November 2024 CPI and Fiscal Policy: Assessing the Impact – this analysis delves into the critical interplay between the November 2024 Consumer Price Index (CPI) data release and the prevailing fiscal policy landscape. The CPI, a key economic indicator measuring inflation, holds significant sway over government policy decisions, particularly in the realm of fiscal measures.

This analysis explores the intricate relationship between these two forces, examining the potential impact of the November CPI data on the course of fiscal policy and the broader economic outlook.

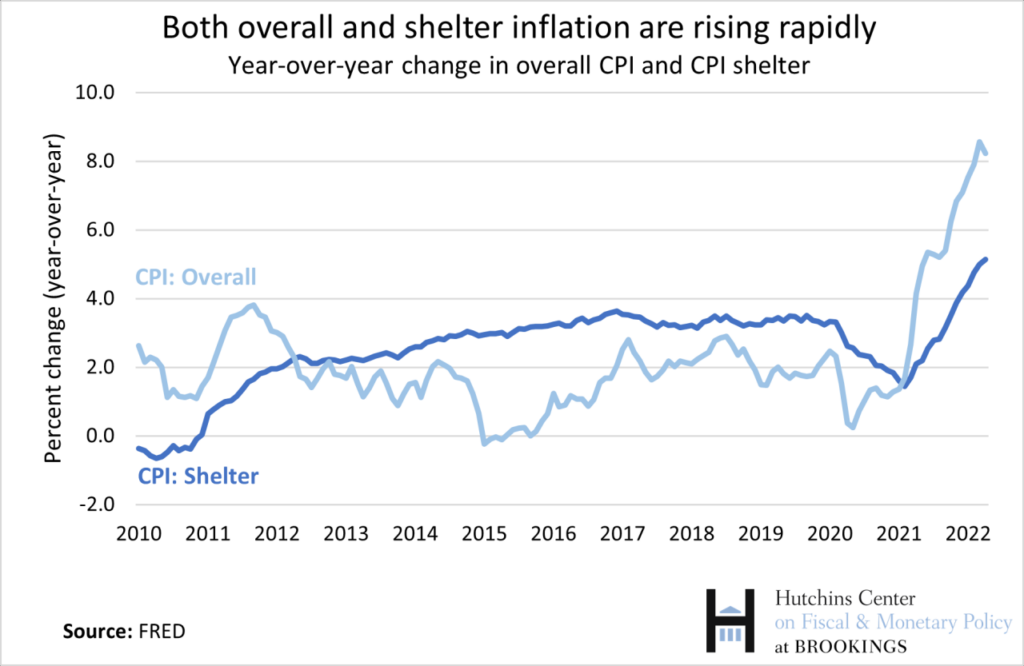

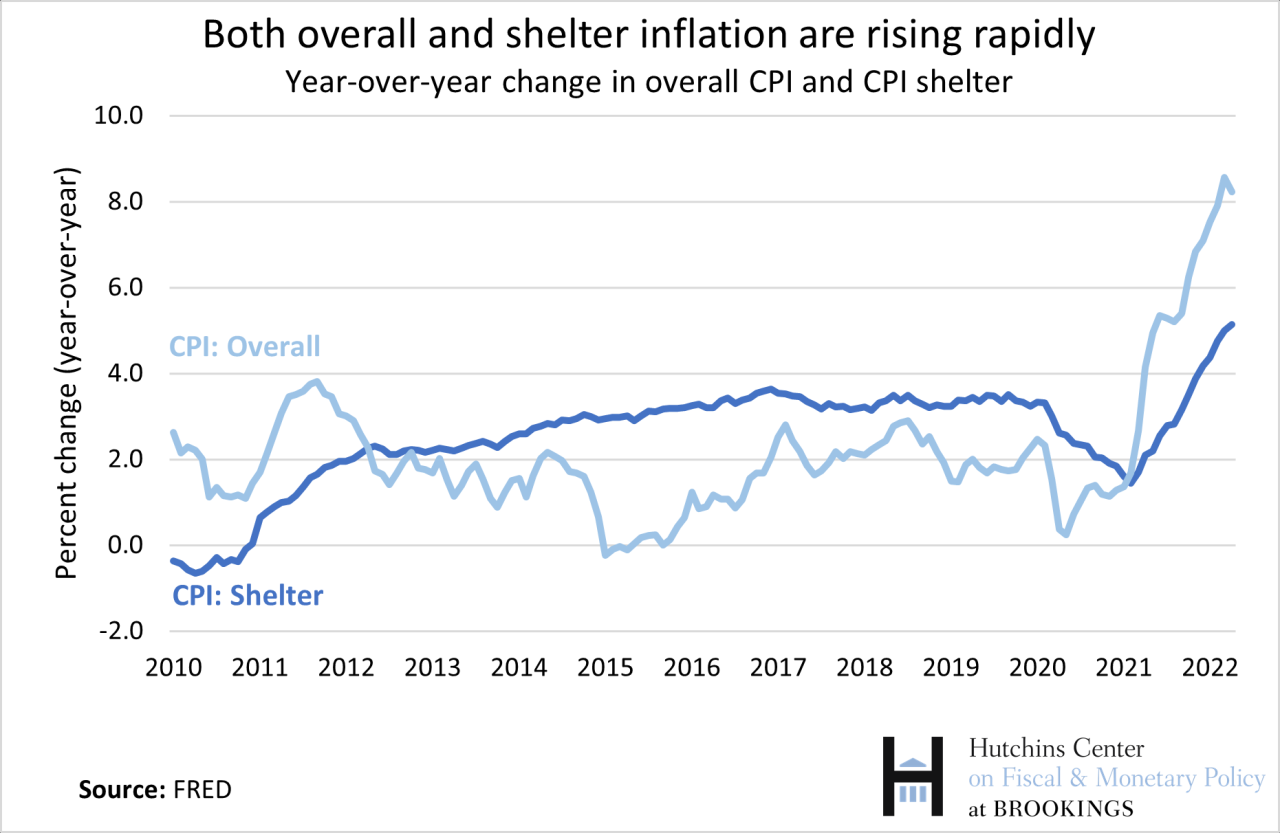

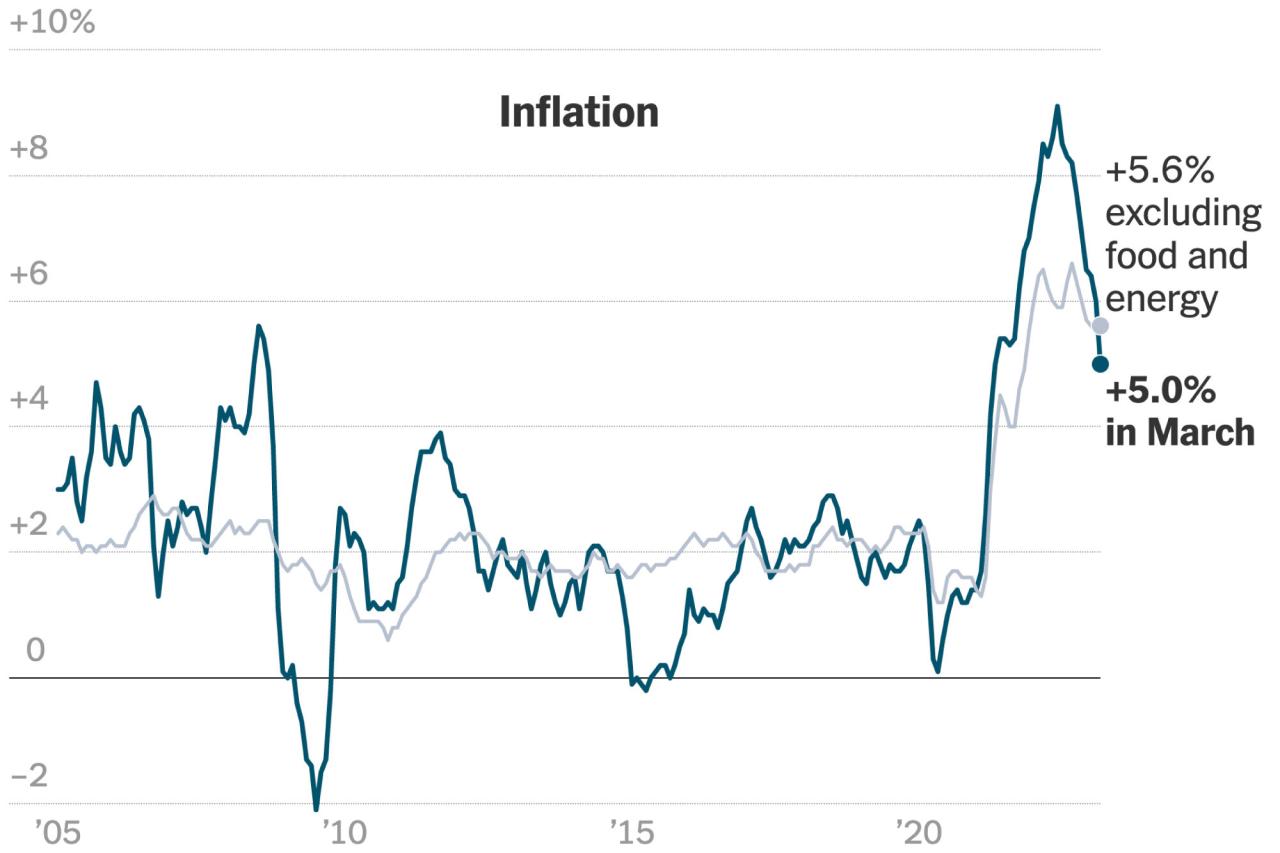

The November 2024 CPI data release will be closely scrutinized for clues about the trajectory of inflation. Analysts will dissect the various components of the CPI, including energy prices, food costs, and housing, to assess the overall inflationary pressure in the economy.

Obtain direct knowledge about the efficiency of November 2024 CPI and Regional Differences in the Cost of Living through case studies.

This information will be vital for policymakers as they weigh the need to stimulate economic growth against the potential for inflationary pressures to escalate.

Understanding November 2024 CPI

The November 2024 CPI data release will be a significant event for economists, policymakers, and investors alike. It will provide valuable insights into the current state of inflation and its impact on the broader economy. The CPI, or Consumer Price Index, is a key economic indicator that measures changes in the prices of a basket of consumer goods and services.

