November 2024 CPI and Technological Advancements: Analyzing Deflationary Forces – The November 2024 Consumer Price Index (CPI) report holds significant weight as we navigate an era defined by rapid technological advancements. This report, coupled with the transformative power of automation, artificial intelligence, and renewable energy, paints a compelling picture of the deflationary forces reshaping our economic landscape.

Find out about how CPI and Education Expenses in November 2024: Affording College can deliver the best answers for your issues.

This analysis explores the intricate interplay between these technological advancements and their potential impact on inflation. We delve into how automation can boost productivity while potentially reducing labor costs, leading to lower prices for goods and services. Artificial intelligence (AI) is examined for its ability to optimize pricing strategies, potentially benefiting consumers with lower prices.

Discover the crucial elements that make CPI and Value Investing in November 2024: Finding Undervalued Stocks the top choice.

The transition to renewable energy is analyzed for its influence on energy prices and overall inflation. By exploring these technological advancements and their impact on consumer behavior and spending patterns, we aim to shed light on the potential deflationary scenarios that may unfold in the coming years.

Obtain access to Seasonal Adjustment of November 2024 CPI Data to private resources that are additional.

Understanding November 2024 CPI

The November 2024 Consumer Price Index (CPI) report will be a crucial indicator of inflation trends in the US economy. This report, released by the Bureau of Labor Statistics, measures changes in the prices of a basket of consumer goods and services, providing insights into the cost of living for American households.

Significance of the November 2024 CPI Report

The November 2024 CPI report will be closely watched by economists, investors, and policymakers alike. Its significance lies in its ability to shed light on the effectiveness of monetary policy measures aimed at controlling inflation. A sustained decline in the CPI could indicate that the Federal Reserve’s efforts to curb inflation are starting to take effect, while a continued rise in prices could signal the need for further interest rate hikes.

Historical Context of CPI Data

Historically, the CPI has exhibited both periods of stability and volatility. In recent years, inflation has surged due to factors such as supply chain disruptions, strong consumer demand, and the war in Ukraine. The CPI reached a 40-year high in 2022, but it has since cooled down, although it remains above the Federal Reserve’s target rate of 2%.

Obtain recommendations related to Causes of Inflation in November 2024: A Deep Dive that can assist you today.

Factors Influencing the November 2024 CPI

Several factors could influence the November 2024 CPI, including:

- Global Economic Events:The global economic outlook, including growth rates and geopolitical tensions, can impact commodity prices and supply chains, ultimately affecting inflation.

- Supply Chain Disruptions:Ongoing supply chain issues, particularly in areas like manufacturing and transportation, can lead to higher prices for goods and services.

- Consumer Behavior:Consumer spending patterns, influenced by factors such as wage growth and confidence levels, can impact demand and, consequently, inflation.

Technological Advancements and Deflationary Forces: November 2024 CPI And Technological Advancements: Analyzing Deflationary Forces

