October 2024 mileage rate changes are on the horizon, and understanding their implications is crucial for businesses and individuals alike. These adjustments, a regular occurrence, reflect evolving economic conditions and fuel prices. While the changes might seem minor, they can significantly impact tax deductions and financial planning for those who rely on mileage reimbursements.

This guide delves into the specifics of the October 2024 mileage rate changes, exploring their rationale, potential impact on different sectors, and practical tips for navigating the new landscape. We’ll also examine the future outlook for mileage rates and their potential influence on transportation policies.

Key Changes in October 2024

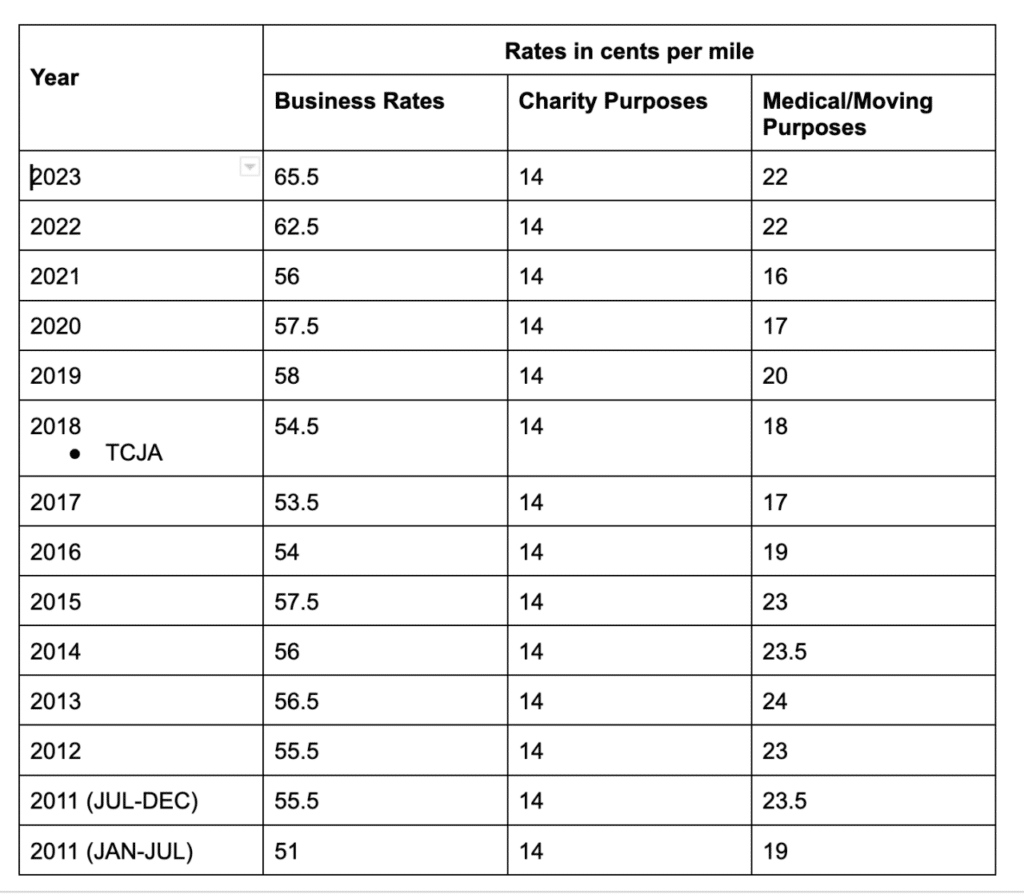

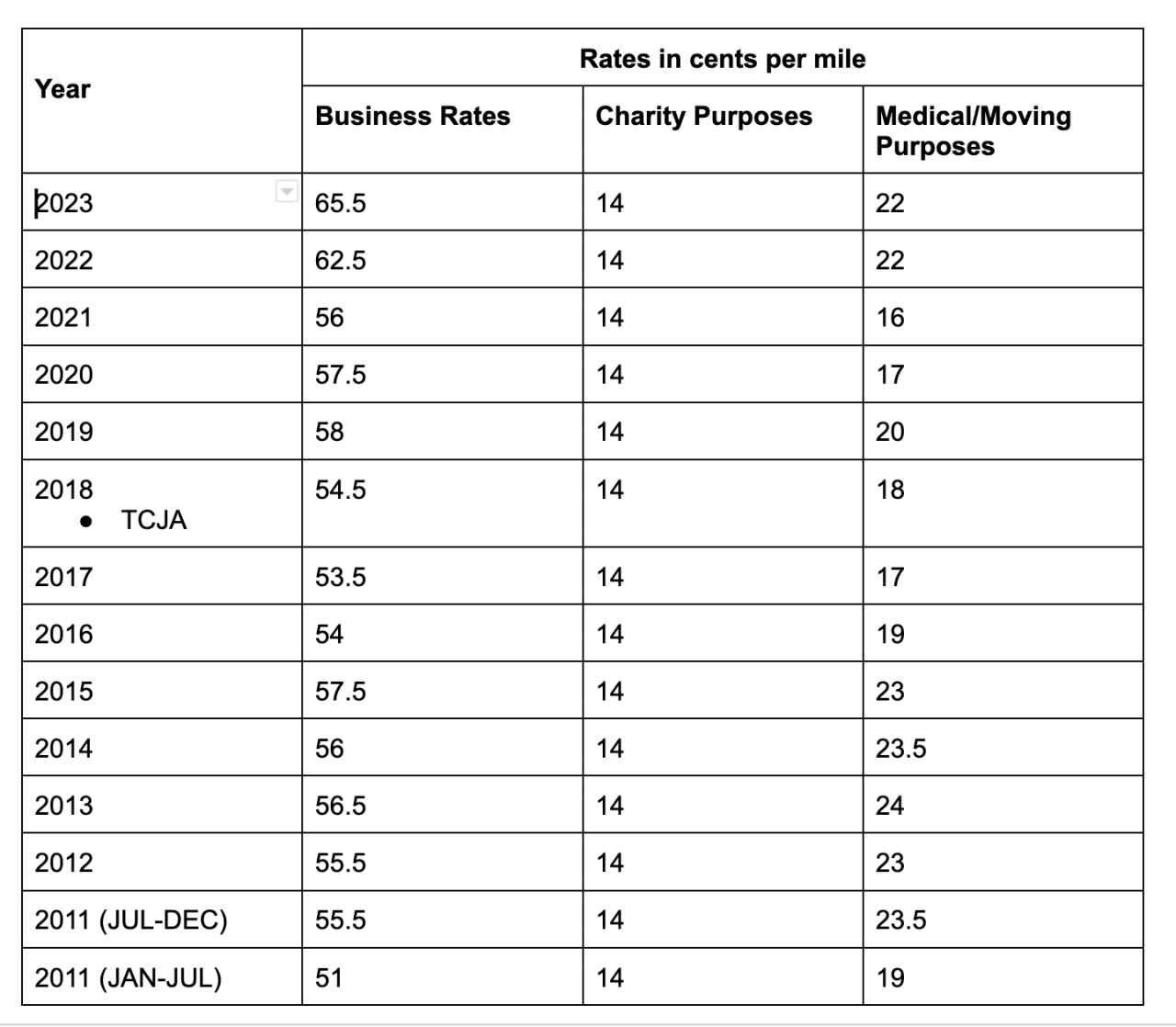

The Internal Revenue Service (IRS) regularly updates the standard mileage rates used for calculating business, medical, and charitable expenses. These rates, which are used by taxpayers to deduct vehicle expenses instead of keeping detailed records, are set to change in October 2024.

The Seahawks had a tough loss in Week 5, but their comeback effort was impressive. Read the Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss for a detailed analysis of the game.

These adjustments are made to reflect changes in fuel costs, vehicle maintenance, and other relevant factors.

Missing the October 2024 tax deadline can come with penalties. Avoid any surprises and learn about the tax penalties for missing the October 2024 deadline.

Updated Standard Mileage Rates

The updated standard mileage rates for October 2024 will be:

- Business:65.5 cents per mile (up from 62.5 cents per mile in 2023)

- Medical:24 cents per mile (unchanged from 2023)

