October 2024 mileage rate for driving to work is a critical factor for individuals who commute to their workplaces. Understanding how mileage rates are calculated, where to find official rates, and the potential tax implications is crucial for maximizing deductions and minimizing expenses.

This guide delves into the intricacies of mileage rates, exploring trends, calculation methods, record-keeping practices, and the impact on work-related expenses.

The IRS sets the standard mileage rate for business use, which includes driving to and from work. This rate is updated periodically to reflect changes in fuel prices and other economic factors. The standard mileage rate for 2024 is not yet available, but it’s expected to be announced in the coming months.

Understanding Mileage Rates

Mileage rates are designed to reimburse individuals for expenses incurred when driving their personal vehicles for work-related purposes. These rates are intended to cover the costs associated with fuel, vehicle maintenance, depreciation, and insurance.

Moving? The IRS offers a standard mileage rate for moving expenses. Learn more about the October 2024 mileage rate for moving expenses. You can find more resources on the IRS website for the October 2024 tax deadline: IRS resources for the October 2024 tax deadline.

Factors Influencing Mileage Rates, October 2024 mileage rate for driving to work

Mileage rates are calculated based on several factors, including:

- Vehicle operating costs:This includes fuel, oil changes, tire replacements, and other maintenance expenses. The cost of these items varies depending on the vehicle’s fuel efficiency, age, and driving conditions.

- Depreciation:This refers to the decrease in the vehicle’s value over time. Depreciation is a significant factor in mileage rate calculations, as it reflects the wear and tear on the vehicle.

- Insurance:Insurance premiums are also factored into mileage rates, as they contribute to the overall cost of owning and operating a vehicle.

- Vehicle type:The type of vehicle used for work-related driving can also influence mileage rates. For example, a smaller, fuel-efficient car will typically have a lower mileage rate than a larger SUV or truck.

- Location:Geographic location can impact mileage rates due to differences in fuel prices, traffic congestion, and road conditions.

Mileage Rate Categories

Mileage rates are categorized based on the purpose of the driving. Common categories include:

- Standard mileage rate:This rate is used for general business driving, such as commuting to work, attending meetings, or visiting clients. The standard mileage rate is typically lower than other categories.

- Business mileage rate:This rate is used for driving related to specific business activities, such as traveling to conferences, meeting with potential clients, or delivering goods. The business mileage rate is generally higher than the standard rate.

- Medical mileage rate:This rate is used for driving related to medical appointments, such as visiting a doctor, hospital, or pharmacy. The medical mileage rate is often the highest, reflecting the importance of access to healthcare.

Official Mileage Rate Sources: October 2024 Mileage Rate For Driving To Work

Determining the official mileage rate for business or work-related driving is crucial for accurate expense reporting and tax deductions. This rate is set by the Internal Revenue Service (IRS) and is used to calculate the reimbursement amount for mileage driven for business purposes.

If you’re filing as head of household, the tax brackets are different. Tax brackets for head of household in 2024. You can also deduct business mileage expenses using the standard rate. October 2024 mileage rate for business use.

