Pacific Life Insurance 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Pacific Life Insurance, a venerable institution with a rich history, has become a dominant force in the life insurance industry.

Karz Insurance offers a range of insurance products, including car insurance. To explore their offerings and find a plan that suits your needs, visit Karz Insurance 2024 for more information.

This comprehensive overview delves into the company’s past, present, and future, exploring its products, financial performance, customer experience, and the evolving landscape of the life insurance market.

If you’re looking for comprehensive dental coverage, exploring Full Coverage Dental Insurance 2024 options is a great place to start. This type of insurance can help you manage the costs of dental procedures, from routine checkups to more complex treatments.

From its humble beginnings to its current position as a leading provider of financial solutions, Pacific Life Insurance has consistently demonstrated its commitment to innovation, customer satisfaction, and financial stability. This exploration will unveil the company’s core values, strategic initiatives, and its vision for the future, shedding light on its journey to becoming a trusted partner for individuals and families seeking financial security.

Anthem Healthkeepers is a health insurance plan offered by Anthem. To learn more about this plan and its features, visit Anthem Healthkeepers 2024 for detailed information.

Pacific Life Insurance Overview

Pacific Life Insurance Company, often referred to as Pacific Life, is a prominent life insurance and financial services company with a rich history spanning over a century. Founded in 1868, the company has grown to become a leading provider of insurance and financial solutions, serving millions of individuals and families across the United States.

For short-term car insurance needs, Temporary Car Insurance 2024 provides flexible and affordable coverage. This option can be useful for situations like renting a car or driving a new vehicle before purchasing it.

Key Milestones and Achievements

Pacific Life’s journey is marked by significant milestones and achievements that have solidified its position in the industry. Some of the key highlights include:

- 1868:Founded in Los Angeles, California, as a mutual life insurance company.

- 1906:Survived the San Francisco earthquake and fire, demonstrating its resilience and commitment to its policyholders.

- 1950s:Expanded into the group life insurance market, offering coverage to employees of large corporations.

- 1980s:Introduced innovative products like universal life insurance, catering to the evolving needs of customers.

- 2000s:Became a publicly traded company, further expanding its reach and financial capabilities.

Current Market Position and Size

Today, Pacific Life is a major player in the life insurance industry, holding a significant market share and a strong reputation for financial stability and customer service. The company’s financial strength is consistently recognized by independent rating agencies, further reinforcing its reliability and trustworthiness.

Humana Gold Plus HMO is a specific type of health insurance plan offered by Humana. To learn more about this plan and its features, visit Humana Gold Plus Hmo 2024 for a detailed overview.

Mission, Vision, and Values

Pacific Life’s mission is to provide financial security and peace of mind to its customers through innovative insurance and financial solutions. The company’s vision is to be a leading provider of life insurance and financial services, committed to excellence, integrity, and customer satisfaction.

Its core values include:

- Customer Focus:Putting customers first and striving to meet their needs.

- Integrity:Operating with honesty, transparency, and ethical conduct.

- Innovation:Continuously developing new products and services to meet evolving customer needs.

- Financial Strength:Maintaining a strong financial position to ensure the long-term security of its policyholders.

Products and Services

Pacific Life offers a comprehensive suite of insurance and financial products designed to meet the diverse needs of individuals and families at different life stages. The company’s product portfolio encompasses life insurance, annuities, retirement planning, investment management, and wealth management services.

Product Offerings

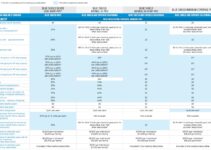

| Product | Features | Benefits | Target Audience |

|---|---|---|---|

| Term Life Insurance | Provides coverage for a specific period, typically 10, 20, or 30 years. | Affordable premiums, death benefit payout to beneficiaries, peace of mind for loved ones. | Individuals seeking affordable coverage for a specific period, such as young families or those with a mortgage. |

| Permanent Life Insurance | Provides lifetime coverage and cash value accumulation. | Long-term financial security, potential for cash value growth, tax-deferred growth. | Individuals seeking lifetime coverage, wealth accumulation, or estate planning. |

| Annuities | Provides guaranteed income stream for a specified period or lifetime. | Retirement income security, protection against market volatility, tax-deferred growth. | Individuals approaching retirement or seeking guaranteed income streams. |

| Retirement Planning | Offers personalized advice and strategies to help individuals plan for their retirement goals. | Customized retirement plans, asset allocation guidance, tax optimization strategies. | Individuals at all stages of their career planning for their retirement. |

Financial Services

Pacific Life provides a range of financial services to help individuals and families manage their finances effectively. These services include:

- Retirement Planning:Personalized advice and strategies to help individuals plan for their retirement goals, including asset allocation, tax optimization, and retirement income planning.

