November 2024 CPI and Monetary Policy: Predicting the Fed’s Response sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The upcoming November 2024 Consumer Price Index (CPI) report is a pivotal event for the Federal Reserve (Fed), as it will provide crucial insights into the state of inflation and guide their monetary policy decisions.

The report’s impact on the Fed’s actions will have far-reaching consequences for the economy, influencing interest rates, asset purchases, and the overall direction of financial markets. This analysis delves into the significance of the November 2024 CPI report, examines the Fed’s current monetary policy stance, and predicts their likely response to the data, exploring the potential economic implications of their decisions.

The November 2024 CPI report will be a critical indicator of the Fed’s success in managing inflation, which has been a major concern for policymakers in recent years. The report will reveal whether inflation has continued to moderate, as the Fed hopes, or if it has shown signs of accelerating.

Find out about how November 2024 CPI and Long-Term Interest Rates: What to Expect can deliver the best answers for your issues.

The report’s details, particularly the core CPI, which excludes volatile food and energy prices, will provide valuable information about the underlying inflationary pressures in the economy. This data will inform the Fed’s decision-making process as they navigate the delicate balance between controlling inflation and supporting economic growth.

Discover the crucial elements that make November 2024 CPI and Credit Card Interest Rates: What Consumers Need to Know the top choice.

Understanding the November 2024 CPI Report

The November 2024 Consumer Price Index (CPI) report is highly anticipated, as it will provide crucial insights into the current state of inflation and its potential impact on the Federal Reserve’s monetary policy decisions. This report will be particularly significant given the ongoing efforts to manage inflation and navigate the complex economic landscape.

Key Components and Impact

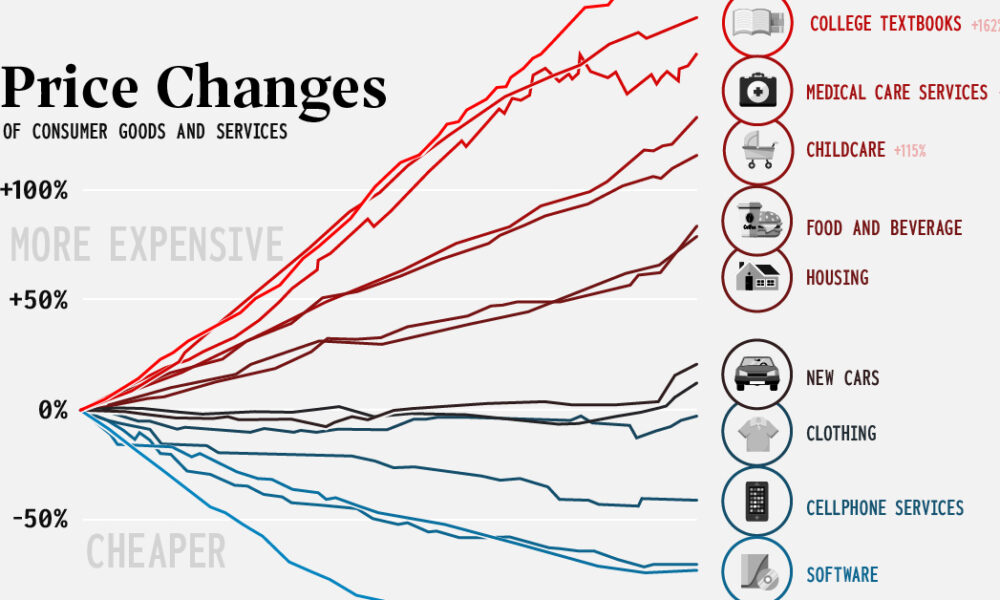

The CPI report comprises various components, including food, energy, housing, medical care, and transportation, each contributing to the overall inflation picture. The report’s release will likely influence the Fed’s decision-making process by providing valuable data on the persistence and breadth of inflation.

Obtain direct knowledge about the efficiency of CPI and Executive Compensation in November 2024 through case studies.

