November 2024 CPI and the Risk of Deflation: Will it Be a Factor? This question looms large as we navigate a complex economic landscape. The Consumer Price Index (CPI), a key measure of inflation, has been a focal point of discussion in recent months, with concerns about potential deflationary pressures rising.

Obtain direct knowledge about the efficiency of CPI and Technological Advancements Leading to November 2024 through case studies.

Deflation, a sustained decrease in the general price level, can have significant consequences for consumers, businesses, and the overall economy.

The upcoming November 2024 CPI reading is particularly significant as it will provide valuable insights into the trajectory of inflation and the likelihood of deflation. Several factors, including global economic conditions, supply chain disruptions, and monetary policy decisions, will influence the CPI reading and its potential implications for the economy.

You also can investigate more thoroughly about Reconciling Differences Between CPI and PCE in November 2024 to enhance your awareness in the field of Reconciling Differences Between CPI and PCE in November 2024.

Understanding CPI and Deflation: November 2024 CPI And The Risk Of Deflation: Will It Be A Factor?

The Consumer Price Index (CPI) is a crucial economic indicator that measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. It plays a vital role in gauging inflation, a persistent increase in the general price level of goods and services in an economy.

Investigate the pros of accepting Inflation Expectations and Interest Rates in November 2024 in your business strategies.

When the CPI rises, it indicates inflation, while a decrease in the CPI suggests deflation.

You also can investigate more thoroughly about CPI and Transportation Costs: A Historical Analysis Leading to November 2024 to enhance your awareness in the field of CPI and Transportation Costs: A Historical Analysis Leading to November 2024.

Deflation, the opposite of inflation, is a sustained decrease in the general price level of goods and services. While it may seem like a positive phenomenon, deflation can have severe consequences for an economy. It discourages spending and investment, leading to economic stagnation or even recession.

This is because consumers and businesses postpone purchases in anticipation of even lower prices in the future, further reducing demand and leading to a vicious cycle of falling prices and economic contraction.

Discover more by delving into CPI and Savings Account Interest Rates in November 2024 further.

Historically, deflationary periods have been associated with economic crises and recessions. The Great Depression of the 1930s is a prime example of a severe deflationary period, characterized by falling prices, widespread unemployment, and a decline in economic activity. Other historical examples include the deflationary periods in Japan in the 1990s and the deflationary pressures experienced in the aftermath of the 2008 financial crisis.

Causes of Deflation

Deflation can be caused by various factors, including:

- Reduced demand:A decrease in consumer spending, investment, or government spending can lead to a decline in demand for goods and services, pushing prices down.

- Increased supply:An increase in the supply of goods and services, coupled with stagnant or declining demand, can also result in deflationary pressures.

- Technological advancements:Rapid technological advancements can lead to increased efficiency and lower production costs, potentially resulting in lower prices for consumers.

- Currency appreciation:A stronger currency can make imported goods cheaper, leading to deflationary pressures in the domestic economy.

- Debt deflation:A cycle of falling prices and rising debt burdens can lead to deflationary pressures as businesses and consumers struggle to repay their debts.

November 2024 CPI Projections and Factors

Predicting the November 2024 CPI is a complex task that requires careful consideration of current economic indicators and potential future developments. While predicting the future is inherently uncertain, analyzing current economic trends and identifying key factors can provide insights into potential scenarios for the November 2024 CPI.

You also can understand valuable knowledge by exploring CPI and PCE: Data Sources and Availability for November 2024.

Key Economic Indicators

Several economic indicators can shed light on the potential direction of the November 2024 CPI. These include:

