October 2024 income tax brackets for single filers are a crucial factor in financial planning, determining how much tax you’ll owe on your earnings. Understanding these brackets allows you to make informed decisions about your income and expenses, potentially minimizing your tax liability and maximizing your financial well-being.

The Internal Revenue Service (IRS) sets these brackets, which are based on your taxable income. The higher your income, the higher the tax rate you’ll pay on a portion of your earnings. This system is designed to ensure a fair distribution of tax burden based on individual financial capacity.

Income Tax Brackets for Single Filers in 2024

The income tax brackets for single filers in 2024 are crucial for understanding your tax obligations and planning your finances. These brackets determine the percentage of your income that you’ll pay in federal income tax. By understanding how these brackets work, you can make informed decisions about your income, deductions, and tax strategies to minimize your tax liability.

Understanding Income Tax Brackets, October 2024 income tax brackets for single filers

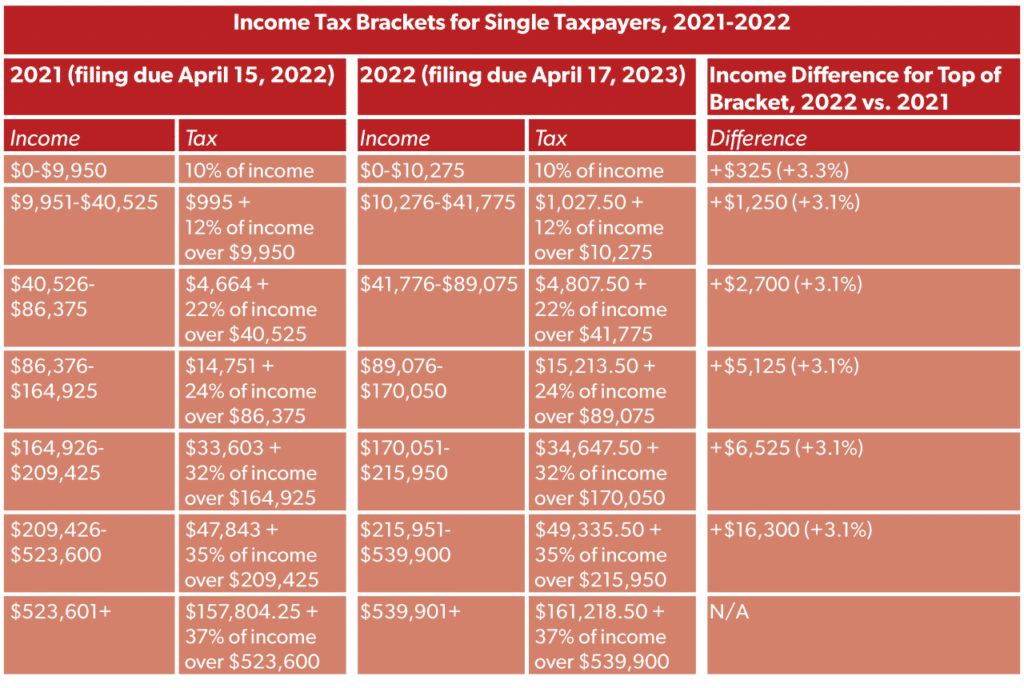

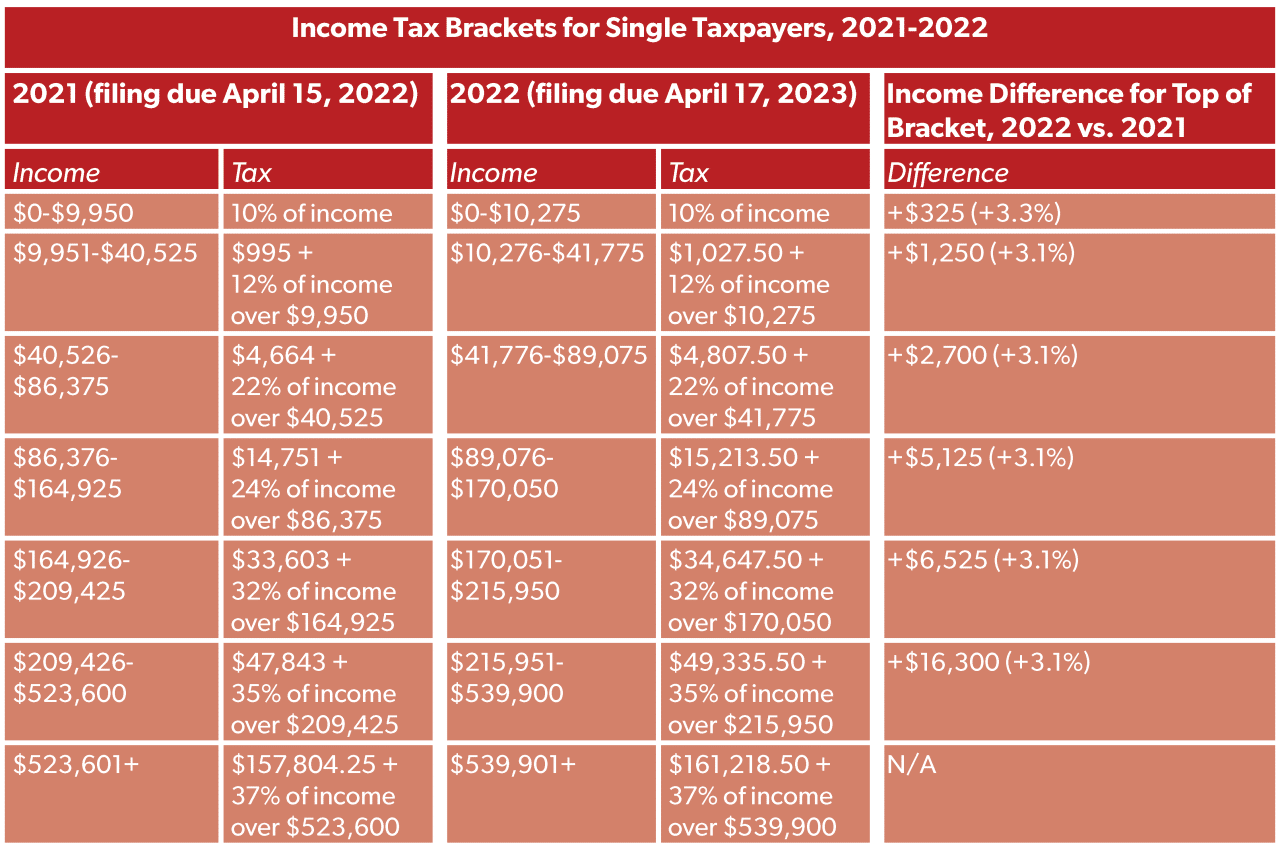

Income tax brackets are ranges of taxable income that are taxed at different rates. Each bracket has a corresponding tax rate, and the higher your income, the higher the tax rate you’ll pay on a portion of your income. The tax brackets for single filers in 2024 are as follows:

| Income Range | Tax Rate |

|---|---|

| $0 to $10,275 | 10% |

| $10,276 to $41,775 | 12% |

| $41,776 to $89,075 | 22% |

| $89,076 to $170,050 | 24% |

| $170,051 to $215,950 | 32% |

| $215,951 to $539,900 | 35% |

| $539,901 or more | 37% |

For example, if your taxable income is $50,000, you’ll pay 10% on the first $10,275, 12% on the income between $10,276 and $41,775, and 22% on the remaining income.

It’s important to note that you only pay the higher tax rate on the portion of your income that falls within that specific bracket.

Small business owners have specific IRA contribution limits in 2024. Ira contribution limits for small business owners in 2024 can help you understand your contribution options and maximize your retirement savings.

Federal Income Tax Brackets for Single Filers in October 2024

It is crucial to understand how federal income tax brackets work and how they might change in the future. This information can help individuals make informed financial decisions and plan for their tax obligations.

