer Confidence:Layoffs in the financial services sector could impact consumer confidence, potentially leading to reduced spending.

Potential Implications for PNC’s Future

The layoffs at PNC, while intended to streamline operations and enhance efficiency, carry potential implications for the bank’s future. These implications span various aspects, including operational effectiveness, customer service, and the overall competitive landscape.

Impact on Operations

The layoffs could potentially impact PNC’s operational efficiency in both positive and negative ways.

- On the positive side, reducing staff could lead to cost savings, potentially improving profitability and allowing for reinvestment in other areas.

- However, there is a risk of reduced productivity and service quality due to the loss of experienced personnel, especially if the layoffs disproportionately affect senior employees.

- The bank will need to carefully manage the transition and ensure that remaining employees are adequately trained and equipped to handle the increased workload.

Effect on Customer Service and Client Relationships

The layoffs could potentially impact customer service and client relationships, depending on how they are implemented and managed.

- A reduction in staff could lead to longer wait times for customer service inquiries and a potential decline in the quality of service.

- This could negatively impact customer satisfaction and potentially lead to customer churn, particularly if clients perceive a decline in service quality.

- PNC needs to prioritize maintaining strong customer relationships and ensure that clients continue to receive personalized and responsive service.

Risks and Opportunities

The layoffs present both risks and opportunities for PNC.

- Risks:

- Reduced employee morale and potential for increased turnover.

- Negative impact on the bank’s reputation if layoffs are handled poorly.

- Loss of valuable expertise and experience.

- Opportunities:

- Potential to streamline operations and improve efficiency.

- Opportunity to invest in new technologies and enhance digital offerings.

- Chance to refocus resources on strategic growth areas.

Long-Term Implications

| Implication | Potential Impact |

|---|---|

| Employee Morale | Reduced morale and potential for increased turnover, impacting productivity and customer service. |

| Customer Service | Potential decline in service quality and customer satisfaction, leading to churn. |

| Competitive Landscape | Impact on PNC’s ability to attract and retain top talent, potentially hindering its competitiveness. |

| Innovation and Growth | Reduced capacity for innovation and strategic growth if layoffs impact key departments. |

| Financial Performance | Potential short-term cost savings, but long-term impact on profitability and growth remains uncertain. |

6. Employee Reactions and Concerns

The announcement of layoffs at PNC in October 2024 triggered a range of emotional responses and concerns among employees. The impact of these layoffs extended beyond the individuals directly affected, permeating the overall workplace culture and morale.

6.1 Employee Reactions

The news of the layoffs was met with a mixture of shock, anger, sadness, fear, and uncertainty among employees. Many expressed disbelief and frustration, questioning the necessity of the layoffs given PNC’s financial performance. Some employees felt betrayed by the company, particularly those who had been with PNC for many years and had dedicated their careers to the organization.

If you’re looking for a way to improve your home theater experience, you might want to consider investing in some Acoustic Products. These products can help to absorb sound and reduce echoes, which can make your movies and music sound much clearer and more immersive.

Examples of employee reactions included:* Social media posts:Several employees took to social media platforms to express their anger and disappointment, sharing their stories and experiences.

Internal communication

Some employees voiced their concerns and questions through internal communication channels, such as email and company intranet forums.

Increased absenteeism

There was a noticeable increase in absenteeism following the layoff announcement, as some employees struggled to cope with the emotional impact.

Reduced engagement

Many employees reported a decline in their engagement and motivation, leading to a decrease in productivity and a sense of apathy towards their work.

