November 2024 CPI and Student Loan Interest Rates: Potential Effects – November 2024 CPI: Impact on Student Loan Rates sets the stage for a crucial analysis of the interplay between inflation and student loan interest rates. The Consumer Price Index (CPI) for November 2024 will likely have a significant impact on the economy, potentially influencing inflation expectations and, in turn, the trajectory of student loan interest rates.

Obtain recommendations related to CPI and PCE in a Changing Economy in November 2024 that can assist you today.

This analysis explores the potential effects of a changing CPI on borrowers, offering insights into the potential economic implications and strategies for managing student loan debt.

Do not overlook explore the latest data about CPI and Education Expenses: A Historical Overview Leading to November 2024.

Understanding the potential effects of the November 2024 CPI on student loan interest rates is vital for borrowers, as it could directly impact their monthly payments and overall debt burden. The analysis delves into the current status of student loan interest rates, examining their impact on borrowers and exploring the potential implications of rising or falling interest rates based on the CPI.

Get the entire information you require about Global Inflation Trends and Their Impact in November 2024 on this page.

By examining key economic indicators and potential scenarios, this analysis provides a comprehensive overview of the economic landscape and its potential impact on student loan borrowers.

Enhance your insight with the methods and methods of Seasonal Adjustment of November 2024 CPI Data.

Consumer Price Index (CPI) in November 2024

The Consumer Price Index (CPI) is a crucial economic indicator that measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. The November 2024 CPI report will provide insights into the inflation trajectory of the US economy and could have significant implications for various aspects of the economy, including interest rates, consumer spending, and business investment.

Obtain a comprehensive document about the application of CPI and PCE: Frequently Asked Questions about November 2024 Data that is effective.

