PNC Bank Layoffs October 2024: A wave of layoffs rippled through PNC Bank in October 2024, affecting numerous employees across various departments and locations. This event, driven by a complex interplay of economic factors and strategic shifts, has left a significant impact on the bank’s workforce and the broader banking industry.

This analysis delves into the reasons behind these layoffs, their impact on employees, and the potential long-term consequences for PNC Bank, its stakeholders, and the economy as a whole.

The layoffs at PNC Bank serve as a stark reminder of the challenges facing the banking industry in an evolving economic landscape. The decision to reduce staff was driven by a combination of factors, including the need to adapt to changing customer preferences, technological advancements, and the broader economic climate.

While PNC Bank has cited these factors as the primary drivers behind the layoffs, the event has sparked concerns about the bank’s future direction and its commitment to its employees.

PNC Bank Layoffs Overview

PNC Bank announced layoffs in October 2024, impacting a significant number of employees across various departments and locations. These reductions in force were a result of a combination of factors, including economic headwinds and the bank’s strategic realignment.

Reasons for Layoffs

PNC Bank cited several reasons for the layoffs, emphasizing the need to adapt to evolving market conditions and optimize its operations for efficiency and profitability. The bank highlighted the following key factors:

- Economic Uncertainty:The global economic landscape has been characterized by rising inflation, interest rate hikes, and geopolitical tensions. These factors have created uncertainty in the financial markets, impacting consumer and business spending, and leading to a slowdown in economic growth. PNC Bank, like many other financial institutions, has been navigating these challenging conditions, which have impacted its business operations and revenue streams.

- Shifting Consumer Behavior:The rise of digital banking and fintech companies has led to a significant shift in consumer behavior, with customers increasingly opting for online and mobile banking services. This has resulted in a decline in branch visits and traditional banking activities, requiring banks to adapt their operations and reduce their physical footprint.

- Strategic Realignment:PNC Bank has been actively pursuing a strategic realignment, focusing on specific growth areas and streamlining its operations. This involves investing in digital technologies, expanding its presence in key markets, and optimizing its workforce to align with its strategic priorities.

The layoffs were part of this broader strategic realignment, aimed at enhancing efficiency and competitiveness.

Public Statements and Press Releases

PNC Bank has issued public statements and press releases acknowledging the layoffs, expressing its commitment to supporting impacted employees through severance packages and outplacement services. The bank has also emphasized its focus on long-term growth and its belief that these strategic adjustments will position it for future success.

“We understand that these changes are difficult for our colleagues, and we are committed to providing them with the support they need during this transition. We are confident that these strategic adjustments will position PNC for continued success in the years to come.”

Planning ahead is always a good idea, and a October 2024 calendar can help you stay organized. Whether you’re scheduling appointments, marking important dates, or simply keeping track of your daily activities, a calendar can be an invaluable tool.

William Demchak, Chairman, President, and CEO of PNC Financial Services Group

2. Impact on Employees

The PNC Bank layoffs in October 2024 will have a significant impact on the affected employees, both professionally and personally. This section will analyze the potential consequences of job loss, explore the emotional toll it may take, and examine the support services offered by PNC Bank to help employees navigate this challenging transition.

If you’ve filed an extension for your taxes, the October extension tax deadline 2024 is a crucial date to remember. Make sure to gather all necessary documents and file your taxes before the deadline to avoid any penalties.

2.1. Job Loss and Financial Hardship

The exact number of employees affected by the layoffs is not publicly available. However, based on reports and industry trends, it is estimated that hundreds of employees across various departments and job roles will be impacted. The layoffs are likely to affect positions in areas such as retail banking, commercial lending, and technology.

As we head into 2024, the tax deadline 2024 is something to keep in mind. It’s always a good idea to stay on top of your tax responsibilities and plan ahead to avoid any last-minute surprises.

The economic impact on affected employees will vary depending on their individual circumstances. Factors such as average salary, cost of living in the affected regions, and the availability of alternative employment opportunities will play a crucial role.

The average salary of affected employees is estimated to be around $75,000 per year, which is significantly higher than the national average. However, the cost of living in many of the areas where PNC Bank has a strong presence, such as Pittsburgh and Philadelphia, is also relatively high.

The loss of a high-paying job can have a significant impact on an individual’s financial well-being. Many affected employees may face challenges in finding new employment opportunities that offer comparable salaries and benefits. This could lead to long-term financial hardship, particularly for those with dependents or significant debt.

