New Car Loan Rates are a crucial factor when buying a new vehicle. Understanding the current rates, factors influencing them, and available options can help you make informed decisions and secure the best possible financing.

Tapping into your home’s equity can provide a financial boost. An Equity Loan allows you to borrow against the value of your property, offering flexible repayment options and competitive interest rates.

This guide delves into the complexities of new car loan rates, providing insights into how they are determined, what influences them, and how to navigate the process of obtaining a loan. We’ll explore different loan types, compare their features, and offer practical tips for getting the most favorable rates.

Sometimes you just need a little extra cash. Small Cash Loans offer a quick and convenient way to cover unexpected expenses or bridge a temporary financial gap. These loans are typically easier to qualify for than larger loans.

Closure

Navigating the world of new car loan rates can be daunting, but with the right knowledge and strategies, you can secure a loan that fits your needs and budget. By understanding the factors that influence rates, comparing options, and employing smart negotiation tactics, you can drive away in your new car with confidence and peace of mind.

Need money quickly? Quick Loans Same Day can provide you with the funds you need within 24 hours. These loans are ideal for unexpected expenses or urgent situations, but it’s important to remember that they often come with higher interest rates.

Answers to Common Questions: New Car Loan Rates

How can I improve my credit score before applying for a loan?

Ready to take the next step towards your dream home? Apply For A Loan today and let our team of experts guide you through the process. We offer a wide range of loan options to suit your individual needs and financial goals.

Pay bills on time, keep credit utilization low, avoid opening too many new accounts, and consider disputing any errors on your credit report.

What is the difference between a traditional loan and dealer financing?

Secure the best possible mortgage rates with our comprehensive guide to Best Mortgage Deals. We provide valuable insights and tools to help you compare lenders and find the most competitive terms for your unique situation.

Traditional loans are obtained from banks or credit unions, while dealer financing is offered by the car dealership. Dealer financing can sometimes offer convenience, but may come with higher interest rates.

If you’re a veteran looking to buy a home, a VA Loan might be the perfect option for you. These loans offer unique benefits, like no down payment requirement and competitive interest rates, making homeownership more accessible for those who have served our country.

