October 2024 Tax Rebate Amount and Payment Schedule: This comprehensive guide will delve into the details of the upcoming tax rebates, providing clarity on eligibility criteria, rebate amounts, and payment schedules. Understanding these details can empower individuals and businesses to prepare for the potential economic impact of these rebates.

The impact of a stimulus on the economy is a complex issue. How will the stimulus affect the economy in October 2024? is a question economists and policymakers will be analyzing closely. The potential effects on inflation, consumer spending, and job growth will be closely watched.

The government has announced a series of tax rebates designed to stimulate the economy and provide financial relief to individuals and businesses. This initiative, known as the October 2024 Tax Rebate Program, will distribute a significant amount of money back to taxpayers, with varying amounts based on income levels.

The tech industry has experienced significant layoffs in recent years. What are the biggest tech layoffs in October 2024? Staying informed about industry trends can be helpful for those working in or considering a career in technology.

The program aims to boost consumer spending and stimulate economic growth by injecting money into the hands of those who need it most.

The Federal Reserve plays a crucial role in monetary policy and economic stability. Will the Federal Reserve play a role in any stimulus measures in October 2024? The Fed’s actions could have a significant impact on the effectiveness and implementation of any stimulus package.

Overview of Tax Rebates in October 2024

Tax rebates are a form of financial relief provided by the government to individuals and businesses. These rebates aim to stimulate economic activity by injecting additional disposable income into the economy. The October 2024 tax rebate program is anticipated to have a significant impact on both individuals and businesses, potentially influencing consumer spending, economic growth, and government revenue.

Families are often the focus of stimulus programs, providing financial assistance during challenging times. October 2024 stimulus check for families could offer much-needed support, so keep an eye out for eligibility requirements and updates.

Purpose and Nature of Tax Rebates

Tax rebates are typically implemented to address economic challenges, such as inflation, recession, or unemployment. By providing financial assistance, the government aims to increase consumer spending, boost demand for goods and services, and ultimately stimulate economic growth. Tax rebates can take various forms, including direct payments to individuals, tax credits, or deductions.

Potential Economic Impact of Tax Rebates

The economic impact of tax rebates can be multifaceted. A significant injection of disposable income can lead to increased consumer spending, potentially driving demand for goods and services across various sectors. This increased demand can stimulate production, create jobs, and contribute to overall economic growth.

However, the effectiveness of tax rebates in achieving these objectives depends on factors such as the size of the rebate, the target audience, and the overall economic conditions.

Examples of Past Tax Rebate Programs

Historical examples of tax rebate programs provide insights into their potential effects. The Economic Stimulus Act of 2008, for instance, included tax rebates to individuals and businesses, aiming to mitigate the impact of the Great Recession. This program resulted in a noticeable increase in consumer spending, although the long-term impact on economic growth remains a subject of debate.

As we approach October 2024, many are eager for updates on the potential for a stimulus. What are the latest updates on the potential for a stimulus in October 2024? Stay informed by checking reliable news sources and official government websites.

The American Recovery and Reinvestment Act of 2009, another significant economic stimulus package, included tax credits and rebates, which contributed to a gradual recovery from the recession. These examples highlight the potential of tax rebates to influence economic activity, but also emphasize the importance of careful design and implementation to maximize their effectiveness.

The stock market can be influenced by various factors, including economic policies. How will the stimulus affect the stock market in October 2024? is a question investors are likely pondering. The impact on market sentiment and investor confidence will be closely monitored.

Eligibility Criteria for Tax Rebates

Eligibility for tax rebates in October 2024 is expected to be determined based on factors such as income level, residency status, and other specific criteria. The government will likely set income thresholds to define who qualifies for the rebate. These thresholds may vary depending on the individual’s filing status, such as single, married filing jointly, or head of household.

Key Factors Determining Eligibility

- Income Level: The government will likely set income thresholds to determine eligibility. Individuals below a certain income level may receive the full rebate amount, while those above the threshold may receive a reduced amount or no rebate at all.

- Residency Status: Tax rebates are typically available only to residents of the country implementing the program. Proof of residency may be required to claim the rebate.

- Other Qualifications: Depending on the specific program, there may be other qualifications that need to be met, such as being a US citizen or permanent resident, having a valid Social Security number, or meeting certain employment requirements.

Potential Changes or Updates to Eligibility Criteria

It’s important to note that eligibility criteria can change based on evolving economic conditions and government policies. Any changes or updates to the eligibility criteria will be announced through official government channels, such as the IRS website or press releases.

Individuals seeking information about eligibility should refer to these reliable sources for the most up-to-date information.