2.2. Emotional Stress and Well-being, PNC Bank Layoffs October 2024

Job loss can have a profound impact on an individual’s emotional well-being. The sudden loss of a job can lead to feelings of anxiety, depression, stress, and even anger. These emotions can have a significant impact on an individual’s self-esteem and confidence, as well as their relationships with family and friends.

It’s always a good idea to stay on top of tax deadlines, and knowing when are taxes due in October can help you avoid any potential penalties. Remember, it’s better to be prepared than to be caught off guard.

A study by the American Psychological Association found that 75% of individuals who experience job loss report experiencing at least one symptom of depression, such as fatigue, loss of interest in activities, and difficulty concentrating.

PNC Bank must provide adequate support services to address the emotional well-being of laid-off employees. These services should include access to mental health professionals, counseling, and support groups.

2.3. Support Services and Resources

PNC Bank has announced that it will offer a severance package to laid-off employees. The package is likely to include a combination of severance pay, health insurance coverage, and outplacement services.

Severance Packages

The amount of severance pay offered will likely be based on factors such as the employee’s length of service and salary. PNC Bank may also offer a continuation of health insurance coverage for a specified period.

Looking for the best credit cards in October 2023 ? There are many options available, each with its own unique features and benefits. It’s important to compare different cards and choose one that best suits your needs and spending habits.

Outplacement Assistance

PNC Bank is likely to provide outplacement services to help laid-off employees find new employment opportunities. These services may include career counseling, resume writing and interview preparation, and job search support.

Outplacement services can be an invaluable resource for laid-off employees, as they provide guidance and support during a challenging transition.

Career Counseling

PNC Bank may offer career counseling services to help laid-off employees explore new career options and develop strategies for job searching.

2.4. Mitigation Initiatives

PNC Bank may implement various initiatives to mitigate the negative effects of the layoffs. These initiatives could include early retirement packages, voluntary separation programs, and training and development programs to help employees acquire new skills.

The IRS October deadline 2023 might be a concern for some, especially if you’ve filed an extension. Make sure to check the specific deadline for your situation, as it can vary depending on the type of tax filing.

Early retirement packages can provide an alternative option for employees who are nearing retirement age and may be considering leaving the workforce. Voluntary separation programs can also help reduce the number of involuntary layoffs.

For those invested in the stock market, the Jepi dividend in October 2023 could be a significant event. It’s always a good idea to stay informed about dividend payouts, especially if they play a role in your investment strategy.

PNC Bank may also partner with local organizations to provide job placement assistance and support to laid-off employees.

Business Context and Industry Trends

PNC Bank’s decision to implement layoffs in October 2024 comes amidst a complex economic landscape and shifting industry trends. Several factors have contributed to this strategic move, highlighting the challenges faced by financial institutions in the current environment.The recent economic climate has been characterized by rising inflation, interest rate hikes, and a potential recession.

These factors have created uncertainty in the market, impacting consumer spending and business investment. As a result, banks have seen a slowdown in loan growth and a decrease in deposit balances, leading to reduced revenue and profitability.

