November 2024 CPI and Sector Rotation: Investing in Winning Industries – November 2024 CPI & Sector Rotation: Investing in Winning Industries is a critical topic for investors seeking to capitalize on market trends. The November 2024 Consumer Price Index (CPI) report will provide crucial insights into inflation and its impact on the economy, setting the stage for strategic sector rotation.

Understanding the report’s implications for interest rates, monetary policy, and consumer behavior is essential for navigating the market and identifying winning industries poised for growth.

This analysis will explore sector rotation strategies, focusing on industries likely to benefit from the November 2024 CPI report. We’ll delve into factors driving growth in these industries, analyze key industry metrics, and Artikel investment strategies for maximizing returns. By examining emerging trends and opportunities, investors can gain a competitive edge in this dynamic market.

Discover more by delving into CPI and Asset Allocation Strategies for November 2024 further.

Understanding the November 2024 CPI Report

The November 2024 Consumer Price Index (CPI) report will be a crucial indicator of inflation trends and their impact on the US economy. This report will provide valuable insights into the effectiveness of the Federal Reserve’s monetary policy in curbing inflation and its potential influence on future interest rate decisions.

Significance of the CPI Report

The November 2024 CPI report holds significant weight as it will offer a snapshot of price changes across a broad range of consumer goods and services. Economists and investors will closely analyze the report to gauge the trajectory of inflation and its potential impact on various sectors of the economy.

Understand how the union of CPI and the Minimum Wage in November 2024: Is an Increase Needed? can improve efficiency and productivity.

Impact on Interest Rates and Monetary Policy

The CPI report will be a key factor in the Federal Reserve’s decision-making process regarding interest rates. If the report indicates a persistent rise in inflation, the Fed might consider further tightening monetary policy by raising interest rates to curb inflation.

Conversely, if the report shows a decline in inflation, the Fed might pause or even reverse its rate hikes, providing relief to businesses and consumers.

Influence on Consumer Confidence and Spending

The CPI report can influence consumer confidence and spending patterns. If the report indicates a high inflation rate, consumers may become more cautious about spending, leading to a slowdown in economic activity. However, if the report shows a decline in inflation, it could boost consumer confidence and encourage increased spending, contributing to economic growth.

