October 2024 mileage rate for medical expenses is a crucial aspect of healthcare reimbursement, offering individuals a way to recover costs associated with traveling for medical treatment. This rate, set by the Internal Revenue Service (IRS), plays a significant role in helping individuals offset the financial burden of medical travel, ensuring that they can access necessary healthcare without excessive financial strain.

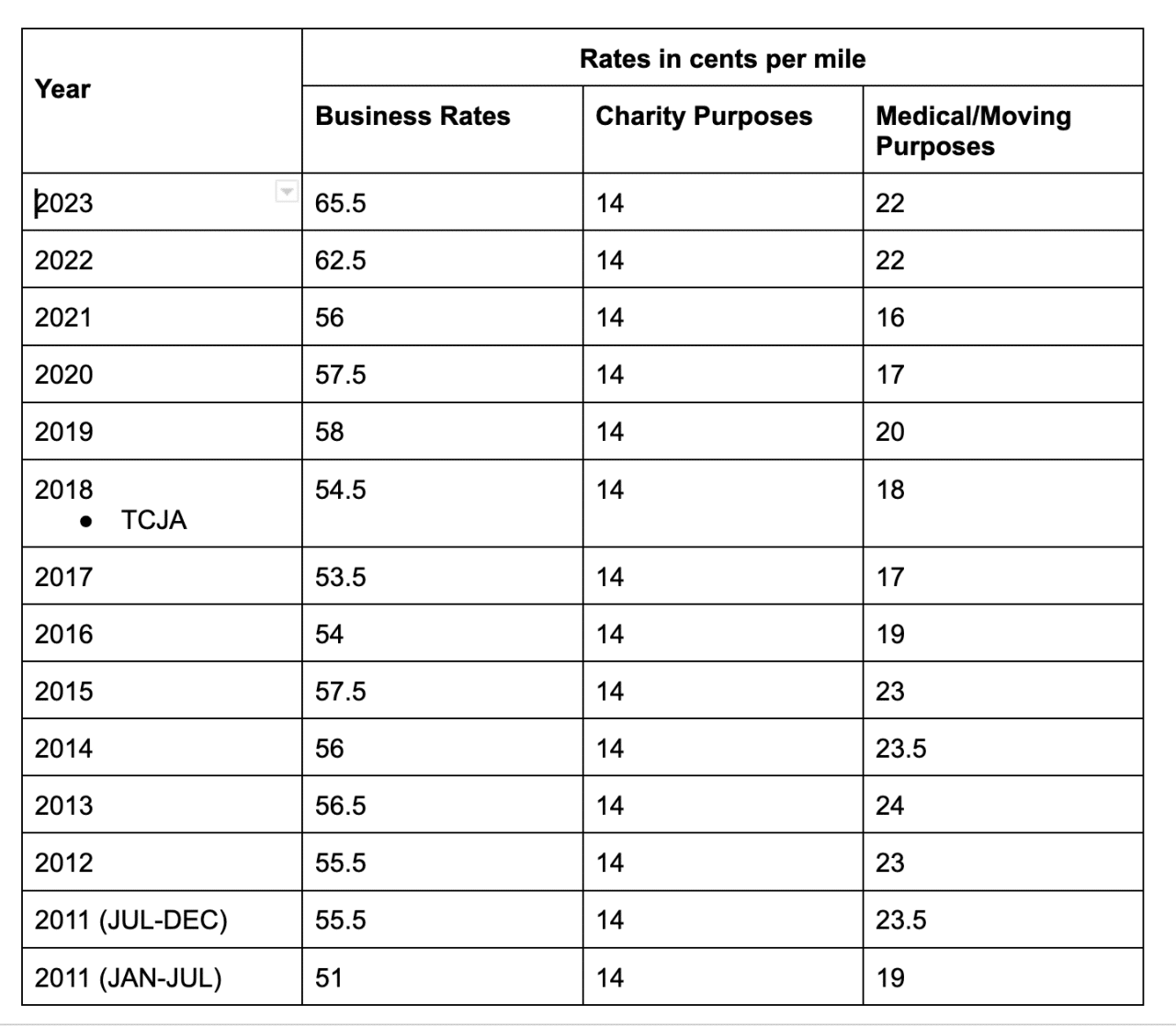

The standard mileage rate for medical expenses is determined annually by the IRS, taking into account factors such as fuel costs, vehicle maintenance, and depreciation. This rate allows individuals to claim a deduction for their medical travel expenses, potentially reducing their tax liability.

Understanding how to calculate and claim this deduction is essential for maximizing tax benefits and minimizing out-of-pocket expenses related to medical care.

