November 2024 CPI and Energy Prices: Forecasting the Impact, this analysis explores the complex interplay between inflation, energy costs, and their potential consequences for consumers and businesses. The Consumer Price Index (CPI) is a vital indicator of inflation, measuring the average change in prices paid by urban consumers for a basket of goods and services.

Understanding the factors driving energy prices in November 2024, including global oil production, geopolitical events, and demand patterns, is crucial for forecasting their impact on the broader economy.

Investigate the pros of accepting Budgeting in an Inflationary Environment: Using the November 2024 CPI in your business strategies.

This exploration delves into the potential consequences of rising inflation on consumer spending and economic growth, examining how energy price fluctuations affect businesses and industries. We will also analyze the potential implications for monetary policy and interest rates, highlighting the intricate relationship between inflation, energy costs, and economic stability.

Expand your understanding about CPI and Globalization in November 2024: Impact on Wages with the sources we offer.

Understanding the Consumer Price Index (CPI)

The Consumer Price Index (CPI) is a crucial economic indicator that measures the average change in prices paid by urban consumers for a basket of consumer goods and services. It serves as a primary gauge of inflation, providing insights into the purchasing power of consumers and the overall health of the economy.

Significance of the CPI

The CPI holds immense significance as a measure of inflation. It allows economists, policymakers, and businesses to:

- Track the rate of inflation and deflation.

- Monitor the effectiveness of monetary and fiscal policies.

- Adjust wages, pensions, and other payments for inflation.

- Analyze the impact of inflation on consumer spending and economic growth.

Components of the CPI

The CPI comprises various components representing different categories of consumer spending, each weighted according to its relative importance in the overall consumer basket. Key components include:

- Food and Beverages:This category includes groceries, restaurant meals, and alcoholic beverages.

- Housing:This category encompasses rent, homeownership costs, utilities, and household furnishings.

- Apparel:This category covers clothing, footwear, and accessories.

- Transportation:This category includes new and used vehicles, gasoline, public transportation, and vehicle maintenance.

- Medical Care:This category covers healthcare services, prescription drugs, and medical supplies.

- Recreation:This category encompasses entertainment, hobbies, and travel.

- Education and Communication:This category covers tuition fees, textbooks, internet services, and communication devices.

- Other Goods and Services:This category includes a wide range of goods and services not classified elsewhere, such as personal care products, financial services, and insurance.