A higher-than-expected CPI reading could signal that inflation is more entrenched than anticipated, potentially leading to more aggressive monetary policy tightening. Conversely, a lower-than-expected CPI reading could suggest that inflation is moderating, potentially allowing the Fed to maintain a more accommodative stance.

Browse the multiple elements of CPI vs. PCE in November 2024: Key Differences and Similarities to gain a more broad understanding.

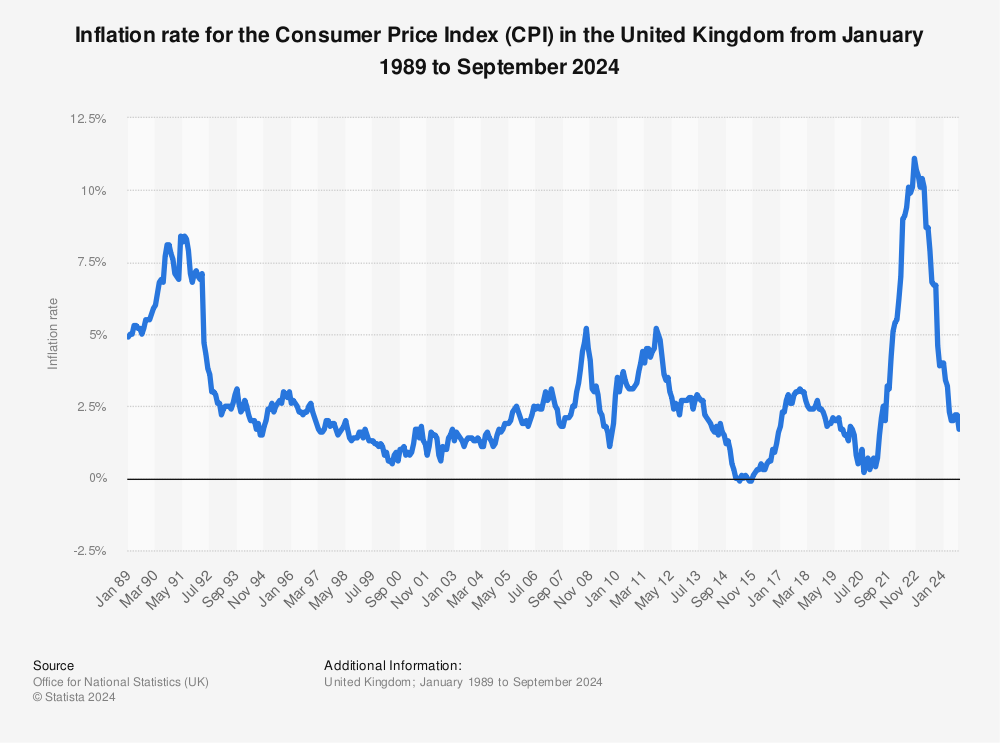

Comparison with Previous Releases and Historical Trends

Comparing the November 2024 CPI report with previous releases and historical trends will be essential for understanding the current inflation trajectory. Analysts will scrutinize the year-over-year and month-over-month changes in the CPI to identify any significant shifts in the inflation landscape.

For instance, a sustained increase in the CPI could suggest that inflationary pressures are intensifying, while a deceleration in the CPI could indicate that inflation is easing.

The Fed’s Current Monetary Policy Stance

The Federal Reserve’s primary objective is to maintain price stability and foster maximum employment. The Fed utilizes various tools, including interest rate adjustments, asset purchases, and forward guidance, to achieve its monetary policy goals. The current monetary policy stance is influenced by several factors, including inflation, employment, and economic growth.

Get the entire information you require about CPI and Technological Advancements Leading to November 2024 on this page.

Factors Influencing the Fed’s Decision-Making Process

The Fed’s decision-making process is data-driven, considering various economic indicators to assess the health of the economy and the effectiveness of its policy actions. The November 2024 CPI report will be a crucial piece of data that the Fed will analyze alongside other economic indicators, such as the unemployment rate, GDP growth, and wage inflation.

