November 2024 CPI: A Turning Point for Interest Rates? This question hangs heavy in the air as we approach the release of the November 2024 Consumer Price Index (CPI) report. The CPI, a crucial economic indicator, reflects the change in prices for a basket of consumer goods and services, providing valuable insights into inflation trends.

Its impact on interest rate adjustments, a key lever for the Federal Reserve in managing the economy, makes this report a highly anticipated event for investors, policymakers, and businesses alike.

You also can investigate more thoroughly about CPI and Savings Account Interest Rates in November 2024 to enhance your awareness in the field of CPI and Savings Account Interest Rates in November 2024.

The upcoming CPI report holds particular significance as it follows a period of significant economic volatility. The Federal Reserve has been navigating a complex landscape, balancing the need to control inflation with the desire to stimulate economic growth. The November 2024 CPI data will offer a crucial snapshot of the current inflationary environment and provide valuable clues about the future trajectory of interest rates.

This analysis will delve into the relationship between the CPI and interest rates, explore the potential scenarios for the November 2024 report, and discuss its broader implications for the economy.

Finish your research with information from CPI and the Treatment of New Products in November 2024.

Understanding the CPI and its Impact on Interest Rates: November 2024 CPI: A Turning Point For Interest Rates?

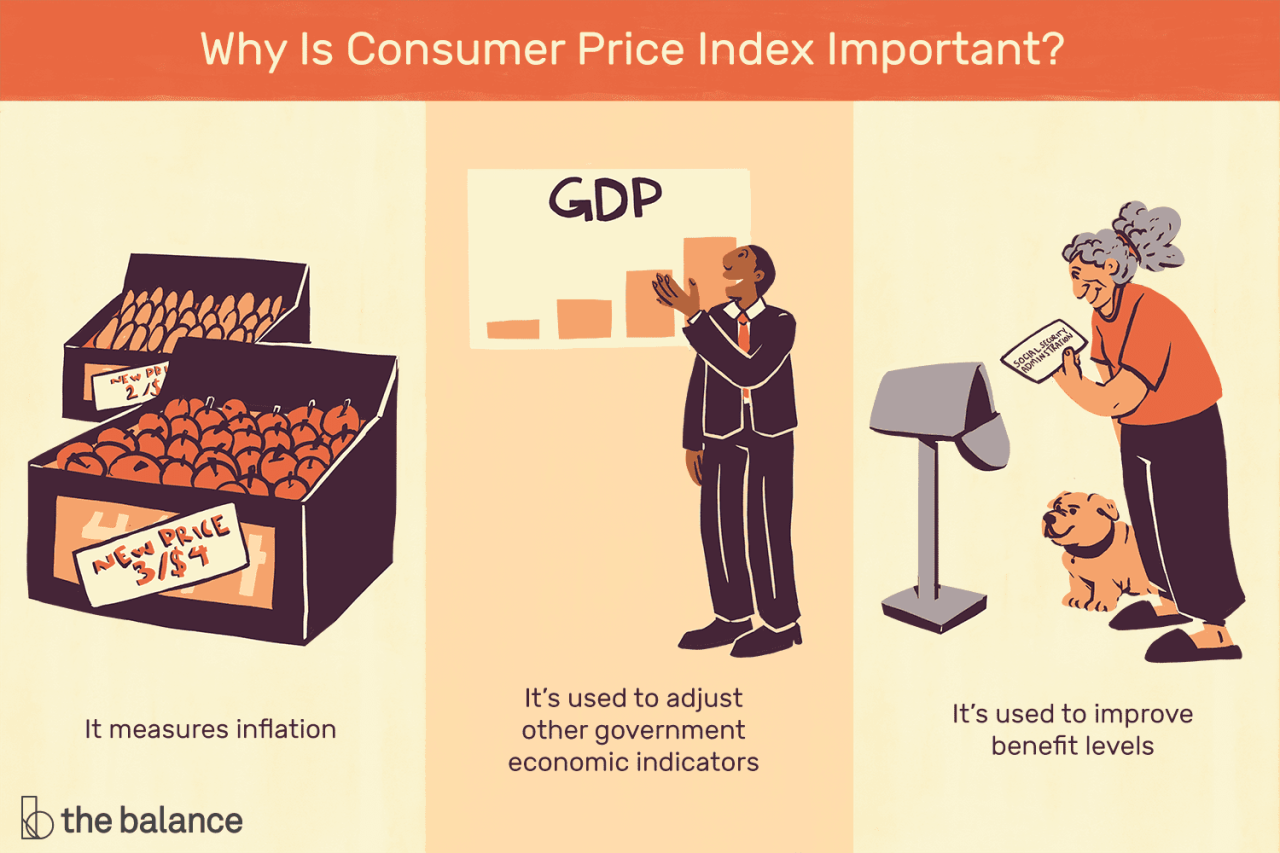

The Consumer Price Index (CPI) is a crucial economic indicator that measures the average change in prices paid by urban consumers for a basket of consumer goods and services. The CPI is closely watched by the Federal Reserve (Fed), as it provides valuable insights into the rate of inflation in the US economy.

For descriptions on additional topics like CPI and PCE: Frequently Asked Questions about November 2024 Data, please visit the available CPI and PCE: Frequently Asked Questions about November 2024 Data.

The relationship between the CPI and interest rates is deeply intertwined, as the Fed uses the CPI data to guide its monetary policy decisions.

The Relationship Between CPI and Interest Rates

The Fed’s primary objective is to maintain price stability and full employment. When inflation rises, the Fed typically raises interest rates to cool down the economy and curb price increases. Conversely, when inflation falls or is below the target rate, the Fed may lower interest rates to stimulate economic growth.

This inverse relationship between inflation and interest rates is known as the “Phillips Curve.”

Inflation Expectations and Monetary Policy

The Fed’s monetary policy decisions are heavily influenced by inflation expectations. When the CPI data suggests that inflation is likely to rise or remain elevated, the Fed may become more hawkish and increase interest rates to prevent inflation from spiraling out of control.

Conversely, if the CPI data indicates that inflation is under control or falling, the Fed may adopt a more dovish stance and keep interest rates stable or even lower them to encourage economic activity.

