October 2024 Mileage Rate for Business Use is a crucial factor for anyone using their personal vehicle for work-related purposes. The Internal Revenue Service (IRS) sets this rate, and it is used to calculate the deductible expenses for business travel.

Understanding how this rate is determined and how to accurately track your mileage is essential for maximizing tax benefits and ensuring compliance with IRS regulations.

This guide provides a comprehensive overview of the October 2024 mileage rate, covering its purpose, calculation, and how to track your mileage for business use. We’ll also explore the types of business expenses that can be deducted using mileage rates, limitations and restrictions associated with these deductions, and alternative methods for deducting business vehicle expenses.

October 2024 Mileage Rate

The standard mileage rate for business use is a crucial factor for individuals and businesses that incur travel expenses. It allows them to deduct a specific amount for each mile driven for business purposes on their tax returns. This rate is set by the Internal Revenue Service (IRS) and is updated annually.

Keep in mind that there may be some “Tax changes impacting the October 2024 deadline” here. Staying up-to-date on these changes is crucial for ensuring you file your taxes correctly.

October 2024 Mileage Rate

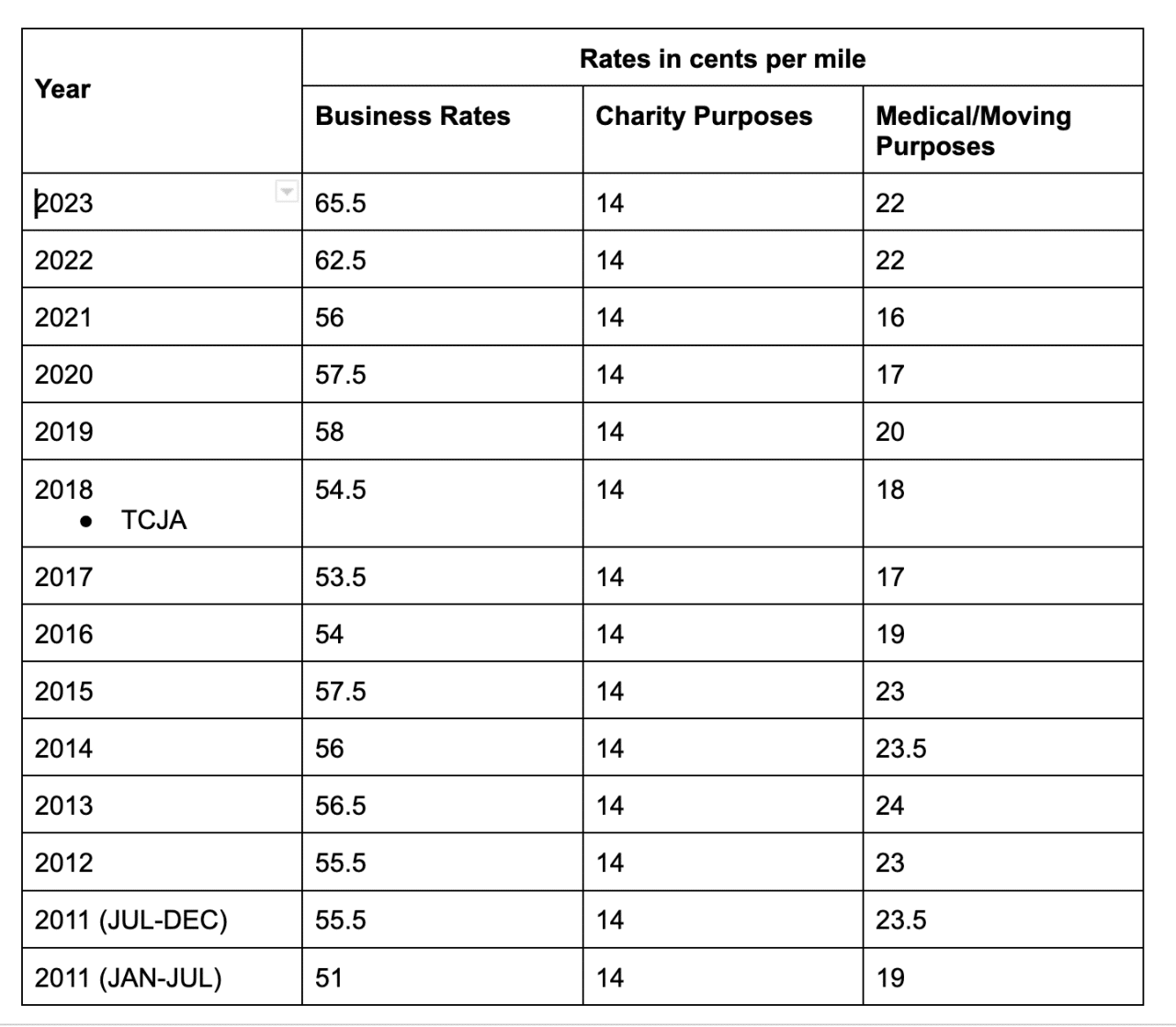

The IRS has not yet announced the standard mileage rate for business use for October 2024. However, we can estimate the rate based on historical trends and current economic conditions. In 2023, the standard mileage rate for business use was 65.5 cents per mile.