Potential Impact of the November 2024 CPI on the Economy

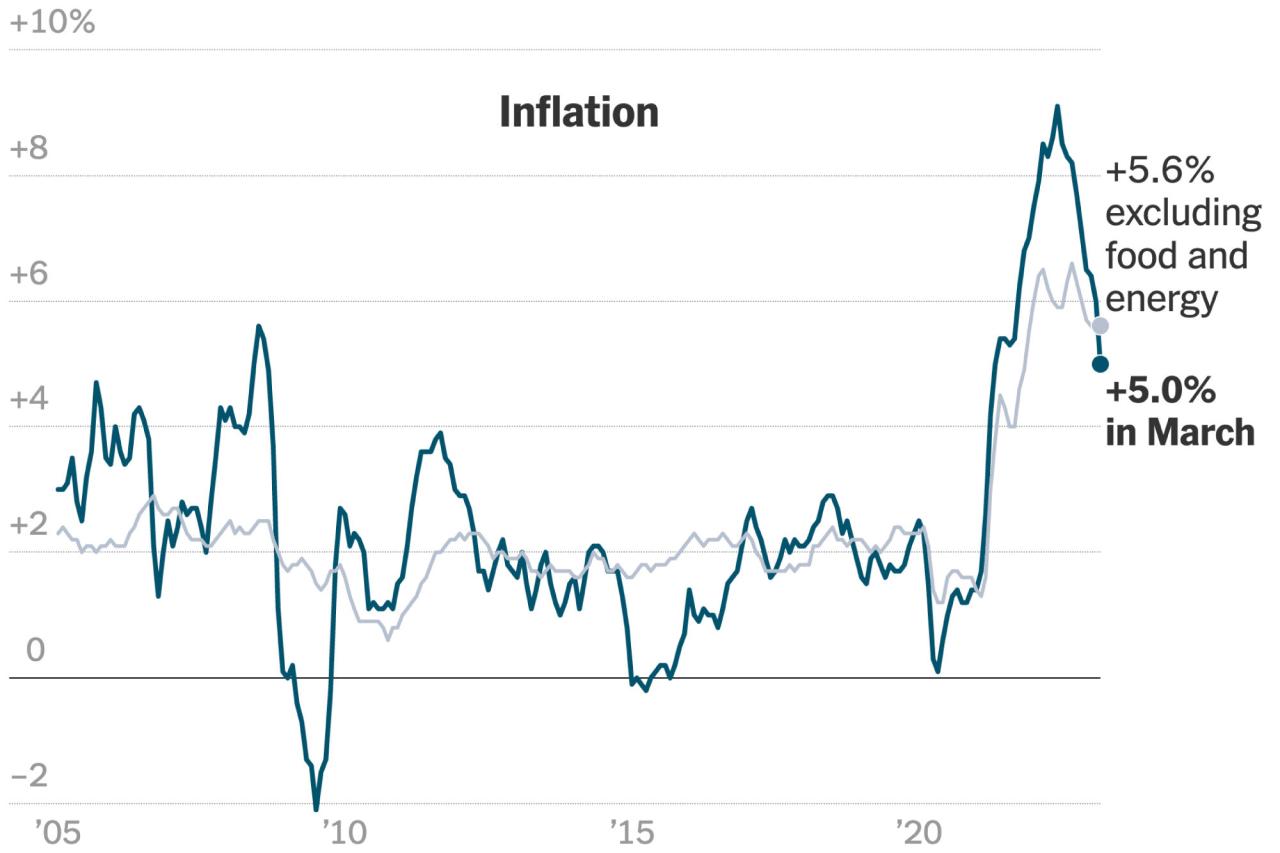

The November 2024 CPI report is likely to be closely watched by economists, policymakers, and investors. A higher-than-expected CPI reading could indicate that inflation is still a concern, prompting the Federal Reserve to maintain or even increase interest rates to curb inflation.

Conversely, a lower-than-expected CPI reading could signal that inflation is easing, potentially leading to a more accommodative monetary policy stance.

Obtain access to The CPI and the Environment in November 2024 to private resources that are additional.

Potential Implications of the CPI for Inflation Expectations

The CPI report can significantly influence inflation expectations, which are crucial for economic stability. If the CPI shows a persistent upward trend, it could reinforce inflationary pressures and lead to higher inflation expectations. This could, in turn, prompt businesses to raise prices, creating a self-fulfilling prophecy of rising inflation.

On the other hand, a declining CPI could signal a cooling inflation environment, leading to lower inflation expectations and potentially easing price pressures.

Key Economic Indicators that Could Influence the CPI

Several economic indicators can influence the CPI. These include:

- Energy prices:Fluctuations in energy prices, particularly oil and gas, have a significant impact on the CPI, as energy is a major component of the consumer basket.

- Food prices:Food prices are another major component of the CPI, and their volatility can significantly influence the overall inflation rate.

- Housing costs:Housing costs, including rent and mortgage payments, constitute a significant portion of the CPI. Changes in these costs can have a considerable impact on the overall inflation rate.

- Wage growth:Wage growth can influence inflation by affecting consumer demand. Strong wage growth can lead to higher consumer spending, potentially contributing to inflation.

- Supply chain disruptions:Disruptions in global supply chains can lead to higher prices for imported goods, affecting the CPI.