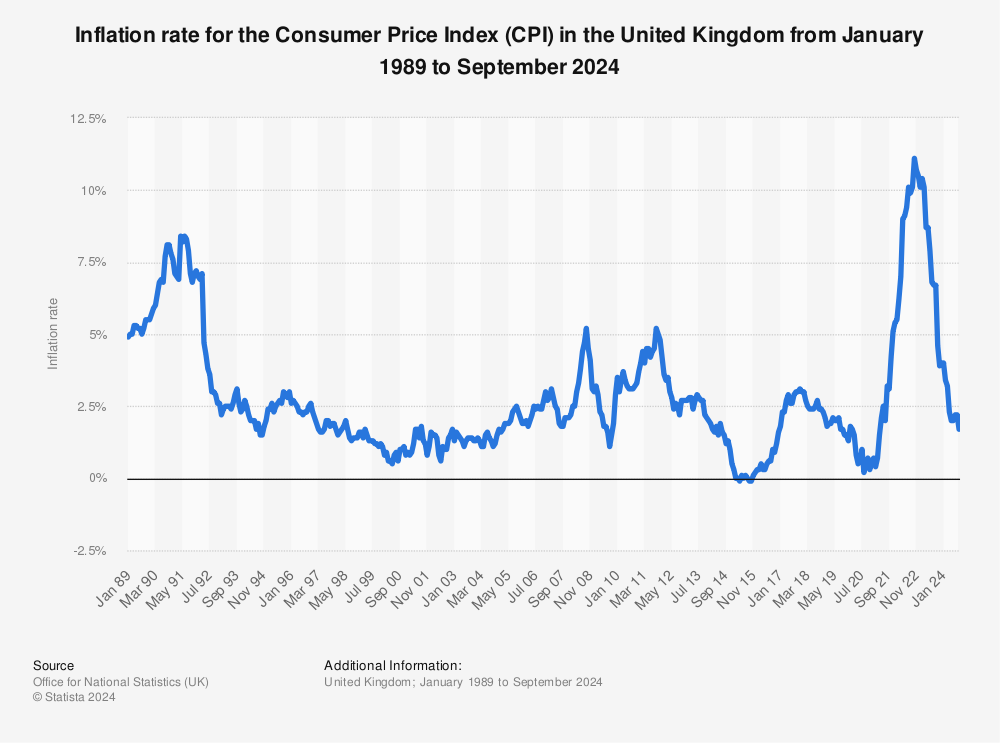

Historical Examples of CPI’s Impact on Interest Rates, November 2024 CPI: A Turning Point for Interest Rates?

Throughout history, the CPI has played a significant role in shaping interest rate movements. For instance, during the 1970s, the US experienced a period of high inflation, known as “stagflation,” which prompted the Fed to raise interest rates aggressively. This resulted in a recession, but ultimately helped to curb inflation.

Conversely, in the aftermath of the 2008 financial crisis, the Fed lowered interest rates to near zero to stimulate the economy. As inflation remained low in the following years, the Fed gradually raised interest rates back to more normal levels.