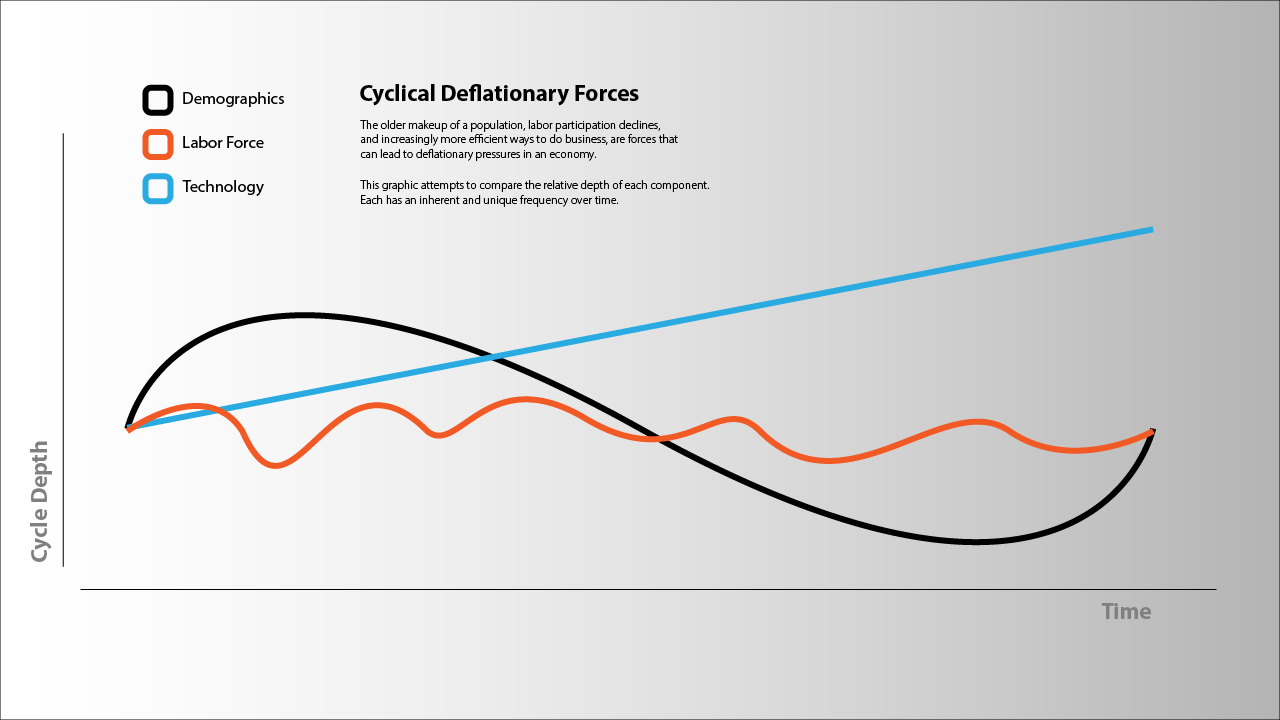

Technological advancements are increasingly seen as potential drivers of deflationary pressures. These advancements, ranging from automation to artificial intelligence, can lead to increased efficiency, lower production costs, and potentially increased competition, all of which can contribute to lower prices for consumers.

Key Technological Advancements

Several key technological advancements are poised to impact inflation:

- Automation:Automation, driven by robotics and artificial intelligence, is transforming industries by replacing manual labor with machines. This can lead to increased productivity and potentially lower labor costs, ultimately reducing the cost of production.

- Artificial Intelligence (AI):AI is revolutionizing various sectors, from healthcare to finance, by automating tasks, improving efficiency, and generating new products and services. AI can also optimize pricing strategies, potentially leading to lower prices for consumers.

- Renewable Energy:The transition to renewable energy sources, such as solar and wind power, can reduce reliance on fossil fuels, potentially leading to lower energy prices and reducing inflationary pressures.

Impact on Different Sectors

The impact of these advancements varies across different sectors of the economy. For example, automation is already having a significant impact on manufacturing, while AI is transforming industries like finance and healthcare. However, these advancements also present challenges, such as job displacement and potential ethical concerns.

The Role of Automation in Deflation

Automation plays a crucial role in driving deflationary pressures by increasing productivity and potentially reducing labor costs. As robots and automated systems take over tasks previously performed by human workers, the cost of production can decrease, leading to lower prices for consumers.

Impact on Prices and Employment

Automation has already had a significant impact on prices and employment in several industries, including:

- Manufacturing:Automated assembly lines and robotic arms have reduced the need for manual labor, leading to lower production costs and potentially lower prices for manufactured goods.

- Transportation:Self-driving vehicles and automated logistics systems are transforming the transportation industry, potentially reducing costs and leading to lower prices for goods and services.

- Customer Service:Chatbots and virtual assistants are increasingly replacing human customer service representatives, potentially reducing labor costs and potentially leading to lower prices for services.

