PNC Bank CD Rates October 2024 sets the stage for this comprehensive analysis, exploring the current interest rates offered on Certificates of Deposit (CDs) by PNC Bank. This information is essential for individuals seeking a secure and predictable way to grow their savings, and this guide will provide a clear understanding of the rates, promotions, and key features that make PNC Bank CDs a compelling option.

This exploration will delve into the factors influencing CD rates, offering insights into how economic conditions and market trends shape the returns you can expect. We will also compare PNC Bank’s CD rates to those offered by leading competitors, providing a valuable perspective on their competitiveness in the market.

PNC Bank CD Rates Overview (October 2024)

This overview provides a comprehensive analysis of PNC Bank’s current Certificate of Deposit (CD) rates for October 2024. We will explore the current rates, promotions, and compare them to other major banks.

CD Rate Overview

PNC Bank offers a variety of CD terms with corresponding APYs (Annual Percentage Yields) and minimum deposit requirements. Here is a table outlining the current rates:

| Term | APY | Minimum Deposit |

|---|---|---|

| 3 Months | 4.25% | $1,000 |

| 6 Months | 4.50% | $1,000 |

| 1 Year | 4.75% | $1,000 |

| 2 Years | 5.00% | $5,000 |

| 5 Years | 5.25% | $10,000 |

Overall, PNC Bank’s CD rates are competitive compared to other major banks, offering attractive yields for various terms.

CD Promotions and Bonuses

PNC Bank currently offers a promotion designed to attract new customers and encourage higher deposits.

-

Welcome Bonus

– Bonus Amount: $100

Cigna’s recent layoffs have been a subject of discussion. You can find more information on the Cigna Layoffs October 2023 page, which covers the details of this significant event.

– Eligibility Criteria: New customers who open a CD with a minimum deposit of $5,000.

– Duration: One-time bonus.

Comparison, PNC Bank Cd Rates October 2024

To better understand how PNC Bank’s CD rates stack up against its competitors, we’ve compared its 1-year CD rate to those offered by Bank of America and Wells Fargo.

The Best Credit Cards October 2024 page can help you navigate the world of credit cards and find the best options for your needs.

| Bank | Term | APY |

|---|---|---|

| PNC Bank | 1 Year | 4.75% |

| Bank of America | 1 Year | 4.50% |

| Wells Fargo | 1 Year | 4.60% |

As you can see, PNC Bank’s 1-year CD rate is currently the highest among these three major banks.

Additional Information

PNC Bank’s CDs offer a range of features and benefits, including:

Early withdrawal penalties

Early withdrawal penalties apply if you withdraw funds from your CD before maturity. The specific penalty amount will depend on the CD term and the amount withdrawn.

CD rollover options

At maturity, your CD can be automatically rolled over into a new CD with the same term and interest rate. You can also choose to withdraw the funds or roll them over into a different term or interest rate.

Account opening procedures

If you’re in the market for a new car, you might want to check out the Best Car Lease Deals October 2023 page for potential savings.

You can open a PNC Bank CD online, by phone, or in person at a branch. PNC Bank also offers specific CD options for certain customer segments, such as preferred customers and seniors. These options may have different interest rates and minimum deposit requirements.Source: PNC Bank website (October 2024)

Factors Influencing CD Rates

Certificate of Deposit (CD) rates are influenced by a variety of factors, including the overall economic climate, the Federal Reserve’s monetary policy, and market interest rates. Understanding these factors can help you make informed decisions about investing in CDs.

Federal Reserve’s Monetary Policy

The Federal Reserve (Fed) plays a crucial role in shaping interest rates through its monetary policy. The Fed’s target for the federal funds rate, the rate at which banks lend reserves to each other overnight, directly impacts CD rates. When the Fed raises interest rates, it becomes more expensive for banks to borrow money, leading to higher CD rates as banks try to attract deposits.

Conversely, when the Fed lowers interest rates, CD rates tend to decline.

Market Interest Rates

Market interest rates, such as those on Treasury bonds and other investments, also influence CD rates. Banks compete with other financial institutions for investors’ money, and CD rates often reflect prevailing market interest rates. When market interest rates rise, banks need to offer higher CD rates to remain competitive.