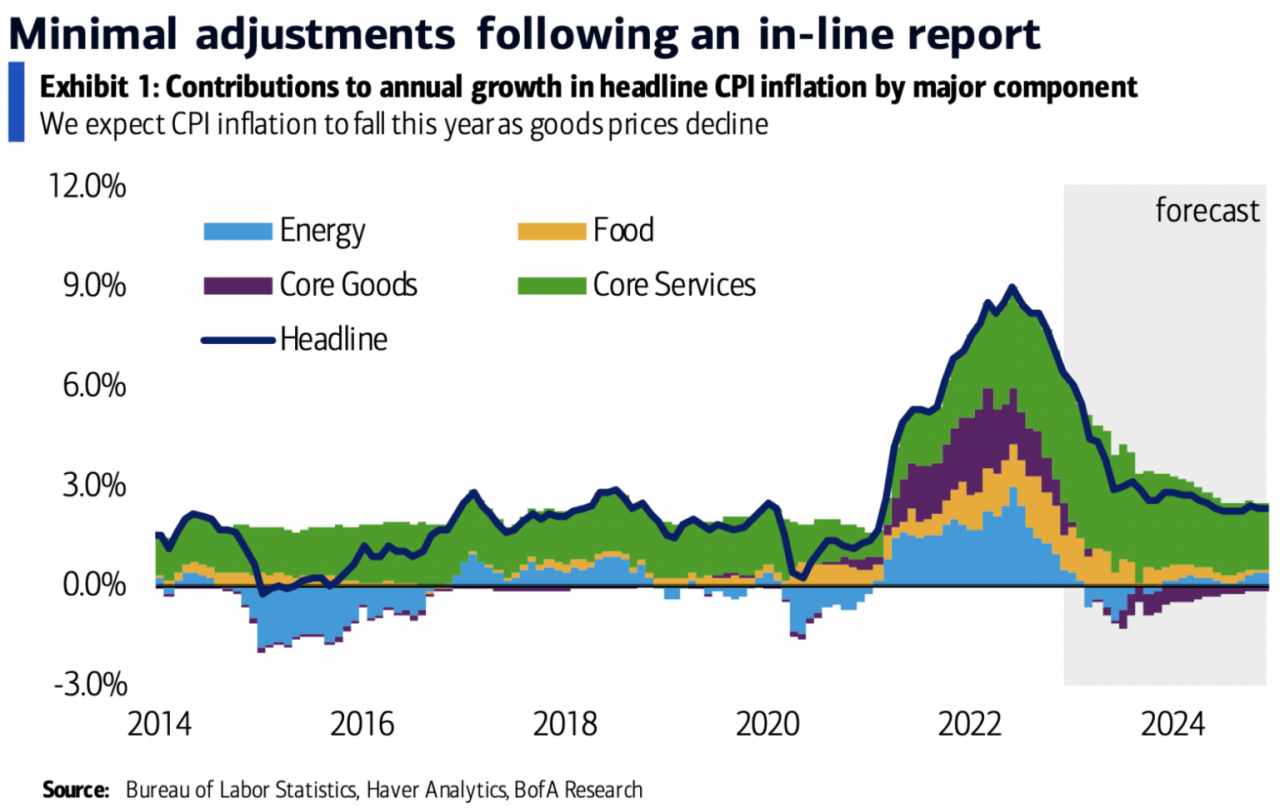

Analyzing the November 2024 CPI Report

The November 2024 CPI report is expected to be released on [insert anticipated release date]. The report will provide crucial insights into the current state of inflation in the US economy and will be closely scrutinized by investors, economists, and policymakers alike.

Key data points to watch for in the report include the headline CPI, which measures the overall change in prices, and the core CPI, which excludes volatile food and energy prices.

You also will receive the benefits of visiting CPI and Social Inequality in November 2024 today.

Potential Scenarios for the November 2024 CPI Report

The November 2024 CPI report could have various implications for interest rates, depending on the outcome of the data. The following table Artikels potential scenarios:

| Scenario | Headline CPI | Core CPI | Impact on Interest Rates |

|---|---|---|---|

| Scenario 1: Inflation Remains Elevated | [Insert potential headline CPI percentage] | [Insert potential core CPI percentage] | The Fed is likely to maintain its hawkish stance and continue raising interest rates to combat inflation. |

| Scenario 2: Inflation Shows Signs of Cooling | [Insert potential headline CPI percentage] | [Insert potential core CPI percentage] | The Fed may pause its rate hikes or even consider lowering interest rates if inflation shows a clear downward trend. |

| Scenario 3: Inflation Unexpectedly Surges | [Insert potential headline CPI percentage] | [Insert potential core CPI percentage] | The Fed is likely to react aggressively and raise interest rates significantly to control inflation. |

| Scenario 4: Inflation Remains Stable | [Insert potential headline CPI percentage] | [Insert potential core CPI percentage] | The Fed may maintain its current course and hold interest rates steady, depending on other economic indicators. |

Implications of Different CPI Outcomes on Interest Rates

If the November 2024 CPI report shows that inflation is still running hot, the Fed is likely to continue raising interest rates to cool down the economy. This could lead to higher borrowing costs for businesses and consumers, potentially slowing down economic growth.