Comparison with Other Financial Institutions

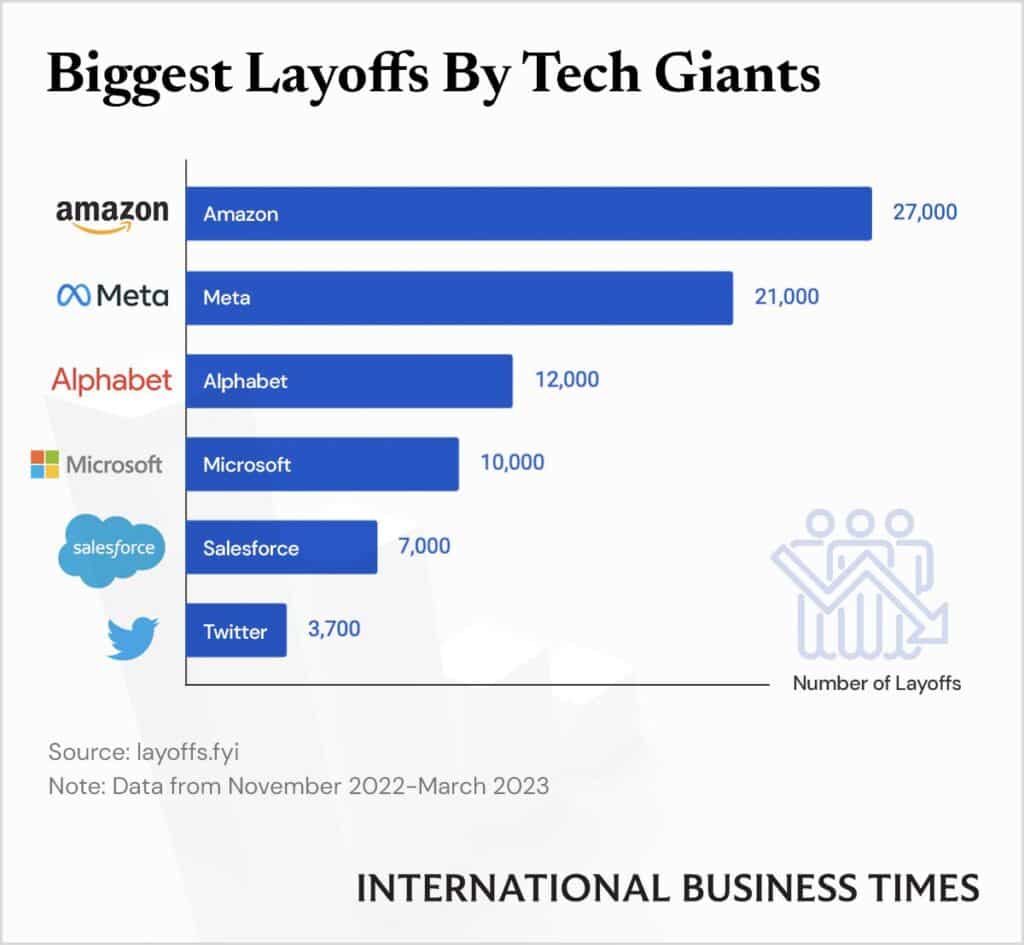

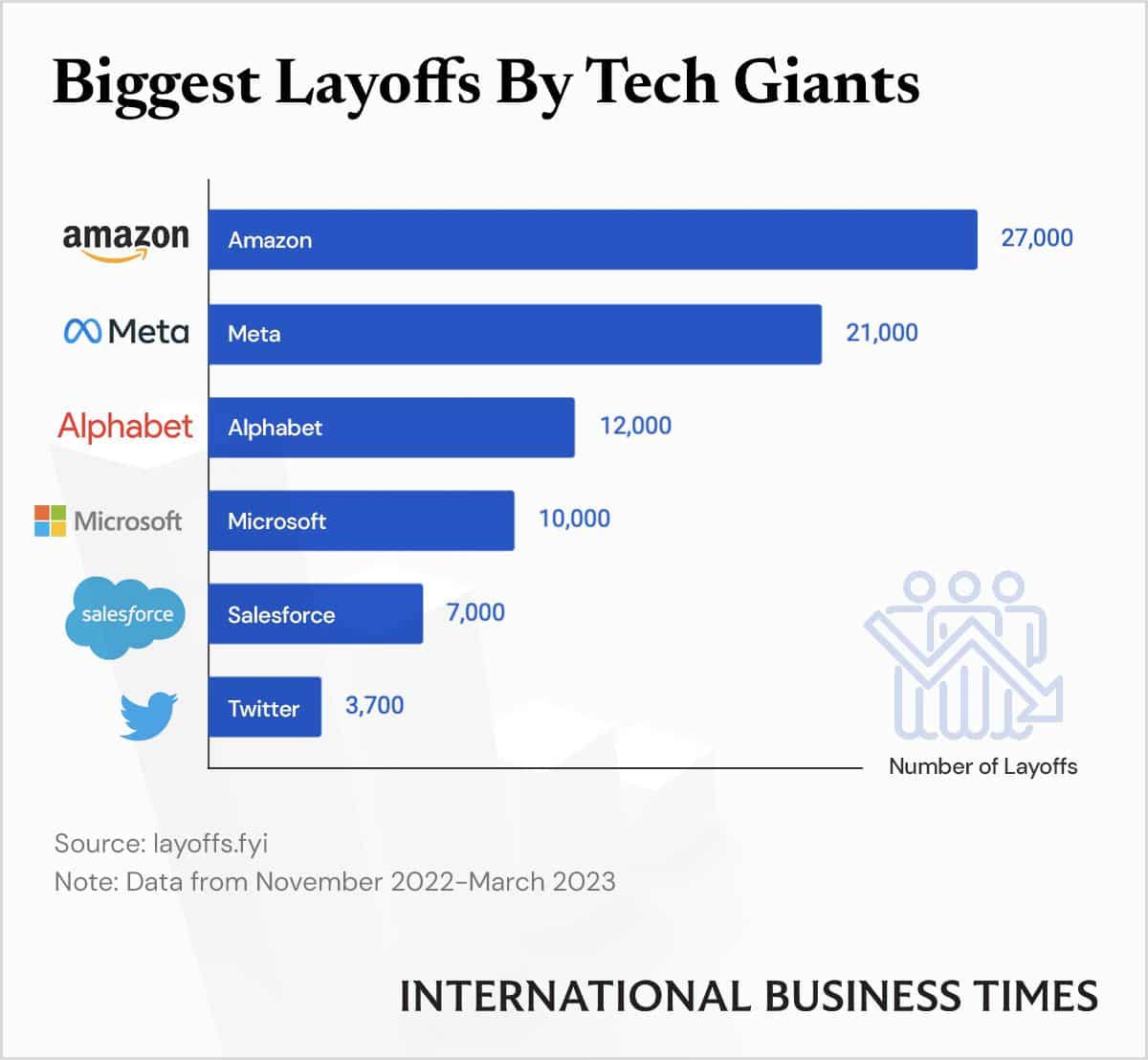

The banking industry has witnessed a wave of layoffs in recent months, with several major financial institutions announcing similar measures. These layoffs are often attributed to cost-cutting efforts, streamlining operations, and adapting to evolving market conditions.

- In June 2024, Goldman Sachs announced plans to lay off approximately 3,200 employees, citing a challenging economic environment and a need to reduce expenses.

- Morgan Stanley followed suit in July 2024, laying off around 1,600 employees, primarily in its investment banking and trading divisions.

- Citigroup also implemented layoffs in August 2024, targeting approximately 5,000 jobs across various departments, as part of a cost-cutting strategy.

Potential Long-Term Implications for PNC Bank

The layoffs at PNC Bank could have both positive and negative long-term implications for the institution. On the one hand, the cost-cutting measures may improve efficiency and profitability, enhancing PNC Bank’s competitive position in the long run. On the other hand, losing experienced employees could impact service quality and customer satisfaction, potentially hindering future growth.

“The layoffs are a necessary step to ensure PNC Bank’s long-term sustainability and competitiveness in a rapidly evolving industry,” said a spokesperson for the bank.

The long-term impact of the layoffs will depend on how effectively PNC Bank manages the transition and integrates the remaining workforce. It will be crucial to retain key talent, invest in training and development programs, and ensure seamless service delivery to maintain customer trust and loyalty.

Regulatory and Legal Considerations

PNC Bank’s layoff decisions must navigate a complex landscape of regulations and legal considerations, particularly in terms of employee rights and compliance with labor laws. These factors can significantly influence the layoff process and potentially lead to legal challenges or lawsuits.

Compliance with Labor Laws and Employee Rights

PNC Bank must ensure its layoff process adheres to federal and state labor laws, including the Worker Adjustment and Retraining Notification (WARN) Act, which requires employers to provide advance notice of mass layoffs. Failure to comply with these regulations could result in legal action and significant penalties.