Official Sources for Mileage Rates

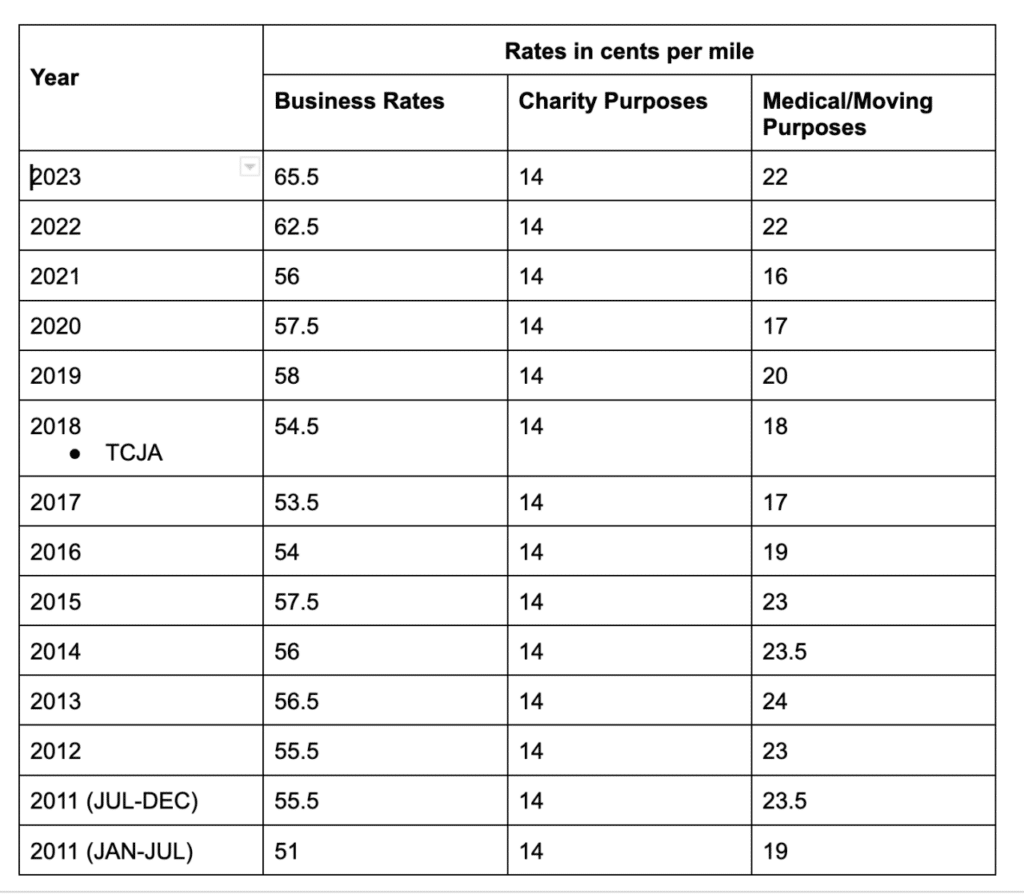

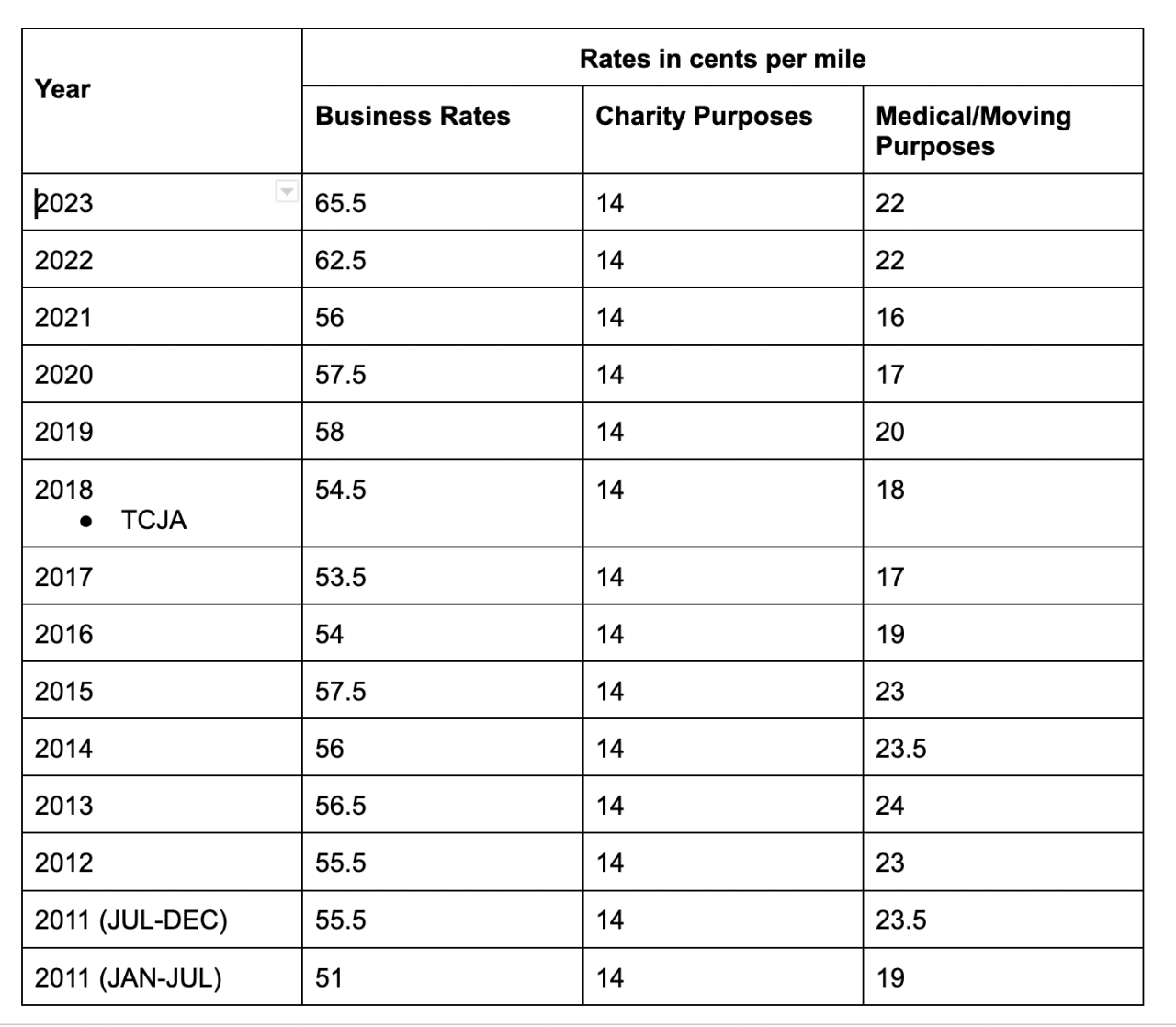

The IRS publishes the standard mileage rates for business, medical, and moving expenses. These rates are updated annually to reflect changes in fuel prices and other relevant factors.

The IRS updates the standard mileage rate annually. What is the standard mileage rate for October 2024? The tax brackets for 2024 have changed, so it’s important to know how this affects your income. Tax bracket changes for 2024.

- IRS Publication 529, Miscellaneous Deductions: This publication provides detailed information about mileage rates and other deductions related to business expenses. It is available on the IRS website.

- IRS Website: The most up-to-date mileage rates are always available on the IRS website. You can access them by searching for “mileage rates” on the IRS website.

Mileage Rate Updates

The IRS updates the standard mileage rates annually. The new rates are typically announced in January or February of each year. To ensure you are using the correct rate, it is essential to check the IRS website for the latest updates.

Students also have specific deadlines and may be eligible for certain deductions. Check out the October 2024 tax deadline for students. Don’t miss the deadline, or you could face penalties! Find out about tax penalties for missing the October 2024 deadline.

The standard mileage rates are updated annually to reflect changes in fuel prices and other relevant factors.

Don’t forget, the tax deadline for 2024 is October 15th! Here’s how to file your taxes by the October 2024 deadline. Foreign nationals have a different deadline, which you can find here: October 2024 tax deadline for foreign nationals.

Accessing Current Mileage Rates

You can access the current mileage rates directly from the IRS website. The website provides a clear and concise table with the rates for business, medical, and moving expenses.

