NIIT vs. Capital Gains Tax: Key Differences and Similarities – Navigating the complex world of finance often involves understanding the nuances of taxes. Two key concepts that frequently arise in this context are NIIT (National Institute of Information Technology) and capital gains tax.

While both play a significant role in shaping financial decisions, their distinct purposes and applications can be confusing. This exploration delves into the key differences and similarities between NIIT and capital gains tax, providing a comprehensive understanding of their impact on individuals and businesses.

The DealBook Summit 2024 showcased inspiring case studies in corporate social responsibility. These examples demonstrate how businesses can integrate ethical and sustainable practices into their operations, fostering positive social impact and long-term value creation.

NIIT, a leading global provider of education and skill development, focuses on empowering individuals with the necessary skills to thrive in the digital age. In contrast, capital gains tax is a levy imposed on profits realized from the sale of assets, including stocks, bonds, and real estate.

Navigating the complex world of investment income? Understanding the strategies for minimizing NIIT is crucial for maximizing your returns. From careful planning to strategic investments, there are numerous ways to mitigate this tax liability.

Understanding the intricacies of these two concepts is crucial for informed financial planning, particularly when it comes to investments and tax liabilities.

Understanding NIIT (National Institute of Information Technology)

NIIT (National Institute of Information Technology) is a global leader in skills and talent development. It plays a pivotal role in bridging the gap between education and industry demands, equipping individuals with the necessary skills for a successful career in the ever-evolving technology landscape.

History and Evolution of NIIT

Established in 1981, NIIT has a rich history spanning over four decades. It began as a small training center in New Delhi, India, focusing on computer programming and software development. Over the years, NIIT has expanded its reach and scope, becoming a global education powerhouse with a presence in over 40 countries.

Its evolution has been marked by continuous innovation, adapting to the changing technological landscape and emerging industry trends.

Courses and Programs Offered by NIIT

NIIT offers a wide range of courses and programs across various domains, catering to diverse learning needs and career aspirations. Its curriculum is designed to provide students with practical skills and industry-relevant knowledge. Here are some key domains covered by NIIT:

- IT Essentials:Covers fundamental IT skills, including hardware, software, networking, and cybersecurity. These courses are ideal for individuals seeking entry-level IT roles or those looking to enhance their basic IT knowledge.

- Software Development:Offers programs in various programming languages, including Java, Python, C++, and .NET. These courses are designed for aspiring software developers, programmers, and web developers.

- Digital Marketing:Provides training in digital marketing strategies, social media marketing, , and online advertising. These courses are beneficial for individuals seeking careers in digital marketing or those looking to enhance their online marketing skills.

- Data Science and Analytics:Offers programs in data analysis, machine learning, and artificial intelligence. These courses are relevant for individuals interested in data-driven decision-making and careers in data science or analytics.

- Cloud Computing:Provides training in cloud computing technologies, including AWS, Azure, and Google Cloud. These courses are valuable for individuals seeking careers in cloud infrastructure management or cloud development.

Capital Gains Tax: A Primer

Capital gains tax is a levy imposed on the profit realized from the sale or disposal of an asset held for investment purposes. This tax plays a crucial role in the financial landscape by ensuring fairness and contributing to government revenue.

Types of Capital Gains and Taxation

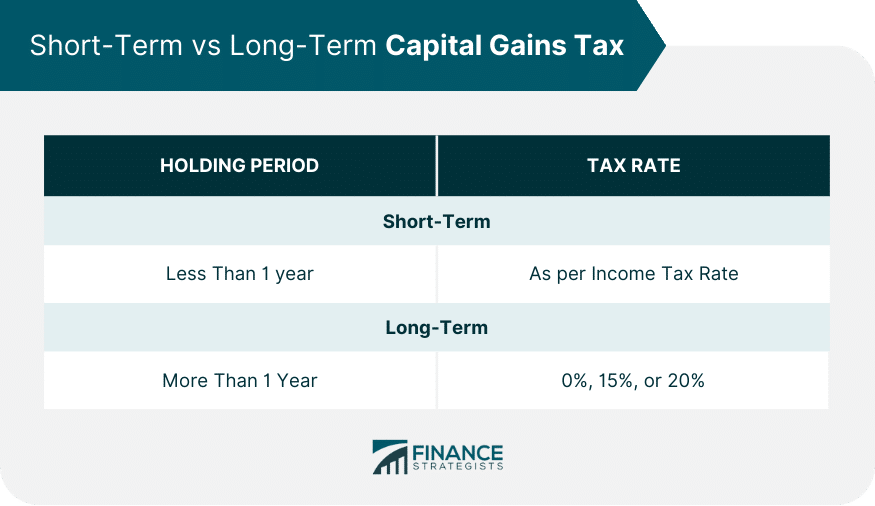

Capital gains can be classified into two main types:

- Short-term capital gains:These arise from the sale of assets held for less than a specified period (usually one year). Short-term capital gains are typically taxed at the ordinary income tax rate.