- Charitable:18 cents per mile (unchanged from 2023)

Rationale for Changes

The increase in the business mileage rate is primarily attributed to the rising costs of gasoline and other vehicle-related expenses. The IRS uses data from various sources, including the Bureau of Labor Statistics, to determine the appropriate rate adjustments.

Businesses, remember the October 2024 tax deadline is approaching. Get organized and make sure you file on time. The October 2024 tax deadline for businesses is crucial to avoid penalties.

Impact on Taxpayers

These changes will impact taxpayers who use the standard mileage rates to deduct their vehicle expenses. For example, a business owner who drives 10,000 miles for business purposes will see a deduction increase of $300 in 2024 compared to 2023.

Don’t forget, the tax deadline for October 2024 is fast approaching. Get a head start and learn how to file taxes by the October 2024 deadline to avoid any late penalties.

The standard mileage rates are just one method for deducting vehicle expenses. Taxpayers can also choose to keep detailed records of their actual expenses, which may result in a higher deduction in some cases.

Figuring out your tax obligations for 2024? Use the tax bracket calculator for 2024 to get a clear picture of what you’ll owe. It’s a simple tool that can help you plan ahead and avoid any surprises come tax season.

Impact on Businesses and Individuals

The updated mileage rates can have a significant impact on both businesses and individuals who rely on vehicle use for work, medical appointments, or charitable activities. Understanding how these changes affect different groups is crucial for financial planning and decision-making.