Wondering if you’ll be eligible for a stimulus payment in October 2024? You can find out by checking the eligibility requirements. This information is essential for anyone hoping to receive financial assistance, so make sure to stay informed about the latest updates.

Rebate Amount and Payment Schedule

The amount of tax rebates in October 2024 is likely to vary depending on individual income levels. The government will likely establish a tiered system, with higher income earners receiving smaller rebates or no rebate at all. The payment schedule will determine when individuals can expect to receive their rebate payments.

The possibility of a stimulus check in October 2024 is a topic of interest for many. Is there a stimulus check coming in October 2024? is a question that only time will tell. Keep an eye out for official announcements and developments.

Anticipated Rebate Amounts

The anticipated rebate amounts for different income levels are still under consideration and may be subject to change. However, based on past tax rebate programs, it’s possible that the government might adopt a similar approach, with larger rebates for lower-income individuals and smaller rebates for higher-income earners.

For example, a household with an annual income below $50,000 might receive a full rebate amount, while a household with an income above $100,000 might receive a reduced amount or no rebate at all. These are hypothetical examples, and the actual amounts will be determined by the government.

Proposed Payment Schedule

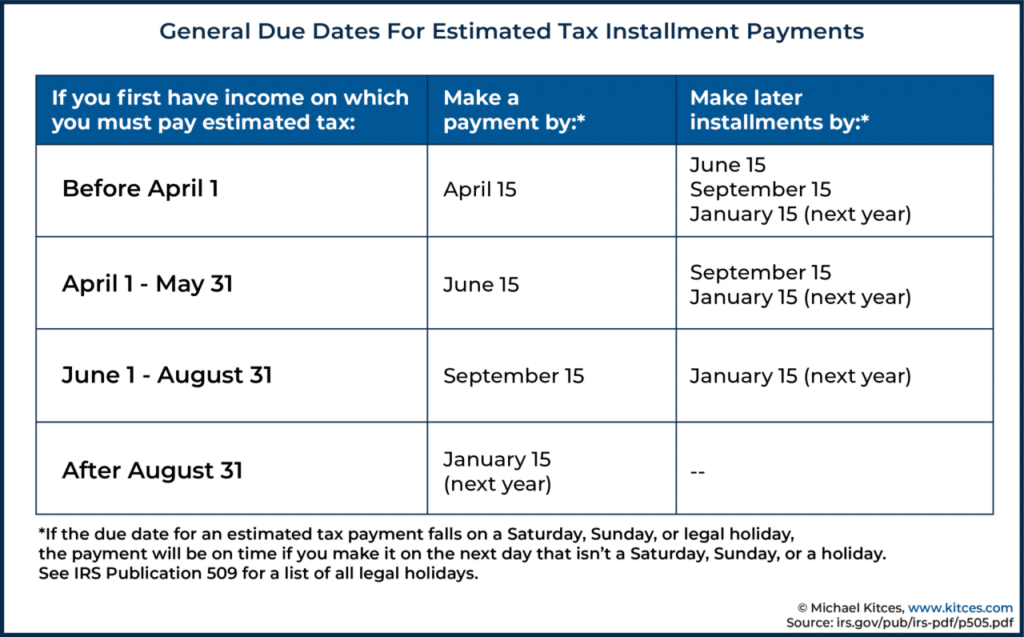

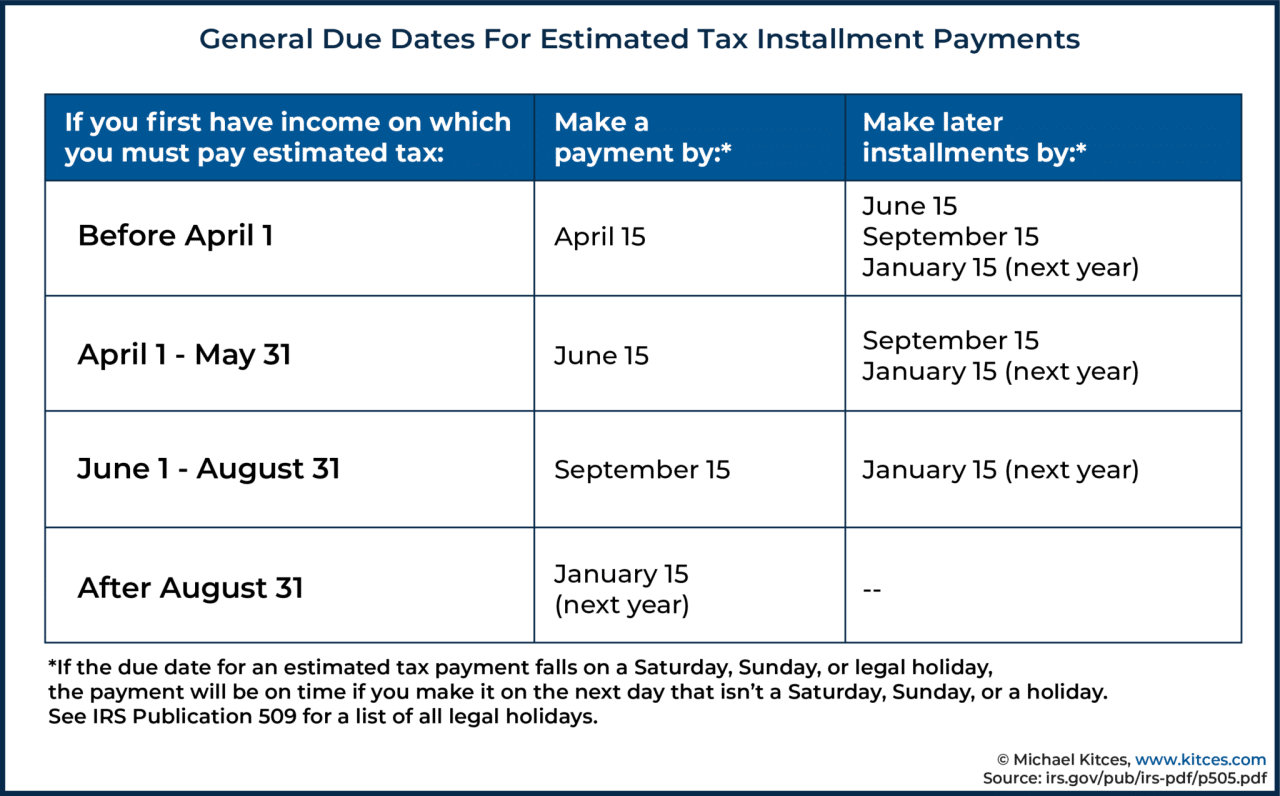

The proposed payment schedule for tax rebates in October 2024 is also subject to change. However, the government might use a similar approach to previous rebate programs, with payments being made in a phased manner over several weeks or months.

This staggered approach helps to manage the distribution process and ensure that all eligible individuals receive their payments. The specific dates for payment distribution will be announced by the government once the program is finalized.

Students often face financial challenges, and a stimulus check could provide some relief. If you’re a student, you might be wondering if you’ll be eligible for a stimulus check in October 2024. Keep an eye out for official announcements and eligibility criteria.

How Individuals Will Receive Payments

Individuals will likely receive their rebate payments through various methods, including direct deposit into their bank accounts, mailed checks, or electronic transfers. The method of payment will be determined by the government and communicated to individuals during the application process.