- Investment Management:Professional management of investment portfolios, including stocks, bonds, mutual funds, and other investment vehicles, to help individuals achieve their financial goals.

- Wealth Management:Comprehensive financial planning services, including estate planning, tax planning, and charitable giving, to help individuals preserve and grow their wealth.

Financial Performance

Pacific Life has a strong track record of financial performance, consistently delivering solid results and demonstrating its commitment to shareholder value. The company’s financial performance is driven by its diversified product portfolio, disciplined investment strategies, and efficient operations.

Recent Financial Performance

In recent years, Pacific Life has experienced consistent growth in revenue, profitability, and market share. The company’s strong financial performance is reflected in its key financial metrics, including:

- Revenue:Steady growth in revenue, driven by strong sales of life insurance, annuities, and other financial products.

- Profitability:Consistent profitability, reflecting the company’s efficient operations and disciplined investment strategies.

- Market Share:Increasing market share in the life insurance and financial services industry, indicating the company’s strong competitive position.

Investment Strategies

Pacific Life’s investment strategies are focused on generating long-term returns while managing risk effectively. The company’s investment portfolio is diversified across a range of asset classes, including fixed income, equities, and real estate. This diversification helps to mitigate risk and enhance returns over time.

Humana Gold Plus is a popular health insurance plan offered by Humana. To understand its features and benefits, visit Humana Gold Plus 2024 for a detailed overview.

Potential Risks and Opportunities

Like any financial institution, Pacific Life faces certain risks and opportunities in the current economic environment. Some of the key risks include:

- Interest Rate Risk:Fluctuations in interest rates can impact the value of fixed income investments and the profitability of certain insurance products.

- Market Volatility:Volatility in the stock market can affect the value of equity investments and the performance of investment portfolios.

- Competition:Increasing competition from other insurance and financial services companies can put pressure on pricing and market share.

However, Pacific Life also has several opportunities for future growth, including:

- Growing Demand for Life Insurance:The aging population and increasing awareness of the need for financial protection are driving demand for life insurance products.

- Expansion into New Markets:Pacific Life can explore opportunities to expand its reach into new markets and segments.

- Technological Advancements:The adoption of new technologies, such as artificial intelligence and data analytics, can help Pacific Life improve efficiency, enhance customer experience, and develop new products and services.

Customer Experience

Pacific Life is committed to providing a positive and seamless customer experience. The company invests heavily in customer service initiatives, technology, and digital capabilities to ensure that its customers have a positive and rewarding experience.

Customer Service Strategies and Initiatives

Pacific Life’s customer service strategies are focused on providing personalized and responsive support to its customers. The company offers a variety of channels for customers to access support, including:

- Phone:Dedicated customer service lines for quick and efficient support.

- Email:Convenient and accessible option for non-urgent inquiries.

- Online Chat:Real-time support for immediate assistance.

- Social Media:Engaging with customers on social media platforms to address inquiries and provide updates.

Pacific Life also invests in training its customer service representatives to provide knowledgeable and empathetic support to its customers. The company’s goal is to ensure that every customer interaction is positive and helpful.

If you have multiple vehicles, Multi Car Insurance 2024 can offer cost savings and convenience. By bundling your car insurance policies, you can often get a better rate and simplify your coverage.

Customer Testimonials and Reviews

Pacific Life has a strong reputation for customer service, as evidenced by numerous positive testimonials and reviews from satisfied customers. Customers often praise the company’s responsiveness, professionalism, and commitment to providing personalized solutions.

For peace of mind during your travels, consider Annual Travel Insurance 2024. This type of insurance can protect you against unexpected medical expenses, trip cancellations, and other travel-related emergencies.

Areas for Improvement

While Pacific Life strives to provide exceptional customer service, there are always areas for improvement. The company is continuously evaluating its customer service processes and seeking feedback from customers to identify areas where it can enhance its offerings. Some areas for potential improvement include:

- Digital Capabilities:Further enhancing its digital capabilities to provide a more seamless and convenient customer experience.

- Personalized Solutions:Continuing to develop personalized solutions that cater to the unique needs of each customer.

- Proactive Communication:Improving proactive communication with customers to keep them informed about their policies and account updates.

Digital Presence, Pacific Life Insurance 2024

Pacific Life has a strong digital presence, with a user-friendly website and mobile app that provides customers with access to their accounts, policy information, and other resources. The company’s digital presence has significantly enhanced the customer experience by providing convenience, accessibility, and self-service options.