Want to know how much you’ll owe in taxes for 2024? Use a tax bracket calculator for 2024 to get a good estimate. You can find the exact thresholds for each tax bracket on this page: Tax bracket thresholds for 2024.

Final Wrap-Up

Navigating the complexities of mileage rates can be daunting, but understanding the basics empowers individuals to make informed decisions regarding their work-related driving expenses. By staying informed about current rates, utilizing proper record-keeping practices, and exploring alternative transportation options, individuals can optimize their finances and minimize their environmental impact.

Whether you’re a seasoned professional or a new employee, understanding the nuances of mileage rates is essential for maximizing your financial well-being.

Questions Often Asked

What if my job requires me to drive a personal vehicle for work-related purposes?

If your job requires you to use your personal vehicle for work-related purposes, you can generally deduct your vehicle expenses, including mileage, gas, and maintenance, on your tax return. You can choose to use the standard mileage rate or track your actual expenses.

Can I deduct mileage for driving to and from work if I have a home office?

No, you cannot deduct mileage for driving to and from work even if you have a home office. However, you can deduct mileage for driving between your home office and another work location.

What are some alternative transportation options to driving to work?

Public transportation, biking, walking, carpooling, and ride-sharing are all viable alternatives to driving to work. These options can be more affordable and environmentally friendly than driving.

Curious about the new tax brackets for 2024? What are the new tax brackets for 2024? The mileage reimbursement rate is used to calculate how much you can deduct for business or medical expenses. What is the mileage reimbursement rate for October 2024?

.

Did you use your car for medical expenses? You may be able to deduct those miles using the standard mileage rate. October 2024 mileage rate for medical expenses.