- Long-term capital gains:These arise from the sale of assets held for a period longer than the specified holding period. Long-term capital gains are often taxed at a lower rate than ordinary income.

The specific tax rates and holding periods for capital gains vary depending on the jurisdiction and the type of asset involved.

Tax Implications of Investments

Capital gains tax applies to various types of investments, including:

- Stocks:Profit realized from selling stocks is subject to capital gains tax. The holding period determines whether the gain is short-term or long-term.

- Bonds:Interest earned from bonds is generally taxed as ordinary income. However, capital gains from selling bonds are subject to capital gains tax, depending on the holding period.

- Real Estate:Profit realized from selling a property is subject to capital gains tax. The tax implications can vary depending on factors such as the holding period, the use of the property, and the nature of the sale.

NIIT and Capital Gains Tax: Key Differences

NIIT and capital gains tax are distinct concepts with different purposes and applications. Understanding these differences is crucial for individuals and businesses to navigate the tax landscape effectively.

Nature and Purpose

- NIIT:NIIT focuses on skills development and education, aiming to bridge the gap between education and industry requirements. It empowers individuals with the necessary knowledge and skills to succeed in the technology-driven workforce.

- Capital Gains Tax:Capital gains tax is a revenue-generating mechanism that aims to ensure fairness in the taxation of investment profits. It is levied on the profit realized from the sale or disposal of assets held for investment purposes.

Applicability and Scenarios

- NIIT:NIIT is applicable to individuals and businesses seeking to enhance their skills and knowledge in various technology domains. It is relevant for those pursuing careers in IT, software development, digital marketing, data science, cloud computing, and other related fields.

Curious about how the NIIT is calculated? Dive into the tax rates, deductions, and credits that influence your final NIIT liability. Understanding these factors can help you optimize your tax strategy and minimize your tax burden.

- Capital Gains Tax:Capital gains tax is applicable to individuals and businesses that invest in assets such as stocks, bonds, real estate, and other investments. It applies when these assets are sold or disposed of at a profit.

Overlap and Potential Conflicts

While NIIT and capital gains tax have distinct purposes, there can be instances where they overlap or potentially conflict. For example, an individual pursuing a course in financial technology at NIIT might invest in stocks or other financial instruments as part of their learning process.

In such scenarios, any profit realized from these investments would be subject to capital gains tax, even though the individual is also engaged in skill development through NIIT.

The future of business is sustainable. Explore the latest trends and predictions shaping the landscape of responsible business practices. From environmental consciousness to social impact, sustainability is no longer just a trend but a necessity for long-term success.

NIIT and Capital Gains Tax: Key Similarities

Despite their differences, NIIT and capital gains tax share some common ground, particularly in their contribution to the overall economic well-being of a nation.

The DealBook Summit 2024 highlighted the critical role of stakeholder engagement in today’s business world. From investors to employees and communities, understanding and responding to stakeholder concerns is essential for building trust and achieving sustainable growth.

Shared Objectives

- Economic Growth and Development:Both NIIT and capital gains tax play a role in fostering economic growth and development. NIIT contributes by equipping individuals with the skills and knowledge necessary to participate in the workforce, while capital gains tax generates revenue for government initiatives that support economic development.

Confused about the Net Investment Income Tax (NIIT) ? This tax applies to certain investment income, and understanding its definition, purpose, and scope is crucial for investors and taxpayers alike.

- Fairness and Equity:Both mechanisms aim to promote fairness and equity in the economy. NIIT provides equal opportunities for individuals to acquire skills and knowledge, regardless of their background, while capital gains tax ensures that investors contribute their fair share of taxes on investment profits.

Impact on Individuals and Businesses

- Individuals:NIIT empowers individuals with skills and knowledge, enabling them to pursue rewarding careers and contribute to economic growth. Capital gains tax affects individuals’ investment decisions, influencing their investment strategies and tax liabilities.

- Businesses:NIIT helps businesses access a skilled workforce, enhancing their productivity and competitiveness. Capital gains tax impacts businesses’ investment decisions and overall tax liabilities, potentially influencing their growth and profitability.

Practical Implications of NIIT and Capital Gains Tax

The practical implications of NIIT and capital gains tax are significant for individuals and businesses alike. Understanding these implications can help individuals make informed financial decisions and businesses optimize their tax strategies.

Impact on Financial Decisions

- Investment Strategies:Individuals considering investments need to factor in the potential capital gains tax implications. The tax rate and holding period can influence investment choices, potentially leading individuals to favor investments with lower tax burdens or longer holding periods.

- Skill Development and Career Choices:Individuals pursuing careers in technology or related fields might consider enrolling in NIIT programs to enhance their skills and increase their earning potential. The knowledge and skills acquired through NIIT can improve their job prospects and career advancement opportunities.