- WARN Act Compliance:The WARN Act mandates employers with 100 or more employees to provide 60 days’ written notice to affected workers, union representatives, and state and local governments before conducting mass layoffs. This notice period allows employees to prepare for job loss and seek alternative employment.

- State-Specific Labor Laws:In addition to federal regulations, PNC Bank must comply with state-specific labor laws, which may have additional requirements regarding layoff procedures, severance packages, and employee benefits.

- Discrimination Laws:Layoff decisions must be made without regard to protected characteristics such as age, race, religion, gender, or disability. Discriminatory practices can lead to lawsuits under federal and state anti-discrimination laws.

Potential for Legal Challenges and Lawsuits

While PNC Bank strives to comply with all applicable laws, layoffs can sometimes trigger legal challenges.

- Wrongful Termination:Employees may claim wrongful termination if they believe they were laid off for discriminatory reasons or without proper justification.

- Breach of Contract:If employees have employment contracts, layoffs may be challenged if they violate contract terms regarding termination or severance benefits.

- Wage and Hour Violations:Layoffs can sometimes lead to claims of wage and hour violations, such as unpaid wages or improper calculation of severance pay.

Ethical Considerations

Beyond legal compliance, PNC Bank must consider the ethical implications of its layoff decisions.

- Transparency and Communication:Open and transparent communication with affected employees is crucial. Providing clear explanations for the layoffs, severance packages, and outplacement services can help mitigate negative employee morale and maintain a positive public perception.

- Employee Morale:Layoffs can significantly impact employee morale, potentially leading to decreased productivity and engagement. PNC Bank should consider strategies to support remaining employees and maintain a positive work environment.

- Public Perception:Layoffs can negatively impact public perception of PNC Bank, especially if perceived as unfair or poorly handled. Ethical considerations should guide the layoff process to minimize reputational damage.