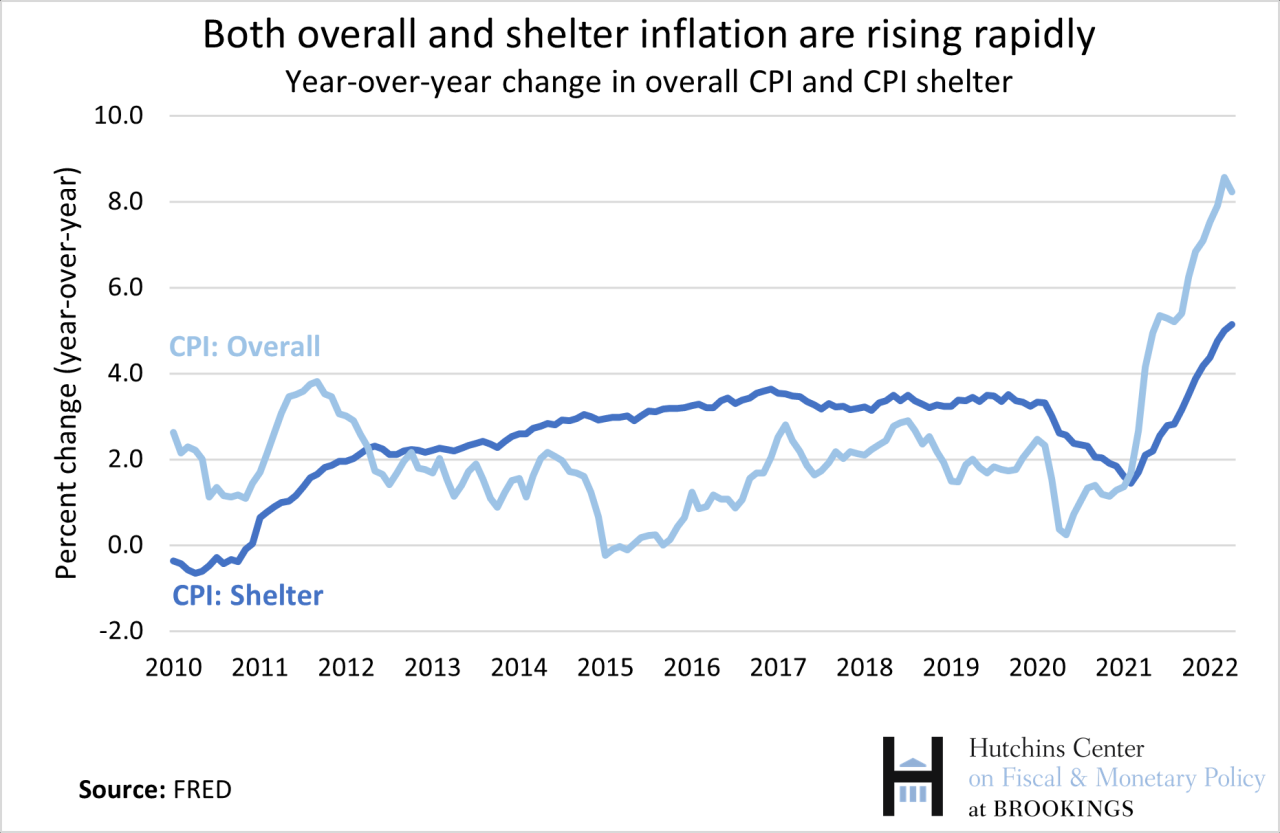

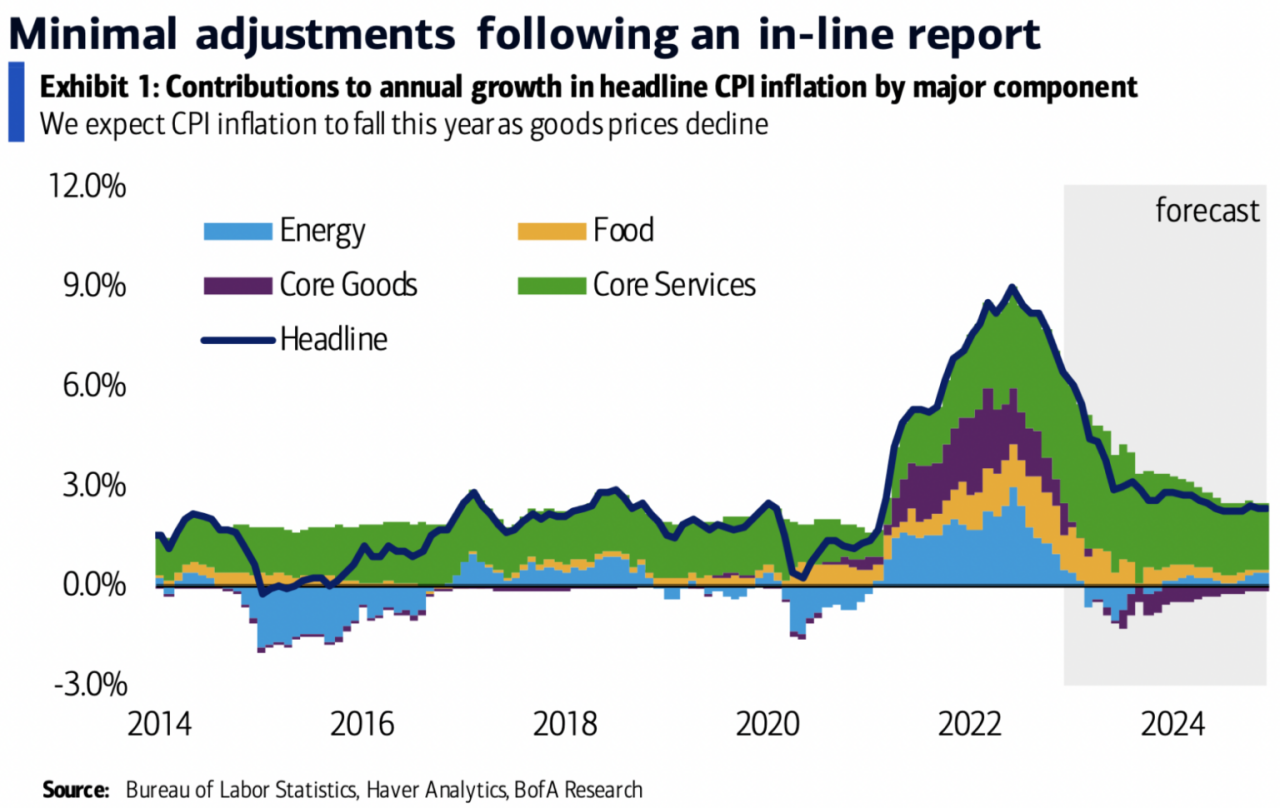

- Inflation rate:The current inflation rate provides a baseline for assessing the potential trajectory of the CPI in November 2024. If inflation remains elevated, it suggests that the CPI is likely to continue rising. Conversely, if inflation starts to moderate, it may indicate a slowdown in price increases.

- Interest rates:Central banks use interest rates as a tool to manage inflation. If interest rates are raised to curb inflation, it can potentially slow down economic growth and lead to deflationary pressures. Conversely, if interest rates are lowered to stimulate economic activity, it can potentially lead to increased inflation.

Discover how Measuring Inflation Expectations in November 2024 has transformed methods in this topic.

- Consumer confidence:Consumer confidence is a measure of consumer sentiment about the economy. High consumer confidence suggests that consumers are more likely to spend, potentially leading to inflationary pressures. Conversely, low consumer confidence indicates that consumers are more likely to save, which can contribute to deflationary pressures.

- Unemployment rate:A low unemployment rate suggests a strong economy and potentially higher demand for goods and services, which can contribute to inflationary pressures. Conversely, a high unemployment rate indicates a weak economy and potentially lower demand, which can lead to deflationary pressures.

Factors Contributing to Deflationary Pressures, November 2024 CPI and the Risk of Deflation: Will it Be a Factor?

Several factors could contribute to deflationary pressures in November 2024, including:

- Global economic slowdown:A global economic slowdown could lead to reduced demand for goods and services, putting downward pressure on prices.

- Supply chain disruptions:Ongoing supply chain disruptions could lead to increased production costs and potentially lower prices for consumers as businesses struggle to pass on higher costs.

