Ohio Residency Requirements for Stimulus Checks sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the complex world of government assistance can be challenging, and understanding residency requirements is crucial for Ohio residents seeking stimulus checks.

This guide will delve into the specific criteria, documentation, and potential scenarios that impact eligibility, ensuring that Ohioans have the information they need to access these vital funds.

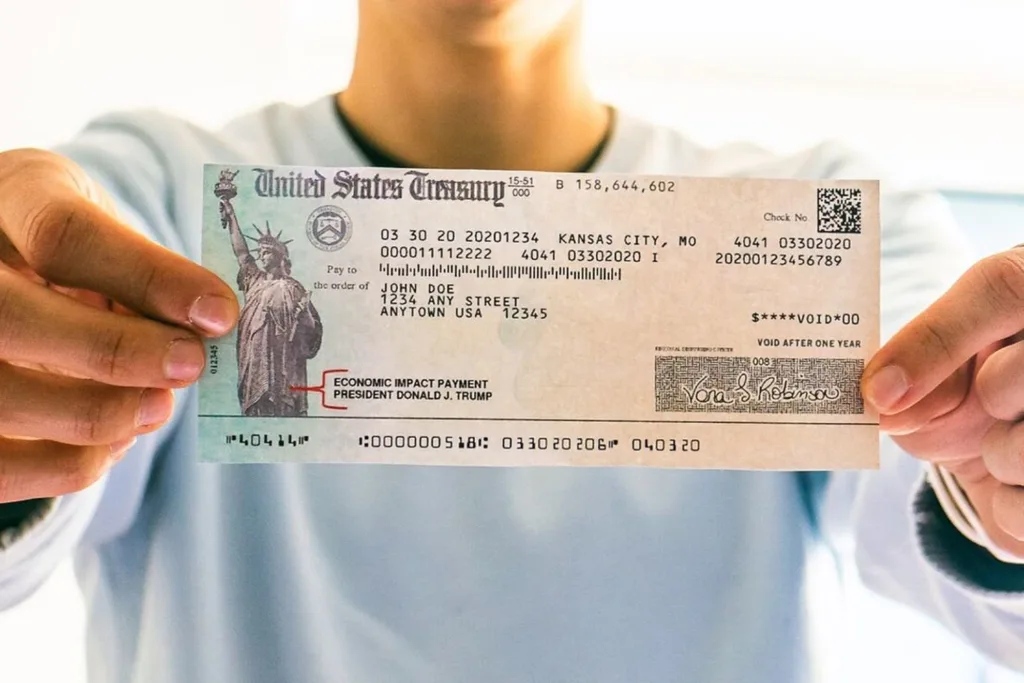

The stimulus checks, formally known as Economic Impact Payments, were designed to provide financial relief during times of economic hardship. Ohio, like other states, has established specific residency requirements to ensure that these funds are distributed fairly and effectively to eligible residents.

This guide will cover the essential aspects of Ohio’s residency requirements, providing clarity and guidance to those seeking to understand their eligibility.

Check what professionals state about Stimulus Checks Eligibility Requirements in Ohio and its benefits for the industry.

Ohio Residency Requirements for Stimulus Checks

The Economic Impact Payments, often referred to as stimulus checks, were distributed by the federal government to help individuals and families cope with the economic challenges brought on by the COVID-19 pandemic. If you were a resident of Ohio during the relevant time periods, you might be eligible for these payments.

You also can investigate more thoroughly about Stimulus Checks Payment Amounts in Ohio to enhance your awareness in the field of Stimulus Checks Payment Amounts in Ohio.

Understanding the residency requirements for stimulus checks in Ohio is crucial to ensure you receive any payments you are entitled to.

Eligibility Criteria for Ohio Residents, Ohio Residency Requirements for Stimulus Checks

To qualify for stimulus checks in Ohio, you must meet specific residency requirements. These requirements typically involve establishing your legal residency in the state for a certain duration and providing proof of your residency.

The general eligibility criteria for stimulus checks in Ohio align with the federal guidelines. These guidelines consider factors like your income, filing status, and dependents. However, residency plays a significant role in determining your eligibility. Here’s a breakdown of residency requirements:

- Length of Residency:While there’s no specific minimum length of residency required to qualify for stimulus checks in Ohio, you must have been a resident of the state during the relevant time periods when the payments were issued. This means you need to have lived in Ohio for a substantial amount of time, even if you’ve moved recently.

- Proof of Residency:To verify your residency, you might be asked to provide documentation. This documentation should demonstrate that you were a resident of Ohio during the relevant periods. The types of documents required and their purpose are explained in the next section.

- Exceptions:There may be exceptions to the residency requirements in specific circumstances. For example, if you were temporarily residing in Ohio for a limited period, you might still be eligible for stimulus checks if you meet other eligibility criteria. However, it’s essential to consult with the relevant government agencies or tax professionals to confirm your eligibility in such cases.

- Residency Status and Different Stimulus Check Programs:The residency requirements might differ slightly depending on the specific stimulus check program you are applying for. It’s crucial to review the eligibility criteria for each program to ensure you meet all the requirements. For example, the first stimulus check program might have different residency requirements compared to subsequent programs.

