Ohio Income Limits for Stimulus Check Eligibility are crucial for determining who qualifies for financial assistance. Understanding these limits is essential for Ohio residents seeking economic relief. This guide provides a comprehensive overview of the income thresholds, eligibility criteria, and resources available to help you navigate the process.

Further details about How to Determine Your New York Stimulus Check Eligibility Online is accessible to provide you additional insights.

Stimulus checks, also known as economic impact payments, were distributed by the federal government to provide financial support during times of economic hardship. These payments were designed to help individuals and families cope with the financial burdens associated with events like the COVID-19 pandemic.

Eligibility for these checks is determined by factors such as income, filing status, and dependents.

Overview of Stimulus Check Eligibility in Ohio

Stimulus checks, also known as Economic Impact Payments, were a series of payments distributed by the U.S. government to individuals and families during the COVID-19 pandemic. The purpose of these payments was to provide economic relief and support during a period of significant economic disruption.

To be eligible for stimulus checks in the United States, individuals generally had to meet certain income and residency requirements. The specific eligibility criteria varied depending on the stimulus check program, but common factors included:

- U.S. citizenship or lawful permanent residency

- A valid Social Security number

- Not being claimed as a dependent on someone else’s tax return

- Meeting certain income thresholds

In Ohio, individuals were eligible for stimulus checks based on the same general criteria as the rest of the United States. However, there were some specific requirements related to income limits that may have impacted eligibility in Ohio.

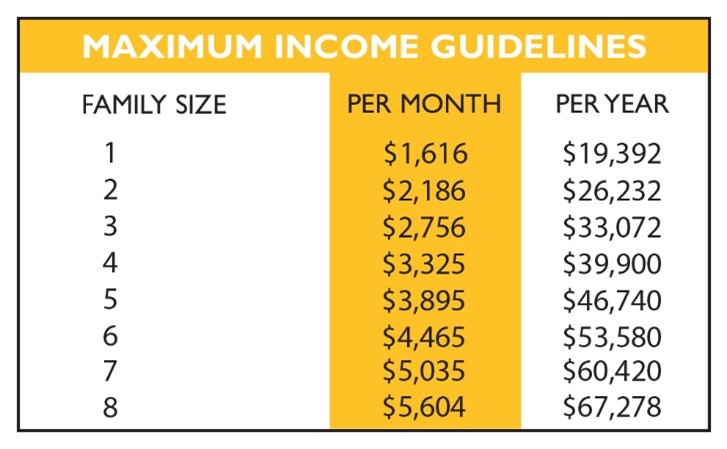

Income Limits for Stimulus Check Eligibility

The income thresholds for stimulus check eligibility in Ohio were based on the adjusted gross income (AGI) reported on federal tax returns. These thresholds varied depending on the stimulus check program and the individual’s filing status. For example, the income limits for the first stimulus check program (CARES Act) were as follows:

| Filing Status | Income Limit |

|---|---|

| Single | $75,000 |

| Married Filing Jointly | $150,000 |

| Head of Household | $112,500 |

Individuals with AGI exceeding these thresholds were generally not eligible for stimulus checks. However, there were some exceptions and nuances to these rules, such as:

- Individuals who received unemployment benefits may have been eligible for stimulus checks even if their income exceeded the thresholds.

- The income limits for stimulus checks were adjusted for individuals with dependents.

It’s important to note that these income limits are just examples and may have changed for subsequent stimulus check programs. It’s always best to consult official government resources for the most up-to-date information on eligibility requirements.

Obtain access to Stimulus Checks Eligibility Requirements in Ohio to private resources that are additional.

Different Stimulus Check Programs

Throughout the COVID-19 pandemic, the U.S. government implemented several stimulus check programs, each with its own set of eligibility criteria and income limits. Some of the key programs included:

- CARES Act (2020): This program provided the first round of stimulus checks to eligible individuals. The income limits for this program were relatively high, but they varied depending on the individual’s filing status and number of dependents.

