November 2024 CPI and Housing Costs: Anticipating Future Changes, this analysis delves into the projected trends for consumer prices and housing costs in November 2024. We’ll explore the factors driving these changes, examine their potential impact on the economy, and offer strategies for navigating the evolving landscape.

The Consumer Price Index (CPI) is a crucial indicator of inflation, reflecting changes in the prices of goods and services commonly purchased by consumers. Simultaneously, housing costs, including rent, mortgage rates, and home prices, play a significant role in household budgets and overall economic stability.

Understanding the interplay between these two factors is essential for individuals, businesses, and policymakers alike.

Obtain access to CPI and Healthcare Costs in November 2024: Staying Healthy on a Budget to private resources that are additional.

November 2024 CPI Overview

The Consumer Price Index (CPI) is a key economic indicator that measures changes in the prices of goods and services purchased by consumers. The November 2024 CPI is expected to provide valuable insights into the current state of inflation and its potential impact on the economy.

Do not overlook the opportunity to discover more about the subject of November 2024 CPI and Student Loan Interest Rates: Potential Effects.

While precise predictions are challenging, analysts are closely monitoring recent economic trends and using various forecasting models to estimate the CPI’s trajectory.

Expected CPI for November 2024

Anticipating the exact CPI for November 2024 requires careful consideration of several factors, including recent economic trends, global events, and policy decisions. Based on current projections, a moderate increase in the CPI is anticipated, reflecting continued inflationary pressures. The rate of increase is likely to be influenced by factors such as energy prices, supply chain dynamics, and consumer demand.

When investigating detailed guidance, check out CPI and the Unemployment Rate in November 2024 now.

Impact of Inflation on Consumer Spending and Business Operations

Inflation can significantly impact consumer spending and business operations. Rising prices can erode purchasing power, leading consumers to cut back on discretionary spending. Businesses may face increased costs for raw materials, labor, and transportation, potentially leading to price increases or reduced profit margins.

Learn about more about the process of Causes of Inflation in November 2024: A Deep Dive in the field.