Filing your taxes on time is important. To avoid penalties, check out “How to file taxes by the October 2024 deadline” here. This article provides helpful tips and resources for filing your taxes.

Factors Influencing Mileage Rate Changes, October 2024 mileage rate for business use

The IRS considers various factors when determining the standard mileage rate. These factors include:

- Fuel prices:The cost of gasoline is a significant component of vehicle operating expenses. Fluctuations in fuel prices directly impact the mileage rate.

- Vehicle maintenance costs:Factors like oil changes, tire replacements, and repairs also contribute to the overall cost of operating a vehicle.

- Inflation:The rate of inflation affects the overall cost of goods and services, including vehicle-related expenses.

- Depreciation:The value of a vehicle depreciates over time. The mileage rate reflects the depreciation cost associated with business use.

Potential Impact of Inflation on Mileage Rates

Inflation can have a significant impact on mileage rates. As prices for goods and services increase, the cost of operating a vehicle also rises. This can lead to an increase in the standard mileage rate to reflect the higher expenses.

Businesses have a different deadline for filing their taxes. If you’re a business owner, make sure to mark your calendar for the “October 2024 tax deadline for businesses” here. This will help you avoid any penalties.

For example, if inflation is high, the IRS may need to adjust the mileage rate upwards to ensure that the deduction accurately reflects the actual cost of driving for business purposes.

If you’re filing as head of household, you’ll want to check out the specific tax brackets that apply to you. You can find all the details on “Tax brackets for head of household in 2024” here. This will help you estimate your tax liability and plan accordingly.

Tracking Mileage for Business Use

Accurately tracking your mileage for business use is crucial for maximizing your tax deductions. By keeping detailed records, you can ensure you receive the full benefit of the standard mileage rate or the actual expenses method for deducting vehicle expenses.

It’s important to understand the tax rates for each income level. You can find a breakdown of “Tax rates for each tax bracket in 2024” here. This information can help you plan your finances and understand your tax obligations.

Methods for Tracking Mileage

To accurately track your mileage, you can use a variety of methods, including:

- Logbooks:Traditional paper logbooks are a tried-and-true method. You can manually record the date, starting and ending mileage, purpose of the trip, and destination. These logbooks provide a physical record of your travels.

- Mileage Tracking Apps:Numerous mobile apps are specifically designed for mileage tracking. These apps automatically record your mileage using your phone’s GPS, and some even allow you to categorize trips for business or personal use. They also provide reports and summaries for easy record-keeping.

The deadline for filing your taxes in October 2024 is approaching. If you’re wondering “What is the tax deadline for October 2024?” here you can find the exact date. Make sure you meet this deadline to avoid any penalties.

- Spreadsheets:You can create your own mileage tracking spreadsheet in programs like Microsoft Excel or Google Sheets. This allows for customized tracking and calculations, but it requires manual input of data.

Importance of Accurate Record-Keeping

Accurate record-keeping is essential for mileage deductions. The IRS requires detailed documentation to support your claims.

Students also have a specific tax deadline. You can find the details on “October 2024 tax deadline for students” here. This information will help you ensure you meet the filing requirements.

The IRS recommends keeping detailed records of your business trips, including the date, starting and ending mileage, destination, purpose of the trip, and the business reason for the trip.

Want to know how much tax you might owe? Use a “Tax bracket calculator for 2024” here to get an estimate. This tool can be helpful for planning your finances and understanding your tax liability.

| Step | Action |

|---|---|

| 1 | Record the date, starting and ending mileage, and the purpose of the trip. |

| 2 | Categorize each trip as business or personal. |

| 3 | Keep detailed records of all trips, including the destination and the business reason for the trip. |

| 4 | Store your mileage records in a safe and organized manner. |

Alternatives to Mileage Rates

While the standard mileage rate provides a convenient way to deduct business vehicle expenses, it’s not the only option. Other methods exist, each with its own advantages and disadvantages. Choosing the best approach depends on your specific circumstances and the nature of your business use.

Are you curious about the new tax brackets for 2024? You can find a breakdown of “What are the new tax brackets for 2024?” here. This information will help you better understand your tax obligations.

Comparing Mileage Rates and Actual Expenses

This section delves into the comparison of mileage rates and actual expenses for deducting business vehicle costs.