Artificial Intelligence and its Impact on Prices

Artificial intelligence (AI) has the potential to significantly impact pricing dynamics across various industries. AI algorithms can analyze vast amounts of data, identify patterns, and optimize pricing strategies, potentially leading to lower prices for consumers.

For descriptions on additional topics like November 2024 CPI and the Fed’s Monetary Policy Response, please visit the available November 2024 CPI and the Fed’s Monetary Policy Response.

AI-Driven Pricing Optimization

AI can help businesses:

- Personalize pricing:AI algorithms can tailor prices to individual customers based on their purchasing history, preferences, and other factors, potentially leading to more competitive pricing.

- Optimize pricing strategies:AI can analyze market trends, competitor pricing, and demand fluctuations to determine the optimal prices for products and services.

- Reduce pricing errors:AI can help businesses avoid pricing errors, such as miscalculations or inconsistent pricing across different channels, potentially leading to more accurate and competitive pricing.

Challenges and Ethical Considerations

While AI offers potential benefits for pricing, it also presents challenges and ethical considerations:

- Price discrimination:AI-powered pricing algorithms could potentially lead to price discrimination, where different customers are charged different prices for the same product or service based on their demographics or purchasing history.

- Transparency:There are concerns about the lack of transparency in AI-driven pricing decisions, making it difficult for consumers to understand how prices are determined.

- Bias:AI algorithms can be biased, reflecting the biases of the data they are trained on. This could lead to unfair or discriminatory pricing practices.

Renewable Energy and its Influence on Inflation

The adoption of renewable energy sources, such as solar and wind power, can have a significant impact on inflation by potentially reducing energy prices and contributing to overall price stability.

You also can investigate more thoroughly about CPI and Household Furnishings Costs in November 2024 to enhance your awareness in the field of CPI and Household Furnishings Costs in November 2024.

Impact on Energy Prices

The transition to renewable energy sources can:

- Reduce reliance on fossil fuels:As renewable energy sources become more prevalent, the demand for fossil fuels could decrease, potentially leading to lower energy prices.

- Increase energy independence:Renewable energy sources can help countries reduce their reliance on imported energy, potentially reducing the impact of global energy price fluctuations.

- Create new jobs:The renewable energy sector is creating new jobs in areas like manufacturing, installation, and maintenance, potentially boosting economic growth.

Economic and Environmental Implications

The widespread adoption of renewable energy can have significant economic and environmental implications:

- Lower energy costs:Renewable energy sources can potentially reduce energy costs for businesses and consumers, leading to lower prices for goods and services.

- Reduced greenhouse gas emissions:Renewable energy sources emit fewer greenhouse gases than fossil fuels, contributing to efforts to mitigate climate change.

- Increased energy security:Renewable energy sources can help countries become more energy independent, reducing their vulnerability to global energy price shocks.

Technological Advancements and Consumer Behavior

Technological advancements are transforming consumer behavior and spending patterns, potentially driving deflationary pressures. The rise of online shopping, e-commerce, and digital marketplaces is creating new opportunities for consumers to access goods and services at lower prices.

Discover the crucial elements that make The Psychology of Investing During Inflation in November 2024 the top choice.

Impact on Spending Patterns, November 2024 CPI and Technological Advancements: Analyzing Deflationary Forces

Technological advancements are influencing consumer behavior in several ways:

- Increased price transparency:Consumers can easily compare prices across different retailers and online marketplaces, potentially leading to lower prices as businesses compete for customers.

- Rise of online shopping:E-commerce platforms offer a wider selection of goods and services at potentially lower prices, as they often have lower overhead costs than traditional brick-and-mortar stores.

- Subscription services:Subscription services for streaming content, food delivery, and other goods and services are becoming increasingly popular, potentially leading to lower prices for consumers who are willing to commit to a recurring subscription.

Impact on Demand for Traditional Goods and Services

Technological advancements are also impacting the demand for traditional goods and services:

- Declining demand for physical media:The rise of streaming services has led to a decline in demand for physical media, such as DVDs and CDs, potentially leading to lower prices for these products.