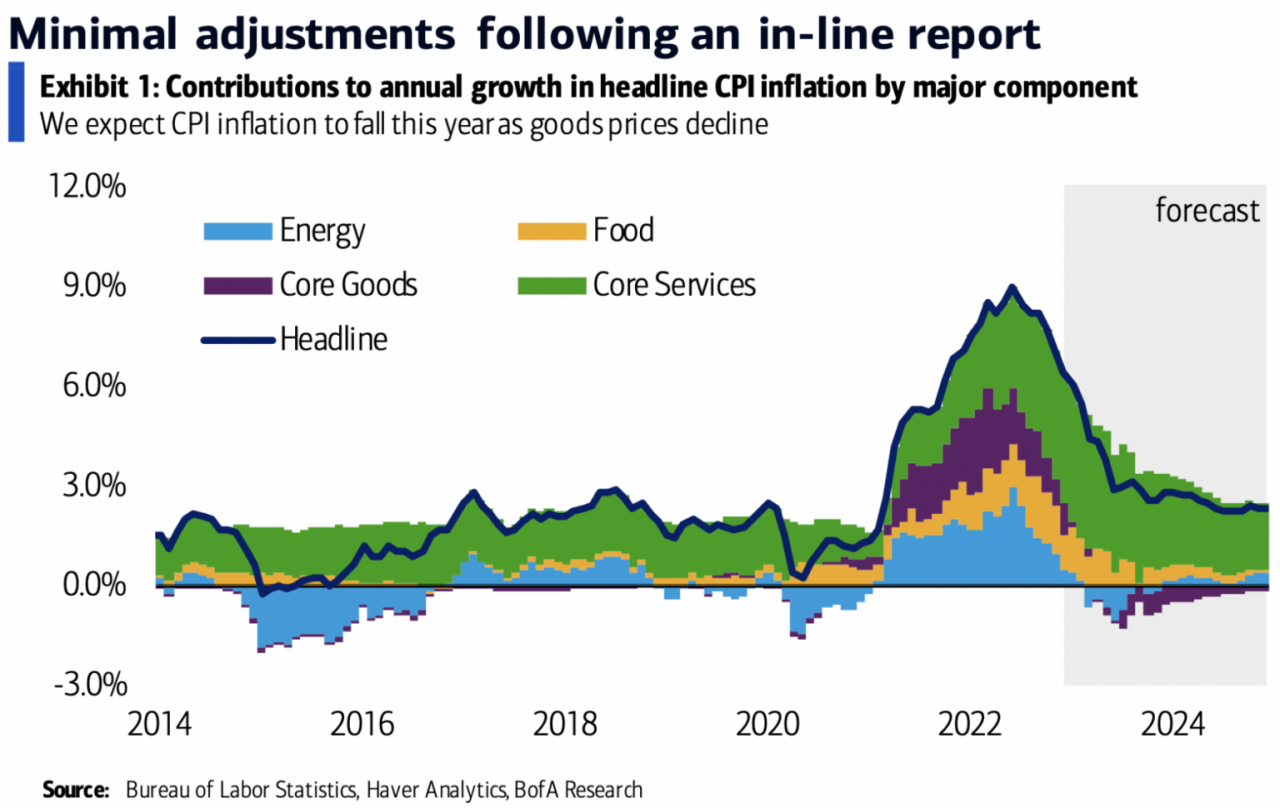

Anticipated Changes in Key CPI Components

- Energy:Energy prices have been volatile in recent years, influenced by global supply and demand dynamics. The November 2024 CPI is expected to reflect the current trends in oil and gas prices, which could contribute to overall inflation.

- Food:Food prices are influenced by factors such as agricultural production, transportation costs, and global commodity markets. While some price increases are anticipated, the magnitude of these changes will depend on specific agricultural conditions and supply chain dynamics.

- Transportation:The cost of transportation is influenced by fuel prices, vehicle prices, and public transportation fares. Continued price increases in these areas are likely to contribute to overall inflation.