Federal Income Tax Brackets for Single Filers in October 2024

While it is impossible to predict the exact tax brackets for October 2024 with absolute certainty, we can analyze current economic trends and historical data to anticipate potential changes. Based on current economic trends, the federal income tax brackets for single filers in October 2024 are likely to remain similar to those in 2023, with some minor adjustments.

Looking to save for retirement in 2024? Small business owners have the option of contributing to a SIMPLE IRA, which offers tax advantages. Ira contribution limits for SIMPLE IRA in 2024 can help you plan your contributions and maximize your retirement savings.

Anticipated Federal Income Tax Brackets for Single Filers in October 2024

The following table Artikels the anticipated federal income tax brackets for single filers in October 2024, along with the corresponding tax rates and marginal tax rates:

| Income Range | Tax Rate | Marginal Tax Rate | Tax Liability |

|---|---|---|---|

| $0

If you’re over 50, you may be eligible for catch-up contributions to your IRA. IRA contribution limits for 2024 for those over 50 details the catch-up contribution rules and limits.

|

10% | 10% | 10% of taxable income |

| $10,951

Sometimes, you need a little extra time to file your taxes. How to file for an extension on my taxes in October 2024 outlines the steps involved in requesting an extension.

|

12% | 12% | $1,095 + 12% of taxable income over $10,950 |

$46,276

|

22% | 22% | $5,580.70 + 22% of taxable income over $46,275 |

| $101,751

Different employers may have different 401k contribution limits. What are the 401k contribution limits for 2024 for different employers helps you understand the specific limits for your employer’s plan.

|

24% | 24% | $19,537.50 + 24% of taxable income over $101,750 |

| $192,151

Even if you work part-time, you can still contribute to a retirement account. IRA contribution limits for 2024 for part-time workers provide guidance on how much you can contribute to an IRA based on your income and employment status.

|

32% | 32% | $43,487.50 + 32% of taxable income over $192,150 |

| $578,126

The 401k contribution limit for 2024 is a significant amount for high earners. 401k contribution limits for 2024 for high earners provides details on the limits and how they impact high-income individuals.

|

35% | 35% | $168,413.50 + 35% of taxable income over $578,125 |

| $693,751+ | 37% | 37% | $221,238.50 + 37% of taxable income over $693,750 |

Potential Changes to Tax Brackets and Rates

It is important to remember that these are just estimates. The actual tax brackets for October 2024 may differ based on several factors, including:* Economic growth:If the economy continues to grow, policymakers may consider lowering tax rates to stimulate further growth or increase revenue to fund government programs.

Both traditional and Roth IRAs offer tax advantages for retirement savings. IRA contribution limits for 2024 and Roth IRA helps you understand the contribution limits for both types of IRAs.

Inflation

If inflation remains high, policymakers may adjust tax brackets to account for the erosion of purchasing power. This could involve raising the income thresholds for each bracket to maintain the same level of real income.

Understanding the 401k contribution limits for 2024 is essential for planning your retirement savings. What are the 401k contribution limits for 2024 provides a clear overview of the current limits.

Political climate

Tax policy is often a subject of political debate, and changes in the political landscape could influence tax bracket adjustments.It is advisable to stay informed about any changes to the tax code through official government sources and consult with a tax professional for personalized advice.

A 2024 tax bracket calculator can help you determine your tax liability based on your income level. 2024 tax bracket calculator for different income levels is a useful tool for tax planning and financial forecasting.

Factors Affecting Income Tax Liability

While your income bracket determines the tax rate applied to your income, several other factors influence your overall tax liability. Understanding these factors can help you minimize your tax burden and maximize your financial well-being.

Deductions

Deductions reduce your taxable income, thereby lowering your tax liability. You can claim various deductions based on your circumstances, such as:

- Standard deduction:This is a fixed amount that you can choose to take instead of itemizing your deductions. For single filers in 2024, the standard deduction is expected to be around $13,850.