Tax Management Strategies

- Capital Gains Tax Planning:Individuals and businesses can employ various strategies to manage their capital gains tax liabilities. These strategies might include holding assets for longer periods to qualify for lower tax rates, utilizing tax-loss harvesting to offset gains, or structuring investments to minimize tax exposure.

- NIIT Course Selection and Planning:Individuals and businesses can strategically choose NIIT courses that align with their career aspirations and industry demands. Careful planning can ensure that the skills acquired through NIIT are relevant to the job market and enhance their employability.

Challenges and Opportunities

- Tax Compliance:Both NIIT and capital gains tax involve tax compliance requirements. Individuals and businesses need to stay informed about tax laws and regulations, file necessary returns, and comply with reporting obligations.

- Technological Advancements:Technological advancements are constantly changing the landscape of both education and finance. NIIT needs to adapt its curriculum and training programs to keep pace with emerging technologies, while capital gains tax laws need to evolve to address new investment vehicles and digital assets.

Knowing what income is included in the NIIT calculation is crucial for accurate tax planning. Discover the various investment income sources and exclusions that fall under this tax. Understanding these nuances can help you minimize your tax burden.

The Future of NIIT and Capital Gains Tax

The future of NIIT and capital gains tax is likely to be shaped by evolving technological advancements, economic trends, and policy changes. Understanding these potential trends is crucial for individuals and businesses to navigate the tax landscape and make informed decisions.

Trends and Changes in Policies

- Growing Demand for Tech Skills:The demand for tech skills is expected to continue growing, driven by technological advancements and digital transformation. NIIT will likely play a crucial role in meeting this demand by providing relevant training and education programs.

- Tax Policy Reform:Governments may consider tax policy reforms to address issues such as fairness, efficiency, and economic growth. These reforms could impact the tax rates, holding periods, and exemptions related to capital gains tax.

Technological Advancements and the Tax Landscape

- Digital Assets and Cryptocurrencies:The emergence of digital assets and cryptocurrencies has raised new tax challenges. Governments are grappling with how to tax these assets, and tax laws are likely to evolve to address these developments.

- Artificial Intelligence and Automation:Advancements in artificial intelligence and automation could significantly impact both NIIT and capital gains tax. AI-powered learning platforms could revolutionize education, while automation could affect investment strategies and tax implications.

Predictions and Future Direction, NIIT vs. Capital Gains Tax: Key Differences and Similarities

- Increased Focus on Upskilling and Reskilling:NIIT is likely to play a more prominent role in providing upskilling and reskilling programs as the workforce adapts to technological advancements. The demand for continuous learning and skill development will likely increase.

- Greater Transparency and Simplification:Governments may strive for greater transparency and simplification in tax laws and regulations, particularly in areas related to capital gains tax. This could involve clarifying tax rules, simplifying reporting procedures, and improving tax compliance.

Conclusion: NIIT Vs. Capital Gains Tax: Key Differences And Similarities

As we conclude our exploration of NIIT vs. Capital Gains Tax: Key Differences and Similarities, it becomes evident that both concepts are integral to the financial landscape. NIIT plays a vital role in equipping individuals with the skills they need to succeed in the evolving digital economy, while capital gains tax contributes to the overall economic well-being of a nation.

Understanding the nuances of both concepts is crucial for individuals and businesses alike, enabling them to make informed decisions and navigate the complexities of financial planning. Whether it’s investing in education or managing investment portfolios, a clear grasp of NIIT and capital gains tax empowers individuals to achieve their financial goals while fulfilling their tax obligations.

Common Queries

What are the specific courses offered by NIIT?

NIIT offers a wide range of courses across various domains, including IT, software development, digital marketing, cybersecurity, and more. These courses are designed to equip individuals with the skills and knowledge needed to succeed in their chosen career paths.

How is capital gains tax calculated?

The calculation of capital gains tax varies depending on the type of asset and the holding period. Short-term capital gains, realized within a year, are typically taxed at a higher rate than long-term capital gains, held for more than a year.

Wondering about the impact of investment income on your taxes? Learn about the Net Investment Income Tax (NIIT) , its purpose, and how it applies to various income sources. This tax can significantly affect your bottom line, so understanding its intricacies is key.

The specific tax rates and exemptions can vary based on the country’s tax laws.

What are some strategies for managing capital gains tax liability?

Individuals and businesses can employ various strategies to manage their capital gains tax liability, such as harvesting losses to offset gains, utilizing tax-advantaged accounts, and strategically timing asset sales. Consulting with a tax professional is advisable to develop a personalized plan.

What are the future trends in NIIT and capital gains tax?

The future of NIIT is likely to be shaped by technological advancements and the growing demand for skilled professionals in the digital economy. Capital gains tax policies are also subject to ongoing evolution, influenced by factors such as economic conditions, government priorities, and technological advancements.