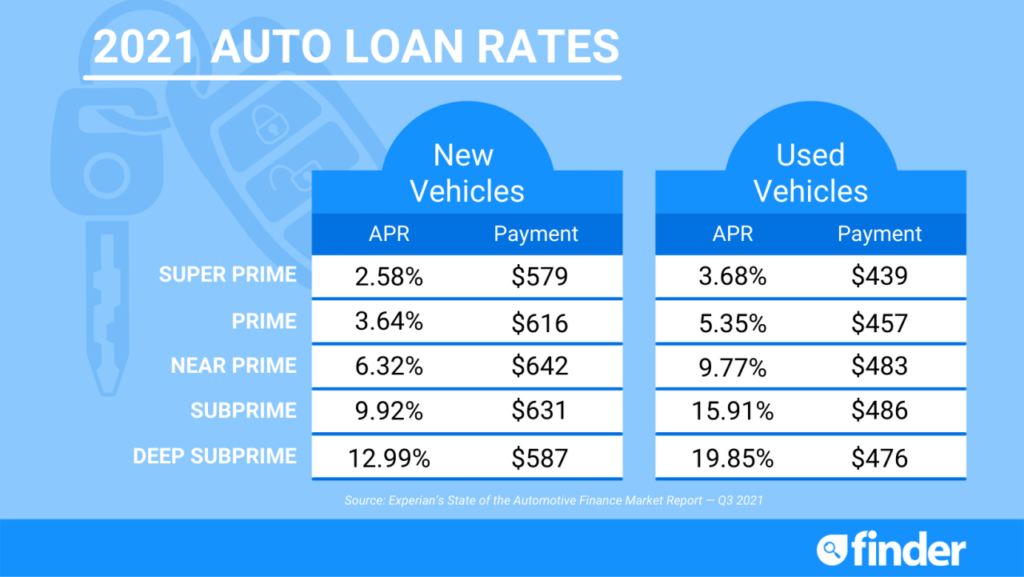

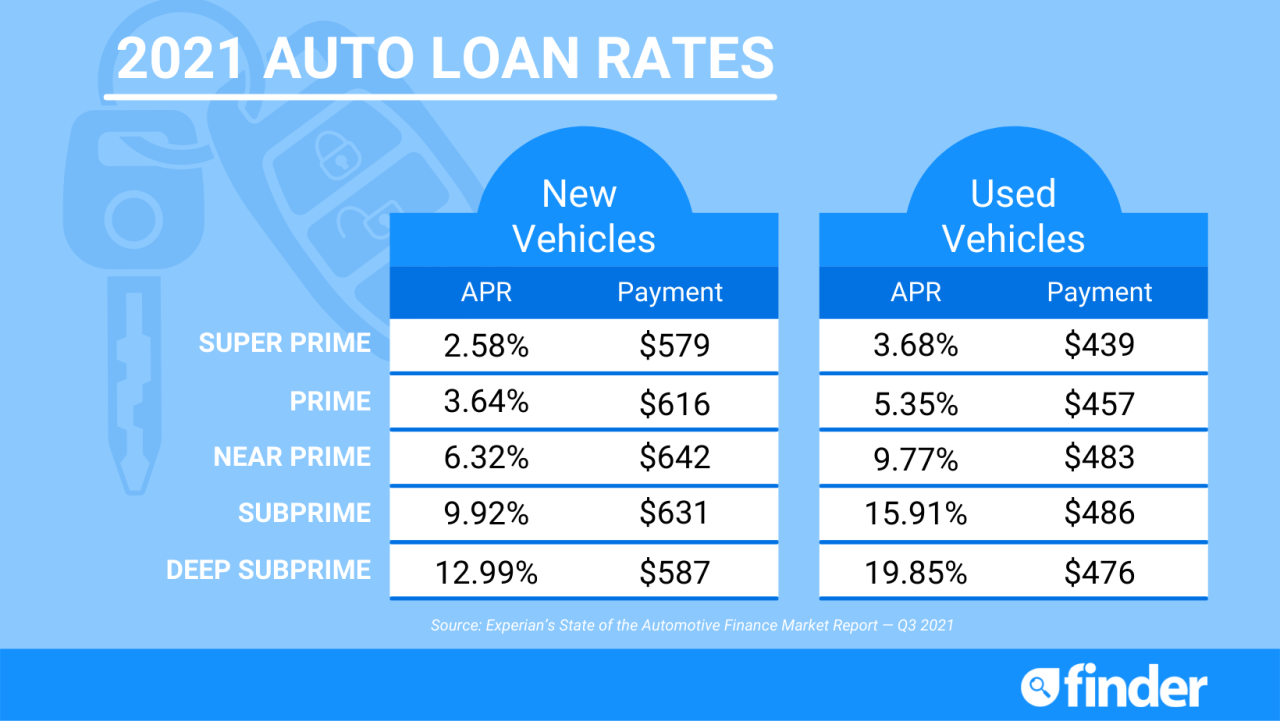

What is the role of APR in a new car loan?

Facing a financial hardship? Hardship Loans can provide much-needed relief during difficult times. These loans are often designed to help individuals manage unexpected expenses or navigate temporary financial setbacks.

APR (Annual Percentage Rate) represents the total cost of borrowing, including interest and fees. A lower APR generally translates to a more affordable loan.

Consider the benefits of working with a credit union. Credit Union Loans often offer competitive interest rates and personalized service. They are known for their commitment to their members’ financial well-being.

Finding the right mortgage lender can make a significant difference in your homeownership journey. Explore our guide to Best Mortgage Lenders and discover reputable institutions that offer competitive rates, flexible terms, and excellent customer service.

Stay informed about current market trends by checking Interest Rates Today. Understanding prevailing interest rates is crucial when making important financial decisions, especially when considering a mortgage.

Need additional financing for your home? A 2nd Mortgage can provide you with the funds you need for home improvements, debt consolidation, or other financial needs. It’s important to carefully consider the terms and potential impact on your overall financial situation.

Stay up-to-date on current rates for home equity lines of credit. Check Current Heloc Rates to explore your options and make informed decisions about accessing your home equity.

Getting pre-approved for a mortgage can give you a significant advantage in the competitive housing market. Mortgage Pre Approval shows sellers that you’re a serious buyer and can often streamline the closing process.

A pre-approval letter can give you a significant advantage when applying for a loan. Pre Approval demonstrates your financial readiness and can help you secure favorable terms.

Payday loans can provide quick access to cash, but they often come with high interest rates and fees. Payday Loans should be used as a last resort and only for short-term financial emergencies.