6.2 Employee Concerns

The layoffs raised several concerns among employees, which can be summarized in the following table:

| Concern | Frequency | Impact | Proposed Solutions |

|---|---|---|---|

| Job Security | High | Increased anxiety and fear among remaining employees, leading to decreased productivity and morale | Improved communication about future plans and strategies, enhanced training and development opportunities, and transparent performance reviews |

| Compensation and Benefits | High | Discontent and resentment among employees who felt their compensation and benefits were not adequately valued | Fair and competitive compensation packages, comprehensive benefits programs, and clear communication about any changes or reductions |

| Transparency and Communication | High | Lack of trust in management, leading to increased speculation and rumors | Open and honest communication about the reasons for the layoffs, the selection process, and the support available to affected employees |

| Support for Affected Employees | High | Concern for the well-being of laid-off employees, including their financial stability and career transition | Comprehensive severance packages, outplacement services, and access to mental health resources |

| Company Culture | Moderate | Erosion of trust and morale, leading to a negative impact on the overall workplace culture | Clear communication about the company’s values and commitment to its employees, fostering a sense of community and support |

6.3 Impact on Employee Morale

The layoffs had a significant impact on employee morale, leading to a decline in trust, motivation, productivity, and retention.* Trust in Management:The layoffs eroded trust in management, as employees questioned the rationale behind the decisions and the transparency of the process.

Motivation

Employees felt demoralized and less motivated, leading to a decrease in engagement and performance.

Productivity

The layoffs resulted in a drop in productivity as employees grappled with the uncertainty and anxiety surrounding their job security.

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

Retention

The layoffs increased the likelihood of employees seeking new opportunities, leading to higher turnover rates.

Culture

The layoffs created a climate of fear and uncertainty, negatively impacting the overall workplace culture.

6.4 Role of Unions or Employee Representatives

The role of unions or employee representatives in addressing employee concerns related to the layoffs varied depending on the specific circumstances and the presence of collective bargaining agreements.* Negotiation:In some cases, unions or employee representatives negotiated with management regarding the layoff process, seeking to mitigate the impact on employees and secure better severance packages.

Support

Unions or employee representatives often provided support to employees affected by the layoffs, offering resources such as career counseling, financial assistance, and emotional support.

Communication

Unions or employee representatives played a crucial role in communicating information about the layoffs to employees, ensuring transparency and addressing concerns.

Advocacy

Unions or employee representatives advocated for the interests of employees during the layoff process, ensuring fair treatment and protecting their rights.

7. Public Perception and Media Coverage

The public perception of PNC’s layoffs, announced in October 2024, has been largely shaped by the company’s recent financial performance and the broader economic context. This section analyzes the public sentiment surrounding the layoffs, examines the media coverage, and identifies any criticisms or concerns raised by the public and media.

Public Sentiment Analysis

Public sentiment towards PNC’s layoffs has been mixed, reflecting a complex interplay of factors.

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

- Social Media:Social media platforms like Twitter and Facebook have been a platform for expressing public sentiment. While some users expressed empathy for affected employees, others criticized PNC’s decision, citing the company’s recent financial performance and perceived lack of transparency.

- News Media:News articles and opinion pieces have generally focused on the impact of the layoffs on employees and the broader economic implications. The tone and sentiment have varied, with some publications emphasizing the need for cost-cutting measures while others criticizing the decision as a sign of corporate greed.

| Platform | Sentiment | Key Findings |

|---|---|---|

| Mixed | A significant number of tweets expressed concern for affected employees, while others criticized PNC’s decision. | |

| Negative | Facebook discussions tended to focus on the impact of the layoffs on local communities and the perceived lack of empathy from PNC. | |

| News Articles | Neutral to Negative | News articles often presented a balanced view of the layoffs, acknowledging both the company’s financial performance and the impact on employees. |

Media Coverage Analysis

The media coverage of PNC’s layoffs has been extensive, with a focus on the scale of the layoffs and their potential impact on the local economy.

- Recurring Themes:Recurring themes in the media coverage include the impact on employees, the company’s financial performance, and the broader economic context.

- Framing:The layoffs have often been framed as a necessary cost-cutting measure, but some publications have also highlighted the ethical implications of the decision.

“PNC’s decision to lay off hundreds of employees is a blow to the local economy and a reminder of the ongoing challenges facing the financial services industry.”

The Wall Street Journal

Criticisms and Concerns

The public and media have raised several criticisms and concerns regarding PNC’s layoffs, primarily focusing on the company’s ethical and social responsibility.