- Itemized deductions:These are specific expenses that you can deduct, such as medical expenses, mortgage interest, and charitable contributions. You can only claim itemized deductions if they exceed the standard deduction.

- Above-the-line deductions:These deductions are taken before calculating your adjusted gross income (AGI). Some common above-the-line deductions include contributions to traditional IRAs and student loan interest payments.

The more deductions you claim, the lower your taxable income and the less tax you’ll owe.

It’s never too early to plan for retirement. Maximum 401k contribution for 2024 is a valuable resource for those looking to maximize their retirement savings potential.

Credits

Tax credits directly reduce the amount of tax you owe, offering a more significant tax benefit than deductions. Credits are available for various purposes, including:

- Child tax credit:This credit provides a significant tax break for families with qualifying children.

- Earned income tax credit (EITC):This credit is available to low- and moderate-income working individuals and families. The amount of the credit depends on your income and the number of qualifying children.

- American Opportunity Tax Credit (AOTC):This credit helps pay for the first four years of college education. The credit is available to students who meet certain income and enrollment requirements.

Exemptions

Exemptions are deductions for certain dependents, such as children or elderly parents. They reduce your taxable income, but they have been suspended for tax years 2018 through 2025.

Are you wondering if the 401k contribution limit will change in 2024? Will the 401k contribution limit change in 2024 provides the latest information on any potential changes.

Exemptions are no longer available for tax years 2018 through 2025.

Effective Tax Rate

The effective tax rate is the percentage of your total income that you pay in taxes. It is calculated by dividing your total tax liability by your total income. Your effective tax rate can be significantly different from your marginal tax rate, which is the rate applied to your highest income bracket.

Effective tax rate = (Total tax liability / Total income) x 100%

For example, if you have a taxable income of $50,000 and a total tax liability of $5,000, your effective tax rate is 10%. However, your marginal tax rate may be 12%, depending on your income bracket.

Factors Affecting Tax Liability

Several factors can affect your tax liability, including:

- Income:As your income increases, your tax liability generally increases as well.

- Filing status:Your filing status (single, married filing jointly, etc.) affects your tax liability. Different filing statuses have different tax brackets and deductions.

- State income tax:Some states have their own income taxes, which can add to your overall tax burden.

- Property taxes:Property taxes are based on the value of your home and other real estate. They can be significant, especially in high-cost areas.

- Investment income:Interest, dividends, and capital gains from investments are taxed at different rates. The specific tax rate depends on the type of investment and your income level.

- Tax credits and deductions:As discussed above, tax credits and deductions can significantly impact your tax liability.

It’s essential to consult with a tax professional to ensure you are claiming all eligible deductions and credits and to understand the implications of your financial decisions on your tax liability.

Strategies for Tax Optimization

Tax optimization is the process of legally minimizing your tax liability by taking advantage of deductions, credits, and other strategies. By implementing effective tax planning, you can maximize your after-tax income and enhance your financial well-being.

Tax Planning Benefits

Tax planning is a proactive approach to managing your finances and ensuring you pay the least amount of taxes possible. It involves strategizing and making informed decisions throughout the year to reduce your tax burden. Effective tax planning can lead to several benefits:

- Increased After-Tax Income:By minimizing your tax liability, you can retain more of your hard-earned income, allowing you to invest, save, or spend more freely.

- Financial Security:Tax planning can help you avoid unexpected tax bills and ensure you have sufficient funds to meet your financial obligations.

- Reduced Tax Stress:By taking proactive steps to manage your taxes, you can alleviate the stress and anxiety associated with tax season.

- Improved Financial Planning:Tax planning can help you make informed financial decisions, such as retirement planning, investment strategies, and estate planning.

Common Tax Deductions and Credits

Single filers have access to a variety of tax deductions and credits that can help reduce their tax liability. Some common examples include:

- Standard Deduction or Itemized Deductions:You can choose to take the standard deduction, which is a fixed amount, or itemize your deductions, which allows you to deduct specific expenses. Itemized deductions may include mortgage interest, state and local taxes, charitable contributions, and medical expenses exceeding a certain threshold.

