November 2024 CPI and Real Estate Investing: Is it a Good Time to Buy? This question weighs heavily on the minds of many potential investors. The Consumer Price Index (CPI) release for November 2024 will be a pivotal moment, offering insights into inflation trends and their potential impact on the real estate market.

Further details about Stagflation: A Challenging Economic Scenario in November 2024 (if applicable) is accessible to provide you additional insights.

Understanding the relationship between CPI and real estate is crucial for making informed investment decisions, especially in an era marked by economic uncertainty.

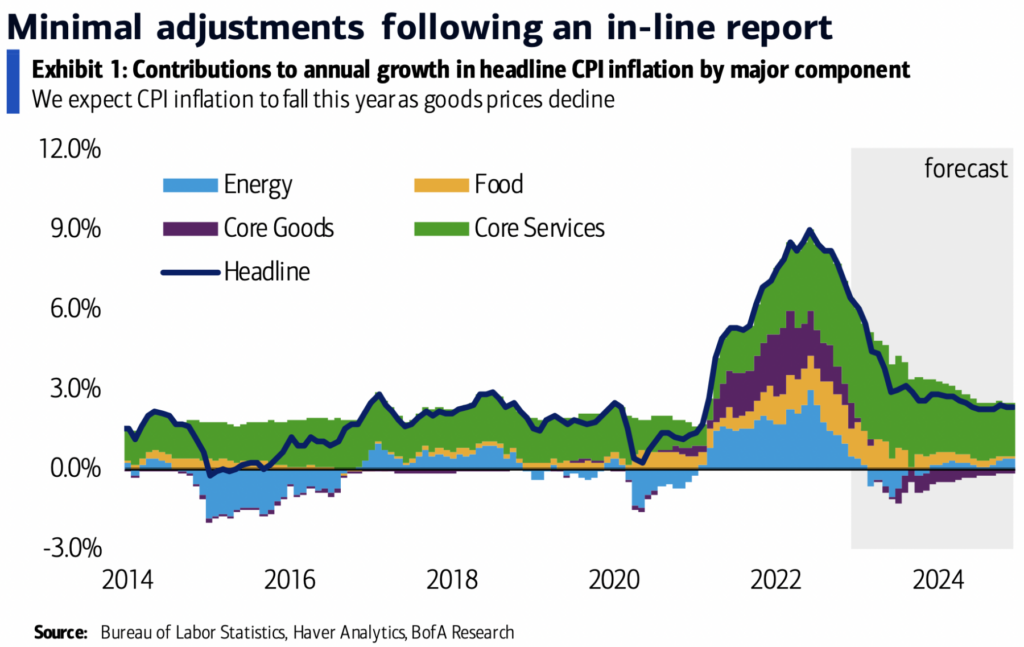

Historically, CPI fluctuations have influenced real estate market dynamics. A high CPI reading can lead to increased interest rates, making mortgages more expensive and potentially dampening demand for housing. Conversely, a low CPI reading might indicate a more stable economic environment, potentially boosting investor confidence and driving up property values.

The upcoming November 2024 CPI release, therefore, holds significant implications for real estate investors.

Understanding November 2024 CPI

The Consumer Price Index (CPI) is a crucial economic indicator that reflects the average change in prices paid by urban consumers for a basket of consumer goods and services. The November 2024 CPI release will be particularly important for real estate investors as it provides valuable insights into inflation trends and their potential impact on the market.

Understanding the CPI’s significance, historical trends, and potential implications is essential for making informed investment decisions.

Check CPI and Interest Rates: A Historical Correlation Leading to November 2024 to inspect complete evaluations and testimonials from users.

Significance of the November 2024 CPI Release

The November 2024 CPI release will be closely watched by real estate investors for several reasons. Firstly, it will provide a snapshot of inflation levels at a time when the market is still grappling with the effects of recent economic volatility.