IRS Standard Mileage Rate for Medical Expenses

The IRS Standard Mileage Rate is a method for calculating the cost of driving for certain business and medical purposes. This rate is updated annually by the IRS and is used by taxpayers to deduct expenses related to driving for medical reasons.

Head of household status offers specific tax benefits. It’s important to understand the tax brackets for this filing status to ensure you’re taking advantage of any potential savings. You can find more information on the Tax brackets for head of household in 2024 page.

Standard Mileage Rate for Medical Expenses in October 2024

The standard mileage rate for medical expenses in October 2024 is not yet available. The IRS typically announces the new rates for the upcoming calendar year in December of the previous year. Therefore, the standard mileage rate for medical expenses in October 2024 will be the same as the rate used for the entire year 2024.

The tax bracket thresholds for 2024 determine which tax rate applies to your income. Understanding these thresholds is crucial for calculating your tax liability. You can find a breakdown of the thresholds for 2024 on the Tax bracket thresholds for 2024 page.

Factors Influencing the Standard Mileage Rate

The IRS considers several factors when determining the standard mileage rate, including:

The cost of operating an automobile, such as fuel, maintenance, depreciation, and insurance.

The tax brackets for 2024 in the United States are determined by income levels. Knowing which bracket you fall into can help you calculate your tax liability. You can find a detailed explanation of the tax brackets for 2024 on the Tax brackets for 2024 in the United States page.

The average number of miles driven by taxpayers for business and medical purposes.

Tax changes can impact the October 2024 deadline, so it’s important to stay informed about any updates or revisions to the tax code. You can find more information about these changes on the Tax changes impacting the October 2024 deadline page.

Changes in the economy, such as inflation and fuel prices.

The tax deadline for October 2024 is likely to be the same as the standard deadline, which is usually April 15th. However, it’s always best to double-check and confirm the exact date with the IRS. You can find more information on the What is the tax deadline for October 2024 page.

Data collected from various sources, including the Bureau of Labor Statistics and the Internal Revenue Service.

The Seahawks had a tough loss in Week 5, despite a valiant comeback effort. You can find more information about the game and the Seahawks’ performance on the Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss page.

Calculating Mileage Reimbursement

The IRS Standard Mileage Rate for Medical Expenses is used to calculate mileage reimbursement for trips related to medical care. This rate is updated annually, and the rate for October 2024 will be announced by the IRS.

The tax rates for each tax bracket in 2024 are subject to change, so it’s important to stay updated on the latest information. You can find a breakdown of the tax rates for each bracket on the Tax rates for each tax bracket in 2024 page.

Mileage Reimbursement Calculation

The mileage reimbursement calculation is straightforward. You multiply the total miles traveled for medical purposes by the current IRS Standard Mileage Rate for Medical Expenses.

Businesses have specific deadlines and requirements for filing their taxes. It’s important for businesses to understand these rules to ensure they meet the October 2024 deadline. You can find more information about the October 2024 tax deadline for businesses on the October 2024 tax deadline for businesses page.

Example

Here’s an example of how to calculate mileage reimbursement using the hypothetical standard mileage rate of 20 cents per mile for October 2024.

Understanding tax brackets for 2024 is crucial for calculating your tax liability. Each bracket has a different tax rate, and your income determines which bracket you fall into. You can find a detailed explanation of tax brackets for 2024 on the Understanding tax brackets for 2024 page.

| Date | Destination | Miles Traveled | Reimbursement Amount |

|---|---|---|---|

| October 10, 2024 | Doctor’s Appointment | 20 miles | $4.00 (20 miles

The October 2024 tax deadline for freelancers might be different than the standard deadline, depending on their filing status and income. It’s crucial for freelancers to understand the specific deadlines and requirements that apply to them. More information on this can be found on the October 2024 tax deadline for freelancers page.

|

| October 25, 2024 | Hospital Visit | 50 miles | $10.00 (50 miles

Students often have different tax obligations and deadlines. It’s important for students to understand the specific requirements and deadlines that apply to them. You can find more information about the October 2024 tax deadline for students on the October 2024 tax deadline for students page.

|

Step-by-Step Guide

- Record the date, destination, and total miles traveled for each medical trip.

- Obtain the current IRS Standard Mileage Rate for Medical Expenses for the relevant period.

- Multiply the total miles traveled by the standard mileage rate to determine the reimbursement amount for each trip.

- Sum the reimbursement amounts for all medical trips to calculate the total mileage reimbursement.