By analyzing the November CPI data, we can gain a better understanding of the inflation trends that are shaping the economic landscape.

Key Components of the CPI

The CPI is comprised of various components that reflect different aspects of consumer spending. Some of the key components include:

- Food and Beverages:This component measures changes in the prices of groceries, restaurant meals, and other food-related items. It is often a volatile component, influenced by factors such as weather conditions and supply chain disruptions.

- Energy:This component captures changes in the prices of gasoline, electricity, and natural gas. It can have a significant impact on overall inflation, especially during periods of high energy prices.

- Housing:This component measures changes in the costs of rent, homeownership, and utilities. It is typically a significant contributor to overall inflation, as housing costs represent a large portion of household budgets.

- Medical Care:This component reflects changes in the prices of healthcare services, prescription drugs, and medical supplies. It is often a source of concern for policymakers, as healthcare costs have been rising steadily in recent years.

- Transportation:This component measures changes in the prices of new and used vehicles, public transportation, and vehicle maintenance. It is influenced by factors such as supply chain issues, fuel prices, and consumer demand.

Historical Trends in November CPI

Historically, November CPI data has shown mixed trends. In some years, November has seen a significant increase in inflation, while in other years, inflation has remained relatively stable or even declined. It is important to consider the historical context of the November CPI data, as well as the current economic climate, when analyzing the implications of the release.

Comparing the Current Economic Climate

The current economic climate is characterized by [insert current economic conditions, e.g., moderate growth, rising interest rates, etc.]. This contrasts with the economic climate of previous years, which may have seen [insert past economic conditions, e.g., high inflation, recessionary pressures, etc.].

Understanding these differences is crucial for interpreting the November CPI data and its potential impact on the economy.

Fiscal Policy Landscape in November 2024: November 2024 CPI And Fiscal Policy: Assessing The Impact

Fiscal policy plays a critical role in shaping the economic landscape. The government’s fiscal policy decisions, such as tax rates, government spending, and debt management, can have a significant impact on inflation, economic growth, and employment.

Current Fiscal Policy Stance, November 2024 CPI and Fiscal Policy: Assessing the Impact

The current fiscal policy stance is [insert current fiscal policy stance, e.g., expansionary, contractionary, neutral]. This stance reflects the government’s priorities in terms of economic growth, inflation control, and debt management. The government’s fiscal policy decisions are often influenced by factors such as the state of the economy, political considerations, and global economic events.