If you’re an independent contractor, you’ll need to complete a W9 form for each client you work with. W9 Form October 2024 for independent contractors provides information on how to fill out the form correctly.

- Child Tax Credit:If you have a qualifying child under 17 years old, you may be eligible for a tax credit of up to $2,000 per child.

- Earned Income Tax Credit (EITC):The EITC is a refundable tax credit for low-to-moderate-income working individuals and families. The amount of the credit depends on your income, filing status, and the number of qualifying children.

- Student Loan Interest Deduction:You can deduct up to $2,500 in interest paid on qualified student loans. This deduction is phased out for taxpayers with higher incomes.

- Retirement Contributions:Contributions to traditional IRAs, 401(k)s, and other retirement plans are generally tax-deductible.

- Health Savings Account (HSA):Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

Tax Resources and Information

Staying informed about income tax regulations is crucial for accurate filing and potential tax optimization. Fortunately, several reliable resources provide access to up-to-date information on tax brackets and other relevant details.

Government Websites

Government websites are the most authoritative sources for tax information. They provide official guidelines, forms, and publications, ensuring accuracy and compliance.

The 2024 tax season is around the corner, and it’s crucial to understand the federal income tax brackets for head of household. 2024 federal income tax brackets for head of household can help you estimate your tax liability and make informed financial decisions.

- Internal Revenue Service (IRS):The IRS website (www.irs.gov) is a comprehensive resource for all tax-related matters. It features tax forms, publications, guides, and frequently asked questions (FAQs).

- State Tax Agencies:Each state has its own tax agency, which provides information on state income tax brackets, deductions, and credits. You can find your state’s tax agency website by searching online for “state tax agency [your state].”

Reputable Tax Organizations

Reputable tax organizations offer valuable resources, including publications, research, and advocacy efforts, to support taxpayers.

- Tax Foundation:The Tax Foundation (www.taxfoundation.org) is a non-partisan research organization that provides in-depth analysis of tax policies and their impact on the economy.

- National Taxpayer Advocate:The National Taxpayer Advocate (www.taxpayeradvocate.irs.gov) is an independent organization within the IRS that advocates for taxpayers’ rights and helps resolve tax disputes.

- American Institute of Certified Public Accountants (AICPA):The AICPA (www.aicpa.org) is a professional organization for certified public accountants (CPAs) that provides resources and guidance on tax matters.

Consulting with a Tax Professional

While online resources offer valuable information, consulting with a qualified tax professional is often recommended for personalized advice.

- Tax professionals, such as CPAs or Enrolled Agents, can provide tailored guidance based on your individual circumstances. They can help you understand complex tax rules, identify deductions and credits you may be eligible for, and ensure your tax return is accurate and compliant.

Conclusion: October 2024 Income Tax Brackets For Single Filers

Navigating the complexities of income tax brackets can feel overwhelming, but understanding the basics and exploring available resources can make a significant difference in your financial well-being. By taking advantage of deductions, credits, and strategic tax planning, you can potentially minimize your tax liability and achieve your financial goals.

Remember to consult with a qualified tax professional for personalized advice tailored to your specific situation.

Key Questions Answered

What is the standard deduction for single filers in October 2024?

The standard deduction for single filers in October 2024 is estimated to be around $13,850. However, it’s important to check the latest IRS guidelines for the most accurate information.

What are some common tax deductions available to single filers?

Some common tax deductions for single filers include deductions for mortgage interest, charitable contributions, medical expenses, and state and local taxes. The availability and amount of these deductions may vary based on individual circumstances and IRS regulations.

How can I find reliable information about income tax brackets and regulations?

The IRS website is the primary source for accurate and up-to-date information on income tax brackets, deductions, and credits. You can also consult reputable tax organizations like the Tax Foundation or the National Taxpayer Advocate.