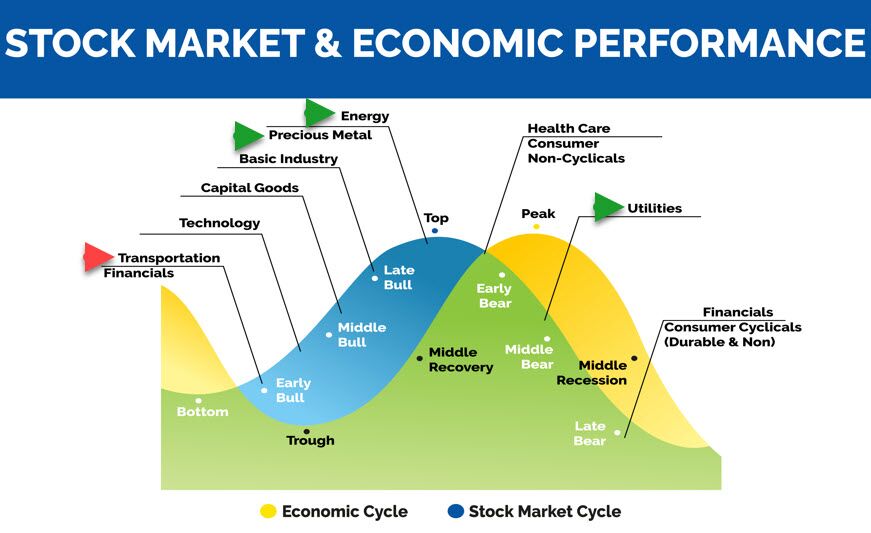

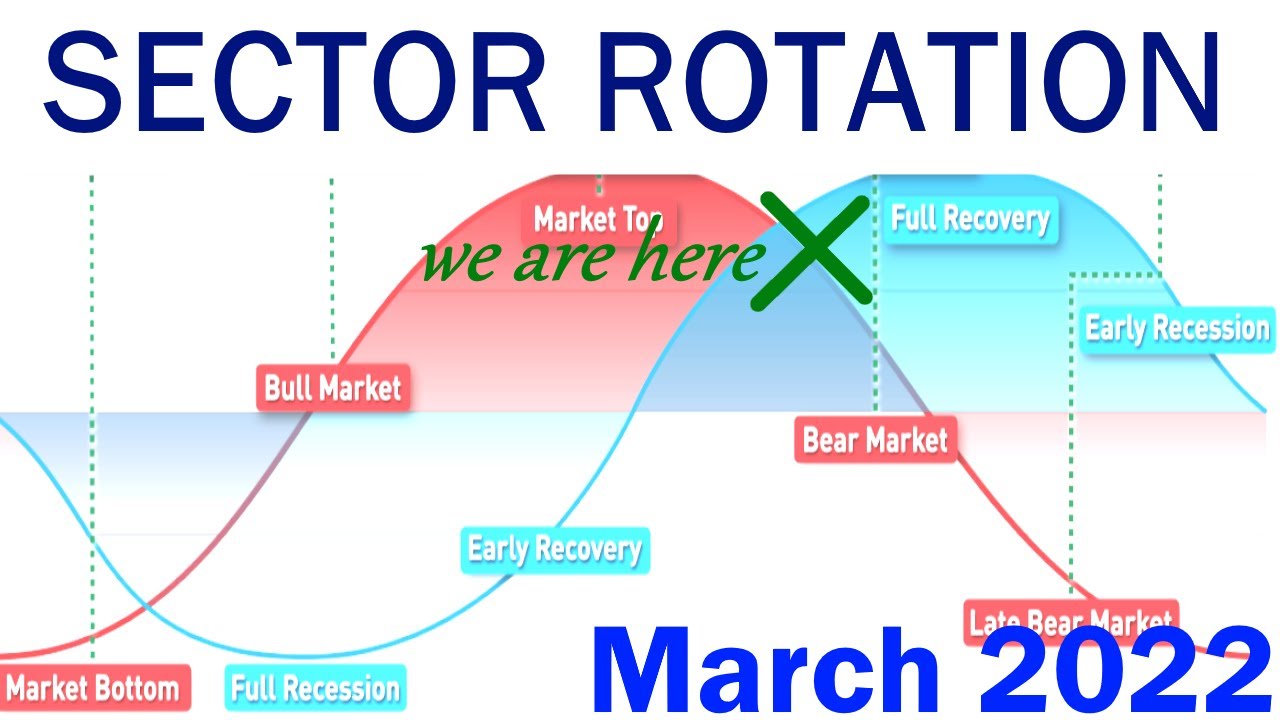

Sector Rotation Strategies

Sector rotation is a dynamic investment strategy that involves shifting investments between different sectors of the economy based on market conditions and anticipated trends. This approach aims to capitalize on sectors that are expected to perform well in the current economic environment.

Find out about how Weighting and Aggregation in the November 2024 CPI Calculation can deliver the best answers for your issues.

Potential Sectors to Benefit from the CPI Report

The November 2024 CPI report could impact different sectors in various ways. For instance, sectors like energy and materials might benefit from continued inflation, as their products are often priced in line with commodity prices. Conversely, sectors like consumer discretionary and technology might be more sensitive to inflation, as consumers may cut back on discretionary spending if inflation remains high.

Obtain direct knowledge about the efficiency of CPI and Savings Account Interest Rates in November 2024 through case studies.

Investment Outlook for Different Sectors

- Energy:If the CPI report shows persistent inflation, the energy sector could continue to benefit, as demand for oil and gas remains high. However, concerns about the long-term transition to renewable energy sources might impact the sector’s long-term growth prospects.