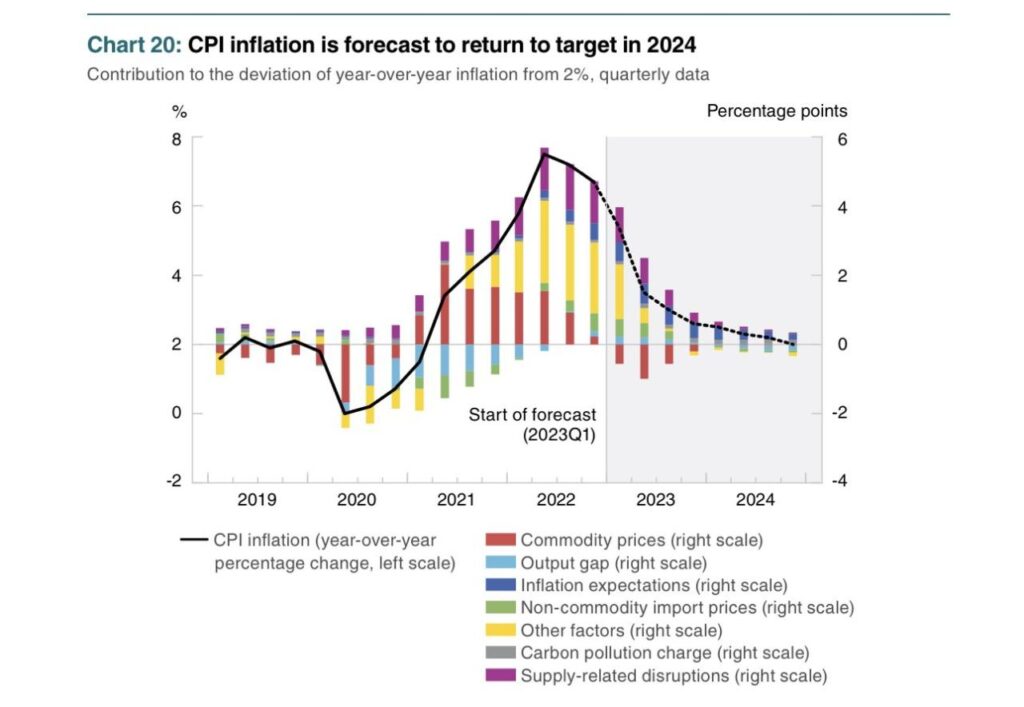

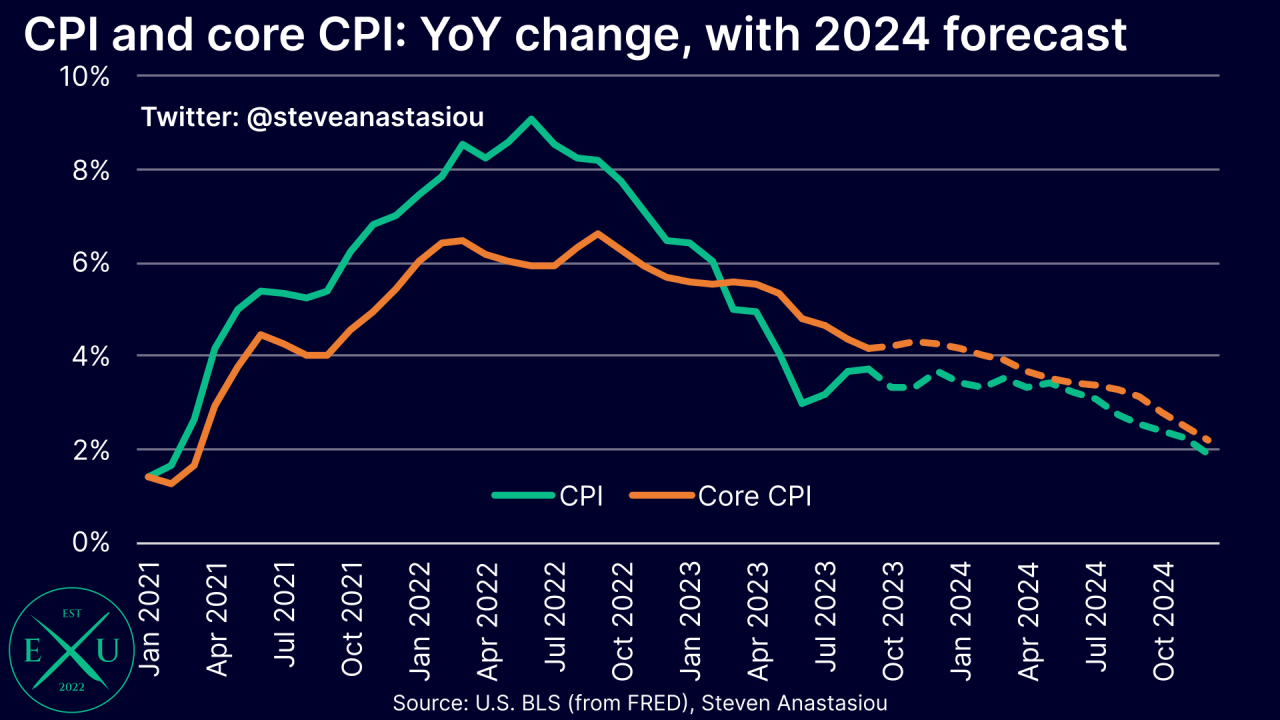

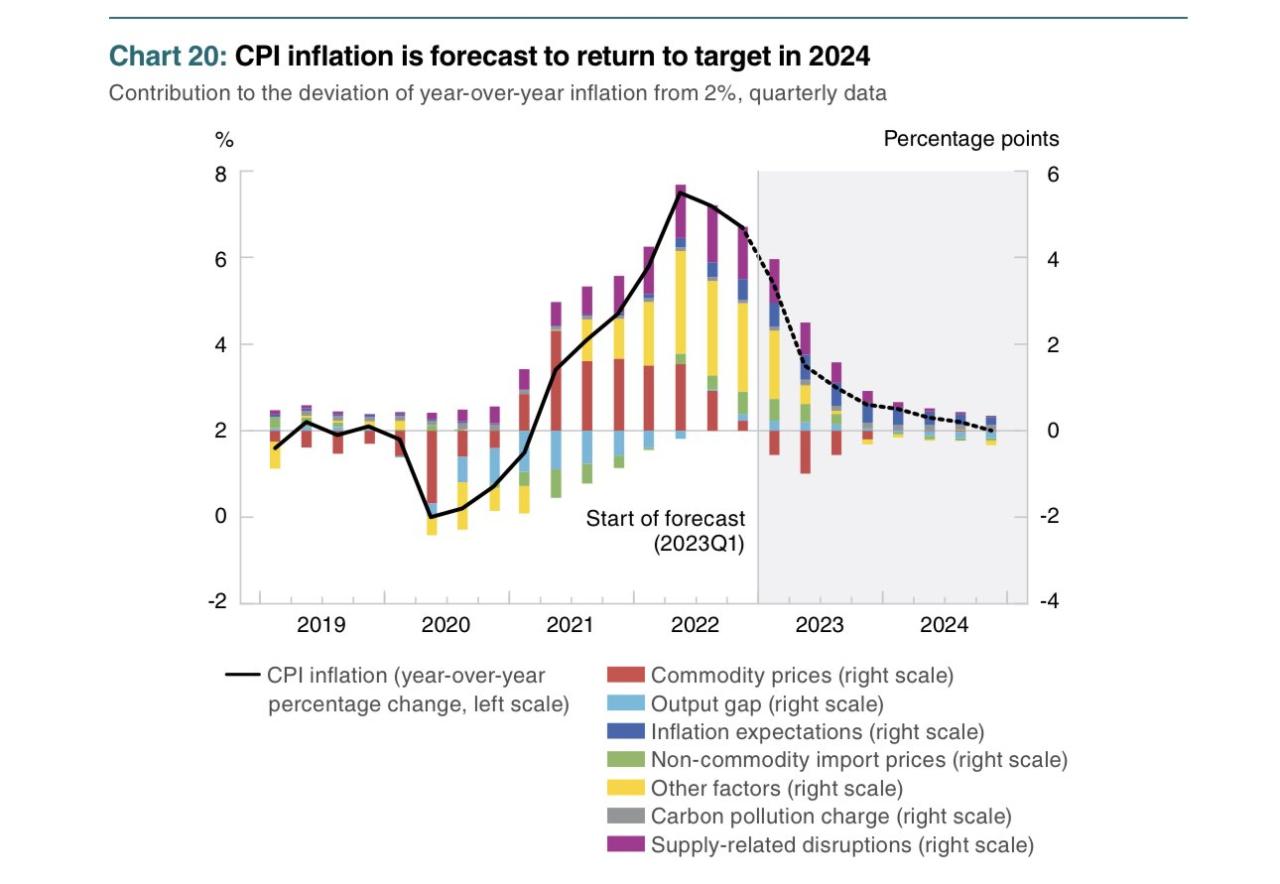

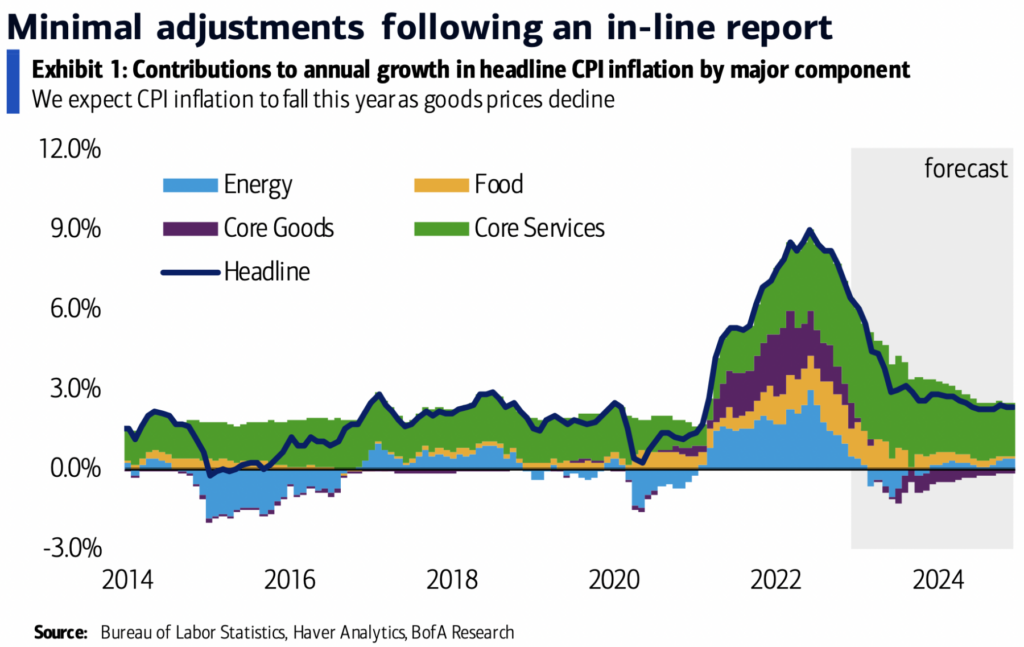

Historical Trends in the CPI

The CPI has exhibited significant fluctuations over time, reflecting periods of inflation and deflation. Notably, the United States experienced high inflation during the 1970s and early 1980s, reaching double-digit rates. However, inflation has generally been more moderate in recent decades, with periods of both price increases and decreases.

When investigating detailed guidance, check out CPI and Consumer Confidence in November 2024 now.

Historical analysis of the CPI provides valuable insights into the cyclical nature of inflation and its impact on the economy.

Understand how the union of CPI and PCE: Implications for Policymakers in November 2024 can improve efficiency and productivity.

Analyzing Energy Prices in November 2024

Energy prices are a critical component of the CPI, significantly impacting consumer spending and economic activity. Understanding the factors driving energy price fluctuations in November 2024 is crucial for forecasting their impact on the economy.

Further details about CPI and Housing Costs: Historical Trends Leading to November 2024 is accessible to provide you additional insights.

Key Factors Influencing Energy Prices

Several factors influence energy prices, including:

- Global Oil Production:Oil production levels, influenced by factors like OPEC policies, geopolitical instability, and technological advancements, directly impact crude oil prices, which in turn affect gasoline prices.