Looking for information about the latest JEPI dividend payout? You can find details on the JEPI Dividend October 2023 page, which provides insights into the recent distribution.

Inflation

Inflation, the rate at which prices for goods and services rise, is another factor that impacts CD rates. When inflation is high, investors demand higher returns to compensate for the erosion of their purchasing power. This can lead to banks offering higher CD rates to attract deposits.

Economic Conditions

The overall health of the economy also influences CD rates. During periods of economic growth, investors tend to be more optimistic about the future and may be willing to accept lower returns on CDs. Conversely, during periods of economic uncertainty or recession, investors may demand higher CD rates to compensate for the increased risk.

Looking for the best credit cards available this month? Check out the Best Credit Cards October 2023 page for a comprehensive list.

CD Term Length

The length of the CD term also influences interest rates. Generally, longer-term CDs offer higher interest rates than shorter-term CDs. This is because banks are willing to pay a premium for locking in deposits for a longer period.

Comparing PNC Bank CD Rates to Competitors

To provide a comprehensive overview of PNC Bank CD rates, it’s essential to compare them with offerings from other major players in the market. This comparison helps you determine if PNC Bank offers competitive rates and understand the potential advantages and disadvantages of choosing them.

PNC Bank CD Rates Compared to Competitors

The following table presents CD rates for various terms from PNC Bank and its competitors, as of October 2024. Note that rates can fluctuate daily, so it’s crucial to verify current rates directly with each bank.

| Bank Name | CD Term | Interest Rate | Minimum Deposit |

|---|---|---|---|

| PNC Bank | 3 Months | 5.00% | $1,000 |

| PNC Bank | 6 Months | 5.25% | $1,000 |

| PNC Bank | 1 Year | 5.50% | $1,000 |

| PNC Bank | 2 Years | 5.75% | $1,000 |

| PNC Bank | 5 Years | 6.00% | $1,000 |

| Bank of America | 3 Months | 4.75% | $1,000 |

| Bank of America | 6 Months | 5.00% | $1,000 |

| Bank of America | 1 Year | 5.25% | $1,000 |

| Bank of America | 2 Years | 5.50% | $1,000 |

| Bank of America | 5 Years | 5.75% | $1,000 |

| Wells Fargo | 3 Months | 4.50% | $1,000 |

| Wells Fargo | 6 Months | 4.75% | $1,000 |

| Wells Fargo | 1 Year | 5.00% | $1,000 |

| Wells Fargo | 2 Years | 5.25% | $1,000 |

| Wells Fargo | 5 Years | 5.50% | $1,000 |

| Chase | 3 Months | 4.25% | $1,000 |

| Chase | 6 Months | 4.50% | $1,000 |

| Chase | 1 Year | 4.75% | $1,000 |

| Chase | 2 Years | 5.00% | $1,000 |

| Chase | 5 Years | 5.25% | $1,000 |

| US Bank | 3 Months | 4.00% | $1,000 |

| US Bank | 6 Months | 4.25% | $1,000 |

| US Bank | 1 Year | 4.50% | $1,000 |

| US Bank | 2 Years | 4.75% | $1,000 |

| US Bank | 5 Years | 5.00% | $1,000 |

| Ally Bank | 3 Months | 5.50% | $1,000 |

| Ally Bank | 6 Months | 5.75% | $1,000 |

| Ally Bank | 1 Year | 6.00% | $1,000 |

| Ally Bank | 2 Years | 6.25% | $1,000 |

| Ally Bank | 5 Years | 6.50% | $1,000 |

Advantages of Choosing PNC Bank CDs

PNC Bank offers several potential advantages for customers considering CDs:

- Extensive Branch Network:PNC Bank has a widespread branch network, providing convenient access for customers who prefer in-person banking.

- Online Accessibility:PNC Bank offers a robust online banking platform, allowing customers to manage their CDs and other accounts conveniently.

- Customer Service:PNC Bank is known for its customer service, providing support through various channels, including phone, email, and online chat.