Student Loan Interest Rates

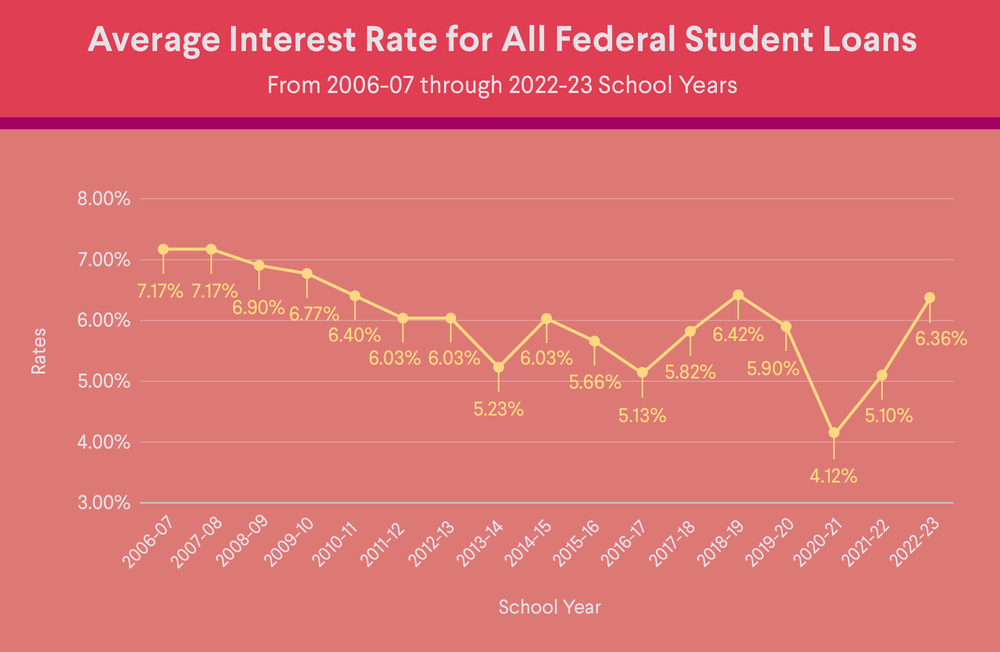

Student loan interest rates are a critical factor for borrowers, as they determine the total cost of their education. The current interest rate environment and its potential impact on student loan borrowers will be discussed in this section.

Obtain recommendations related to CPI and PCE: Implications for Policymakers in November 2024 that can assist you today.

Current Status of Student Loan Interest Rates and Their Impact on Borrowers

Currently, student loan interest rates vary depending on the type of loan and the loan origination date. Federal student loans generally have lower interest rates than private student loans. However, interest rates on both types of loans have been rising in recent years due to the Federal Reserve’s efforts to combat inflation.

Rising interest rates can significantly increase the overall cost of student loans, making it more challenging for borrowers to repay their debt.

Potential Impact of the November 2024 CPI on Student Loan Interest Rates

The November 2024 CPI report could have a significant impact on student loan interest rates. If the CPI indicates that inflation is still a concern, the Federal Reserve might continue to raise interest rates. This could lead to higher interest rates on new and existing student loans, increasing the cost of borrowing for students.

Obtain access to The Use of Technology in November 2024 CPI Data Collection to private resources that are additional.

Conversely, if the CPI shows that inflation is easing, the Federal Reserve might consider lowering interest rates, potentially leading to lower interest rates on student loans.

Comparing the Potential Effects of Rising and Falling Interest Rates on Student Loan Borrowers, November 2024 CPI and Student Loan Interest Rates: Potential Effects

Rising interest rates can significantly impact student loan borrowers by:

- Increasing the total amount of interest paid over the life of the loan.

- Making it more challenging to make monthly payments.

- Extending the repayment term, leading to higher overall borrowing costs.

Falling interest rates, on the other hand, can benefit borrowers by:

- Reducing the total amount of interest paid over the life of the loan.

- Making monthly payments more affordable.

- Shortening the repayment term, leading to lower overall borrowing costs.

Potential Effects of CPI and Student Loan Interest Rates

The November 2024 CPI report and its potential impact on student loan interest rates could have significant implications for borrowers. Understanding these potential effects can help borrowers make informed decisions about their debt management strategies.

Do not overlook explore the latest data about Deflation: Causes and Effects in November 2024 (if applicable).

Potential Effects of a High CPI and Low CPI on Student Loan Borrowers

The following table compares the potential effects of a high CPI and a low CPI on student loan borrowers:

| Scenario | Potential Impact on Student Loan Borrowers |

|---|---|

| High CPI |

|

| Low CPI |

|

Strategies for Borrowers to Manage Student Loan Debt in a Fluctuating Economic Environment

In a fluctuating economic environment, student loan borrowers can adopt several strategies to manage their debt effectively:

- Consolidate loans:Consolidating multiple loans into a single loan with a lower interest rate can reduce monthly payments and overall borrowing costs.