- Geopolitical Events:Conflicts, sanctions, and political instability in oil-producing regions can disrupt supply chains and lead to price spikes.

- Demand Patterns:Global economic growth, seasonal variations, and consumer behavior influence energy demand, impacting prices.

- Technological Advancements:Developments in renewable energy technologies and energy efficiency can influence the demand for traditional fossil fuels and impact prices.

Breakdown of Energy Price Components

Energy prices comprise various components, each with its own dynamics:

- Gasoline:Gasoline prices are highly sensitive to global oil prices, refining costs, and taxes. They directly impact consumer transportation costs and overall inflation.

- Natural Gas:Natural gas prices are influenced by supply and demand dynamics, weather conditions, and competition from other energy sources like oil and renewable energy.

- Electricity:Electricity prices are determined by factors like fuel costs (coal, natural gas, nuclear), transmission and distribution costs, and government regulations.

Comparison with Previous Periods

To assess the significance of energy prices in November 2024, it’s essential to compare them with previous periods. This analysis can reveal trends, such as whether prices are rising or falling, and whether the changes are significant or minor. By examining historical data, we can gain a better understanding of the current energy price environment and its potential impact on the economy.

Forecasting the Impact of CPI and Energy Prices on the Economy

The interplay of inflation and energy prices can have significant implications for the economy. Rising inflation erodes consumer purchasing power, potentially dampening economic growth, while energy price fluctuations affect businesses and industries, influencing their production costs and profitability.

Impact of Rising Inflation on Consumer Spending and Economic Growth

When inflation rises, consumers experience a decline in their purchasing power. As prices for goods and services increase, consumers have less disposable income to spend on other items, leading to a potential decrease in consumer spending. Reduced consumer spending can slow economic growth, as businesses experience lower demand for their products and services.

Impact of Energy Price Fluctuations on Businesses and Industries

Energy price fluctuations can have a significant impact on businesses and industries, particularly those with high energy consumption, such as manufacturing, transportation, and agriculture. Rising energy prices increase production costs, potentially leading to price increases for consumers, reduced profit margins, or even business closures.

Implications for Monetary Policy and Interest Rates

Central banks closely monitor inflation and energy prices, as these factors influence monetary policy decisions. When inflation rises, central banks may raise interest rates to curb spending and slow economic growth. Conversely, if inflation is low and energy prices are stable, central banks may lower interest rates to stimulate economic activity.

Strategies for Managing Inflation and Energy Price Volatility

Businesses and governments can implement strategies to mitigate the impact of inflation and energy price volatility. These strategies aim to protect profits, maintain competitiveness, and support economic stability.