Finish your research with information from CPI and the Global Economy in November 2024.

Major Fiscal Policies Implemented

In the year leading up to November 2024, the government has implemented a number of fiscal policies aimed at [insert objectives of fiscal policies, e.g., stimulating economic growth, controlling inflation, reducing budget deficits, etc.]. These policies include [insert examples of fiscal policies implemented, e.g., tax cuts, infrastructure spending, stimulus packages, etc.].

The impact of these policies on the economy is still unfolding, and the November CPI data will provide insights into their effectiveness.

Potential Fiscal Policy Adjustments

Given the current economic climate and the anticipated November CPI data, there is a possibility of fiscal policy adjustments in the coming months. The government may consider [insert potential fiscal policy adjustments, e.g., increasing taxes, reducing government spending, adjusting interest rates, etc.] in response to the inflation outlook and its impact on the economy.

These adjustments could have a significant impact on the November CPI and the broader economic outlook.

Get the entire information you require about November 2024 CPI and Student Loan Interest Rates: Potential Effects on this page.

Impact of Fiscal Policy Changes

Fiscal policy changes can have a direct impact on the CPI. For example, [insert examples of how fiscal policy changes can affect the CPI, e.g., tax cuts could lead to increased consumer spending and higher demand for goods and services, which could contribute to inflation, while increased government spending on infrastructure could lead to higher construction costs, which could also contribute to inflation].

Discover more by delving into CPI and Wage Inequality in November 2024: The Growing Gap further.

The impact of fiscal policy changes on the CPI is complex and depends on a variety of factors, including the nature of the policy change, the state of the economy, and consumer behavior.

Impact of CPI on Fiscal Policy Decisions

The November CPI data is likely to have a significant influence on future fiscal policy decisions. Policymakers will carefully analyze the data to assess the current inflation trajectory and its implications for the economy. This information will inform their decisions regarding future fiscal policy actions.

Fiscal Policy to Address Inflation Concerns

If the November CPI data reveals a higher-than-expected inflation rate, policymakers may consider implementing fiscal policies aimed at addressing inflation concerns. These policies could include [insert examples of fiscal policies to address inflation, e.g., increasing interest rates, reducing government spending, increasing taxes, etc.].

The goal of these policies would be to cool down the economy and reduce inflationary pressures.

Trade-offs Between Economic Growth and Inflation Control

Policymakers often face a trade-off between economic growth and inflation control. Fiscal policies aimed at stimulating economic growth can sometimes lead to higher inflation, while policies aimed at controlling inflation can sometimes dampen economic growth. The November CPI data will provide policymakers with valuable insights into this trade-off and help them to make informed decisions about future fiscal policy actions.

Hypothetical Scenario

Let’s consider a hypothetical scenario where the November CPI data shows a significant increase in inflation. In this scenario, policymakers might decide to [insert hypothetical fiscal policy response, e.g., increase interest rates, reduce government spending, etc.]. This response would aim to curb inflation by [insert explanation of how the hypothetical policy would curb inflation, e.g., making borrowing more expensive, reducing consumer spending, etc.].

Obtain recommendations related to November 2024 CPI and Business Loan Interest Rates: Implications for Businesses that can assist you today.

However, it is important to note that the actual fiscal policy response to the November CPI data will depend on a variety of factors, including the severity of inflation, the state of the economy, and political considerations.

Economic Outlook and Market Reactions

The November CPI data is likely to have a significant impact on the overall economic outlook and market reactions. Investors and analysts will closely watch the release to gauge the health of the economy and the potential for future policy changes.

Potential Market Reactions

The market reactions to the November CPI data will depend on the direction and magnitude of the inflation figures. If the data shows a higher-than-expected inflation rate, it could lead to [insert potential market reactions to higher inflation, e.g., a decline in stock prices, an increase in bond yields, a strengthening of the US dollar, etc.].

Conversely, if the data shows a lower-than-expected inflation rate, it could lead to [insert potential market reactions to lower inflation, e.g., an increase in stock prices, a decrease in bond yields, a weakening of the US dollar, etc.].