- Consolidated Appropriations Act (2021): This program provided a second round of stimulus checks, with slightly lower income limits than the CARES Act. The eligibility requirements for this program were similar to the first program.

- American Rescue Plan Act (2021): This program provided a third round of stimulus checks, with the most generous income limits of all the programs. The eligibility requirements for this program were also relatively broad, but they did include some restrictions on income levels.

The income limits for each stimulus check program were generally based on the individual’s adjusted gross income (AGI) as reported on their federal tax return. However, the specific thresholds and eligibility criteria varied depending on the program and the individual’s filing status and number of dependents.

Discover the crucial elements that make Will You Get a New York Stimulus Check if You Owe Taxes? the top choice.

It’s important to note that the income limits for stimulus check programs may have been subject to change based on the specific program and the individual’s circumstances. It’s always best to consult official government resources for the most up-to-date information on eligibility requirements.

Check How Previous Stimulus Payments Affect Eligibility in New York to inspect complete evaluations and testimonials from users.

Resources for Obtaining Information

To obtain reliable information on stimulus check eligibility in Ohio, it’s important to consult official government resources. Here are some helpful sources:

| Resource Name | Website URL | Contact Information |

|---|---|---|

| Internal Revenue Service (IRS) | https://www.irs.gov/ | (800) 829-1040 |

| Ohio Department of Taxation | https://tax.ohio.gov/ | (614) 728-2100 |

| Ohio Treasurer of State | https://treasurer.ohio.gov/ | (614) 644-1111 |

These websites provide comprehensive information on stimulus check programs, eligibility requirements, and how to receive payments. It’s also advisable to consult with a tax professional or financial advisor for personalized guidance on your specific situation.

Potential Challenges and Considerations

Determining eligibility for stimulus checks in Ohio can sometimes be challenging due to various factors that may impact an individual’s eligibility. Some of the key considerations include:

- Dependents: The number of dependents claimed on a tax return can impact income thresholds and eligibility for stimulus checks.

- Filing Status: The filing status used on a tax return (e.g., single, married filing jointly) can also influence eligibility for stimulus checks.

- Income Sources: The types of income received can impact eligibility, as some income sources may be excluded from the AGI calculation used to determine eligibility.

To navigate these complexities, it’s crucial to carefully review official government guidelines and seek guidance from qualified professionals. It’s also advisable to keep accurate records of all income sources and expenses to ensure you meet the eligibility requirements for stimulus checks.

Final Wrap-Up: Ohio Income Limits For Stimulus Check Eligibility

Navigating the complexities of stimulus check eligibility can be challenging, but understanding the Ohio income limits is a crucial first step. By familiarizing yourself with the eligibility requirements, available resources, and potential challenges, you can increase your chances of receiving the financial assistance you need.

Remember to consult reliable sources and seek guidance if you have any questions.

Browse the multiple elements of Stimulus Checks Eligibility Requirements in Ohio to gain a more broad understanding.

Questions Often Asked

What are the specific income thresholds for stimulus check eligibility in Ohio?

Discover more by delving into Special Circumstances and Stimulus Check Eligibility in New York (e.g., Disabilities, Recently Unemployed) further.

The income thresholds for stimulus check eligibility in Ohio are determined by the specific stimulus program. It’s essential to check the guidelines for each program to understand the applicable income limits.

What are the different types of stimulus checks that have been implemented?

The United States has implemented several stimulus check programs, including the Economic Impact Payments (EIP) distributed in 2020 and 2021, as well as the Recovery Rebate Credit, which was part of the American Rescue Plan Act of 2021.

How do I know if I am eligible for a stimulus check?

To determine your eligibility for a stimulus check, you should review the specific eligibility criteria for each program. These criteria may vary based on factors such as your income, filing status, dependents, and whether you received a previous stimulus check.

Where can I find more information about stimulus check eligibility in Ohio?

You can find reliable information about stimulus check eligibility in Ohio on the official websites of the Internal Revenue Service (IRS) and the Ohio Department of Taxation. You can also consult with a tax professional or financial advisor for guidance.