Housing Costs in November 2024

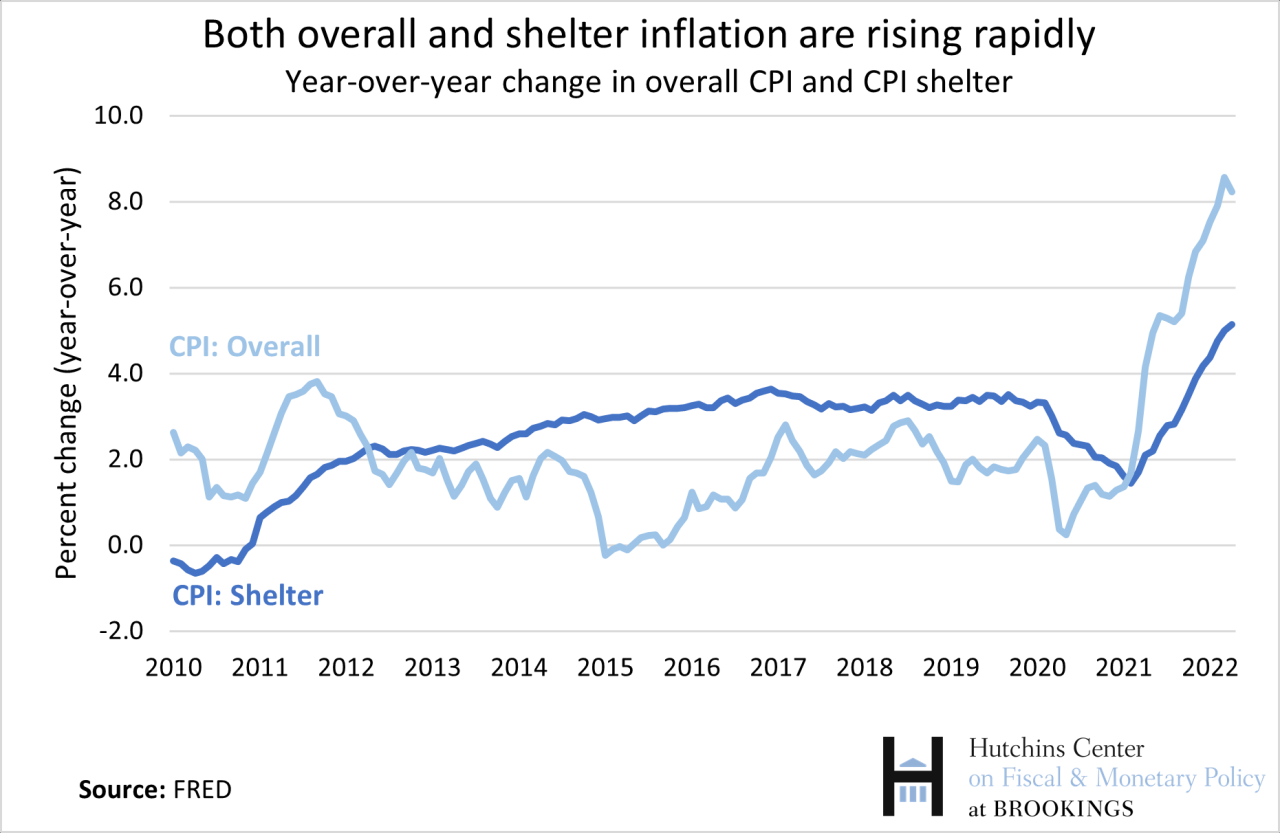

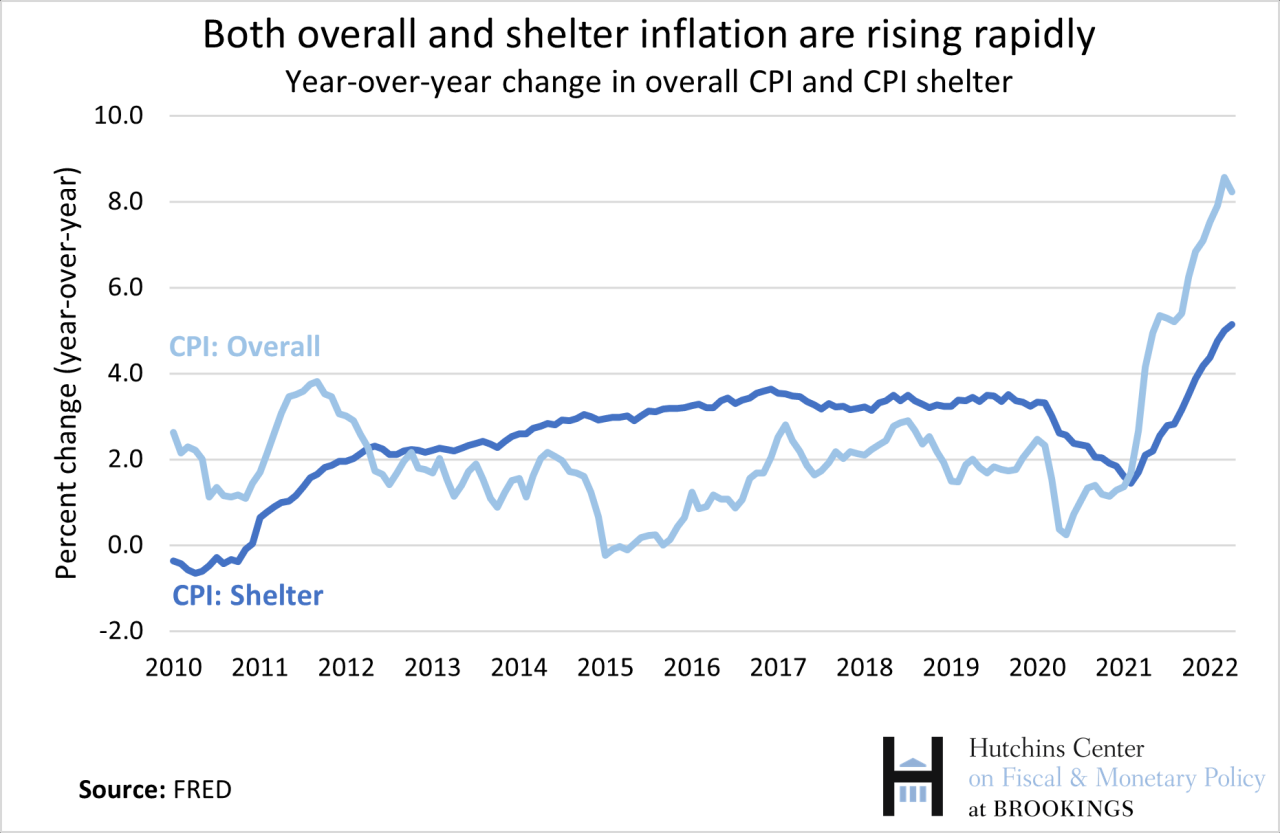

Housing costs are a significant component of the CPI and a major expense for many households. Understanding the anticipated trends in housing costs is crucial for assessing the overall economic outlook and the affordability of housing.

Further details about The Psychology of Investing During Inflation in November 2024 is accessible to provide you additional insights.

Anticipated Trends in Housing Costs

The housing market is dynamic and influenced by a complex interplay of factors. In November 2024, housing costs are expected to remain elevated, although the rate of increase may moderate compared to previous years. This moderation could be attributed to factors such as higher interest rates, cooling demand, and potential adjustments in supply and demand dynamics.