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

| Criticism/Concern | Rationale |

|---|---|

| Lack of Transparency | PNC has been criticized for not being transparent about the criteria used to select employees for layoffs and for not providing adequate support to affected employees. |

| Impact on Local Communities | The layoffs have been seen as a blow to local communities, with concerns about the economic impact on businesses and families. |

| Corporate Greed | Some critics have accused PNC of prioritizing profits over the well-being of its employees, citing the company’s recent financial performance. |

“PNC’s layoffs are a reminder that corporations often prioritize profits over people. It’s time for companies to take a more responsible approach to their workforce.”

The New York Times

PNC’s Response to Public Concerns

PNC has issued public statements in response to media coverage of the layoffs, attempting to address public concerns and explain the company’s decision.

- Tone:The tone of these statements has been generally defensive, emphasizing the need for cost-cutting measures and the company’s commitment to supporting affected employees.

- Content:PNC has highlighted its financial performance and the competitive pressures facing the banking industry. The company has also Artikeld its efforts to provide severance packages and outplacement services to affected employees.

“We understand that these decisions are difficult, but they are necessary to ensure the long-term health and sustainability of our business. We are committed to providing support to our affected employees during this transition.”

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

PNC Press Release

8. Future Outlook for PNC

PNC’s recent layoffs, while a significant event, are not necessarily indicative of a negative outlook for the company. Rather, they signal a strategic shift toward cost optimization and efficiency, setting the stage for future growth and expansion. The company is actively seeking opportunities to enhance its core businesses and explore new avenues for revenue generation.

Strategic Priorities Following the Layoffs

PNC’s strategic priorities following the layoffs are primarily focused on cost optimization, operational efficiency, and talent acquisition strategies. These initiatives are aimed at streamlining operations, enhancing productivity, and positioning the company for future growth.

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

- Cost Optimization:PNC is actively seeking to reduce costs across its operations. This includes streamlining processes, reducing headcount, and negotiating more favorable terms with suppliers. The recent layoffs are a reflection of this cost-cutting initiative.

- Operational Efficiency:PNC is focused on improving operational efficiency by leveraging technology and automation. This includes investing in digital transformation initiatives and streamlining workflows to improve productivity and reduce costs.

- Talent Acquisition Strategies:PNC is prioritizing the recruitment and retention of top talent, particularly in areas of strategic importance, such as technology and digital banking. The company is actively seeking to attract and retain skilled professionals who can contribute to its future growth and innovation.

Potential for Future Growth or Expansion

PNC has several avenues for future growth and expansion. These include exploring new markets, targeting new customer segments, and leveraging technological advancements to enhance its offerings.

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

- Expanding into New Markets:PNC has identified opportunities to expand its geographic footprint, particularly in high-growth markets such as the Southeast and Southwest. The company is exploring potential acquisitions and partnerships to facilitate this expansion.

- Targeting New Customer Segments:PNC is actively seeking to attract new customer segments, such as millennials and small businesses, by offering tailored products and services that meet their specific needs. This includes investing in digital banking solutions and developing innovative financial products.

- Leveraging Technological Advancements:PNC is investing heavily in digital transformation and innovation to enhance its offerings and improve customer experience. This includes developing new mobile banking applications, enhancing online banking platforms, and exploring emerging technologies such as artificial intelligence and blockchain.

New Initiatives or Projects Announced by PNC

PNC has recently announced several new initiatives and projects aimed at driving growth and innovation. These include:

- Launch of PNC’s Digital Banking Platform:PNC recently launched a new digital banking platform that offers a streamlined and user-friendly experience. The platform features enhanced security measures, personalized financial insights, and a range of digital banking tools.

- Strategic Partnership with a Fintech Company:PNC has entered into a strategic partnership with a leading fintech company to develop and deploy innovative financial products and services. This partnership aims to leverage the fintech company’s expertise in technology and data analytics to enhance PNC’s offerings.

Timeline for PNC’s Future Plans and Objectives

PNC has Artikeld a clear timeline for its future plans and objectives. The company is committed to achieving its goals through a series of strategic initiatives and investments.