Expand your understanding about CPI and Personal Care Costs in November 2024 with the sources we offer.

Impact on Different Economic Sectors

The November CPI data will have different implications for different economic sectors. For example, [insert examples of how the CPI data could impact different economic sectors, e.g., a higher inflation rate could benefit energy companies, while a lower inflation rate could benefit consumer goods companies].

Understanding the potential impact of the CPI data on different sectors is crucial for investors and businesses alike.

Economic Implications Table

| Sector | Impact | Potential Actions | Timeline |

|---|---|---|---|

| Energy | Higher inflation could lead to increased demand for energy products, boosting prices and profits. | Energy companies may increase production and investment. | Short-term |

| Consumer Goods | Higher inflation could lead to decreased demand for consumer goods, impacting sales and profits. | Consumer goods companies may adjust pricing strategies and focus on cost-cutting measures. | Short-term to medium-term |

| Housing | Higher inflation could lead to increased housing costs, making homeownership more expensive. | Homeowners may consider refinancing their mortgages, while renters may face higher rent payments. | Medium-term |

| Financial Services | Higher inflation could lead to higher interest rates, impacting loan costs and investment returns. | Financial institutions may adjust lending rates and investment strategies. | Medium-term to long-term |

Factors Beyond CPI and Fiscal Policy

While the November CPI data and fiscal policy decisions are crucial factors influencing the economic landscape, it is important to consider other external factors that could also play a role. These factors can have a significant impact on the overall economic outlook, potentially affecting the November CPI and fiscal policy decisions.

Global Economic Events

Global economic events, such as [insert examples of global economic events, e.g., trade wars, global recessions, changes in interest rates, etc.], can have a ripple effect on the US economy. These events can impact consumer spending, inflation, and business investment, potentially influencing the November CPI and fiscal policy decisions.

Further details about Types of Inflation: Demand-Pull vs. Cost-Push in November 2024 is accessible to provide you additional insights.

Geopolitical Developments

Geopolitical developments, such as [insert examples of geopolitical developments, e.g., political instability, international conflicts, changes in government policies, etc.], can also have a significant impact on the US economy. These developments can disrupt supply chains, increase uncertainty, and affect consumer confidence, potentially influencing the November CPI and fiscal policy decisions.

External Factors Table

| External Factor | Potential Impact | Possible Mitigating Strategies |

|---|---|---|

| Global Trade Wars | Increased tariffs and trade barriers could lead to higher prices for imported goods, contributing to inflation. | Negotiating trade agreements, promoting free trade, and diversifying supply chains. |

| Global Recessions | A global recession could lead to decreased demand for US exports, impacting economic growth and employment. | Strengthening domestic demand, supporting businesses, and providing economic assistance to affected sectors. |

| Political Instability | Political instability in key trading partners could disrupt supply chains, increase uncertainty, and impact investment. | Promoting diplomacy, fostering international cooperation, and maintaining a stable political environment. |

Final Wrap-Up

The interplay between November 2024 CPI and fiscal policy holds profound implications for the economic landscape. Understanding the potential impact of the CPI data on fiscal policy decisions is crucial for investors, businesses, and consumers alike. The analysis presented here provides a framework for navigating this complex interplay, highlighting the key factors at play and the potential consequences for the economy.

In this topic, you find that CPI as a Measure of Inflation in November 2024 is very useful.

As the November CPI data release draws near, the economic community will be closely watching to see how this information shapes the course of fiscal policy and influences the overall economic outlook.

Discover more by delving into The Future of Work and CPI After November 2024 further.

FAQ Guide

What are the potential consequences of a higher-than-expected CPI reading?

A higher-than-expected CPI reading could prompt policymakers to tighten fiscal policy, potentially leading to slower economic growth. This could include measures like reducing government spending or increasing taxes.

Finish your research with information from CPI and Savings Account Interest Rates in November 2024.

How might the November CPI data impact the stock market?

A higher-than-expected CPI reading could lead to increased market volatility and potentially negative stock market performance as investors anticipate tighter monetary policy.

What are the key external factors that could influence the November CPI and fiscal policy?

Global economic events, geopolitical developments, and commodity price fluctuations are among the external factors that could influence the November CPI and fiscal policy. For example, a global recession could lead to lower demand for goods and services, potentially impacting the CPI.