5. Employee Reactions and Public Response

PNC Bank’s decision to implement layoffs in October 2024 likely sparked a range of reactions from employees, the public, and stakeholders. Understanding these responses is crucial to assess the potential impact of the layoffs on the bank’s reputation, customer relationships, and overall business performance.

5.1 Employee Reactions

The manner in which PNC Bank communicated the layoffs to its employees significantly influenced their reactions. The bank’s communication strategy, employee morale, union involvement, social media sentiment, and employee advocacy all played a role in shaping the overall employee response.

- Internal Communication:PNC Bank likely employed a combination of communication channels to inform employees about the layoffs. This might have included internal memos, company-wide emails, town hall meetings, or dedicated websites. The clarity and transparency of the communication were crucial in mitigating employee anxiety and fostering understanding.

- Employee Morale:Layoffs inevitably affect employee morale. The impact on morale can manifest in decreased productivity, increased absenteeism, and higher stress levels. The extent of these effects depends on factors such as the size of the layoffs, the communication strategy employed, and the overall economic climate.

- Union Involvement:If labor unions represented PNC Bank employees, their response to the layoffs would have been crucial. Unions might have engaged in negotiations with the bank to mitigate the impact of the layoffs on their members, potentially demanding severance packages, job retraining programs, or other forms of support.

Looking ahead to 2024, the 2024 October tax deadline is a date to keep in mind. It’s always best to stay organized and plan ahead to avoid any last-minute stress.

In some cases, unions might have organized protests or public statements to express their dissatisfaction with the layoffs.

- Social Media Sentiment:Social media platforms like LinkedIn, Twitter, and Facebook provided a platform for PNC Bank employees to express their feelings about the layoffs. Analyzing the sentiment expressed on these platforms can offer insights into employee morale, concerns, and reactions.

- Employee Advocacy:Layoffs can impact employee advocacy for the bank. Some employees might publicly express support for the bank’s decision, citing factors like the need to remain competitive or the potential for long-term benefits. Others might publicly oppose the layoffs, highlighting the impact on their colleagues and the potential damage to the bank’s reputation.

News of Geico layoffs in October 2023 might be a concern for some. It’s important to stay informed about industry trends and be prepared for any potential changes in the job market.

5.2 Public Response

The public response to the layoffs was likely shaped by media coverage, public opinion, and the potential impact on PNC Bank’s reputation.

- Media Coverage:News outlets, blogs, and social media discussions likely covered the layoffs, providing a platform for public debate. The narratives presented in these media outlets would have influenced public perception of the layoffs. Some media outlets might have focused on the economic rationale behind the layoffs, while others might have highlighted the impact on employees and the community.

- Public Opinion:Public opinion on the layoffs could have been gauged through surveys, polls, and social media sentiment analysis. Key concerns expressed by the public might have included the impact on the local economy, the fairness of the selection process, and the potential for a decline in customer service.

- Reputational Impact:The layoffs could have had a negative impact on PNC Bank’s reputation, potentially damaging its image and affecting its brand perception. This impact would have been influenced by factors such as the size of the layoffs, the communication strategy employed by the bank, and the overall economic climate.

- Investor Response:Investors would have closely monitored the bank’s stock price following the announcement of the layoffs. A significant decline in the stock price could have indicated investor concerns about the impact of the layoffs on the bank’s future performance. Analysts and investors might have issued statements expressing their views on the layoffs and their potential impact on the bank’s profitability.

5.3 Impact on Customers

The layoffs could have had a direct impact on PNC Bank’s customers, potentially affecting customer retention rates, brand perception, and service quality.

- Customer Retention:Some customers might have expressed dissatisfaction with the layoffs and chosen to switch banks as a result. This could have led to a decline in customer retention rates.

- Brand Perception:The layoffs could have negatively impacted PNC Bank’s brand perception among customers. Some customers might have perceived the layoffs as a sign of the bank’s lack of commitment to customer service or its values.

- Service Quality:The layoffs could have led to a decline in the quality of customer service provided by PNC Bank. This could have manifested in longer wait times, reduced service availability, or other issues related to service quality.

Future Outlook for PNC Bank

The layoffs at PNC Bank in October 2024, while aimed at streamlining operations and improving efficiency, will undoubtedly have a ripple effect on the bank’s future. It’s crucial to analyze how these changes might impact PNC Bank’s workforce, financial performance, and its position in the competitive landscape.

Potential Long-Term Effects of Layoffs

The layoffs at PNC Bank could lead to both positive and negative long-term effects. While the bank aims to achieve greater efficiency and cost savings, there are potential consequences for its workforce, financial performance, and future growth prospects.