It’s crucial to ensure that your contact information is up-to-date with the relevant government agency to avoid delays or issues with receiving your rebate payment.

Tax Rebate Impact on Individuals and Businesses: October 2024 Tax Rebate Amount And Payment Schedule

Tax rebates can have a significant impact on both individuals and businesses. For individuals, rebates can provide much-needed financial relief, boosting disposable income and potentially leading to increased consumer spending. For businesses, rebates can stimulate demand for goods and services, leading to increased sales and potentially encouraging investment and expansion.

To stay up-to-date on the latest developments, you can check for news updates on the official website or reliable news sources. This will ensure you’re in the loop about any changes or announcements.

Potential Economic Benefits for Individuals, October 2024 Tax Rebate Amount and Payment Schedule

- Increased Disposable Income: Tax rebates directly increase disposable income, giving individuals more money to spend on essential goods and services or save for future needs.

- Stimulated Consumer Spending: With additional financial resources, individuals may be more inclined to spend on goods and services, boosting demand and supporting businesses across various sectors.

- Improved Financial Security: Rebates can help individuals manage financial obligations, such as paying bills, reducing debt, or building savings, leading to improved financial security and stability.

Impact on Consumer Spending and Economic Growth

The impact of tax rebates on consumer spending and economic growth is a complex issue that depends on various factors. If individuals use the rebate money to purchase goods and services, it can lead to increased demand, stimulating production and creating jobs.

A stimulus package can have significant political implications. What are the political implications of a stimulus in October 2024? The potential impact on elections, party platforms, and public opinion will be closely watched.

However, if individuals save the rebate money or use it to pay down debt, the impact on consumer spending and economic growth may be less pronounced. The effectiveness of tax rebates in stimulating economic growth also depends on other factors, such as the overall economic climate and the availability of other economic policies.

For accurate and up-to-date information, you can visit the official website for the October 2024 stimulus check. This is the best source for details on eligibility, application processes, and payment information.