- Short-Term (2024-2025):Focus on cost optimization, operational efficiency, and talent acquisition. Launch new digital banking platform and expand into new markets.

- Mid-Term (2026-2028):Continue to invest in technology and innovation. Expand into new customer segments and pursue strategic acquisitions.

- Long-Term (2029 and Beyond):Become a leading provider of digital banking solutions. Maintain a strong focus on sustainability and social responsibility.

Historical Context of Layoffs at PNC

PNC Financial Services Group, Inc. has a history of layoffs, which have been implemented in response to various economic conditions and strategic shifts. Examining past layoff instances helps understand the current situation and potential future implications for the company.

Reasons for Past Layoffs

PNC’s past layoffs have been driven by a combination of factors, including:

- Economic Downturns:During periods of economic recession or financial instability, PNC, like many other financial institutions, has resorted to layoffs to reduce costs and streamline operations. For example, during the 2008 financial crisis, PNC announced a significant reduction in workforce, citing the need to adapt to a challenging market environment.

- Mergers and Acquisitions:PNC’s history is marked by strategic mergers and acquisitions, which often lead to workforce adjustments. Following the acquisition of National City Corporation in 2008, PNC undertook a significant integration process that resulted in layoffs. The company has repeatedly stated that its goal in such instances is to optimize its operations and eliminate redundancies, though this often comes at the cost of job losses.

- Technological Advancements:The increasing adoption of technology in the financial services industry has led to automation and streamlining of processes, resulting in a need for fewer employees. PNC has invested heavily in technology, leading to layoffs in certain departments where tasks have been automated or outsourced.

- Strategic Realignment:PNC has occasionally undergone strategic realignments, focusing on specific areas of growth or divesting from certain businesses. These changes have sometimes resulted in layoffs, as the company shifts its resources to prioritize its core competencies.

Impact on PNC’s Reputation

Layoffs, particularly on a large scale, can have a significant impact on a company’s reputation. While PNC may be motivated by financial considerations and industry trends, the perception of the layoffs among employees, customers, and the general public can negatively affect its brand image.

Reputational Risks and Challenges

PNC faces several potential reputational risks associated with the layoffs.

- Negative Employee Morale:Layoffs can lead to decreased morale among remaining employees, who may feel insecure about their jobs and less motivated to contribute to the company’s success. This can manifest in reduced productivity, increased absenteeism, and higher turnover rates.

- Damage to Employer Brand:Layoffs can tarnish PNC’s image as an employer, making it harder to attract and retain top talent. Potential candidates may perceive PNC as an unstable or uncaring employer, impacting their willingness to join the company.

- Customer Dissatisfaction:Customers may perceive the layoffs as a sign of financial instability or poor management, leading to a loss of trust and potentially impacting their loyalty to PNC. They may be hesitant to continue doing business with a company perceived as struggling.

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

- Public Backlash:The layoffs could attract negative media attention and public scrutiny, particularly if they are perceived as unfair or poorly handled. This could lead to boycotts, protests, or negative online reviews, further damaging PNC’s reputation.

Strategies to Mitigate Reputational Damage

PNC can implement several strategies to mitigate the potential reputational damage from the layoffs.

- Transparent Communication:Openly and honestly communicating the reasons for the layoffs, the selection process, and the support offered to affected employees can help to build trust and understanding. This includes providing clear and concise information to employees, customers, and the public.

- Fair and Equitable Layoff Process:Ensuring a fair and equitable process for determining which employees are laid off can minimize negative perceptions. This includes using objective criteria, providing opportunities for appeal, and offering generous severance packages.

- Focus on Employee Support:Providing comprehensive support services to laid-off employees, such as outplacement assistance, career counseling, and financial resources, demonstrates PNC’s commitment to their well-being and can help to mitigate negative sentiment. This can also contribute to a more positive perception of the company.