- Impact on Workforce:The layoffs might lead to a reduction in morale and employee engagement, potentially affecting productivity and customer service. This could also result in a loss of institutional knowledge and experience, impacting the bank’s ability to adapt to future challenges.

- Financial Performance:The layoffs are expected to result in short-term cost savings. However, the long-term impact on financial performance is uncertain. The loss of experienced employees could hinder innovation and growth, potentially impacting revenue generation in the long run.

- Future Growth Prospects:The layoffs might affect PNC Bank’s ability to attract and retain top talent, potentially hindering its future growth prospects. The perception of a company that resorts to layoffs can impact its brand image and its ability to compete for talent in a competitive market.

The IRS tax deadline in October 2023 might be a bit of a blur, especially if you’re juggling multiple deadlines. It’s important to stay organized and prioritize your tax obligations to avoid any issues.

Strategic Adjustments and Changes in Direction

In response to the layoffs, PNC Bank might undertake strategic adjustments and changes in direction to mitigate potential negative impacts and ensure long-term success. These could include:

- Focus on Automation and Technology:To compensate for the loss of personnel, PNC Bank might invest more heavily in automation and technology to streamline processes and enhance efficiency. This could involve adopting artificial intelligence (AI) and machine learning (ML) solutions for tasks like customer service and fraud detection.

- Restructuring and Reorganization:PNC Bank might restructure its operations and reorganize teams to optimize resource allocation and streamline workflows. This could involve consolidating departments, eliminating redundancies, and redefining roles and responsibilities.

- Enhanced Training and Development:To retain and upskill remaining employees, PNC Bank might invest in comprehensive training and development programs to equip them with the necessary skills and knowledge to navigate the changing landscape. This could include programs focusing on digital skills, data analytics, and customer experience management.

Impact on Competitive Landscape and Talent Acquisition

The layoffs at PNC Bank could impact its competitive landscape and its ability to attract and retain talent.

- Competitive Landscape:The layoffs might create a perception of instability and uncertainty, potentially impacting PNC Bank’s brand image and its ability to compete with other financial institutions. This could affect its ability to attract and retain customers, especially those seeking stability and long-term partnerships.

- Talent Acquisition:The layoffs might make it challenging for PNC Bank to attract and retain top talent, especially in a competitive market. The perception of a company that resorts to layoffs can deter potential employees, particularly those seeking long-term career opportunities and stability.

7. Best Practices for Layoffs: PNC Bank Layoffs October 2024

Layoffs are a complex and sensitive issue that requires careful planning and execution to minimize negative impacts on both employees and the organization. This section will explore best practices for managing layoffs, covering communication strategies, employee support programs, layoff plan design, and recommendations for companies facing this difficult situation.

If you’re looking for information on taxes due in October , you’re likely nearing a tax deadline. Make sure to check the specific date for your situation, as it can vary depending on your filing status and the type of tax you’re paying.

Communication Strategies

Effective communication is paramount during a layoff. A well-defined communication plan can help ensure transparency, empathy, and clarity for all stakeholders.

If you’re wondering when are taxes due in October 2023 , you’re not alone. It’s a common question, especially as the year winds down. It’s important to remember that deadlines can vary depending on your situation, so it’s always best to check with the IRS for the most up-to-date information.

- Transparency:Companies should strive for complete transparency in their communication. This includes being upfront about the reasons for the layoff, the selection criteria, and the support programs available. Transparency builds trust and reduces speculation, which can contribute to anxiety and negativity.

- Timing:The timing of communication is crucial. Companies should aim to communicate the layoff decision as soon as possible after it has been made, while also allowing sufficient time for planning and preparation. Sudden and unexpected announcements can be highly disruptive and stressful for employees.

- Delivery Methods:The choice of communication channels should be tailored to the specific audience and the nature of the message. For example, a company might use email for initial announcements, followed by in-person meetings or town halls for more detailed information and Q&A sessions.

In-person meetings can be especially important for employees who are directly affected by the layoff, as it allows for personal interaction and support.

- Tone and Language:The tone and language used in communication should be empathetic and respectful. Companies should avoid using jargon or technical terms that may be difficult for employees to understand. While it is important to be professional, it is also crucial to acknowledge the emotional impact of the layoff and to express sympathy for those who are affected.

If you’re looking for the best CD rates in October 2024 , there are a few things to keep in mind. Consider the term length, interest rate, and any potential penalties for early withdrawal before making a decision.