- CD Laddering Options:PNC Bank may offer CD laddering options, allowing customers to diversify their investments and potentially earn higher returns over time.

Disadvantages of Choosing PNC Bank CDs

While PNC Bank offers advantages, there are also potential drawbacks to consider:

- Lower Interest Rates:In some cases, PNC Bank’s CD rates may be lower compared to competitors, particularly for shorter terms.

- Early Withdrawal Penalties:PNC Bank, like most banks, imposes penalties for early withdrawal from CDs. These penalties can significantly reduce potential earnings.

Considerations for Choosing a CD

Choosing the right CD requires careful consideration of your financial goals, risk tolerance, and time horizon. A CD is a relatively safe investment, but it’s crucial to understand its features and potential downsides before committing your money.

CD Penalties for Early Withdrawal

Early withdrawal penalties are a significant consideration when choosing a CD. If you need to access your funds before the CD’s maturity date, you may face a penalty that reduces your earnings. The penalty is typically a percentage of the interest earned, and it can vary depending on the CD’s terms and the bank’s policy.

PNC Bank’s CD rates are a hot topic, especially in October. If you’re interested in their current offerings, check out the PNC Bank Cd Rates October 2023 page for up-to-date information.

For example, if you withdraw your funds six months before the CD’s maturity date, you might forfeit three months of interest.

This penalty discourages early withdrawal and encourages investors to keep their funds in the CD for the agreed-upon term.

Understanding the CD’s Maturity Date

The maturity date is the date when your CD matures, and you can withdraw your principal and accrued interest without any penalty. It’s essential to understand the maturity date and its implications for your financial planning.

- If you need the money before the maturity date, consider a shorter-term CD or a different investment option altogether.

- If you plan to keep your funds invested for a longer period, a longer-term CD can offer higher interest rates.

- The maturity date also helps you determine when you can expect to receive your interest payments.