Factors Driving Housing Cost Trends

- Supply and Demand:The availability of housing units and the level of demand play a significant role in determining housing costs. Tight supply and strong demand can drive up prices, while increased supply and reduced demand can moderate price increases.

- Interest Rates:Interest rates influence mortgage costs, which can impact affordability and demand for housing. Higher interest rates can make borrowing more expensive, potentially slowing down housing market activity.

- Economic Growth:Economic growth can influence housing demand, as a strong economy typically leads to increased employment and consumer confidence, potentially driving up demand for housing.

Impact of Housing Cost Changes on Affordability and Housing Market Stability

Changes in housing costs can have a significant impact on affordability and housing market stability. Rising housing costs can make it more challenging for individuals and families to afford housing, potentially leading to increased housing insecurity. Furthermore, rapid price increases can create market instability, potentially leading to price bubbles and subsequent corrections.

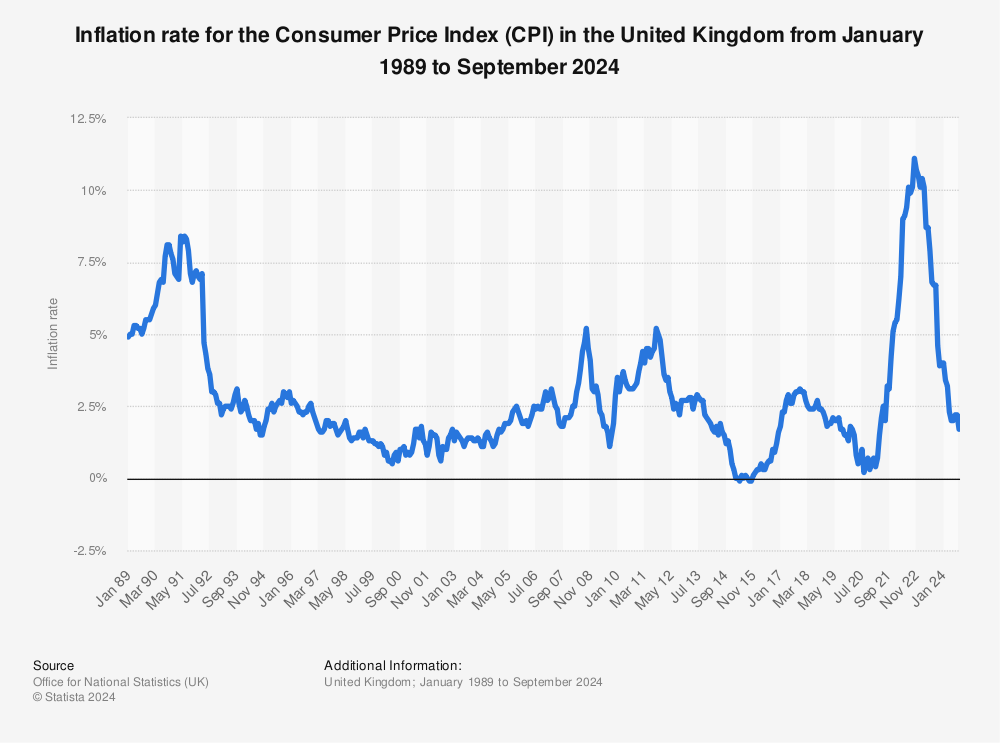

Historical Perspective on CPI and Housing Costs: November 2024 CPI And Housing Costs: Anticipating Future Changes

Examining historical data on CPI and housing costs can provide valuable insights into long-term trends and potential future scenarios. Comparing November 2024 projections with historical data can help us identify any significant deviations from past patterns and understand the factors driving these changes.

Find out further about the benefits of The Future of Work and CPI After November 2024 that can provide significant benefits.

Historical Trends in CPI and Housing Costs

Over the past few decades, both CPI and housing costs have exhibited periods of inflation and deflation, influenced by various economic factors. Historical data reveals that periods of economic expansion and low interest rates have often been associated with higher inflation, while recessions and higher interest rates have typically led to lower inflation.

Factors Contributing to Historical Fluctuations

- Economic Cycles:Economic expansions and contractions can significantly impact CPI and housing costs. During periods of economic growth, consumer demand and business activity tend to increase, leading to higher inflation. Conversely, recessions can lead to lower inflation due to reduced demand and business activity.