Example:A hypothetical company facing a layoff due to an economic downturn might implement the following communication plan:

- Stage 1: Initial Announcement (Email):The CEO sends an email to all employees announcing the layoff decision, explaining the reasons for the decision and outlining the next steps. The email emphasizes the company’s commitment to transparency and employee support.

- Stage 2: Departmental Meetings (In-Person):Department heads hold meetings with their teams to provide more detailed information about the layoff, including the selection criteria and the timeline for the process. These meetings allow for Q&A sessions and address specific concerns.

- Stage 3: Individual Notifications (In-Person):Affected employees are notified individually in person by their manager. These meetings are conducted in a private and confidential setting, and managers are provided with training and support to deliver the news with sensitivity and empathy.

- Stage 4: Post-Layoff Communication (Email, Intranet):The company continues to communicate with employees regularly after the layoff, providing updates on the company’s performance, opportunities for career development, and available support services.

Employee Support Programs

Companies have a responsibility to provide comprehensive support to employees who are affected by layoffs. These programs can help employees manage the financial, emotional, and career transition challenges they may face.

- Financial Support:Financial assistance can help ease the immediate financial burden of a layoff. This might include severance packages, outplacement services, extended health benefits, and access to financial counseling. The level of financial support should be commensurate with the employee’s length of service and salary.

If you’re wondering when are taxes due in October 2023 , you’re not alone. It’s a common question, especially as the year winds down. It’s important to remember that deadlines can vary depending on your situation, so it’s always best to check with the IRS for the most up-to-date information.

- Emotional Support:Layoffs can be emotionally challenging, and employees may experience stress, anxiety, grief, and anger. Companies should provide access to emotional support services, such as counseling, support groups, and employee assistance programs. These services can help employees cope with the emotional impact of the layoff and develop strategies for moving forward.

- Career Transition Support:Companies should provide resources and support to help employees transition to new employment opportunities. This might include resume writing workshops, networking events, job search assistance, and career counseling. Outplacement services can also be valuable in helping employees identify their skills and interests, develop job search strategies, and connect with potential employers.

- Legal Compliance:Companies must comply with all applicable labor laws regarding employee support programs during layoffs. This includes providing advance notice of layoffs, ensuring fair and equitable treatment of all employees, and providing adequate documentation of the layoff process.

Example:A company might offer the following employee support programs:

- Severance Packages:Severance packages provide employees with a lump sum payment based on their length of service and salary. This financial assistance can help employees cover immediate expenses and bridge the gap until they find new employment.

- Outplacement Services:Outplacement services provide employees with personalized career coaching and job search support. Outplacement providers can help employees create resumes and cover letters, develop job search strategies, and practice interviewing skills.

- Extended Health Benefits:Extended health benefits provide employees with continued coverage for health insurance, dental care, and other benefits for a specified period after their layoff. This can help employees maintain their health and well-being during a time of transition.

- Employee Assistance Program (EAP):EAPs provide employees with confidential counseling and support services for a variety of personal and work-related issues. EAPs can be especially valuable during a layoff, as they can help employees cope with stress, anxiety, and grief.

- Career Transition Workshops:Career transition workshops provide employees with training and resources on topics such as resume writing, interviewing skills, and job search strategies. These workshops can help employees prepare for the job search process and increase their chances of finding new employment.

8. Impact on the Economy

The layoffs at PNC Bank, while aimed at streamlining operations and improving efficiency, will undoubtedly have ripple effects on the broader economy. Understanding these impacts is crucial for policymakers, businesses, and individuals alike to prepare for potential challenges and opportunities.

8.1. Direct Economic Implications

The immediate economic consequences of PNC Bank layoffs are multifaceted and will likely impact various segments of the economy.

- Job Losses:The exact number of job losses at PNC Bank is yet to be determined, but it is expected to be significant. These job losses will be distributed across various job categories, including customer service representatives, loan officers, and back-office staff.

The distribution of job losses across different locations will also impact local economies differently.

- Reduced Consumer Spending:The loss of income due to layoffs will lead to a decrease in consumer spending. The magnitude of this decrease will depend on factors such as the average income and spending patterns of affected employees. For example, if a significant number of middle-income earners lose their jobs, the impact on consumer spending could be substantial, potentially affecting sectors like retail, hospitality, and entertainment.

- Impact on Local Economies:PNC Bank has significant operations in several cities and states. Layoffs in these locations will have a ripple effect on local economies. Reduced business activity due to job losses will lead to a decrease in local tax revenue, potentially affecting public services and infrastructure projects.

Looking for the best car lease deals in October 2023 ? There are a variety of factors to consider, such as the make and model of the car, the lease term, and any potential fees or charges. It’s always a good idea to shop around and compare different deals before making a decision.