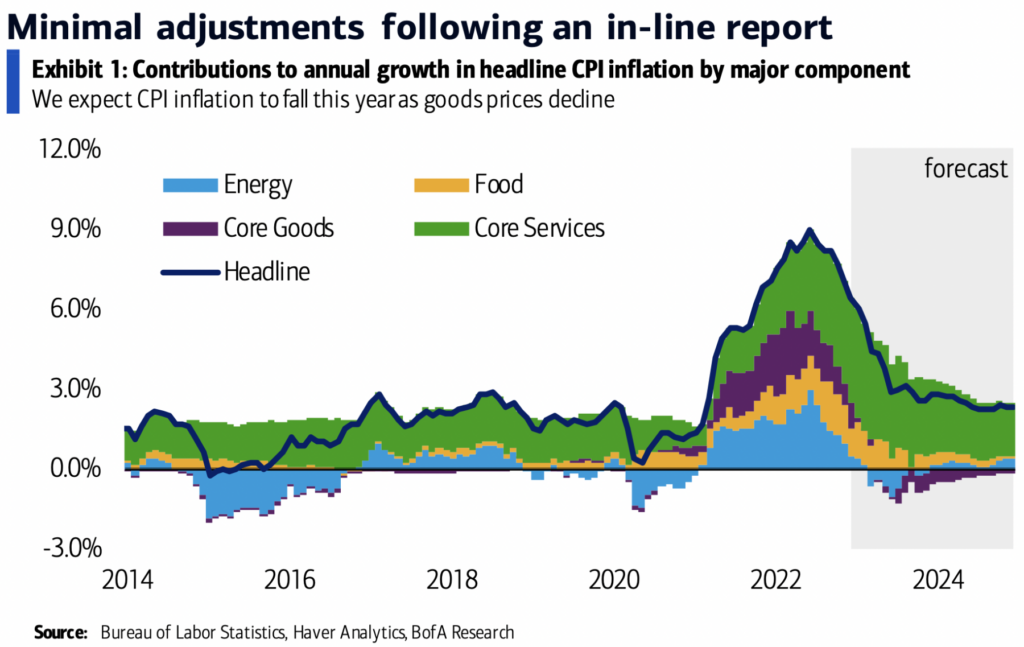

- Technological advancements:Continued technological advancements can lead to lower production costs and potentially lower prices for consumers.

- Geopolitical uncertainties:Geopolitical uncertainties, such as trade wars or international conflicts, can disrupt global supply chains and lead to economic instability, potentially contributing to deflationary pressures.

Potential Scenarios for November 2024 CPI

Based on current economic conditions and potential future developments, several scenarios are possible for the November 2024 CPI:

- Inflationary scenario:If the economy continues to grow at a healthy pace and inflation remains elevated, the November 2024 CPI is likely to continue rising. This scenario could be driven by strong consumer demand, robust economic growth, and persistent supply chain disruptions.

Browse the multiple elements of November 2024 CPI and the Fed’s Monetary Policy Response to gain a more broad understanding.

- Deflationary scenario:If the economy slows down significantly, inflation moderates, and deflationary pressures intensify, the November 2024 CPI could decline. This scenario could be driven by a global economic slowdown, weak consumer confidence, and increased supply chain disruptions.

- Stagflation scenario:A stagflation scenario, characterized by high inflation and stagnant economic growth, is also possible. In this scenario, the November 2024 CPI could rise, but economic growth would remain sluggish. This scenario could be driven by a combination of factors, such as supply chain disruptions, high energy prices, and weak consumer confidence.

Last Word

Understanding the potential risks and implications of deflation in November 2024 is crucial for policymakers, businesses, and individuals alike. While the exact impact of deflation is difficult to predict, proactive measures can be taken to mitigate its potential negative consequences.

Obtain direct knowledge about the efficiency of The Yield Curve and the November 2024 CPI: Analyzing the Relationship through case studies.

By carefully analyzing economic indicators, monitoring policy responses, and implementing appropriate strategies, we can navigate this potential economic challenge and foster a more stable and sustainable future.

For descriptions on additional topics like CPI Calculation in November 2024: Addressing Substitution Bias, please visit the available CPI Calculation in November 2024: Addressing Substitution Bias.

FAQ Overview

What are the potential consequences of deflation?

Deflation can lead to a decrease in consumer spending as people wait for prices to fall further, resulting in a decline in economic activity. It can also create challenges for businesses, as they may face declining revenues and profits. Additionally, deflation can make it more difficult for borrowers to repay their debts, potentially leading to financial instability.

How can policymakers address deflationary pressures?

Policymakers can use a combination of monetary and fiscal policies to address deflation. Monetary policy tools, such as lowering interest rates and increasing the money supply, can stimulate economic activity and encourage borrowing and spending. Fiscal policies, such as tax cuts and government spending, can also help to boost demand and counter deflationary pressures.