Pioneer Vision 2 Variable Annuity 2024 offers a unique opportunity for investors seeking to diversify their portfolio and potentially grow their savings. This annuity combines the security of a guaranteed minimum death benefit with the potential for higher returns through investments in a range of sub-accounts.

It provides a flexible approach to retirement planning, allowing individuals to tailor their investment strategy to their specific financial goals and risk tolerance.

This comprehensive guide explores the key features and benefits of the Pioneer Vision 2 Variable Annuity, including its investment options, fees, and contractual provisions. We’ll also delve into its performance history, risk management strategies, and tax implications. Ultimately, this guide aims to provide investors with the necessary information to make informed decisions about whether this annuity aligns with their individual investment objectives.

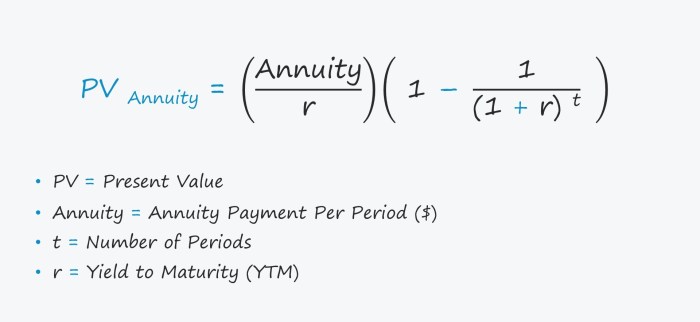

Variable annuities, a type of annuity that offers potential growth, are subject to taxation. For details on this, refer to Variable Annuity Taxable 2024. The formula used to calculate variable annuities is outlined in Variable Annuity Formula 2024 , and the definition of a deferred variable annuity is found in Deferred Variable Annuity Definition 2024.

Pioneer Vision 2 Variable Annuity Overview: Pioneer Vision 2 Variable Annuity 2024

The Pioneer Vision 2 Variable Annuity is a retirement savings product that offers a combination of investment growth potential and guaranteed income benefits. It allows investors to allocate their funds among a variety of sub-accounts, each representing a different investment strategy.

The annuity’s core features and benefits include:

Investment Options

The Pioneer Vision 2 Variable Annuity provides investors with a range of investment options, including:

- Mutual Funds:Investors can choose from a wide selection of mutual funds, covering various asset classes like stocks, bonds, and real estate.

- Exchange-Traded Funds (ETFs):The annuity offers access to ETFs, providing diversification and potential for growth.

- Managed Accounts:Investors can opt for professionally managed accounts, where a dedicated advisor oversees their investments.

Potential Risks and Rewards

Like any investment, the Pioneer Vision 2 Variable Annuity carries both potential risks and rewards. The primary risk is the potential for investment losses due to market volatility. However, the annuity also offers the potential for growth and income generation through its investment options.

Retirement Planning

The annuity’s guaranteed income benefits can provide a stream of income during retirement, ensuring financial security and peace of mind.

Income Generation

Investors can utilize the annuity’s investment options to generate income through dividends and interest payments.

To understand the basics of variable annuities, you can explore What’s Variable Annuity 2024. A compound annuity utilizes the principles of compounding interest, which are discussed further in Compound Annuity Uses The Principles Of 2024.

Risk Tolerance

The annuity’s flexibility allows investors with varying risk tolerances to find suitable investment options. For example, conservative investors may choose to allocate a larger portion of their funds to fixed income investments, while more aggressive investors might opt for a higher allocation to equities.

Fee Breakdown

The fees associated with the annuity include:

- Mortality and Expense (M&E) Charges:These charges cover the cost of providing the annuity’s guaranteed income benefits and other administrative expenses.

- Investment Management Fees:These fees are charged by the mutual funds or ETFs within the annuity.

- Administrative Fees:These fees cover the cost of managing the annuity contract and providing customer service.

Impact on Returns

Fees can significantly impact the potential returns of an investment. It is crucial to consider the overall cost of ownership when evaluating the Pioneer Vision 2 Variable Annuity.

Annuity income can be taxable, and the specifics for the UK are covered in Is Annuity Income Taxable In Uk 2024. For individuals using BMO services, a dedicated calculator can be found at Annuity Calculator Bmo 2024.

Comparison to Similar Products

The fee structure of the Pioneer Vision 2 Variable Annuity should be compared to other similar annuity products in the market to determine its competitiveness.

Key Contractual Provisions

- Death Benefit Options:The annuity offers various death benefit options, such as a guaranteed death benefit or a return of premium, which provide financial protection to beneficiaries in case of the investor’s death.

- Withdrawal Restrictions:The annuity may have withdrawal restrictions, such as surrender charges or limitations on the amount that can be withdrawn annually, which can impact the investor’s access to funds.

Benefits and Drawbacks

The contractual provisions of the Pioneer Vision 2 Variable Annuity can offer both benefits and drawbacks. It is essential to carefully consider these provisions before making an investment decision.

Contractual Features Summary

| Feature | Description |

|---|---|

| Death Benefit Options | Guaranteed death benefit, return of premium, etc. |

| Withdrawal Restrictions | Surrender charges, annual withdrawal limits, etc. |

| Guaranteed Income Benefits | Provides a stream of income during retirement. |

| Investment Options | Mutual funds, ETFs, managed accounts. |

Historical Performance

The historical performance of the investment options within the annuity can provide insights into their potential for growth and risk.