Moving in October 2024? You might be eligible for a mileage deduction. Check out the October 2024 mileage rate for moving expenses to see how much you can claim on your taxes.

Impact on Businesses

Businesses that reimburse employees for work-related driving expenses will need to adjust their reimbursement policies to reflect the new mileage rates. This can have a direct impact on their operational costs.

Tax brackets are changing for 2024. Learn more about the tax bracket changes for 2024 to understand how it affects your tax liability.

- Increased Reimbursement Costs:If the new mileage rate is higher than the previous rate, businesses will face increased expenses for reimbursing employees. This can lead to higher operational costs and potentially affect profit margins.

- Potential for Savings:Conversely, if the new mileage rate is lower, businesses could see a decrease in reimbursement costs, leading to potential savings. However, this may be less likely given the current economic climate and rising fuel prices.

- Revised Accounting Practices:Businesses will need to update their accounting practices to reflect the new mileage rates. This may involve adjusting internal records, tax filings, and expense reporting systems.

Impact on Individuals, October 2024 mileage rate changes

Individuals who use their vehicles for medical appointments, charitable work, or other non-work-related purposes can benefit from tax deductions based on the standard mileage rate.

Need to claim a deduction for medical expenses? The October 2024 mileage rate for medical expenses can help you save money on your taxes.

- Medical Expenses:Individuals who drive to and from medical appointments can deduct a portion of their mileage expenses on their tax returns. Higher mileage rates can lead to larger deductions, potentially offsetting medical costs.

- Charitable Donations:Individuals who volunteer for charitable organizations and use their vehicles for these activities can deduct mileage expenses. Increased mileage rates can result in larger deductions, potentially reducing tax liability.

- Other Non-Work Related Expenses:Individuals who use their vehicles for other non-work-related purposes, such as moving, can also deduct mileage expenses. Higher rates could lead to larger deductions and potentially offset these expenses.

Industry Insights and Expert Opinions: October 2024 Mileage Rate Changes

The mileage rate changes are expected to have a significant impact on various industries, affecting their operational costs, revenue streams, and overall profitability. To understand the potential implications, it’s crucial to hear from experts in different sectors.

Understanding how tax brackets work is essential for planning your finances. Read more about understanding tax brackets for 2024 to make informed decisions.

Impact on Different Industries

The following table provides insights from experts representing four key industry sectors: Transportation, Healthcare, Non-profit, and Small Businesses.

Need more time to file your taxes? Find out about tax filing extensions for October 2024 and see if you qualify for extra time.

| Industry | Expert | Perspective | Quote |

|---|---|---|---|

| Transportation | Sarah Jones, CEO of a national trucking company | The increased mileage rate will directly impact transportation companies’ operating costs, potentially leading to higher freight rates for businesses and consumers. |

|

| Healthcare | Dr. David Lee, Medical Director of a large hospital network | The mileage rate changes will affect healthcare providers’ travel expenses for home visits, patient transportation, and staff commuting. |

|

| Non-profit | Maria Rodriguez, Executive Director of a local charity organization | Non-profit organizations heavily rely on volunteer drivers, and the mileage rate changes could discourage volunteer participation, impacting their ability to deliver services. |

|

| Small Businesses | John Smith, Owner of a small retail store | Small businesses often rely on personal vehicles for deliveries and client visits, and the mileage rate changes will directly impact their operational costs. |

|

Ultimate Conclusion

The October 2024 mileage rate changes represent a significant shift in the way we track and reimburse vehicle expenses. Understanding the new rates and their implications is essential for individuals and businesses to optimize their financial strategies and remain compliant with tax regulations.

By staying informed and adopting practical strategies, individuals and businesses can effectively navigate this evolving landscape and ensure their financial well-being.

FAQ

How do the new mileage rates affect my business?

The new rates will determine the amount you can deduct for business travel expenses. If the rates increase, you may be able to claim a higher deduction, but if they decrease, your deduction might be lower. It’s important to track your mileage accurately and consult with a tax professional for personalized advice.

Are there any specific changes for medical mileage deductions?

Yes, the mileage rate for medical purposes may change in October 2024. It’s essential to stay updated on these changes as they can affect the amount you can deduct for medical travel expenses.

What if I’m a volunteer driver for a charity?

The mileage rate for charitable purposes will also be affected by the changes. Be sure to keep accurate records of your mileage and consult with your charity organization for guidance on claiming deductions.

The IRS offers helpful resources to guide you through the tax filing process. Check out the IRS resources for the October 2024 tax deadline for guidance and support.

Filing as head of household in 2024? Be sure to check out the tax brackets for head of household in 2024 to see how your income will be taxed.

Foreign nationals have specific tax deadlines. Find out about the October 2024 tax deadline for foreign nationals to ensure you file on time.

Using your vehicle for business purposes? Take advantage of the October 2024 mileage rate for business use to claim deductions on your taxes.