However, if the CPI report indicates that inflation is moderating, the Fed may be more inclined to pause or even lower interest rates to support economic activity.

Factors Influencing Interest Rate Decisions Beyond the CPI

While the CPI is a crucial indicator, the Fed considers a range of other economic data points when making interest rate decisions. These include employment data, GDP growth, and global economic conditions.

Other Economic Indicators Considered by the Fed

- Employment Data:The Fed closely monitors employment indicators such as the unemployment rate, nonfarm payrolls, and labor force participation rate. Strong employment growth suggests a healthy economy and could support higher interest rates. Conversely, weak employment data could signal a weakening economy, prompting the Fed to consider lowering interest rates.

Obtain recommendations related to November 2024 CPI and Credit Card Interest Rates: What Consumers Need to Know that can assist you today.

- GDP Growth:The Fed monitors GDP growth to gauge the overall health of the economy. Strong GDP growth indicates a robust economy and could support higher interest rates. Conversely, weak GDP growth could suggest a slowing economy, prompting the Fed to consider lowering interest rates.

Further details about Inflation and Asset Prices in November 2024 is accessible to provide you additional insights.

- Global Economic Conditions:The Fed also considers global economic conditions, including international trade, exchange rates, and the performance of major economies. These factors can influence the US economy and may affect the Fed’s interest rate decisions.

Relative Weight of Indicators in the Fed’s Decision-Making Process

The relative weight assigned to each indicator in the Fed’s decision-making process can vary depending on the prevailing economic conditions. However, the CPI is generally considered a key indicator, particularly when it comes to assessing inflation pressures.

Expand your understanding about CPI and Food Prices: A Look Back Leading to November 2024 with the sources we offer.