Strategies for Businesses

| Strategy | Benefits | Potential Drawbacks |

|---|---|---|

| Cost Reduction | Reduced operating expenses, improved profit margins. | Potential impact on product quality or customer service. |

| Price Increases | Maintained profit margins, offsetting rising costs. | Potential loss of customers due to higher prices. |

| Energy Efficiency | Reduced energy consumption, lower energy costs. | Initial investment costs for efficiency upgrades. |

| Diversification | Reduced reliance on specific energy sources, mitigating price volatility. | Increased complexity in managing multiple energy sources. |

| Hedging | Locking in energy prices, protecting against price fluctuations. | Potential for losses if energy prices fall below the hedged price. |

Government Policies

Governments can play a significant role in managing inflation and energy price volatility through various policies, including:

- Monetary Policy:Central banks can adjust interest rates to control inflation and stabilize the economy.

- Fiscal Policy:Governments can use taxes, subsidies, and spending programs to influence inflation and energy prices.

- Regulation:Governments can regulate energy markets to promote competition and prevent price manipulation.

- Investment in Renewable Energy:Governments can incentivize investments in renewable energy sources to reduce reliance on fossil fuels and promote energy independence.

Examples of Successful Strategies

Businesses and governments have successfully implemented strategies to address inflation and energy price volatility in the past. For example, during the energy crisis of the 1970s, many businesses invested in energy efficiency measures, while governments implemented fuel-efficient standards for vehicles and provided tax credits for renewable energy projects.

These efforts helped to mitigate the impact of high energy prices and promote a transition to more sustainable energy sources.

Potential Implications for Consumers and Businesses

High inflation and volatile energy prices can significantly impact consumers and businesses. Consumers may experience a decline in purchasing power, while businesses may face challenges in managing costs and maintaining profitability.

Do not overlook explore the latest data about CPI and the November 2024 Election.

Impact on Consumer Purchasing Power and Affordability

High inflation erodes consumer purchasing power, making it more difficult for consumers to afford essential goods and services. This can lead to reduced consumer spending, potentially slowing economic growth.

Adjusting Pricing Strategies for Businesses

Businesses may need to adjust their pricing strategies to cope with rising costs. This could involve increasing prices to maintain profit margins or finding ways to reduce costs through operational efficiencies.

Check what professionals state about Using CPI and PCE for Economic Analysis in November 2024 and its benefits for the industry.

Opportunities for Businesses in an Inflationary Environment, November 2024 CPI and Energy Prices: Forecasting the Impact

While inflation presents challenges, it can also create opportunities for businesses. For example, businesses that offer essential goods and services may see increased demand as consumers seek to maintain their standard of living. Additionally, businesses that can innovate and offer cost-effective solutions to inflation-related challenges may gain a competitive advantage.

Last Word: November 2024 CPI And Energy Prices: Forecasting The Impact

Navigating the complex landscape of November 2024 CPI and energy prices requires a comprehensive understanding of the interconnected forces at play. By analyzing historical trends, identifying key factors influencing energy prices, and forecasting the potential impact on the economy, we can gain valuable insights into the challenges and opportunities that lie ahead.

This analysis serves as a guide for consumers and businesses alike, equipping them with the knowledge and strategies needed to navigate the complexities of an evolving economic landscape.

Do not overlook explore the latest data about CPI and Remote Work in November 2024: Impact on Wages.

Questions and Answers

What are the key factors driving energy prices in November 2024?

Do not overlook explore the latest data about The Coverage and Scope of CPI and PCE in November 2024.

Key factors driving energy prices in November 2024 include global oil production, geopolitical events, and demand patterns. Global oil production levels, influenced by factors like OPEC policies and technological advancements, play a significant role. Geopolitical events, such as conflicts or sanctions, can disrupt supply chains and impact prices.

Additionally, demand patterns, driven by economic growth, population trends, and seasonal variations, influence energy prices.

How do energy price fluctuations affect businesses and industries?

Further details about CPI and Gold Prices: A Historical Connection Leading to November 2024 is accessible to provide you additional insights.

Energy price fluctuations significantly impact businesses and industries. Rising energy costs can increase production expenses, leading to higher prices for consumers or reduced profit margins. Industries heavily reliant on energy, such as transportation, manufacturing, and agriculture, are particularly vulnerable.

However, businesses can also benefit from lower energy prices, leading to increased profitability and competitiveness.