AIG is a well-known insurance provider that offers travel insurance. If you’re planning a trip and want to explore their coverage options, visit Aig Travel Insurance 2024 for more information.

Industry Trends and Future Outlook

The life insurance industry is constantly evolving, driven by demographic shifts, technological advancements, and changing consumer preferences. Pacific Life is actively monitoring these trends and adapting its strategies to remain competitive and meet the evolving needs of its customers.

Medigap plans can help bridge the gap between Medicare coverage and out-of-pocket expenses. To learn more about the different plans available, visit Medigap Plans 2024 for comprehensive information and resources.

Current Trends

Some of the key trends shaping the life insurance industry include:

- Aging Population:The aging population is driving demand for life insurance and retirement planning products.

- Technological Advancements:New technologies, such as artificial intelligence, data analytics, and blockchain, are transforming the way life insurance is sold, underwritten, and managed.

- Digitalization:Consumers are increasingly using digital channels to access financial services, including life insurance.

- Focus on Customer Experience:Customers are demanding a more personalized and convenient experience, leading insurance companies to invest in customer service and digital capabilities.

Emerging Technologies

Emerging technologies have the potential to revolutionize the life insurance industry, offering new opportunities for innovation and efficiency. Some of the key technologies that are impacting the industry include:

- Artificial Intelligence (AI):AI can automate tasks, improve underwriting processes, and personalize customer experiences.

- Data Analytics:Data analytics can help insurance companies better understand customer needs and risks, leading to more personalized and targeted products.

- Blockchain:Blockchain technology can enhance security and transparency in insurance transactions.

Future of Life Insurance

The future of life insurance is likely to be characterized by:

- Increased Digitalization:Digital channels will continue to play a major role in the distribution and management of life insurance products.

- Personalized Solutions:Insurance companies will continue to develop personalized solutions that cater to the unique needs of each customer.

- Focus on Value:Customers will demand more value from their life insurance products, leading to innovative products and services that address specific needs and offer greater flexibility.

Competitive Landscape

The life insurance industry is highly competitive, with a large number of players vying for market share. Pacific Life faces competition from both traditional insurance companies and new entrants, including fintech companies and digital insurance providers. The company’s ability to adapt to changing market conditions and leverage its strengths, such as its financial stability, customer service, and innovative product offerings, will be critical to its future success.

Health insurance is crucial for managing healthcare costs and ensuring access to essential medical services. Health Insurance Plans 2024 offers a comprehensive guide to the different plans available, helping you find the right coverage for your situation.

Summary: Pacific Life Insurance 2024

As we conclude this exploration of Pacific Life Insurance 2024, one thing becomes abundantly clear: the company’s commitment to excellence, coupled with its adaptability to industry trends, positions it for continued success in the years to come. Pacific Life Insurance remains a beacon of financial strength and a reliable source of security for its policyholders.

Humana is a well-known insurance provider offering a range of plans. If you’re interested in learning more about their offerings, check out Humana Insurance 2024 to explore their options and find a plan that suits your needs.

By embracing innovation, prioritizing customer experience, and navigating the evolving financial landscape with foresight, Pacific Life Insurance continues to write a compelling story of resilience and growth, solidifying its place as a leader in the life insurance industry.

User Queries

What is Pacific Life Insurance’s history?

Pacific Life Insurance was founded in 1868 and has a long history of providing life insurance and financial services. It has a strong track record of financial stability and customer satisfaction.

Veterans have access to a range of healthcare benefits through the VA. To understand your options and find the right plan for you, visit Va Health Insurance 2024 for comprehensive information and resources.

What are the key benefits of Pacific Life Insurance products?

For long-term financial security and peace of mind, Best Whole Life Insurance 2024 options can be a valuable investment. This type of insurance provides lifetime coverage and can also build cash value over time.

Pacific Life Insurance offers a variety of products designed to meet the diverse needs of its customers, including life insurance, annuities, and retirement plans. The specific benefits vary by product, but generally include financial security, tax advantages, and flexibility.

How does Pacific Life Insurance compare to its competitors?

Pacific Life Insurance is known for its strong financial performance, competitive pricing, and comprehensive product offerings. It is considered a reputable and reliable provider of life insurance and financial services.

What are the future prospects for Pacific Life Insurance?

Pacific Life Insurance is well-positioned for continued growth in the life insurance industry. The company is investing in technology, expanding its product offerings, and focusing on customer experience to meet the evolving needs of its customers.

Navigating the world of insurance can be daunting, but understanding your options is key. Usa Insurance 2024 provides a comprehensive overview of the different types of insurance available, helping you make informed decisions for your needs.