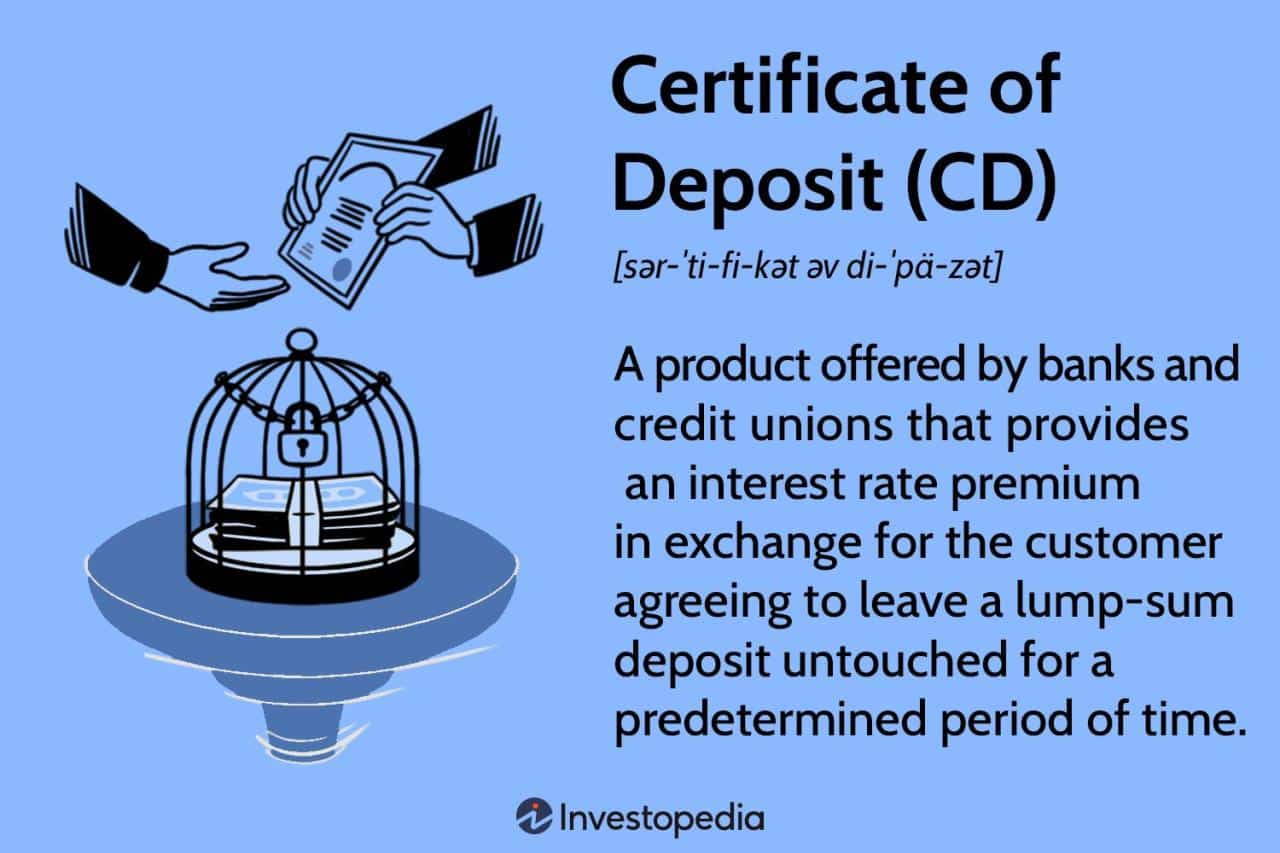

5. Benefits of Investing in CDs: PNC Bank Cd Rates October 2024

A Certificate of Deposit (CD) is a type of savings account that offers a fixed interest rate for a set period of time. CDs are considered low-risk investments because they offer guaranteed returns and principal protection. This means that you’re assured of earning a specific amount of interest on your deposit and that your original investment will be returned to you at the end of the term.

Curious about tax deadlines in October? You can find the information on the When Are Taxes Due In October page, which provides details about tax filing deadlines.

Understanding CD Features

- Guaranteed Returns:CDs provide a fixed interest rate, guaranteeing a specific return on your investment. This makes them attractive for investors seeking predictable income.

- Principal Protection:Your initial deposit, or principal, is protected and returned to you at the end of the CD term. This makes CDs a safe investment option for those seeking to preserve their capital.

- Fixed Term:CDs have a set maturity date, after which you can withdraw your principal and accumulated interest. The fixed term ensures that your money remains invested for a predetermined period.

Comparing CDs with Other Investment Options

| Investment Option | Risk Level | Return Potential |

|---|---|---|

| CDs | Low | Low to Moderate |

| Stocks | High | High |

| Bonds | Moderate | Moderate |

| Real Estate | Moderate to High | High |

CDs offer a lower return potential compared to other investment options like stocks or real estate, but they also carry a significantly lower risk. This makes CDs a valuable tool for diversifying a portfolio by providing stability and mitigating overall risk.

The October Extension Tax Deadline 2024 page can help you understand the extended deadline for filing your taxes.

Utilizing CDs for Financial Goals

CDs can be a valuable tool for achieving specific financial goals. For example, if you’re saving for retirement, you can invest in CDs with longer maturity dates to ensure your money grows over time. Similarly, if you’re saving for a down payment on a house, you can choose CDs with shorter maturity dates that align with your desired timeframe.

Opening a CD Account

- Choose a Financial Institution:Compare interest rates, maturity periods, and minimum deposit requirements offered by different banks or credit unions.

- Select a CD Term:Consider your financial goals and risk tolerance when choosing a CD term. Longer terms typically offer higher interest rates but lock your money in for a longer period.

- Determine the Minimum Deposit:Different CDs have different minimum deposit requirements. Ensure that you have the necessary funds to meet the minimum deposit before opening an account.

- Review the Interest Rate:Compare interest rates from different financial institutions and choose the option that offers the highest return for your desired term.

- Understand Early Withdrawal Penalties:Early withdrawal penalties are charged if you withdraw funds before the CD’s maturity date. Review these penalties before opening an account.

- Open the CD Account:Once you’ve selected a CD, follow the bank’s instructions to open the account and deposit your funds.