Secondly, the CPI reading can influence interest rates, which directly impact mortgage costs and the affordability of real estate. Finally, the CPI can provide insights into consumer spending patterns, which can affect demand for housing and, consequently, real estate prices.

Historical CPI Trends in November and Their Impact on Real Estate Markets

Historically, November CPI readings have shown mixed trends. In some years, the CPI has risen, leading to higher interest rates and a cooling effect on the real estate market. In other years, the CPI has declined or remained stable, creating a more favorable environment for real estate investments.

For example, in November 2023, the CPI rose by 0.3%, contributing to a slight increase in mortgage rates. However, in November 2022, the CPI remained stable, leading to a more stable real estate market.

Potential Implications of a High or Low CPI Reading for Real Estate Investment Strategies

A high CPI reading could lead to increased inflation expectations, prompting the Federal Reserve to raise interest rates. This could result in higher mortgage costs, making it more expensive for buyers to enter the market. In such a scenario, investors might consider focusing on rental properties, as demand for affordable housing could remain strong.

Do not overlook explore the latest data about Accuracy and Reliability of the November 2024 CPI Data.

On the other hand, a low CPI reading could indicate a cooling inflation environment, potentially leading to lower interest rates and a more favorable market for buyers. This could create opportunities for investors to purchase properties at attractive prices.

Real Estate Market Dynamics

The real estate market is constantly evolving, influenced by various factors, including economic conditions, interest rates, and consumer sentiment. Understanding the current state of the market is essential for investors to make informed decisions about their investment strategies.

Current State of the Real Estate Market

As of November 2024, the real estate market is experiencing a period of moderate growth. While prices have stabilized after a period of rapid appreciation, inventory levels remain relatively low, creating a competitive environment for buyers. Mortgage rates have also remained relatively stable, although they are still higher than they were a few years ago.

Discover how November 2024 CPI and Wage Growth: Are Wages Keeping Pace with Inflation? has transformed methods in this topic.

This has contributed to a slower pace of sales, but demand remains strong in many areas.

Investigate the pros of accepting Budgeting in an Inflationary Environment: Using the November 2024 CPI in your business strategies.

Impact of November 2024 CPI on Real Estate Market Sentiment and Investor Behavior

The November 2024 CPI release could have a significant impact on real estate market sentiment and investor behavior. A high CPI reading could lead to increased uncertainty and caution among investors, potentially slowing down market activity. Conversely, a low CPI reading could boost investor confidence, leading to increased demand and potential price appreciation.

Obtain access to November 2024 CPI and Long-Term Interest Rates: What to Expect to private resources that are additional.

The overall impact will depend on the magnitude of the CPI change and the market’s reaction to it.

Comparison with Historical Periods of High or Low Inflation

Comparing the current market conditions with historical periods of high or low inflation can provide valuable insights for investors. For example, during periods of high inflation, real estate investments have often performed well as a hedge against inflation. However, it’s important to note that past performance is not necessarily indicative of future results.

The current economic environment is unique, and investors should carefully consider the specific factors at play before making any investment decisions.

Check what professionals state about The Impact of Consumer Behavior on CPI and PCE in November 2024 and its benefits for the industry.

Analyzing Investment Opportunities

The November 2024 CPI release will provide valuable information for investors seeking to identify attractive real estate investment opportunities. By understanding the potential impact of the CPI on market dynamics, investors can make more informed decisions about their investment strategies.

Specific Real Estate Investment Opportunities

- Rental Properties:A high CPI reading could lead to increased demand for affordable rental housing, making this a potentially attractive investment strategy. Rental properties can provide a steady stream of income, even in a volatile market.

- Value-Add Properties:In a market with limited inventory, investors may find opportunities to purchase properties that require some renovation or improvement. By investing in value-add properties, investors can potentially increase their returns through appreciation and rental income.

- Emerging Markets:Some emerging markets may offer attractive investment opportunities, particularly if they are not as sensitive to interest rate fluctuations. Investors should carefully research these markets and understand the local economic conditions before making any decisions.