- Monetary Policy:Central banks use monetary policy tools, such as interest rate adjustments, to influence inflation. Higher interest rates can slow down economic activity and reduce inflation, while lower interest rates can stimulate economic growth and potentially lead to higher inflation.

- Global Events:Global events, such as wars, natural disasters, and supply chain disruptions, can significantly impact inflation and housing costs. These events can lead to supply shortages, price increases, and economic uncertainty, influencing both CPI and housing market dynamics.

Impact of November 2024 CPI and Housing Costs on the Economy

The November 2024 CPI and housing cost figures will provide valuable insights into the current economic landscape and their potential impact on consumer confidence, business activity, and monetary policy.

Impact on Consumer Confidence and Spending

High inflation can erode consumer confidence and reduce spending. When prices rise faster than wages, consumers may feel less secure about their financial situation, leading to a decline in discretionary spending. This can have a ripple effect on the economy, slowing down economic growth and business activity.

Implications for Businesses

Inflation can impact businesses in various ways, including increased costs for raw materials, labor, and transportation. Businesses may need to adjust their pricing strategies to maintain profitability or face reduced profit margins. In the housing and construction sectors, rising housing costs and interest rates can impact demand for new homes and construction projects.

Remember to click CPI and the Cost of Essential Goods and Services in November 2024 to understand more comprehensive aspects of the CPI and the Cost of Essential Goods and Services in November 2024 topic.

Potential Effects on Monetary Policy and Economic Growth, November 2024 CPI and Housing Costs: Anticipating Future Changes

Central banks closely monitor inflation and housing cost trends to guide monetary policy decisions. High inflation can prompt central banks to raise interest rates to curb inflation and stabilize the economy. However, aggressive interest rate hikes can also slow down economic growth, creating a delicate balancing act for policymakers.

Examine how CPI and Portfolio Diversification in November 2024: Managing Risk can boost performance in your area.

Strategies for Navigating Future Changes

Understanding the potential impact of inflation and housing cost changes is crucial for individuals and businesses to develop strategies for navigating future economic conditions. Effective financial planning, business adaptation, and policy measures can help mitigate the challenges posed by these changes.

Advice for Consumers

- Budgeting and Financial Planning:Develop a detailed budget and track your expenses to manage your finances effectively. Consider adjusting your spending habits to account for rising prices and prioritize essential needs over discretionary spending.

- Debt Management:Minimize debt and focus on paying down high-interest loans. Explore options for refinancing existing loans to lower interest rates and reduce monthly payments.

- Investment Strategies:Consider diversifying your investments to mitigate the impact of inflation. Explore investments that have historically outpaced inflation, such as stocks or real estate.

Insights for Businesses

- Cost Management:Implement strategies to control costs, such as negotiating better prices with suppliers, improving operational efficiency, and exploring alternative sources of materials.

- Pricing Strategies:Carefully consider your pricing strategies to maintain profitability while remaining competitive. Evaluate the need for price increases and communicate them effectively to customers.

- Innovation and Adaptability:Explore opportunities for innovation and product development to offer new products and services that meet changing consumer needs and preferences.

Potential Policy Measures

Government policies can play a significant role in mitigating the impact of inflation and housing cost fluctuations. Policy measures such as tax credits for homebuyers, increased investment in affordable housing, and regulation of rental markets can help address affordability concerns and promote housing market stability.

Finish your research with information from How the November 2024 CPI Could Impact the Federal Funds Rate.

Final Review

As we look ahead to November 2024, understanding the interplay between CPI and housing costs is paramount. By analyzing historical trends, considering current economic conditions, and anticipating future changes, individuals and businesses can make informed decisions to navigate these evolving dynamics.

Staying informed and proactive is key to mitigating potential challenges and maximizing opportunities in a dynamic economic environment.

Helpful Answers

What are the main factors influencing the November 2024 CPI projections?

The November 2024 CPI projections are influenced by a complex interplay of factors, including global supply chain dynamics, energy prices, labor market conditions, and monetary policy decisions.

Expand your understanding about November 2024 CPI and International Investing: Diversification Strategies with the sources we offer.

How can businesses prepare for potential changes in housing costs?

Businesses, especially those in the housing and construction sectors, should monitor housing cost trends, adjust pricing strategies, and consider alternative financing options to mitigate potential risks and capitalize on emerging opportunities.

What are some strategies for consumers to manage their finances in light of anticipated inflation?

Consumers can manage their finances effectively by creating a budget, prioritizing essential expenses, exploring alternative investment options, and seeking financial advice from professionals.