Additionally, reduced consumer spending by laid-off employees will further impact local businesses and industries.

8.2. Comparative Analysis

Comparing the impact of PNC Bank layoffs to recent job cuts in the financial sector provides a broader context for understanding the potential consequences.

- Scale of Layoffs:While the exact number of job losses at PNC Bank is yet to be confirmed, it is likely to be significant. However, it is crucial to compare this number to layoffs at other major financial institutions that have recently announced job cuts.

For instance, Goldman Sachs announced layoffs of 3,200 employees in January 2023, while Morgan Stanley announced layoffs of 1,600 employees in December 2022. Comparing the scale of layoffs across different institutions will provide a better understanding of the relative impact on the financial sector.

- Geographic Impact:The distribution of job losses across different regions is also important to consider. Comparing the geographic impact of PNC Bank layoffs to other financial sector layoffs will highlight the potential impact on local economies. For example, if a significant number of jobs are lost in a specific region, the local economy may experience a more pronounced impact than regions with more diversified employment bases.

- Industry-Specific Consequences:Layoffs in the financial sector can have specific consequences for different sectors within the industry. For instance, layoffs in investment banking could impact the availability of capital for businesses, while layoffs in commercial banking could affect lending activities and economic growth.

Comparing the industry-specific consequences of PNC Bank layoffs to other financial sector layoffs will shed light on the potential impact on different sectors within the industry.

8.3. Policy Responses

Government interventions and policy changes can play a significant role in mitigating the economic consequences of large-scale layoffs.

- Unemployment Benefits:Existing unemployment benefits provide a crucial safety net for laid-off workers. However, the effectiveness of these benefits can be enhanced by extending the duration of benefits, increasing the benefit amount, and simplifying the application process.

- Job Retraining Programs:Job retraining programs can help displaced workers acquire new skills and knowledge, making them more competitive in the job market. The availability and effectiveness of these programs for workers in the financial sector are crucial. Governments and educational institutions should collaborate to offer tailored retraining programs that address the specific needs of laid-off financial professionals.

- Economic Stimulus Measures:Government stimulus measures can help offset the economic impact of layoffs. These measures could include tax breaks for businesses, investments in infrastructure projects, or increased government spending on public services. However, it is essential to carefully design and implement these measures to ensure they are effective and sustainable.

8.4. Long-Term Economic Impact

The long-term economic impact of PNC Bank layoffs will depend on several factors, including the overall health of the financial sector, the pace of economic growth, and the effectiveness of policy responses.

- Impact on the Financial Sector:Layoffs in the financial sector could potentially trigger further instability and impact overall economic growth. This is because a decline in financial sector employment can lead to reduced lending activity, slower economic growth, and a decrease in investment.

- Impact on Innovation and Competitiveness:Layoffs can also impact the ability of the financial sector to innovate and compete globally. The loss of experienced and skilled employees could hinder the development of new products and services, potentially putting the financial sector at a disadvantage in a globalized economy.

- Impact on Future Employment:The long-term implications of layoffs for future job creation and employment prospects in the financial sector are also significant. If layoffs lead to a decline in the overall size and scope of the financial sector, it could have a lasting impact on future employment opportunities.

Closure

The PNC Bank layoffs highlight the ongoing challenges and uncertainties facing the banking industry. As the industry navigates technological advancements, regulatory changes, and evolving customer expectations, it is essential for banks to prioritize transparency, employee support, and responsible business practices.

The impact of these layoffs will be felt for years to come, and the lessons learned from this event will shape the future of banking for both employers and employees alike.

Questions Often Asked

What were the specific departments or locations impacted by the PNC Bank layoffs?

The Artikel does not specify the exact departments or locations impacted by the layoffs. This information would likely be detailed in official company announcements or news reports.

What were the specific reasons cited by PNC Bank for the layoffs?

The Artikel indicates that PNC Bank cited a combination of factors, including changing customer preferences, technological advancements, and the broader economic climate. However, it does not provide specific details on these reasons. More information can be found in company press releases or other public statements.

What is the potential impact of the layoffs on PNC Bank’s future growth prospects?

The Artikel suggests that the layoffs could have both positive and negative impacts on PNC Bank’s future growth prospects. On the one hand, the layoffs could result in cost savings and improved efficiency. On the other hand, the layoffs could negatively impact employee morale and productivity, and potentially hinder the bank’s ability to attract and retain top talent.

The long-term impact on growth prospects will depend on how the bank manages the transition and adapts to the changing industry landscape.