If you’re a qualifying widow(er), there are specific tax brackets that apply to you. You can find the details on “Tax brackets for qualifying widow(er)s in 2024” here. This information is essential for filing your taxes accurately.

- Mileage Rates:The IRS sets an annual standard mileage rate, which simplifies the process of tracking and deducting vehicle expenses. You multiply the rate by the number of business miles driven. This method is often preferred for its ease of use and straightforward calculations.

The Seahawks had a tough game in Week 5, but their comeback effort fell short. You can read about the “Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss” here. This article provides insights into the game and the team’s performance.

However, it may not always reflect the actual costs incurred.

- Actual Expenses:This method involves tracking and documenting all vehicle expenses related to business use, including gas, repairs, insurance, depreciation, and more. You can then deduct these actual expenses from your taxes. While this method can potentially result in a larger deduction, it requires meticulous record-keeping and can be more complex to calculate.

Self-employed individuals have a different deadline for filing their taxes. Make sure to check out the “October 2024 tax deadline for self-employed individuals” here. This will help you avoid any penalties.

Situations Where Alternative Methods Might Be More Beneficial

This section explores scenarios where alternative methods to mileage rates might be more advantageous.

There are various tax credits available, and some of them might be applicable to you. You can find information on “Tax credits for the October 2024 deadline” here. Claiming these credits can help you reduce your tax liability.

- High Vehicle Costs:If your vehicle has significant expenses, such as high fuel consumption or frequent repairs, the actual expense method might yield a larger deduction. This is because the standard mileage rate might not fully capture these elevated costs.

- Long-Term Business Use:If you use your vehicle extensively for business purposes over a long period, the actual expense method can provide a more accurate reflection of your vehicle’s depreciation. This method allows you to deduct the depreciation cost based on the vehicle’s actual use and age, potentially resulting in a greater deduction.

There might be some changes in the tax brackets for 2024. To stay informed, check out “Tax bracket changes for 2024” here. Understanding these changes can help you make informed financial decisions.

- Specialized Vehicles:If you use a specialized vehicle for your business, such as a truck or a van, the actual expense method might be more appropriate. The standard mileage rate might not accurately account for the unique costs associated with these vehicles, such as higher maintenance and fuel expenses.

Wondering about the top tax rate for 2024? You can find the answer to “What is the highest tax bracket in 2024?” here. This information is crucial for planning your finances and understanding how your income will be taxed.

Advantages and Disadvantages of Using Mileage Rates

This section Artikels the pros and cons of utilizing mileage rates for deducting business vehicle expenses.

Advantages:

- Simplicity:The standard mileage rate method is easy to use and requires minimal record-keeping. You only need to track your business miles driven, making it a convenient option for many taxpayers.

- IRS-approved:The IRS sets the standard mileage rate, ensuring that your deduction is compliant with tax regulations. This eliminates the need for complex calculations or justifications.

- Flexibility:The mileage rate can be adjusted based on the type of vehicle used (business or personal) and the purpose of the trip (business or commuting). This flexibility accommodates various business scenarios.

Disadvantages:

- Potential Underestimation:The standard mileage rate might not accurately reflect the actual costs associated with your vehicle, especially if you have high expenses. This could result in a smaller deduction than you’re entitled to.

- Limited Flexibility:The mileage rate is a fixed amount, meaning it doesn’t account for variations in vehicle costs based on location, driving conditions, or individual expenses. This can lead to an underestimation of your actual costs.

- No Depreciation Deduction:The standard mileage rate does not allow for a separate deduction for depreciation. This can be a disadvantage if you have a vehicle that depreciates rapidly.

Epilogue

Navigating the intricacies of mileage deductions for business use can seem daunting, but with a clear understanding of the rules and regulations, you can ensure you’re maximizing your tax benefits. By accurately tracking your mileage and adhering to IRS guidelines, you can confidently claim the deductions you deserve.

This guide provides a starting point for your journey, equipping you with the knowledge to navigate the world of mileage rates and business expenses with confidence.

Frequently Asked Questions: October 2024 Mileage Rate For Business Use

What factors influence changes in mileage rates?

Mileage rates are adjusted periodically by the IRS to reflect changes in fuel costs, vehicle maintenance, and other relevant factors. These adjustments ensure the rate remains fair and accurate for taxpayers.

How often does the IRS update mileage rates?

The IRS typically updates mileage rates annually, usually in January. However, they can make adjustments throughout the year if necessary.

Are there any penalties for inaccurate mileage tracking?

Yes, the IRS can impose penalties for inaccurate mileage tracking. It’s crucial to maintain accurate records and be prepared to provide documentation if audited.

What are some examples of business expenses that can be deducted using mileage rates?

Common deductible expenses include travel to client meetings, job site visits, attending conferences, and picking up supplies for your business.