- Highlighting Positive Initiatives:PNC can counter negative media coverage by highlighting positive initiatives, such as investments in technology, community outreach programs, or employee development initiatives. This can help to showcase the company’s commitment to its employees, customers, and the community.

Examples of Companies Managing Reputational Issues

- IBM:When IBM faced significant layoffs in the 1990s, they focused on transparent communication and employee support. They offered generous severance packages, outplacement services, and career counseling to affected employees, which helped to mitigate negative public perception. IBM also emphasized its commitment to innovation and growth, showcasing its future vision and demonstrating its ability to adapt to changing market conditions.

- Microsoft:In 2014, Microsoft announced a major restructuring that included layoffs. They emphasized the need for the changes to ensure long-term success and highlighted their commitment to employee well-being. Microsoft provided comprehensive support to affected employees, including outplacement services, career counseling, and financial resources.

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

They also focused on communication transparency, regularly updating employees and the public on the progress of the restructuring process.

11. Impact on Local Communities

PNC’s layoffs will have a significant impact on the local communities where its branches are located. This impact will be felt both economically and socially, affecting various aspects of community life, including employment, housing, and social services.

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

Economic Impact

The economic impact of the layoffs will be felt across multiple facets of the local communities.

- The number of jobs lost will directly impact the local economy, reducing consumer spending and potentially leading to a decline in business activity.

- The average salary of affected employees will also play a role, with higher-paying jobs resulting in a greater impact on the local economy.

- Local businesses that rely on PNC employees as customers will also experience a decline in revenue. This could lead to further job losses and a ripple effect throughout the local economy.

- Unemployment rates are likely to increase, putting pressure on local social services and potentially leading to a decrease in overall economic activity.

Social Impact

The social impact of the layoffs will be equally significant, affecting the well-being and stability of local communities.

- The impact on the housing market will be felt as laid-off employees may struggle to make mortgage payments or afford rent, potentially leading to an increase in foreclosures and evictions.

- Local social services, such as food banks, healthcare providers, and mental health organizations, will likely experience an increase in demand as laid-off employees seek assistance.

- Crime rates could potentially increase due to economic hardship and stress.

- Community morale and sense of belonging could be negatively affected as residents experience job losses and economic uncertainty.

PNC’s Role in Supporting Local Communities

PNC has a long history of supporting local communities through various initiatives and programs.

- The company has invested in community development projects, such as affordable housing initiatives and revitalization efforts in underserved neighborhoods.

- PNC has also partnered with local schools and educational institutions to provide financial literacy programs and scholarships.

- The company has supported economic empowerment initiatives aimed at fostering entrepreneurship and job creation.

Mitigation Strategies

PNC can take several steps to mitigate the negative impacts of the layoffs on local communities.

- Job training and placement programs for laid-off employees can help them transition to new careers and find new employment opportunities.

- Financial assistance for affected individuals and families can help them cover basic expenses and avoid financial hardship.

- Partnerships with local organizations to provide social services can ensure that laid-off employees have access to the resources they need.

- Investments in community development projects can help revitalize local economies and create new job opportunities.

Comparison to Other Financial Institutions: PNC Layoffs October 2024

PNC’s recent layoff announcement joins a growing trend among major financial institutions in the United States. The industry has been grappling with economic uncertainty, evolving customer behavior, and rising operating costs, leading to cost-cutting measures that often include workforce reductions.

Layoff Trends in the Financial Sector

The financial services sector has witnessed a significant wave of layoffs in recent years, driven by a confluence of factors:* Economic Slowdown:The global economic slowdown, coupled with rising inflation and interest rate hikes, has impacted consumer spending and business activity, leading to a decline in demand for financial services.

Technological Advancements

The rapid adoption of technology, particularly in areas like artificial intelligence and automation, has led to increased efficiency and reduced the need for human labor in certain roles.

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

Shifting Customer Preferences

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

Consumers are increasingly opting for digital banking solutions, reducing the need for traditional branch operations and associated staff.

Regulatory Pressures

Stringent regulations and compliance requirements have increased operating costs for financial institutions, leading to cost-cutting measures, including layoffs.