Alternative Methods of Reimbursement

The standard mileage rate isn’t the only way to get reimbursed for medical travel expenses. You can also use the actual expenses method. This involves keeping track of all your expenses related to medical travel, such as gas, tolls, parking, and lodging, and submitting them for reimbursement.

Missing the October 2024 tax deadline can result in penalties, which can include late payment fees and interest charges. The amount of the penalty will depend on the amount of tax owed and the length of the delay. You can find more information on the Tax penalties for missing the October 2024 deadline page.

Comparing Standard Mileage Rate and Actual Expenses

The standard mileage rate and the actual expenses method each have advantages and disadvantages.

Qualifying widow(er)s have a separate set of tax brackets, which can be beneficial for those who qualify. Understanding these brackets can help you determine your tax liability. You can find more information on the Tax brackets for qualifying widow(er)s in 2024 page.

- The standard mileage rate is simpler and easier to use, as you don’t need to keep track of all your individual expenses. You just need to multiply your mileage by the current rate.

- The actual expenses method can potentially result in a higher reimbursement, especially if your actual expenses exceed the standard mileage rate.

However, using the actual expenses method requires more work. You need to carefully document all your expenses and keep your receipts.

Using Actual Expenses for Maximum Reimbursement

In certain situations, using actual expenses might be more beneficial.

The IRS offers a variety of resources to help taxpayers understand their obligations and meet the October 2024 deadline. These resources include online tools, publications, and contact information for assistance. You can learn more about these resources on the IRS resources for the October 2024 tax deadline page.

- If you have significant expenses, such as lodging for an extended medical stay, using the actual expenses method can result in a higher reimbursement.

- If you drive a vehicle that has high fuel efficiency, using the actual expenses method may be advantageous because your actual fuel costs may be lower than what the standard mileage rate assumes.

- If you have any other deductible expenses, such as parking fees or tolls, you can claim these expenses using the actual expenses method.

Tax Implications: October 2024 Mileage Rate For Medical Expenses

The reimbursement you receive for medical expenses, including mileage, can significantly impact your tax filings. It’s essential to understand how these reimbursements are treated for tax purposes.

Deductions Available for Medical Expenses and Mileage Reimbursement, October 2024 mileage rate for medical expenses

When calculating your medical expenses for tax purposes, you can deduct certain eligible expenses, including mileage. The IRS offers two methods for calculating your medical expense deductions:* Standard Mileage Rate:The IRS provides a standard mileage rate for medical expenses. This rate is updated annually and is generally more convenient than the actual expense method.

Actual Expense Method

You can choose to deduct your actual expenses, including gas, oil, repairs, insurance, and depreciation. This method requires more documentation and calculation but may be more beneficial if your actual expenses are higher than the standard mileage rate.

Tax Implications of Using the Standard Mileage Rate

The standard mileage rate for medical expenses is considered a tax-free reimbursement. This means that the amount you receive for your medical mileage is not considered taxable income. However, the amount you deduct from your taxes is limited to the amount of eligible medical expenses you incurred.

For example, if you drove 100 miles for medical appointments and received $250 in reimbursement using the standard mileage rate, you would not have to report the $250 as income. However, you can only deduct $250 from your medical expenses for the year, assuming your total eligible medical expenses exceed the $250.

End of Discussion

Navigating the complexities of medical expense reimbursement can be challenging, but understanding the October 2024 mileage rate for medical expenses empowers individuals to claim their rightful deductions. By carefully documenting travel expenses, adhering to IRS guidelines, and utilizing available resources, individuals can effectively manage their medical costs and ensure that they receive the financial support they deserve.

General Inquiries

Can I use the standard mileage rate for all medical expenses?

No, the standard mileage rate only applies to travel expenses incurred for medical treatment. It does not cover other medical expenses such as prescriptions or doctor’s fees.

What if I use my personal vehicle for medical travel?

You can use the standard mileage rate for travel in your personal vehicle for medical purposes. However, you must keep accurate records of your mileage and destination.

Is there a limit on the amount of mileage I can claim?

There is no specific limit on the amount of mileage you can claim for medical expenses. However, you must have documentation to support your claim.

What if I use public transportation for medical travel?

You can claim the actual expenses incurred for public transportation for medical travel. Keep receipts and documentation of your travel costs.

Can I use the standard mileage rate for travel to a doctor’s appointment?

Yes, you can use the standard mileage rate for travel to and from doctor’s appointments, as long as the appointments are for medical treatment.

A tax bracket calculator can be a helpful tool for estimating your tax liability and understanding how different income levels affect your tax rate. You can find a tax bracket calculator for 2024 on the Tax bracket calculator for 2024 page.