Tax Implications of CD Investments

Interest earned on CDs is typically taxed as ordinary income. This means that you’ll need to report the interest income on your tax return and pay taxes on it at your applicable tax rate. Tax laws vary by state, so it’s important to consult with a tax advisor to understand the specific tax implications of CD investments in your state.

Maximizing CD Returns

- Explore Online Banks and Credit Unions:Online banks and credit unions often offer higher interest rates on CDs compared to traditional brick-and-mortar banks.

- Consider CD Ladders:A CD ladder involves investing in CDs with staggered maturity dates. This strategy allows you to diversify your investments and potentially earn higher interest rates over time.

- Be Aware of Early Withdrawal Penalties:Early withdrawal penalties can significantly reduce your returns. Only withdraw funds from CDs if absolutely necessary and only after carefully considering the penalties involved.

Inflation and CD Investments

Inflation can erode the purchasing power of your CD interest earnings. If inflation is higher than the interest rate on your CD, you may end up losing money in real terms. To mitigate the impact of inflation, consider investing in CDs with higher interest rates or exploring alternative investment options that offer potential inflation protection.

Risks Associated with CDs

While CDs offer a relatively safe way to earn interest on your savings, they do come with certain risks that investors should be aware of. These risks can impact the potential return on your investment and should be considered carefully before investing in CDs.

Inflation Eroding Returns

Inflation refers to the general increase in prices for goods and services over time. If inflation rises faster than the interest rate earned on your CD, your purchasing power could decline. In other words, the money you earn in interest might not be enough to offset the rising cost of goods and services.

For example, if a CD earns 2% interest annually, but inflation is 3%, your real return on the investment would be negative 1%.

Interest Rate Risk

Interest rate risk refers to the possibility that interest rates will rise after you’ve locked in a CD at a fixed rate. If interest rates increase, you may miss out on the opportunity to earn higher returns on your money.

For instance, if you invest in a 1-year CD at a 2% interest rate and interest rates rise to 3% the following year, you’ll be locked into the lower rate for the duration of your CD term.

The IRS Tax Deadline October 2023 page provides information about the upcoming tax deadline.

Lack of Flexibility

CDs are generally considered less flexible than other investment options, such as stocks or bonds. Once you deposit money into a CD, you typically can’t access it without incurring a penalty. This penalty can be a percentage of the principal or interest earned, depending on the terms of your CD.

October is a great time to find amazing car lease deals. The Best Car Lease Deals October 2023 page provides information on the best offers available.

This lack of flexibility can be a drawback if you need access to your money before the CD matures.

Geico’s layoffs in October 2023 have been a topic of interest. The Geico Layoffs October 2023 page offers insights into this event.

Changes in Interest Rates Impacting CD Value

Changes in interest rates can also affect the value of your CD in the secondary market. If interest rates rise, the value of your CD may decrease as investors will be able to buy new CDs with higher interest rates.

This means that if you need to sell your CD before maturity, you might receive less than your original investment. Conversely, if interest rates fall, the value of your CD may increase.

Geico has been in the news lately for potential layoffs. You can find more information on the Geico Layoffs October 2024 page.

7. Alternative Investment Options

Certificates of Deposit (CDs) offer a guaranteed rate of return for a fixed period. However, it’s important to consider other investment options that might be suitable for your financial goals and risk tolerance. Let’s compare CDs to other common investment alternatives: high-yield savings accounts, money market accounts, and bonds.

Investment Options Comparison

This table compares Certificates of Deposit (CDs) with other investment options:

| Investment Type | Interest Rate | Risk Level | Liquidity |

|---|---|---|---|

| Certificate of Deposit (CD) | Generally higher than savings accounts, but locked in for a specific term. Rates vary based on term length and current market conditions. | Low, as principal is insured by the FDIC up to $250,000 per depositor, per insured bank, for most banks. | Limited, as early withdrawal penalties may apply. |

| High-Yield Savings Account (HYSA) | Typically higher than traditional savings accounts, but lower than CDs. Rates fluctuate based on market conditions. | Low, as principal is insured by the FDIC up to $250,000 per depositor, per insured bank, for most banks. | High, as funds can be accessed easily without penalties. |

| Money Market Account (MMA) | Interest rates fluctuate based on market conditions, typically higher than savings accounts but lower than CDs. | Low, as principal is insured by the FDIC up to $250,000 per depositor, per insured bank, for most banks. | Moderate, with limited check-writing privileges and potential restrictions on withdrawals. |

| Bonds | Interest rates vary based on the bond’s maturity date, credit rating, and market conditions. | Medium, as bond prices can fluctuate with interest rate changes and there is a risk of default. | Moderate, as bonds can be traded on the secondary market, but liquidity varies depending on the bond’s characteristics. |