Potential Market Reactions to the November 2024 CPI Report

The November 2024 CPI report is likely to have a significant impact on financial markets, particularly on stock markets, bond yields, and the value of the US dollar.

Impact on Financial Markets

- Stock Markets:A lower-than-expected CPI report could boost stock markets, as it may signal a less aggressive stance from the Fed on interest rate hikes. Conversely, a higher-than-expected CPI report could lead to a decline in stock markets, as investors may become concerned about higher inflation and tighter monetary policy.

Get the entire information you require about The Yield Curve and the November 2024 CPI: Analyzing the Relationship on this page.

- Bond Yields:Bond yields tend to move inversely to interest rates. A lower-than-expected CPI report could lead to a decline in bond yields, as investors may anticipate lower interest rates in the future. Conversely, a higher-than-expected CPI report could push bond yields higher, as investors demand a higher return to compensate for rising inflation.

- US Dollar Value:The US dollar tends to strengthen when interest rates rise, as investors are attracted to higher returns. A higher-than-expected CPI report could lead to a stronger US dollar, as investors anticipate higher interest rates in the future. Conversely, a lower-than-expected CPI report could weaken the US dollar, as investors may anticipate lower interest rates and reduced returns.

Market Reactions Based on CPI Outcomes

The following table illustrates potential market reactions based on various CPI outcomes:

| CPI Outcome | Stock Market Reaction | Bond Yield Reaction | US Dollar Value |

|---|---|---|---|

| Lower-than-expected CPI | Potential increase | Potential decrease | Potential decrease |

| Higher-than-expected CPI | Potential decrease | Potential increase | Potential increase |

| CPI in line with expectations | Potential mixed reaction | Potential mixed reaction | Potential mixed reaction |

Long-Term Implications for the Economy

The November 2024 CPI report will have significant long-term implications for the US economy, particularly for economic growth and inflation.

Implications for Economic Growth and Inflation

- Consumer Spending:Higher interest rates can lead to higher borrowing costs for consumers, potentially reducing their discretionary spending. This could dampen economic growth, as consumer spending accounts for a significant portion of the US economy.

- Business Investment:Higher interest rates can also discourage businesses from investing in new projects and expanding operations. This could further slow down economic growth, as business investment is another crucial driver of economic activity.

- Housing Market:Higher interest rates can make mortgages more expensive, potentially cooling down the housing market. This could affect home prices, construction activity, and overall economic growth.

Economic Outlook Based on the Anticipated CPI Report

The anticipated CPI report will provide valuable insights into the trajectory of inflation and the Fed’s future course of action. If the report indicates that inflation is still elevated, the Fed is likely to continue raising interest rates, which could lead to a slowdown in economic growth.

Do not overlook the opportunity to discover more about the subject of CPI and Housing Affordability in November 2024.

However, if the report shows signs of moderating inflation, the Fed may become more accommodative, potentially supporting economic activity.

Conclusion

The November 2024 CPI report will be a pivotal moment in shaping the economic landscape. Its impact on interest rates, financial markets, and the broader economy will be felt for months to come. While the report itself is just one data point in a complex economic puzzle, it offers valuable insights into the current state of inflation and the potential path forward.

Understanding the implications of the CPI report is essential for navigating the ever-evolving economic environment.

Commonly Asked Questions

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. It is a key economic indicator that tracks inflation.

How does the CPI affect interest rates?

The CPI is a primary factor influencing the Federal Reserve’s decisions on interest rate adjustments. High inflation, as reflected in a rising CPI, typically leads to interest rate hikes to curb spending and cool down the economy. Conversely, low inflation or deflation may prompt interest rate cuts to stimulate economic growth.

What are the potential market reactions to the November 2024 CPI report?

You also can investigate more thoroughly about Which is a Better Measure of Inflation in November 2024: CPI or PCE? to enhance your awareness in the field of Which is a Better Measure of Inflation in November 2024: CPI or PCE?.

The market reaction to the November 2024 CPI report will depend on the actual data released. A higher-than-expected CPI could lead to increased volatility in the stock market, higher bond yields, and a stronger US dollar. Conversely, a lower-than-expected CPI could result in a more positive market response.