Pros and Cons of Different Real Estate Investment Strategies

| Investment Strategy | Pros | Cons |

|---|---|---|

| Rental Properties | Steady income stream, potential for appreciation | Higher maintenance costs, tenant management challenges |

| Value-Add Properties | Potential for higher returns, opportunity to create value | Higher upfront investment, potential for unexpected costs |

| Emerging Markets | Potential for higher returns, less competition | Higher risk, limited market knowledge |

Decision-Making Process for Evaluating Real Estate Investments

The decision-making process for evaluating real estate investments should be systematic and comprehensive. Here’s a flowchart that Artikels the key steps:

1. Analyze the November 2024 CPI release.

Examine how The Psychology of Inflation in November 2024 can boost performance in your area.

2. Assess the potential impact of the CPI on the real estate market.

3. Identify potential investment opportunities.

4. Evaluate the risk profile of each investment opportunity.

5. Make a decision based on your investment goals and risk tolerance.

Expand your understanding about CPI and PCE: A Guide for Researchers Using November 2024 Data with the sources we offer.

Risk Management Considerations: November 2024 CPI And Real Estate Investing: Is It A Good Time To Buy?

Real estate investing, like any investment, carries inherent risks. It’s essential for investors to understand these risks and implement appropriate risk management strategies to protect their investments.

Obtain access to CPI and Labor Productivity in November 2024 to private resources that are additional.

Potential Risks Associated with Real Estate Investing

- Interest Rate Risk:Rising interest rates can increase mortgage costs, making it more expensive for buyers to enter the market and potentially reducing demand for real estate.

- Economic Volatility:Economic downturns can lead to job losses, reduced consumer spending, and a decline in real estate values.

- Market Fluctuations:Real estate prices can fluctuate significantly, influenced by factors such as supply and demand, interest rates, and economic conditions.

Strategies for Mitigating Risk in Real Estate Investments

- Diversification:Investing in a variety of properties in different locations can help reduce the impact of localized market fluctuations.

- Thorough Due Diligence:Conducting comprehensive research on properties and market conditions before making any investment decisions can help identify potential risks and minimize surprises.

- Conservative Financing:Securing a mortgage with a lower loan-to-value ratio can reduce the risk of foreclosure in case of market downturns.

Checklist of Factors to Consider When Evaluating the Risk Profile of a Real Estate Investment, November 2024 CPI and Real Estate Investing: Is it a Good Time to Buy?

- Location:Consider the overall economic health of the area, crime rates, and proximity to amenities.

- Property Condition:Assess the age, condition, and maintenance history of the property.

- Rental Market:If you plan to rent the property, research the local rental market to determine potential rental income and vacancy rates.

- Financing:Evaluate the terms of your mortgage, including the interest rate, loan-to-value ratio, and repayment schedule.

- Exit Strategy:Consider how you will sell the property in the future and what factors could affect its value.

Last Recap

Navigating the real estate market in the wake of the November 2024 CPI release requires a strategic approach. By understanding the historical relationship between CPI and real estate, analyzing current market trends, and considering risk management strategies, investors can position themselves for success.

Whether the CPI indicates a surge in inflation or a period of stability, careful planning and a comprehensive understanding of the market are essential for making sound investment decisions.

Detailed FAQs

How will the November 2024 CPI affect mortgage rates?

A high CPI reading could lead to the Federal Reserve raising interest rates, which would likely increase mortgage rates. Conversely, a low CPI reading might indicate that the Fed will maintain or even lower interest rates, potentially keeping mortgage rates stable or even decreasing them.

What are the potential risks associated with real estate investing in 2024?

Risks include market volatility, interest rate fluctuations, economic downturns, and changes in government regulations. It’s crucial to conduct thorough due diligence, diversify investments, and have a solid risk management plan.

What are some alternative investment options to consider alongside real estate?

Other investment options include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and precious metals. Diversifying your portfolio across different asset classes can help mitigate risk.