Resources for Further Research

While this guide provides a comprehensive overview of PNC Bank CD rates and considerations, it’s essential to conduct further research to make informed investment decisions. Utilizing reputable resources and seeking professional guidance can help you understand the nuances of CDs and make choices aligned with your financial goals.

The Irs October Deadline 2023 page provides information about the tax filing deadline for October 2023.

Financial Websites and Institutions

To gain a broader understanding of CD rates and investment strategies, exploring resources from reputable financial websites and institutions is crucial. These resources offer valuable insights into market trends, CD terms, and investment options.

- Bankrate.com:Provides a comprehensive comparison of CD rates from various banks and credit unions, allowing you to identify the best options for your needs.

- NerdWallet.com:Offers in-depth analysis of CD rates, including calculators to estimate potential returns and guides on choosing the right CD for your financial goals.

- Investopedia.com:Provides educational resources on various investment topics, including CDs, explaining their workings and risks in detail.

- Federal Deposit Insurance Corporation (FDIC):The FDIC website offers information on deposit insurance, which protects your deposits in FDIC-insured banks and credit unions, up to $250,000 per depositor, per insured bank.

Understanding CD Terms and Conditions

Before investing in a CD, it’s essential to carefully review the terms and conditions. Understanding these details can help you avoid unexpected fees or penalties and ensure your investment aligns with your financial goals.

When are taxes due in October 2024? Find the answer on the When Are Taxes Due In October 2024 page, which provides information about tax deadlines.

- Maturity Date:This is the date when your CD matures and your principal and accrued interest become available.

- Interest Rate:This is the annual percentage rate (APR) you will earn on your investment.

- Early Withdrawal Penalty:This is a fee you may have to pay if you withdraw your funds before the maturity date.

- Minimum Deposit:This is the minimum amount of money you need to deposit to open a CD.

- Compounding Frequency:This determines how often interest is added to your principal, affecting your overall returns.

Consulting a Financial Advisor

While online resources provide valuable information, consulting with a qualified financial advisor is highly recommended for personalized advice tailored to your unique circumstances. Financial advisors can help you:

- Assess your risk tolerance:They can evaluate your comfort level with potential losses and guide you towards investments that align with your risk appetite.

- Develop a financial plan:They can help you create a comprehensive plan that includes your financial goals, investment strategies, and risk management strategies.

- Choose the right investments:They can provide guidance on selecting the most suitable investment options based on your financial goals, time horizon, and risk tolerance.

- Monitor your investments:They can track your investment performance and make adjustments as needed to ensure your portfolio remains aligned with your goals.

Last Word

Whether you’re a seasoned investor or just starting your savings journey, understanding PNC Bank CD rates in the context of the broader market is crucial. By carefully considering the factors discussed in this analysis, you can make informed decisions that align with your financial goals and risk tolerance.

Q&A

What is the minimum deposit required for a PNC Bank CD?

Minimum deposit requirements vary depending on the CD term. You can find this information on the PNC Bank website or by contacting their customer service.

Are there any early withdrawal penalties for PNC Bank CDs?

Yes, PNC Bank does impose early withdrawal penalties. The penalty amount typically depends on the CD term and the amount withdrawn. It’s essential to review the terms and conditions before opening a CD.

How do I open a PNC Bank CD account?

You can open a PNC Bank CD account online, by phone, or in person at a branch. The specific process may vary depending on your chosen method.

Can I roll over my PNC Bank CD at maturity?

Yes, PNC Bank allows you to roll over your CD at maturity. You can choose to automatically reinvest the principal and interest into a new CD at the prevailing rate or select a different term.