Obtain direct knowledge about the efficiency of CPI and the Informal Economy in November 2024 through case studies.

Implications of the November 2024 CPI Report

The November 2024 CPI report will likely have a significant impact on the Fed’s future policy actions. A higher-than-expected CPI reading could prompt the Fed to accelerate its rate hike cycle or adopt a more hawkish stance, aiming to curb inflation more aggressively.

Expand your understanding about CPI and Globalization Leading to November 2024 with the sources we offer.

Conversely, a lower-than-expected CPI reading could provide the Fed with more flexibility to maintain its current policy path or even consider easing monetary policy if economic conditions warrant it.

Get the entire information you require about CPI and Commodities Investing in November 2024 on this page.

Predicting the Fed’s Response to the CPI Data

The Fed’s response to the November 2024 CPI report will depend on the magnitude of the CPI change, the underlying drivers of inflation, and the broader economic outlook. A scenario analysis can help to understand the potential implications of different CPI outcomes for monetary policy.

Scenario Analysis

- Scenario 1: Higher-Than-Expected CPI

- Scenario 2: Lower-Than-Expected CPI

- Scenario 3: CPI Remains Stable

Potential Fed Responses

| CPI Scenario | Potential Fed Response |

|---|---|

| Higher-Than-Expected CPI | Increased interest rates, accelerated asset sales, hawkish forward guidance |

| Lower-Than-Expected CPI | Maintain current policy stance, potential for easing, dovish forward guidance |

| CPI Remains Stable | Maintain current policy stance, monitor economic data closely, balanced forward guidance |

The Impact of the Fed’s Decision on the Economy

The Fed’s policy decisions can have a significant impact on the economy, influencing inflation, employment, and economic growth.

Economic Consequences of Different Fed Policy Responses

- Aggressive Tightening:Could lead to slower economic growth, higher unemployment, and a potential recession.

- Accommodative Stance:Could help to stimulate economic growth and reduce unemployment but could also fuel inflation.

- Maintaining the Current Stance:Could help to balance the need to control inflation while supporting economic growth, but could also lead to uncertainty in the market.

Risks and Opportunities, November 2024 CPI and Monetary Policy: Predicting the Fed’s Response

The Fed’s actions could have both short-term and long-term effects on financial markets, businesses, and consumers. For instance, a sudden increase in interest rates could lead to higher borrowing costs for businesses and consumers, potentially slowing economic activity. Conversely, a sustained period of low interest rates could encourage borrowing and investment, potentially stimulating economic growth.

Last Word

The November 2024 CPI report is a key data point that will shape the Fed’s monetary policy trajectory in the coming months. The Fed’s response, whether to maintain its current course, tighten further, or even pivot towards easing, will have significant implications for the economy, financial markets, and businesses.

Find out about how November 2024 CPI and Wage Growth: Are Wages Keeping Pace with Inflation? can deliver the best answers for your issues.

Understanding the potential scenarios and the factors influencing the Fed’s decision-making process is crucial for investors, policymakers, and anyone interested in the future direction of the economy.

Quick FAQs: November 2024 CPI And Monetary Policy: Predicting The Fed’s Response

What is the significance of the November 2024 CPI report?

The November 2024 CPI report will provide the Fed with crucial information about the current state of inflation, influencing their decision on interest rate adjustments and other monetary policy actions.

How does the CPI data impact the Fed’s decision-making process?

The CPI data provides insights into the rate of inflation, helping the Fed assess whether their current monetary policy stance is appropriate for achieving their inflation target.

Further details about The Future of Interest Rates in a Changing CPI Landscape After November 2024 is accessible to provide you additional insights.

What are the potential economic consequences of the Fed’s response to the CPI data?

The Fed’s response can impact inflation, employment, economic growth, and financial markets, potentially leading to changes in interest rates, asset prices, and business investment.

What are the key factors that will influence the Fed’s response to the CPI data?

The magnitude of the CPI change, the underlying drivers of inflation, the broader economic outlook, and the level of uncertainty in the economy will all play a role in the Fed’s decision-making process.