Obtain access to Inflation Expectations and Interest Rates in November 2024 to private resources that are additional.

- Materials:Similar to energy, the materials sector could benefit from inflation, as demand for metals and other raw materials is likely to remain strong. However, supply chain disruptions and geopolitical tensions could pose challenges to the sector.

- Consumer Discretionary:The consumer discretionary sector is sensitive to inflation, as consumers may cut back on discretionary spending if inflation remains high. However, if the CPI report shows a decline in inflation, this sector could rebound, driven by pent-up demand and improved consumer confidence.

- Technology:The technology sector is often considered a defensive sector, as demand for technology products and services tends to remain relatively stable even during economic downturns. However, the sector’s growth prospects could be impacted by inflation, as businesses may delay technology investments if they are concerned about economic uncertainty.

Winning Industries for Investment

Following the release of the November 2024 CPI report, certain industries are likely to outperform based on their sensitivity to inflation and economic growth.

In this topic, you find that CPI and Gold Prices: A Historical Connection Leading to November 2024 is very useful.

Industries Poised for Outperformance

- Healthcare:The healthcare sector is generally considered a defensive sector, as demand for healthcare services tends to remain stable regardless of economic conditions. Moreover, an aging population and the development of new medical technologies are expected to drive long-term growth in the sector.

- Consumer Staples:The consumer staples sector, which includes essential goods like food and beverages, is also considered a defensive sector, as consumers continue to purchase these products even during economic downturns. The sector is likely to benefit from continued inflation, as demand for essential goods remains strong.

- Renewable Energy:The renewable energy sector is poised for significant growth, driven by increasing government support, falling technology costs, and growing consumer demand for sustainable energy solutions. The sector is expected to benefit from both inflation and economic growth, as investments in renewable energy infrastructure are likely to increase.

- Cybersecurity:The cybersecurity sector is experiencing rapid growth, driven by the increasing prevalence of cyberattacks and the growing reliance on digital technologies. The sector is likely to benefit from both inflation and economic growth, as businesses continue to invest in cybersecurity solutions to protect their data and operations.

Obtain direct knowledge about the efficiency of The Impact of Consumer Behavior on CPI and PCE in November 2024 through case studies.

Factors Driving Growth in Winning Industries

- Healthcare:Aging population, technological advancements, and rising healthcare costs are driving growth in the healthcare sector.

- Consumer Staples:Essential goods remain in high demand, even during economic downturns, making the consumer staples sector relatively resilient to inflation.

- Renewable Energy:Government incentives, falling technology costs, and growing consumer demand for sustainable energy solutions are driving the growth of the renewable energy sector.

- Cybersecurity:The increasing prevalence of cyberattacks and the growing reliance on digital technologies are driving the rapid growth of the cybersecurity sector.

Industry Metrics and Outlook

| Industry | Expected Returns | Risk Profile | Potential Challenges |

|---|---|---|---|

| Healthcare | Moderate to High | Low to Moderate | Regulatory changes, high research and development costs |

| Consumer Staples | Moderate | Low | Competition, commodity price fluctuations |

| Renewable Energy | High | Moderate to High | Intermittency of renewable energy sources, grid integration challenges |

| Cybersecurity | High | Moderate | Rapidly evolving threat landscape, skilled labor shortages |

Investment Strategies for Winning Industries

To maximize returns in the identified winning industries, a well-diversified portfolio allocation strategy is crucial.

Browse the implementation of CPI and Healthcare Costs in November 2024: Staying Healthy on a Budget in real-world situations to understand its applications.

Portfolio Allocation Strategy

- Healthcare:Allocate a portion of your portfolio to healthcare ETFs, such as the Health Care Select Sector SPDR Fund (XLV)or the Vanguard Health Care ETF (VHT). Consider investing in individual healthcare stocks, such as Johnson & Johnson (JNJ)or UnitedHealth Group (UNH), for potential higher returns.