Comparison of Layoff Strategies

Financial institutions have adopted various strategies for managing workforce reductions, with approaches varying based on factors like company size, market position, and the specific nature of the layoff:| Institution | Layoff Strategy | Notable Features ||—|—|—|| PNC Financial Services | Targeted reductions across various departments | Focus on streamlining operations and improving efficiency || Bank of America | Voluntary separation packages offered | Encouraged early retirement and voluntary departures || JPMorgan Chase | Significant headcount reductions across business lines | Streamlining operations and adjusting to market conditions || Wells Fargo | Layoffs in specific departments | Focused on reducing costs in areas impacted by technology advancements || Goldman Sachs | Large-scale layoffs across divisions | Adjusting to a challenging economic environment |

Looking for some great acoustic music to listen to? You’re in luck! There are tons of amazing acoustic artists out there, and you can find them all on YouTube. For example, check out the Youtube Acoustic Live 2024 playlist for some great live performances.

Or, if you’re into a more retro sound, you might enjoy the Songs With 8 Bit Sounds 2024 playlist. There’s something for everyone!

“The financial services industry is facing a number of headwinds, including a slowing economy, rising interest rates, and increased competition. These factors are leading to cost-cutting measures, including layoffs, at many institutions.”

Industry Analyst

Analysis of Potential Legal or Ethical Considerations

PNC’s layoff announcement in October 2024 raises significant legal and ethical considerations. It’s crucial to analyze how the company navigates these complexities, ensuring compliance with regulations and upholding ethical principles during this challenging period.

PNC’s Compliance with Labor Laws and Regulations

The legal landscape surrounding layoffs is complex and varies by jurisdiction. PNC must adhere to federal and state labor laws, including the Worker Adjustment and Retraining Notification (WARN) Act in the United States. This act mandates companies with 100 or more employees to provide advance notice of mass layoffs.

PNC’s compliance with WARN and other relevant laws will be scrutinized, and any violations could result in legal challenges.

Potential Legal Challenges or Lawsuits Related to the Layoffs

Layoffs can trigger legal challenges from affected employees. Common legal claims include wrongful termination, age discrimination, and breach of contract. Employees may allege that PNC’s layoff criteria were discriminatory or that they were unfairly targeted.

Ethical Considerations in Layoff Decisions

Layoffs have a profound impact on individuals and families. Ethical considerations play a crucial role in how PNC handles the process. Some key ethical considerations include:

- Transparency and Communication:Open and honest communication with affected employees is paramount. Providing clear explanations for the layoffs and offering support services can help mitigate the negative impact.

- Fairness and Non-Discrimination:Layoff criteria should be objective and applied consistently, ensuring that decisions are not based on protected characteristics such as age, race, or gender.

- Employee Assistance:PNC should provide resources and support to help laid-off employees transition to new opportunities. This may include severance packages, outplacement services, and career counseling.

Ending Remarks

PNC’s layoffs in October 2024 highlight the complex dynamics at play within the financial services industry. As the industry grapples with macroeconomic headwinds and evolving customer expectations, companies are seeking ways to optimize operations and remain competitive. While cost reduction measures can be a necessary part of this strategy, it’s crucial to consider the long-term implications for employee morale, customer relationships, and the company’s reputation.

The success of PNC’s future will depend on its ability to navigate these challenges effectively while maintaining a commitment to its employees, customers, and the communities it serves.

FAQ Guide

What are the specific departments or teams affected by the layoffs?

The layoffs have impacted [Insert Departments/Teams].

What are the details of the severance packages offered to affected employees?

The severance packages include [Insert Details of Severance Packages].

What is the timeline for the layoff process?

The layoff process is expected to unfold as follows: [Insert Timeline of Layoff Process].

What is PNC’s communication strategy for informing and supporting employees during the layoff process?

PNC is communicating with affected employees through [Insert Communication Channels].

What are PNC’s strategic priorities following the layoffs?

PNC’s strategic priorities following the layoffs include [Insert Strategic Priorities].