Documentation Required for Residency Verification

To verify your residency in Ohio for stimulus check purposes, you might be required to provide specific documentation. The documentation should demonstrate your connection to the state and establish your residency during the relevant periods. Here’s a table outlining the types of documentation, their purpose, where to obtain them, and any specific requirements:

| Documentation Type | Purpose | Where to Obtain | Specific Requirements |

|---|---|---|---|

| Driver’s License or State ID | Proof of identity and residency | Ohio Bureau of Motor Vehicles | Must be current and valid |

| Voter Registration Card | Proof of residency | County Board of Elections | Must be current and reflect your Ohio address |

| Utility Bill | Proof of residency | Utility provider (e.g., electric, gas, water) | Must be recent and show your name and Ohio address |

| Bank Statement | Proof of residency | Financial institution | Must be recent and show your name and Ohio address |

You should submit the required documentation to the relevant government agency, such as the Ohio Department of Taxation or the Internal Revenue Service. Providing false information or falsifying documents can have serious consequences, including penalties and legal action.

Expand your understanding about Stimulus Check Eligibility for Those with No Income in New York with the sources we offer.

Residency Changes and Stimulus Check Eligibility

Changes in residency during the stimulus check application period can affect your eligibility. Understanding the rules regarding residency changes is crucial to ensure you receive any payments you are entitled to. Here’s a breakdown of how residency changes might impact your eligibility:

- Moving Within Ohio:If you move within Ohio, your eligibility for stimulus checks generally remains unchanged. However, you might need to update your address with the relevant government agencies to receive any payments or notifications. It’s essential to notify the Ohio Department of Taxation and the IRS about your address change.

- Moving to Ohio:If you move to Ohio from another state, your eligibility for stimulus checks might depend on the specific program and the time period you were a resident of Ohio. You should contact the Ohio Department of Taxation or the IRS to confirm your eligibility based on your specific circumstances.

Find out further about the benefits of Can Immigrants Receive Stimulus Checks in New York? that can provide significant benefits.

- Moving from Ohio:If you move from Ohio to another state, you might still be eligible for stimulus checks if you meet the residency requirements for the relevant time periods. However, you should ensure that your address information is updated with the Ohio Department of Taxation and the IRS to receive any payments or notifications.

Here are some examples of scenarios involving residency changes and their impact on stimulus check eligibility:

- Scenario 1:You moved from Michigan to Ohio in January 2020 and were a resident of Ohio during the time periods when the stimulus checks were issued. You are likely eligible for the payments if you meet other eligibility criteria.

- Scenario 2:You were a resident of Ohio from 2018 to 2020 but moved to California in February 2020. You might be eligible for the first stimulus check if you were a resident of Ohio during the relevant time period, but you might not be eligible for subsequent checks if you were not a resident of Ohio during those time periods.

- Scenario 3:You moved from Ohio to Florida in March 2020 and were not a resident of Ohio during the time periods when the stimulus checks were issued. You are likely not eligible for the payments, as you were not a resident of Ohio during the relevant time periods.

Resources for Ohio Residents

Several resources are available to Ohio residents for information on stimulus checks and residency requirements. These resources can provide guidance, answer questions, and help you navigate the application process.

- Ohio Department of Taxation:The Ohio Department of Taxation website provides information on state taxes, including stimulus checks. You can find contact information and resources on their website.

- Internal Revenue Service (IRS):The IRS website offers comprehensive information on federal taxes, including stimulus checks. You can find frequently asked questions, eligibility guidelines, and instructions on how to claim your payments.

Here’s a flowchart to guide Ohio residents through the process of verifying their residency and applying for stimulus checks:

[Flowchart]

Examine how Special Circumstances and Stimulus Check Eligibility in New York (e.g., Disabilities, Recently Unemployed) can boost performance in your area.

Comparison with Other States

The residency requirements for stimulus checks can vary from state to state. While Ohio’s requirements generally align with federal guidelines, other states might have specific rules or exceptions. Here’s a comparison of Ohio’s residency requirements with those of other states:

For example, some states might require a longer minimum residency period, while others might have different documentation requirements. It’s essential to consult with the relevant government agencies or tax professionals in each state to understand the specific residency requirements. This is especially important for residents who have recently moved to or from Ohio.

Last Word: Ohio Residency Requirements For Stimulus Checks

Navigating the complexities of Ohio residency requirements for stimulus checks can be daunting, but with the right information and resources, the process can become more manageable. By understanding the eligibility criteria, documentation requirements, and potential scenarios, Ohio residents can confidently pursue their entitlement to these vital funds.

This guide serves as a valuable resource, empowering individuals to navigate the process effectively and ensure they receive the financial assistance they deserve.

You also can investigate more thoroughly about Can You Get a New York Stimulus Check if You Are Claimed as a Dependent? to enhance your awareness in the field of Can You Get a New York Stimulus Check if You Are Claimed as a Dependent?.

Frequently Asked Questions

What if I recently moved to Ohio?

Your eligibility for stimulus checks will depend on your residency status during the specific application period. Consult the relevant government resources for details on residency requirements.

What if I moved out of Ohio during the application period?

You may still be eligible for stimulus checks if you were a resident of Ohio during the relevant time frame. However, you may need to provide documentation to verify your residency status.

Can I get help with understanding the residency requirements?

Yes, contact the Ohio Department of Taxation or the Internal Revenue Service for assistance with navigating the residency requirements and eligibility criteria.