Business Response to Tax Rebates

Businesses can respond to tax rebates in various ways. Increased consumer spending can lead to higher sales, potentially encouraging businesses to invest in expansion, hiring new employees, or developing new products and services. Businesses might also use the additional income from increased sales to improve their financial position, reduce debt, or invest in research and development.

The specific response of businesses will depend on factors such as their industry, size, and financial situation.

Potential Challenges and Concerns

While tax rebates can have positive economic effects, they also present potential challenges and concerns. One concern is the impact on government revenue and debt. Another concern is the potential for unintended consequences, such as inflation or increased income inequality.

Challenges Associated with Tax Rebates

- Impact on Government Revenue and Debt: Tax rebates can reduce government revenue, potentially leading to increased budget deficits or the need to raise taxes in the future. The government must carefully weigh the potential economic benefits of rebates against their impact on government finances.

- Potential for Unintended Consequences: Tax rebates can have unintended consequences. For example, if individuals use the rebate money to purchase imported goods, it might not stimulate domestic production or create jobs. Additionally, if rebates are not targeted effectively, they could lead to increased income inequality, with higher-income individuals benefiting more than lower-income individuals.

Wondering how you’ll receive your stimulus check if it’s approved? The payment methods could include direct deposit, paper checks, or debit cards. It’s important to stay informed about the options available to you.

- Inflationary Pressures: A significant increase in consumer spending fueled by tax rebates could lead to inflationary pressures, as demand outpaces supply, driving up prices for goods and services.

Potential Impact on Government Revenue and Debt

Tax rebates can reduce government revenue, potentially leading to increased budget deficits or the need to raise taxes in the future. The government must carefully weigh the potential economic benefits of rebates against their impact on government finances. For example, if a tax rebate program costs the government $100 billion, it might reduce government revenue by that amount, potentially leading to increased budget deficits.

This reduction in revenue could necessitate cuts to government programs or an increase in taxes to balance the budget. The government must consider the long-term financial implications of tax rebate programs.

Potential Unintended Consequences

Tax rebates can have unintended consequences. For example, if individuals use the rebate money to purchase imported goods, it might not stimulate domestic production or create jobs. Additionally, if rebates are not targeted effectively, they could lead to increased income inequality, with higher-income individuals benefiting more than lower-income individuals.

The government must carefully consider the potential unintended consequences of tax rebate programs and design them to minimize these risks.

Resources and Information

For the most up-to-date information about tax rebates in October 2024, individuals should consult official government websites and resources. These websites provide detailed information on eligibility criteria, rebate amounts, payment schedules, and other relevant details. Individuals seeking clarification or assistance can contact the relevant government agency for guidance.

Relevant Government Websites

- Internal Revenue Service (IRS): www.irs.gov

- United States Treasury: www.treasury.gov

Contact Information for Assistance

Individuals seeking clarification or assistance regarding tax rebates can contact the IRS or the US Treasury Department through their respective websites or phone lines. These agencies provide comprehensive information and support to taxpayers.

Key Information on Tax Rebates

| Criteria | Details |

|---|---|

| Eligibility | Individuals meeting specific income thresholds and other qualifications may be eligible for tax rebates. Refer to official government websites for detailed criteria. |

| Amount | The rebate amount is likely to vary based on income levels. Higher income earners may receive smaller rebates or no rebate at all. |

| Payment Schedule | The government will likely distribute payments in a phased manner over several weeks or months. Specific dates will be announced through official channels. |

Ending Remarks

The October 2024 Tax Rebate Program presents a unique opportunity for individuals and businesses to benefit from government support. Understanding the eligibility criteria, rebate amounts, and payment schedules will allow individuals to maximize their potential benefits and businesses to plan for the potential economic impact.

By staying informed and prepared, individuals and businesses can navigate this program effectively and contribute to a robust economic recovery.

User Queries

How do I know if I’m eligible for a tax rebate?

Eligibility is based on income levels and other factors. You can check the government’s official website for detailed eligibility criteria.

Are you a senior citizen looking for information about the potential stimulus check in October 2024? The stimulus check for seniors might be a welcome addition to your finances, so stay tuned for updates.

When will I receive my tax rebate?

The eligibility requirements for the October 2024 stimulus check will likely be based on income levels and other factors, similar to past stimulus programs. It’s always a good idea to check the official website for the most up-to-date information.

The payment schedule will be announced closer to the disbursement date. The rebates will likely be distributed via direct deposit or mail.

What can I do with my tax rebate?

You can use the rebate for any purpose, such as paying bills, saving for the future, or investing.

How will tax rebates impact businesses?

Businesses may see an increase in consumer spending, leading to higher sales and revenue.