- Consumer Staples:Invest in consumer staples ETFs like the Consumer Staples Select Sector SPDR Fund (XLP)or the Vanguard Consumer Staples ETF (VDC). Consider investing in individual stocks like Procter & Gamble (PG)or Coca-Cola (KO)for potential higher returns.

- Renewable Energy:Invest in renewable energy ETFs like the Invesco Solar ETF (TAN)or the iShares Global Clean Energy ETF (ICLN). Consider investing in individual renewable energy stocks like First Solar (FSLR)or Enphase Energy (ENPH)for potential higher returns.

- Cybersecurity:Invest in cybersecurity ETFs like the ETFMG Prime Cyber Security ETF (HACK)or the First Trust Cybersecurity ETF (CIBR). Consider investing in individual cybersecurity stocks like CrowdStrike Holdings (CRWD)or Palo Alto Networks (PANW)for potential higher returns.

Risk Management and Portfolio Adjustments

- Diversification:Spread your investments across different industries and asset classes to mitigate risk.

- Rebalancing:Regularly rebalance your portfolio to maintain your desired asset allocation.

- Market Monitoring:Stay informed about market conditions and adjust your portfolio accordingly.

Analyzing Industry Trends and Opportunities: November 2024 CPI And Sector Rotation: Investing In Winning Industries

Understanding the key trends shaping the long-term growth potential of winning industries is crucial for making informed investment decisions.

Check what professionals state about November 2024 CPI and Housing Affordability: A Growing Concern and its benefits for the industry.

Key Trends Shaping Industry Dynamics, November 2024 CPI and Sector Rotation: Investing in Winning Industries

- Technological Advancements:Advancements in artificial intelligence, biotechnology, and renewable energy are transforming industries and creating new investment opportunities.

- Regulatory Changes:Government regulations, such as those related to healthcare, environmental protection, and cybersecurity, are shaping industry dynamics and influencing investment strategies.

- Consumer Behavior:Changing consumer preferences, such as the growing demand for sustainable products and services, are driving industry growth and creating new investment opportunities.

Investment Opportunities within Winning Industries

- Healthcare:Invest in companies developing innovative medical treatments, personalized medicine, and digital health solutions.

- Consumer Staples:Invest in companies focusing on healthy and sustainable food options, personalized nutrition, and convenience-oriented products.

- Renewable Energy:Invest in companies developing advanced solar, wind, and energy storage technologies, as well as those involved in grid modernization and smart energy solutions.

- Cybersecurity:Invest in companies developing advanced threat detection and prevention technologies, as well as those providing cybersecurity consulting and managed security services.

Closure

In conclusion, navigating the post-November 2024 CPI report environment requires a strategic approach to sector rotation. By understanding the report’s implications, identifying winning industries, and implementing a well-defined investment strategy, investors can position themselves for success in a market shaped by inflation and economic growth.

The insights provided in this analysis can empower investors to make informed decisions and capitalize on the opportunities presented by sector rotation in the evolving market landscape.

Question & Answer Hub

What are the key factors driving growth in the winning industries identified in this analysis?

The factors driving growth in winning industries will vary depending on the specific industry and the economic conditions. However, some common factors include:

- Strong demand for goods and services

- Innovation and technological advancements

- Favorable regulatory environment

- Cost advantages

- Access to capital

How can I manage risk in my investment portfolio during periods of high inflation?

Enhance your insight with the methods and methods of CPI and the Evolution of the US Economy Leading to November 2024.

Managing risk during periods of high inflation requires a diversified portfolio with a focus on assets that tend to hold their value or even appreciate during inflation. Consider investing in:

- Real estate

- Commodities (gold, oil)

- Inflation-protected bonds (TIPS)

- Value stocks

- Companies with pricing power

What are the potential challenges facing the winning industries identified in this analysis?

The challenges facing winning industries can vary depending on the specific industry and the overall economic environment. However, some common challenges include:

- Competition

- Rising input costs

- Supply chain disruptions

- Regulatory changes

- Economic slowdown