- Refinance loans:Refinancing loans with a lower interest rate can also reduce monthly payments and overall borrowing costs, especially if interest rates have fallen since the original loan was taken out.

- Explore income-driven repayment plans:Income-driven repayment plans can help borrowers manage their monthly payments by adjusting them based on their income. These plans can be particularly beneficial for borrowers facing financial hardship.

- Make extra payments:Making extra payments on student loans can help reduce the principal balance and shorten the repayment term, ultimately saving money on interest charges.

Economic Outlook

The November 2024 CPI report and its potential impact on student loan interest rates could have significant implications for the overall economic outlook. Understanding these potential implications can help borrowers and investors make informed decisions.

Potential Economic Implications of the November 2024 CPI and Student Loan Interest Rates

The November 2024 CPI report and its impact on student loan interest rates could influence the overall economic outlook in several ways:

- Consumer spending:If inflation remains high, it could lead to a decline in consumer spending as consumers face higher prices for goods and services. This could slow economic growth.

- Business investment:High inflation and rising interest rates could make it more expensive for businesses to borrow money, potentially leading to reduced business investment and job creation.

- Financial markets:Volatility in the financial markets is possible if the CPI report indicates that inflation is still a concern. This could lead to fluctuations in stock prices and bond yields.

Potential Economic Scenarios and Their Implications for Borrowers

The economic outlook for the coming months depends on various factors, including the Federal Reserve’s monetary policy stance, global economic conditions, and geopolitical events. Here are some potential economic scenarios and their implications for borrowers:

Scenario 1: Continued High Inflation and Rising Interest Rates

If inflation remains high and the Federal Reserve continues to raise interest rates, borrowers could face higher interest rates on their student loans, making it more challenging to repay their debt. This scenario could also lead to a decline in consumer spending and slower economic growth.

Scenario 2: Inflation Easing and Interest Rates Stabilizing

If inflation starts to ease and the Federal Reserve stabilizes interest rates, borrowers could see lower interest rates on their student loans, making debt repayment more manageable. This scenario could also lead to stronger economic growth.

Discover the crucial elements that make CPI and Technological Advancements Leading to November 2024 the top choice.

Scenario 3: Unexpected Economic Shock

An unexpected economic shock, such as a global recession or a major geopolitical event, could significantly impact the economy and borrowers. This scenario could lead to higher unemployment, lower consumer spending, and potentially higher interest rates on student loans.

Key Factors that Could Influence the Economic Outlook in the Coming Months

Several factors could influence the economic outlook in the coming months:

- Federal Reserve’s monetary policy:The Federal Reserve’s decisions on interest rates will have a significant impact on the economy and borrowers.

- Global economic conditions:The economic performance of other major economies, such as China and the European Union, can influence the US economy.

- Geopolitical events:Geopolitical events, such as the war in Ukraine, can disrupt global supply chains and affect energy prices, influencing the economy and borrowers.

Wrap-Up

The November 2024 CPI and its potential impact on student loan interest rates present a complex economic landscape. While the analysis highlights potential challenges, it also emphasizes the importance of proactive strategies for managing student loan debt in a fluctuating economic environment.

By understanding the potential effects of a changing CPI and interest rates, borrowers can make informed decisions to minimize the impact on their finances and navigate the complexities of the student loan market.

Frequently Asked Questions: November 2024 CPI And Student Loan Interest Rates: Potential Effects

What are the potential consequences of a high CPI on student loan borrowers?

A high CPI could lead to higher interest rates, increasing monthly payments and the overall cost of borrowing. This could also make it more challenging for borrowers to manage their debt and achieve financial goals.

How can borrowers manage their student loan debt in a fluctuating economic environment?

Borrowers can consider strategies like income-driven repayment plans, refinancing options, and consolidating loans to manage their debt more effectively. It’s also essential to stay informed about changes in interest rates and economic conditions.