Risk Management Strategies, Pioneer Vision 2 Variable Annuity 2024

Pioneer Investments employs various risk management strategies to mitigate potential losses and protect investor assets.

Variable annuities are often offered by life insurance companies, and you can learn more about this in Variable Annuity Life Insurance Co 2024. The underlying equation used to calculate annuities is explained in Annuity Equation 2024.

Market Volatility Impact

Market volatility can significantly impact the annuity’s performance. It is essential to understand the potential impact of market fluctuations on investment outcomes.

Tax Treatment

The annuity’s tax treatment can vary depending on the type of investment options chosen and the investor’s individual circumstances.

Impact on Investment Decisions

The tax implications of the annuity can influence investment decisions, such as the timing of withdrawals or the allocation of funds.

When dealing with annuity calculations, you might encounter various questions and answers that are addressed in Annuity Calculation Questions And Answers 2024. If you’re looking for a specific tool to help with your calculations, consider using the Qlac Annuity Calculator 2024.

Tax Implications Comparison

| Investment Option | Tax Treatment |

|---|---|

| Pioneer Vision 2 Variable Annuity | Tax deferred growth, taxed at withdrawal. |

| Traditional IRA | Tax deductible contributions, taxed at withdrawal. |

| Roth IRA | After-tax contributions, tax-free withdrawals in retirement. |

Alternative Retirement Savings Products

- Traditional IRAs:Traditional IRAs offer tax-deductible contributions and tax-deferred growth, but withdrawals are taxed in retirement.

- 401(k) Plans:401(k) plans are employer-sponsored retirement savings plans that offer tax advantages and potential employer matching contributions.

Advantages and Disadvantages

Each retirement savings product has its own advantages and disadvantages. It is essential to carefully consider these factors when making an investment decision.

Key Features Comparison

| Feature | Pioneer Vision 2 Variable Annuity | Traditional IRA | 401(k) Plan |

|---|---|---|---|

| Tax Treatment | Tax deferred growth, taxed at withdrawal. | Tax deductible contributions, taxed at withdrawal. | Tax-deferred growth, taxed at withdrawal. |

| Investment Options | Mutual funds, ETFs, managed accounts. | Wide range of investments. | Limited to employer-selected options. |

| Guaranteed Income Benefits | Yes | No | No |

Long-Term Growth Potential

The annuity’s investment options offer the potential for long-term growth and income generation.

Diversification and Asset Allocation

Diversifying investments across different asset classes within the annuity can help mitigate risk and enhance long-term returns.

Potential Drawbacks

- Fees and Expenses:The annuity’s fees and expenses can impact the overall return on investment.

- Withdrawal Restrictions:The annuity may have withdrawal restrictions that can limit access to funds.

- Market Volatility Risk:The value of the annuity’s investment options can fluctuate due to market volatility, potentially leading to investment losses.

Impact on Investment Outcomes

The drawbacks and limitations of the Pioneer Vision 2 Variable Annuity can impact investment outcomes. It is essential to carefully consider these factors before making an investment decision.

Key Risks and Limitations

| Risk/Limitation | Description |

|---|---|

| Fees and Expenses | Can significantly impact returns. |

| Withdrawal Restrictions | Can limit access to funds. |

| Market Volatility Risk | Can lead to investment losses. |

Closing Summary

The Pioneer Vision 2 Variable Annuity 2024 presents a compelling opportunity for investors seeking to build a secure and potentially lucrative retirement nest egg. While it’s essential to understand the associated risks and limitations, the annuity’s flexibility, potential for growth, and guaranteed minimum death benefit make it a worthy consideration for individuals seeking to diversify their portfolio and navigate the complexities of long-term investment planning.

By carefully analyzing your financial goals, risk tolerance, and investment horizon, you can determine if this annuity aligns with your specific needs and aspirations.

To determine how much annuity you might receive based on a specific amount, you can utilize resources like How Much Annuity For 80000 2024. For those with a Federal Employee Retirement System (FERS) annuity, you can calculate its value using the information provided at Calculate Annuity Fers 2024.

Essential Questionnaire

What are the minimum investment requirements for the Pioneer Vision 2 Variable Annuity?

The minimum initial investment amount for the Pioneer Vision 2 Variable Annuity is typically $5,000. However, specific requirements may vary depending on the individual investment options selected.

How does the Pioneer Vision 2 Variable Annuity differ from a traditional IRA?

While both are retirement savings vehicles, the Pioneer Vision 2 Variable Annuity offers potential for higher returns through investment in sub-accounts, but it also carries greater risk compared to a traditional IRA. Additionally, the annuity may have higher fees and more complex contractual provisions.

If you’re considering retirement planning, understanding the differences between an annuity and a pension is crucial. You can explore this in more detail by visiting Annuity Vs Pension 2024. An annuity is primarily used to provide a steady stream of income during retirement, and its purpose is further explained in Annuity Is Primarily Used To Provide 2024.

It’s crucial to carefully compare the features and implications of each option to determine the best fit for your individual needs.