- Shifting consumer preferences:Consumers are increasingly seeking experiences and personalized products and services, potentially leading to changes in the demand for traditional goods and services.

Analyzing Potential Deflationary Scenarios

The November 2024 CPI report could reflect a range of potential scenarios, depending on the interplay of economic factors and technological advancements. Here is a table outlining different potential scenarios, considering both positive and negative factors:

| Scenario | Assumptions | Potential Outcomes | Implications for the Economy |

|---|---|---|---|

| Deflationary Scenario | Continued technological advancements lead to significant productivity gains, lower production costs, and increased competition. Consumer demand remains strong, but prices decline due to technological deflationary pressures. | CPI falls below the Federal Reserve’s target rate of 2%. Businesses may face challenges with pricing and profitability, but consumers benefit from lower prices. | Potential for sustained economic growth, but with risks of deflationary spiral and potential for job losses in industries impacted by automation. |

| Stagflationary Scenario | Technological advancements continue to drive productivity gains, but rising energy prices and supply chain disruptions contribute to inflation. Consumer demand weakens due to rising prices and uncertainty. | CPI remains above the Federal Reserve’s target rate of 2%. Economic growth slows down, unemployment rises, and businesses face challenges with profitability. | Potential for economic recession, with higher unemployment and potential for social unrest. |

| Moderate Inflation Scenario | Technological advancements offset some inflationary pressures, but rising wages and strong consumer demand contribute to continued inflation. | CPI remains above the Federal Reserve’s target rate of 2%, but at a slower pace than in previous years. Economic growth remains moderate, with low unemployment. | Potential for sustained economic growth, but with risks of higher interest rates and potential for asset bubbles. |

| Disinflationary Scenario | Technological advancements drive productivity gains and lower prices, but these deflationary pressures are offset by rising energy prices and other factors. | CPI falls below the Federal Reserve’s target rate of 2%, but at a slower pace than in a deflationary scenario. Economic growth remains moderate, with low unemployment. | Potential for sustained economic growth, but with risks of disinflationary spiral and potential for businesses to face challenges with pricing. |

Closure

The confluence of technological advancements and the November 2024 CPI report presents a fascinating case study in the evolving relationship between innovation and inflation. While the potential for deflationary pressures exists, understanding the nuances of these forces is crucial for informed economic decision-making.

By carefully considering the interplay between technological advancements, consumer behavior, and the broader economic landscape, we can navigate this dynamic environment with a greater degree of clarity and foresight.

Question & Answer Hub

What are the potential implications of deflation for the economy?

Deflation can have both positive and negative implications for the economy. On the one hand, lower prices can stimulate consumer spending and economic growth. However, prolonged deflation can lead to a decrease in investment, as businesses anticipate further price declines.

Browse the implementation of Stagflation: A Challenging Economic Scenario in November 2024 (if applicable) in real-world situations to understand its applications.

It can also create a deflationary spiral, where falling prices lead to lower demand, further reducing prices.

How can we mitigate the potential risks associated with deflation?

Obtain access to CPI and Transportation Costs in November 2024 to private resources that are additional.

Mitigating the risks of deflation requires a multifaceted approach. Central banks can implement monetary policies to stimulate demand and prevent a deflationary spiral. Governments can also play a role through fiscal policies, such as increased government spending or tax cuts, to boost economic activity.

Additionally, policies that encourage innovation and investment can help offset the deflationary pressures associated with technological advancements.

You also will receive the benefits of visiting The Future of Work and CPI After November 2024 today.

What are the ethical considerations surrounding the use of AI in pricing decisions?

The use of AI in pricing decisions raises ethical concerns about potential biases and discrimination. AI algorithms can be influenced by historical data that reflects existing societal biases, potentially leading to unfair pricing practices. It’s crucial to ensure transparency and accountability in the development and deployment of AI-powered pricing systems to mitigate these risks.